VIZSLA SILVER PROVIDES 2025 YEAR-END SUMMARY AND 2026 OUTLOOK

Rhea-AI Summary

Vizsla Silver (NYSE: VZLA) provided a 2025 year-end summary and a 2026 outlook for the Panuco silver‑gold project in Sinaloa, Mexico. Key 2025 milestones included a 43% increase in measured & indicated resources, a Feasibility Study showing an after‑tax NPV(5%) of US$1.8B, 111% IRR, a 7‑month payback, and production averaging 20.1 Moz AgEq/yr (yrs 1–5) and 17.4 Moz AgEq/yr over a 9.4‑year mine life. The company ended 2025 with > US$450M cash and secured project finance including a US$300M capped‑call convertible note facility. Exploration and development highlights include a 21,000m 2025 drill program, a new Animas discovery (897 g/t AgEq over 5.85m), an advancing test mine and a planned district drill program of ~60,000m in 2026. Target: construction decision after permits, first production in H2 2027.

Positive

- Measured & indicated resources increased by 43%

- Feasibility Study: after‑tax NPV(5%) US$1.8B and 111% IRR

- Average production 20.1 Moz AgEq/yr (years 1–5); 17.4 Moz AgEq/yr life of mine

- Project funded with > US$450M cash and a US$300M financing facility

- Animas discovery: 897 g/t AgEq over 5.85 m

- Budgeted ~60,000 m district drilling for 2026

Negative

- Major permits (MIA) not yet received; construction decision contingent on mid‑2026 permit timing

- Feasibility economics are sensitive to commodity prices used (assumptions at US$35.50/oz Ag, US$3,100/oz Au)

- Project financing includes cash‑settled capped‑call convertible notes with an effective conversion price (~US$10.51–10.54) that may affect future capital structure

News Market Reaction – VZLA

On the day this news was published, VZLA gained 6.33%, reflecting a notable positive market reaction. Argus tracked a peak move of +3.1% during that session. Argus tracked a trough of -6.4% from its starting point during tracking. Our momentum scanner triggered 15 alerts that day, indicating notable trading interest and price volatility. This price movement added approximately $136M to the company's valuation, bringing the market cap to $2.28B at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

VZLA gained 3.01% while momentum-screened peers like CRML (+8.44%) and SGML (+4.73%) moved up without same-day news, and key sector peers show mixed moves, pointing to a stock-specific move rather than a broad sector rotation.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Jan 13 | Drill results update | Positive | -0.2% | High‑grade geotechnical intercepts at Copala to support resource upgrading. |

| Dec 18 | Strategic acquisition | Positive | -1.7% | Acquisition of 2,378 ha of strategic claims along Panuco–San Dimas corridor. |

| Dec 09 | Feasibility filing | Positive | +4.0% | Filing of NI 43‑101 technical report and Feasibility Study for Panuco. |

| Dec 02 | FS webinar & notes | Positive | -0.2% | Technical webinar on positive Feasibility Study and announcement of convertible notes. |

| Nov 24 | Convertible notes offering | Positive | +6.5% | Closing of US$300M 5.00% convertible senior notes to fund Panuco development. |

Recent positive technical, acquisition, and financing news often saw mixed short-term price reactions, with both aligned gains and divergences on strong updates.

Over the past few months, Vizsla Silver advanced the Panuco project through feasibility, financing, and technical work. A Nov 24 convertible notes offering and subsequent Dec 2 feasibility study webinar underpinned development funding and project viability. The company then filed the full NI 43‑101 Feasibility Study on Dec 9 and expanded its land position via strategic claims announced on Dec 18. High‑grade geotechnical drilling results reported on Jan 13 further supported resource quality, framing today’s broader 2025 recap and 2026 outlook.

Market Pulse Summary

The stock moved +6.3% in the session following this news. A strong positive reaction aligns with the company’s year-end positioning, with shares already at a 52-week high of 6.16 and trading above the 200-day MA of 3.73. The update reinforced robust Feasibility Study metrics, full funding of over US$450M, and a clear 2026 work program. However, prior news sometimes saw mixed follow-through, and existing leverage from the US$300M convertible notes means future financing or execution risks could still influence sustainability of gains.

Key Terms

ni 43-101 regulatory

feasibility study technical

npv (5%) financial

irr financial

capped call convertible notes financial

hlem surveys technical

lidar technical

AI-generated analysis. Not financial advice.

