Vox Royalty Acquires Feasibilty-Stage Stockman Copper-Gold Royalty in Australia

Rhea-AI Summary

Vox Royalty (TSX:VOXR, NASDAQ:VOXR) agreed to buy a 1.5% NSR royalty (reducing to 1.0% after 9.0Mt produced) over the feasibility-stage Stockman copper-gold-zinc-silver project in Victoria, Australia for up to A$15 million (A$5m cash at closing; A$10m deferred payable in cash or Vox shares on production milestones).

Stockman has an indicated resource of 13.4Mt @ 2.1% Cu, 4.2% Zn, 1.0 g/t Au (Dec 31, 2024), a Currawong-focused 12-year mine plan at up to 850,000 tpa, all primary permits in place, and Albion Process test recoveries >98% Cu/Zn (overall >90%). Closing expected Dec 2025; TXSE conditional approval received.

Positive

- 1.5% NSR royalty (drops to 1.0% after 9.0Mt)

- Purchase price up to A$15M (A$5M cash at closing)

- Potential >$3M annual royalty revenue per feasibility study

- Stockman has all primary permits in place for mining and processing

- Albion Process testwork: >98% Cu/Zn leach recoveries, overall >90% recoveries

Negative

- A$10M deferred payable in cash or VOXR shares at Vox election (potential dilution)

- Royalty rate reduces to 1.0% after 9.0Mt produced

- Initial mine plan excludes Wilga, limiting early mine life to ~12 years

News Market Reaction – VOXR

On the day this news was published, VOXR gained 1.61%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers in Basic Materials show mixed pressure: PLG down 10.65%, PLL down 9.6%, LODE and IONR down modestly, while NMG shows a small gain of 0.33% but also appears in momentum data with a larger intraday drop tied to an equity offering headline. Movements do not present a clear sector-wide trend for this royalty-focused name.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Nov 14 | Board appointment | Positive | -2.2% | New director with capital markets and mining expertise joined the board. |

| Nov 12 | Earnings & dividend | Positive | -4.9% | Record Q3 revenue, higher YTD revenue, and a declared cash dividend. |

| Nov 06 | Earnings timing | Neutral | -0.5% | Announcement of the release date for Q3 2025 financial results. |

| Oct 16 | Board changes | Positive | -6.1% | New director appointed while two existing directors stepped down. |

| Sep 26 | Major acquisition | Positive | +6.7% | Completion of sizeable global gold royalty and offtake portfolio acquisition. |

Recent history shows frequent negative price reactions to generally positive corporate updates, with only one clearly positive reaction among the last five news events.

Over the last few months, Vox Royalty reported several constructive developments. On Sep 26, 2025, it completed a $57.5M Global Gold Portfolio acquisition funded by a $63.25M share offering, which saw shares rise 6.67%. Q3 2025 results on Nov 12 showed record quarterly revenue of $3,815,640 and year-to-date revenue of $9,365,530, plus a $0.0125 dividend, yet the stock fell. Board changes and additions in October and November also drew negative reactions. Today’s acquisition continues the pattern of portfolio expansion following September’s transformational deal.

Market Pulse Summary

This announcement details Vox’s acquisition of a 1.5% net smelter return royalty (stepping to 1.0%) over the feasibility-stage Stockman copper-gold-zinc-silver project for up to A$15 million. The deal targets potential annual royalty revenue of over $3M supported by a 12-year mine plan and significant resources. In context of prior gold and copper-gold royalty acquisitions, investors may track feasibility updates, processing-route optimisation by mid-FY26, and any future production milestones tied to deferred payments.

Key Terms

net smelter return financial

environmental effects statement regulatory

mine work plan technical

environmental protection and biodiversity conservation act regulatory

volcanic-hosted massive sulphide technical

mineral resource estimate technical

albion process technical

pressure oxidation (pox) technical

AI-generated analysis. Not financial advice.

DENVER, CO / ACCESS Newswire / December 18, 2025 / Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ("Vox" or the "Company"), a returns-focused mining royalty and streaming company, is pleased to announce that it has executed a binding agreement to acquire an existing royalty over the feasibility-stage Stockman copper-gold-zinc-silver project ("Stockman") in Victoria, Australia.

The royalty is a

The Stockman project is operated by Aeris Resources Limited ("Aeris"), a mid-tier Australian copper and gold producer, and is recognised as one of the most advanced undeveloped polymetallic projects in Australia.

