Company Description

Orion Group Holdings, Inc. (NYSE: ORN) is a specialty construction company that serves the infrastructure, industrial, and building sectors. According to the company, it provides services both on and off the water across the continental United States, Alaska, Hawaii, Canada, and the Caribbean Basin through two primary operating segments: a marine segment and a concrete segment. Orion is headquartered in Houston, Texas and maintains regional offices throughout its operating areas.

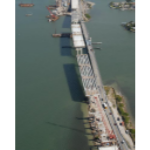

The company’s marine segment focuses on construction and dredging services. These activities include marine transportation facility construction, marine pipeline construction, marine environmental structures, dredging of waterways, channels and ports, environmental dredging, design, and specialty services. This work positions Orion in projects related to coastal and marine infrastructure, navigation channels, ports, and other water-related facilities, as reflected in awards such as maintenance dredging contracts and shoreline protection work for public agencies.

Through its concrete segment, Orion provides turnkey concrete construction services for large commercial, structural and other associated business areas. The company describes these services as including place and finish, site preparation, layout, forming, and rebar placement. Recent disclosures note that this segment has been involved in projects such as data centers, manufacturing facilities, healthcare projects, energy-related facilities, cold storage, and other commercial developments, highlighting its role in supporting a range of industrial and building customers.

Orion’s business model is organized around contract revenues generated from construction projects. The company reports that its projects typically range from several months to multiple years in duration, and that it tracks a contracted backlog consisting of projects under contract that have not yet started or are in progress but not complete. Backlog includes revenue the company expects to realize over the next twelve months as well as in future years, and can fluctuate with the timing and execution of contracts.

The company’s disclosures emphasize that it uses measures such as EBITDA, Adjusted EBITDA, and Adjusted EBITDA margin, alongside GAAP metrics, to evaluate operating performance, operating efficiency, and financial condition. These non-GAAP measures are used internally to assess operating expense, profitability on a variable cost basis, and the ability to meet debt service and working capital requirements, and are also referenced in incentive compensation plans.

Orion’s activities include work for public and private customers. Publicly described examples include maintenance dredging for the U.S. Army Corps of Engineers, repair work on marine transportation facilities, crane trestle installation for transportation projects, export dock replacement, and coastal rehabilitation and shoreline protection projects. In its concrete operations, the company notes awards for multiple data centers, energy and consumer goods facilities, transportation-related projects, and healthcare and manufacturing projects, reflecting exposure to diverse end markets within its stated infrastructure, industrial, and building focus.

The company has reported that its marine and concrete segments both contribute to its contracted backlog and revenue growth. In its public communications, Orion has highlighted strong demand across the markets it serves, including opportunities related to port expansions and maintenance, coastal rehabilitation, energy infrastructure, data centers, and other commercial and industrial construction. The company also notes that it has increased its aggregate bonding capacity, which enables it to bid on and execute larger projects.

From a capital structure perspective, Orion has entered into a senior credit facility with UMB Bank, N.A., as Administrative Agent and Issuing Bank. The related Credit Agreement provides for a revolving loan, an equipment term loan, and an acquisition term loan, along with an uncommitted accordion option for future acquisitions, and is secured by substantially all of the assets of the company and its domestic subsidiaries. The facility includes financial covenants based on a consolidated fixed charge coverage ratio and a consolidated senior leverage ratio, and allows the company to use borrowings for repayment of a prior credit agreement, acquisitions permitted under the agreement, working capital, and other general corporate purposes.

Orion states that it uses investor presentations, earnings releases, and conference participation to communicate its strategy, backlog, and financial performance to the market. The company has reported contract wins across both segments, participation in industry and investor conferences, and updates to financial guidance, all of which are documented in its press releases and associated Form 8-K filings.

Business Segments

Marine segment

- Construction and dredging services related to marine transportation facility construction.

- Marine pipeline construction and marine environmental structures.

- Dredging of waterways, channels and ports.

- Environmental dredging, design, and specialty services.

Concrete segment

- Turnkey concrete construction services for large commercial, structural and associated business areas.

- Services include place and finish, site preparation, layout, forming, and rebar placement.

Geographic Scope

According to company disclosures, Orion provides services both on and off the water in the continental United States, Alaska, Hawaii, Canada, and the Caribbean Basin. The company is headquartered in Houston, Texas and notes that it has regional offices throughout its operating areas.

Backlog and Project Characteristics

Orion defines backlog as projects under contract that have either not yet started or are in progress but not complete. The company notes that:

- Backlog includes revenue expected within the next twelve months and in future years.

- Project durations typically range from three to nine months on shorter projects to multiple years on larger projects.

- Backlog can change from period to period based on the timing and execution of contracts.

The company cautions that it cannot guarantee that the revenue implied by its backlog will be realized or will result in earnings or profitability.

Financial and Reporting Practices

In its public filings and press releases, Orion explains that it supplements GAAP results with non-GAAP measures such as Adjusted Net Income (Loss), Adjusted Earnings (Loss) Per Share, EBITDA, Adjusted EBITDA, and Adjusted EBITDA margin. These measures are used internally to evaluate operating performance, liquidity, capital structure, and to support incentive compensation decisions. The company provides reconciliations of these non-GAAP measures to the most directly comparable GAAP measures in its earnings materials.

Stock and Regulatory Status

Orion Group Holdings, Inc. is incorporated in Delaware and its common stock, with a par value of $0.01 per share, trades on the New York Stock Exchange under the ticker symbol ORN. The company files periodic and current reports with the U.S. Securities and Exchange Commission, including Forms 10-K, 10-Q, and 8-K, which provide additional detail on its operations, risk factors, financial condition, and governance.