NYSE: VZLA TSX: VZLA

"2025 was an extraordinary year for Vizsla, the

Key Objectives for 2026

- Advance detailed engineering and select contractors for construction and mining

- Advance ongoing test mine and bulk sample program

- Continue underground infill and expansion drilling to support an updated project MRE

- Advance district-wide surface exploration drilling, including follow up test work at Animas

- Complete updated district-scale airborne EM and MAG surveys

- Conduct initial LiDAR, mapping and sampling on the Peñoles and La Garra claims

2025 Highlights

2025 represented a step-change for Vizsla Silver as the Company advanced from study-driven validation to construction readiness. Throughout the year Vizsla continued to expand its land package with new acquisitions and delivered on several key de-risking initiatives, including the development of a fully funded and fully permitted test mine, publication of the Project's first Feasibility Study and securing project finance to construct the Panuco Mine, have been transformative for the Company and the asset as it enters the development stage.

The year started with an updated mineral resource estimate outlining both growth and conversion of resources into higher confidence categories. This ultimately served as the foundation for a Feasibility Study published in November, highlighting 17.4 Moz AgEq of annual production over an initial 9.4-year mine life (averaging 20.1 Moz AgEq per year for years 1-5), an after-tax NPV (

Vizsla Silver is now fully funded to develop and construct the

The test mine advanced from surface to over 700 meters down the decline, achieving an average of two blasts and six meters of development per day. Two of three planned underground drill bays were established, closing the year with two underground drill rigs conducting infill drilling at central

Drilling throughout the year totaled ~21,000 meters, focused primarily on geotechnical drilling around the Feasibility Study mine plan area. This drilling will support the final phase of detailed engineering slated to commence in early 2026. Additionally, two drill rigs carried out expansion and discovery-based drilling in the west and eastern portions of the district to extend known resources and target select anomalies highlighted in a recently completed HLEM survey. A new discovery at Animas, located in the eastern portion of the district, marked by 897g/t AgEq over 5.85 meters, adds another high-grade center of near-surface mineralisation to continue exploring and defining in 2026.

Other notable achievements in 2025:

- Vizsla Silver's share price increased by

220% fromUS to$1.71 US per share, and liquidity across the TSX and NYSE collectively increased the 3-month average daily trading volume$5.47 217% from 2.2 million to 6.8 million. - Vizsla Silver raised

US in equity including a$160M US bought deal at$115.5M US per share in June.$3.00 - Raised net proceeds of

US through a cash-settled, capped-call convertible bond issuance to fully fund the construction and development of the Panuco project, carrying a$240M 5% coupon rate an effective conversion price ofUS .$10.51 - Completed 50-line km HLEM surveys across Panuco West covering Copala North and Napoleon North, identifying several extensional targets for drilling in 2026.

- Expanded district-scale geological interpretation by extending 1:1,000-scale mapping beyond the original Project 1 footprint into the central and eastern Panuco district and integrating WorldView-III, ASTER, and Terraspec datasets to refine alteration patterns, structural controls, and target prioritization.

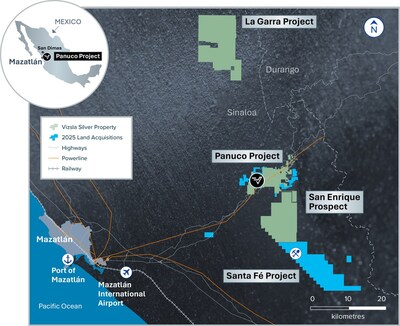

- Vizsla Silver acquired a total of 14,607 hectares in 2025 along the San Dimas corridor, comprising 12,229 hectares Santa Fé claims in May, and 2,378 hectares Peñoles claims in December (see figure 1 below).

- Completed a fourth round of metallurgical test work to support Feasibility Study flow sheet variability and optimization.

- Published the third annual Sustainability Report.

- Organized four health fairs/social programs, servicing approximately 2,000 individuals within the local communities

- Vizsla Silver's Mexican subsidiary, Minera CANAM, was awarded the Socially Responsible Company Distinction (ESR), for the fourth year in a row.

2026 Outlook

2026 should be another transformative year for Vizsla Silver and the Panuco Project. With several new growth and de-risking initiatives, the Company is focused on further validating and enhancing value beyond the recently published Feasibility Study. Key initiatives include detailed engineering, underground drilling, geophysical surveys, and optimization work required to enter a construction decision in the second half of 2026, once permits are received.

Vizsla has budgeted ~60,000 meters of diamond drilling across the

In parallel, the engineering team is advancing detailed engineering of the mine and process infrastructure as it transitions into project execution, including the selection of key partners for construction and mining. Contractor selection for bulk earthworks, electrical, piping, and underground mining will continue through competitive processes, supported by equipment-specific test work from the test mine bulk sample material to validate performance guarantees.