Spencer Cole, Vox Chief Investment Officer stated: "We are excited to acquire this brownfields development-stage copper royalty in Australia that has potential to generate over

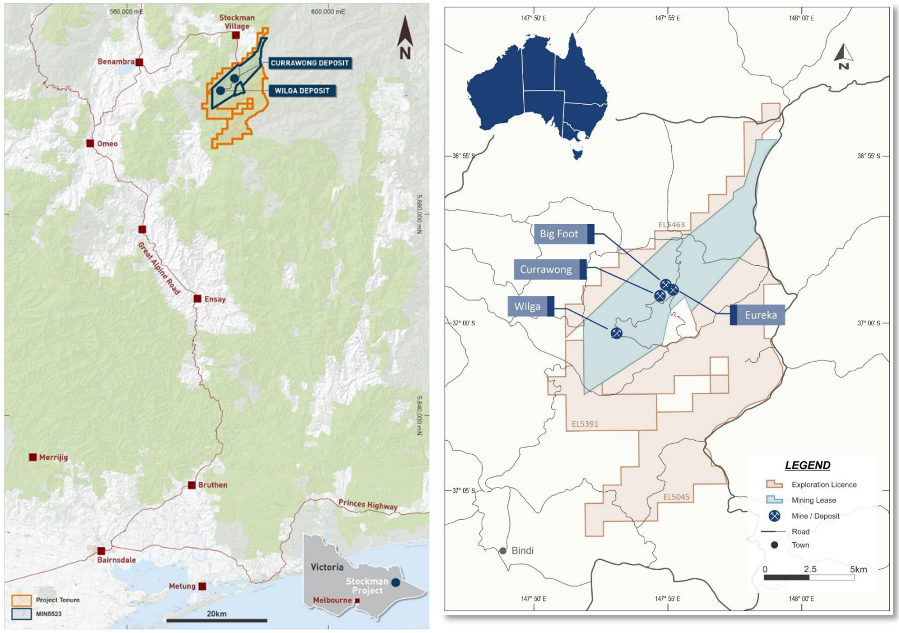

Figure 1 - Stockman Project Location & Mineral Tenure(2)

Transaction Highlights

Advanced brownfields polymetallic copper-zinc-gold-silver development project in Victoria, Australia with all primary permits in place for mining and onsite processing, including the Environmental Effects Statement (EES), Mine Work Plan (MWP), and Environmental Protection and Biodiversity Conservation Act (EPBC) approvals.

The historical Wilga mine produced copper and zinc and was operated from October 1992 to July 1996(6).

January-2024 Feasibility Update outlined a simplified mine plan focused on the Currawong deposit only (excluded the Wilga deposit) for an expected 12 year mine life processing up to 850,000tpa.

Expansion potential from the Wilga, Eureka and Bigfoot deposits beyond initial the 12-year mine life.

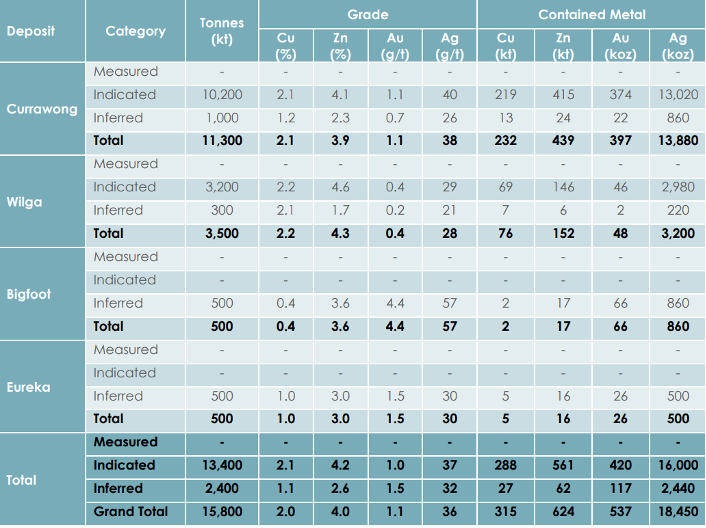

Current total resource as of Dec 31, 2024 comprises 13.4Mt @

2.1% Cu,4.2% Zn, 1.0g/t Au Indicated and 2.4Mt @1.1% Cu,2.6% Zn, 1.5g/t Au Inferred.Strong community support through active engagement programs including the Community Reference Group.

Albion Process testwork showing leach recoveries of +

98% for Cu and Zn, and overall Cu & Zn recoveries above90% (vs ~77% Cu and70% Zn recoveries via conventional flotation).Processing optimisation studies targeting completion by mid-FY26 and strategic partner engagement underway.

Project Overview - Stockman (1,2,3,4,5)

Stockman is an advanced copper-zinc-gold-silver development project located approximately 300km northeast of Melbourne in the East Gippsland region of Victoria. Currawong and Wilga are volcanic-hosted massive sulphide (VHMS) style deposits, occurring as polymetallic (pyrite-sphalerite-chalcopyrite) massive sulphide lenses with stringer feeder zones within a volcano-sedimentary succession.

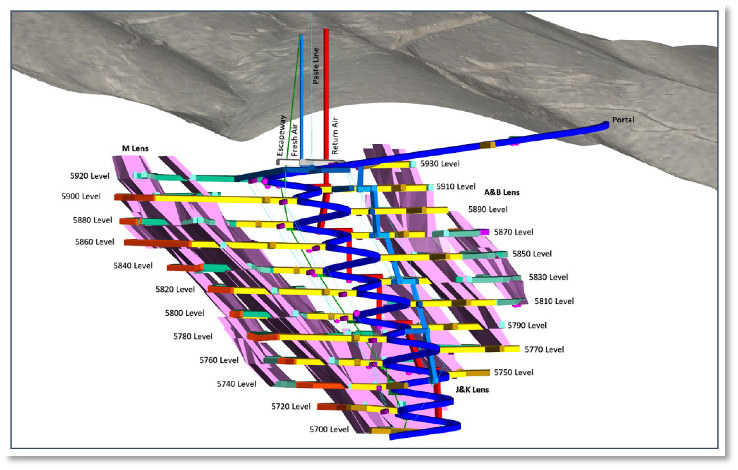

Figure 2 - Currawong Mine Design looking west(3)

Aeris acquired the project in July 2022 as part of the Round Oak Minerals transaction and has advanced the project through a major technical work program since 2023:

January 2024 Updated Mineral Resource Estimate (MRE) for Currawong and Wilga

January 2024 Feasibility Study Update confirming simplified Currawong-only mine plan

2024 (Q1-Q3) Metallurgical variability testwork, Albion Process desktop studies, flowsheet redesign

July 2024 Breakthrough metallurgical testwork results

August 2024 Offsite processing site selection shortlisting

December 2024 Testwork expansion, marketing activities, concentrate sampling

Late 2025 Albion optimisation testwork, leach refinement, front-end engineering, feasibility study update

2026 Strategic partner process outcomes

The development plan outlined in the Stockman Feasibility Study Update (dated January 24, 2024), focuses on mining the Currawong deposit for the first 12 years of operations at a rate of up to 850,000 tonnes per annum of ore. This simplified approach reduces upfront capital requirements compared to the previous plan of mining Currawong and Wilga concurrently. The development plan is underpinned by a strong and updated mineral resource base, with the Currawong deposit containing 10.2 million tonnes at

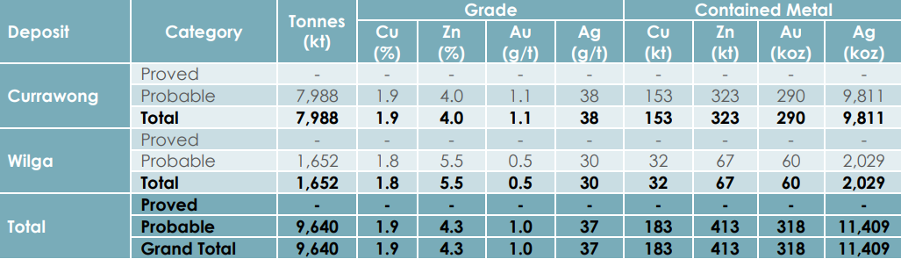

The most recent Mineral Resource and Reserve Estimates announced by Aeris on July 22, 2025, are as follows:

Table 1 - Stockman Mineral Resource (December 31, 2024)(2)

Table 2 - Stockman Mineral Reserve (December 31, 2024)(2)

A significant inflection point for the project occurred in July 2024, when Aeris reported breakthrough metallurgical testwork results utilising the Albion Process - an oxidative leach technology developed by Glencore Technology in 1994. The Albion Process is successfully deployed at multiple operations worldwide, including at the McArthur River and Mount Isa sites in Australia. Compared with conventional pressure oxidation (POx) circuits, the Albion Process offers materially lower capital costs and, by operating at atmospheric pressure, eliminates the substantial technical and operational risks typically associated with POx plants.

The Aeris Albion test results demonstrated leach recoveries exceeding

The new flowsheet has also materially improved gold recoveries to

Aeris flagged a potential two-stage processing strategy which includes an onsite mine processing plant producing high-grade copper concentrate and a polymetallic bulk concentrate (reducing the site processing plant footprint and power consumption); as well as a bulk concentrate trucked to a regional offsite facility utilizing the Albion Process to produce separate saleable copper, zinc and precious metals products.

Aeris is targeting completion of processing-route optimisation studies by approximately mid-FY26, ahead of progressing to a final feasibility update and, subsequently, a development decision. The company is presently evaluating multiple development pathways and is also considering the introduction of a strategic partner to help unlock long-term value.