The planned 10k tonne bulk sample material will support a fifth phase of metallurgical testwork to optimize silver and gold recovery, reagent usage, and further rheological testing to ensure robustness of tailings and paste backfill.

Exploration in 2026 will focus on advancing surface drilling around Panuco West to extend resources proximal to the Feasibility Study mine plan, while ongoing technical work will support future drill programs at Santa Fé, follow-up drilling at Animas, and initial testing of other targets in the northeast. Vizsla will also commence initial LiDAR surveys, geological mapping, and surface sampling across the newly acquired Peñoles claims, alongside first pass LiDAR, mapping, and prospecting at La Garra, laying the groundwork for future drill targeting across the broader land package.

Key Objectives for 2026

- Advance detailed engineering and select contractors for construction and mining

- Advance ongoing test mine and bulk sample program

- Continue underground infill and expansion drilling to support an updated project MRE

- Advance district wide surface exploration drilling, including follow up test work at Animas

- Complete updated district scale airborne EM and MAG surveys

- Conduct initial LiDAR, mapping and sampling on the Peñoles and La Garra claims

In accordance with NI 43-101, Jesus Velador, Ph.D. MMSA QP., Chief Geologist, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

About Vizsla Silver and the Panuco Project

Vizsla Silver is a Canadian mineral exploration and development company headquartered in

Website: www.vizslasilvercorp.ca

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release contains "forward-looking statements" and "forward-looking information" (together, "forward-looking statements") within the meaning of applicable Canadian securities laws and the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to future events or performance and reflect management's expectations or beliefs regarding future events, plans, and objectives.

Forward-looking statements in this release include, but are not limited to, statements regarding: the Company's 2026 objectives and milestones, including the timing and receipt of environmental and other regulatory permits (including the MIA/EIA); the timing and execution of construction activities, including the commencement of construction, advancement of detailed engineering, and selection of contractors and development partners; the Company's ability to advance the Panuco Project toward production, including expectations regarding first silver production in the second half of 2027; the results, timing and scope of planned drilling programs, including underground infill and expansion drilling, district-wide surface drilling, and follow-up drilling at Animas, Santa Fé, La Garra, Peñoles and other targets; the conversion of inferred mineral resources to indicated mineral resources, including targeted conversion of inferred mineralization within the

Forward-looking statements are based on a number of assumptions believed to be reasonable by the Company as of the date of this release, including, without limitation: the accuracy of the Feasibility Study parameters; the availability of financing on acceptable terms; that required permits and approvals will be obtained in the expected timeframe; continued community and government support; stability in market, political and economic conditions; reasonable accuracy of operating and capital cost estimates; and continued favourable metal prices and exchange rates.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. Such risks include, but are not limited to: exploration, development and operating risks; permitting, environmental and regulatory risks; community relations and social licence risks; commodity price and currency fluctuations; inflation and cost escalation; financing and liquidity risks; reliance on contractors and suppliers; title and surface rights risks; changes in project parameters; inaccuracies in technical or economic modelling; the risk that the feasibility study assumptions prove inaccurate; and other risks described in the Company's continuous disclosure filings available under its profile on SEDAR+ at www.sedarplus.ca.

There can be no assurance that the Panuco Project will be placed into production or that the results of the Feasibility Study will be realized. The purpose of the forward-looking statements is to provide information about management's current expectations and plans and may not be appropriate for other purposes. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this release. Except as required by applicable law, the Company undertakes no obligation to update or revise any forward-looking statements contained herein.

No Production Decision: The Company has not made a production decision for the Panuco Project. A decision to proceed with construction will only be made following the completion and review of detailed engineering, financing arrangements, and receipt of all required permits and approvals.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/vizsla-silver-provides-2025-year-end-summary-and-2026-outlook-302665058.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/vizsla-silver-provides-2025-year-end-summary-and-2026-outlook-302665058.html

SOURCE Vizsla Silver Corp.

FAQ

What production profile did Vizsla Silver (VZLA) report in the 2025 Feasibility Study?

How much cash did VZLA have at year‑end 2025 and is Panuco fully funded?

When does Vizsla Silver expect to make a construction decision and start production (VZLA)?

What exploration and drilling does VZLA plan for 2026 at Panuco?

What was the notable discovery at Panuco reported by Vizsla (VZLA) in 2025?

What are the key financial metrics from Vizsla’s Feasibility Study that matter to investors (VZLA)?