Transaction Details

Vox will acquire the Royalty for total consideration of up to A

The Transaction has received conditional approval from the Toronto Stock Exchange. Closing is expected to occur in December 2025.

Upcoming potential catalysts for the Stockman Royalty:

Completion of processing route optimisation studies expected by mid-FY26, including finalisation of Albion Process design parameters, updated recoveries, capital/operating cost outcomes, and flowsheet selection, providing several key required inputs before a full feasibility update and development decision.

Resource and life-of-mine expansion potential from Wilga, Eureka, and Bigfoot - future drilling or inclusion of Wilga in updated mine planning could materially extend mine life beyond the initial 12 years.

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a "Qualified Person" under NI 43-101, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty company with a portfolio of over 70 royalties and streams spanning eight jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 25 separate transactions to acquire over 60 royalties.

Further information on Vox can be found at www.voxroyalty.com.

For further information contact:

Spencer Cole | Kyle Floyd |

Chief Investment Officer | Chief Executive Officer |

spencer@voxroyalty.com | info@voxroyalty.com |

Cautionary Statements to U.S. Securityholders

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards"). In addition to NI 43-101, a number of resource and reserve estimates have been prepared in accordance with the JORC Code (as such term is defined in NI 43-101), which differ from the requirements of NI 43-101 and U.S. securities laws but is defined in NI 43-101 as an "acceptable foreign code". Readers are cautioned that a qualified person has not carried out independent work to validate the JORC Code resource and reserve estimates referenced herein.

For U.S. reporting purposes, the U.S. Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by companies domiciled in the U.S. subject to U.S. federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act of 1933, as amended, the U.S. Securities Exchange Act of 1934, as amended, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

The forward-looking statements and information in this press release include, but are not limited to, summaries of operator disclosure provided by management and the potential impact on the Company of such operator disclosure, statements regarding expectations for the timing of commencement of resource updates, development, construction at and/or resource production at Stockman, expectations regarding the size, quality and exploitability of the resources at Stockman, and requirements for and operator ability to receive regulatory approvals.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements, including but not limited to: the impact of general business and economic conditions; the absence of control over mining operations from which Vox will purchase precious metals or from which it will receive royalty or stream payments, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; the volatility of the stock market; competition; risks related to Vox's dividend policy; epidemics, pandemics or other public health crises, including the global outbreak of the novel coronavirus, geopolitical events and other uncertainties, such as the conflict in Ukraine, as well as those factors discussed in the section entitled "Risk Factors" in Vox's annual information form for the financial year ended December 31, 2024 available at www.sedar.com and the SEC's website at www.sec.gov (as part of Vox's Form 40-F).

Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

None of the TSX, its Regulation Services Provider (as that term is defined in policies of the TSX) or The Nasdaq Stock Market LLC accepts responsibility for the adequacy or accuracy of this press release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, access to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox's royalty interests. Vox's royalty interests often cover less than

References & Notes:

ASX Aeris News Release dated 20 Oct 2025: Annual Report 30 June 2025 (https://clients3.weblink.com.au/pdf/AIS/03010516.pdf)

ASX Aeris News Release dated 22 July 2025: Group Mineral Resource and Ore Reserve Statement (https://clients3.weblink.com.au/pdf/AIS/02969483.pdf)

ASX Aeris News Release dated 24 January 2024: Stockman Feasibility Update (https://clients3.weblink.com.au/pdf/AIS/02765095.pdf)

ASX Aeris News Release dated 04 July 2024: Stockman Project - Flotation & Albion Leach Testwork Results Provides Opportunity to Materially Improve Project Returns (https://clients3.weblink.com.au/pdf/AIS/02824587.pdf)

Glencore Technology - The Albion Process (https://www.glencoretechnology.com/en/technologies/albion-process?gad_source=1&gad_campaignid=14231387696&gbraid=0AAAAADEpjRrh959UwQMF7RMYVs4Mrkrjt&gclid=CjwKCAiA8vXIBhAtEiwAf3B-g77Y8s94_cvIntvzvP1zd6IDfbubV2Z01n9A8fRD5nLWVNfKZrfDrRoCs3UQAvD_BwE)

Stockman Project Fact Sheet (March 2023):

https://www.aerisresources.com.au/wp-content/uploads/2023/03/Aeris-Fact-Sheet-Stockman-V1.pdfVox estimate of potential illustrative annual royalty revenues based on the following calculation: 850Ktpa reserves mined x reserve grades (

1.9% Cu and4.3% Zn) x77% Cu and70% Zn recoveries x long term consensus prices (US$9,345 /t Cu and US$2,667 /t Zn) x1.5% NSR = US$3M (rounded)

SOURCE: Vox Royalty Corp.

View the original press release on ACCESS Newswire