Company Description

Southland Holdings, Inc. (SLND) is an infrastructure construction company that focuses on specialized projects across North America. According to company disclosures and recent press releases, Southland and its subsidiaries form one of the largest infrastructure construction companies in North America, with experience on projects throughout the world. The company is headquartered in Grapevine, Texas and its common stock and warrants trade on the NYSE American under the symbols SLND and SLND WS.

Southland describes itself as a leading provider of specialized infrastructure construction services, with roots dating back to 1900. Over its history, the company has developed expertise across multiple end markets, including bridges, tunneling, communications, transportation, facilities, marine, steel structures, water and wastewater treatment, and water pipeline projects. These activities place Southland within the construction sector, with a specific industry focus on water and sewer line and related structures construction and large-scale civil and transportation infrastructure.

Business Segments and Core Activities

Southland operates through two primary reportable segments: Civil and Transportation. This segment structure is consistently referenced in the company’s financial results and project award announcements.

The Civil segment is associated with water-related and other civil infrastructure. Based on company descriptions and segment disclosures, this segment includes activities such as water resource projects and water pipeline work, as well as water and wastewater treatment projects. Subsidiaries in this segment include Oscar Renda Contracting, which has been identified in press releases as executing water resource projects in the Southwest and in the City of Austin, Texas. Civil segment results are reported separately in Southland’s financial statements, with revenue and gross profit metrics provided for each reporting period.

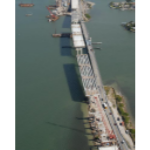

The Transportation segment focuses on infrastructure that supports mobility and access. Company materials indicate that this segment covers bridges, roadways, marine work, ship terminals and piers, and specialty structures and facilities. American Bridge Company, a Southland subsidiary, is cited in news releases as performing bridge rehabilitation projects for private clients in the Pacific Northwest, illustrating the type of work that falls under the Transportation segment. Segment reporting in Southland’s quarterly and annual results breaks out revenue and gross profit (or loss) for Transportation separately from Civil.

Across both segments, Southland reports that it serves end markets including bridges, tunneling, communications, transportation and facilities, marine, steel structures, water and wastewater treatment, and water pipeline projects. These categories are repeatedly listed in the company’s “About Southland” descriptions in multiple press releases, underscoring their central role in the business model.

Geographic Scope and Project Profile

Southland states that it is an infrastructure construction company in North America, and that it and its subsidiaries form one of the largest infrastructure construction companies in North America, with experience throughout the world. Specific project announcements reference work in the Pacific Northwest, the Southwest, and the City of Austin, Texas, reflecting a footprint that spans multiple regions within North America. The company’s activities are tied to large, often long-duration projects, which is reflected in its disclosed backlog figures and the use of segment-level revenue and gross profit reporting.

Southland’s projects include water conveyance systems, tunnels, long-span bridges, vertical structures, water pipelines, pump stations, lift stations, water and wastewater treatment plants, concrete and structural steel work, outfall structures, tunneling, roadways, marine and dredging work, ship terminals and piers, and specialty structures and facilities. These project types are described in the company profile information and align with the end markets highlighted in its news releases.

Backlog and Contracting Environment

Southland regularly discloses its backlog as a key metric, defining it in its financial communications as part of its non-GAAP measures. Backlog balances are presented in tables that reconcile beginning-of-period balances, new contracts, change orders, adjustments, and contract revenue recognized during the period. For example, the company has reported backlog balances in the billions of dollars, reflecting the cumulative value of contracted work not yet recognized as revenue. Management commentary in earnings releases refers to “legacy backlog” and “new core work,” indicating that the company distinguishes between older contracts and more recently awarded projects within its backlog.

Southland’s disclosures emphasize that it operates in markets characterized by demand for critical infrastructure. In management commentary, the company has referenced strong demand across its markets and a robust pipeline of infrastructure opportunities. It also notes the impact of government spending initiatives on its opportunity set, although specific programs are described in the context of management outlook rather than as structural elements of the business model.

Financial Reporting and Segment Performance

Southland provides detailed financial reporting through quarterly earnings releases and SEC filings. These materials include consolidated statements of operations, segment revenue and gross profit (or loss), balance sheets, cash flow statements, and reconciliations of non-GAAP measures such as EBITDA and Adjusted EBITDA. The company reports revenue and gross profit by segment, showing the relative contributions of the Civil and Transportation segments over time.

In its communications, Southland discusses trends in gross margin, selling, general and administrative expenses, and segment-level performance. For example, management commentary has highlighted margin improvement in the core business, the impact of specific businesses such as Materials & Paving on gross profit, and efforts to wind down legacy projects. These details provide investors with insight into how different parts of the company’s operations contribute to overall financial results.

Capital Structure, Surety Relationships, and Governance

Southland’s SEC filings describe its capital structure, including common stock and redeemable warrants exercisable for shares of common stock. The company has a Term Loan and Security Agreement with a lending group, and it discloses interactions with lenders and surety providers in its current reports on Form 8-K.

In an 8-K filed in December 2025, Southland reported that Berkshire Hathaway Specialty Insurance Company, a surety provider, agreed to advance up to a specified amount in surety funds under a general indemnity agreement to support bonded construction contract obligations and project progress. The filing notes that Southland is obligated to indemnify and reimburse the surety for such advances and that the company is working with its term loan agent and lenders to assess the impact of these surety advances on its credit agreement. The filing also states that there can be no assurances that a resolution for additional surety funds or a long-term financing arrangement will be reached.

Another 8-K filed in December 2025 describes the appointment of a Chief Transformation Officer, engaged through Meru, LLC, to provide strategic guidance on Southland’s review of financial and operational alternatives. According to the filing, this role includes advising on asset sales, executive compensation matters, strategic or financial alternatives, and cash management strategies, in alignment with the objectives of the company’s Board of Directors.

Southland also reports on corporate governance matters through its proxy-related 8-K filings. For example, an 8-K filed in June 2025 details the results of the company’s annual meeting of stockholders, including approval of a proposal to declassify the Board of Directors, the election of directors, and the ratification of the company’s independent registered public accounting firm.

Non-GAAP Measures and Investor Communications

In its earnings releases, Southland presents non-GAAP financial measures such as EBITDA, Adjusted EBITDA, Adjusted Net Loss, and backlog, along with reconciliations to the most directly comparable GAAP measures. The company explains that these non-GAAP measures are used by management and investors to evaluate financial and business trends, and it cautions that such measures are not a substitute for GAAP metrics and may not be comparable to similarly titled measures used by other companies.

Southland regularly announces the timing of its quarterly earnings releases and associated conference calls via press releases. These communications specify the date and time of the calls and note that replays are made available through the company’s channels. Earnings releases include management commentary on recent performance, segment trends, backlog, and operational priorities.

Stock and Investor Profile

Southland Holdings, Inc. is incorporated in Delaware and reports its results as a public company through SEC filings, including Forms 10-K, 10-Q, and 8-K. Its common stock and warrants trade on the NYSE American, and the company provides detailed financial and operational information to the market through Business Wire press releases and EDGAR filings. Investors interested in SLND stock can review Southland’s segment disclosures, backlog trends, non-GAAP reconciliations, and governance updates to understand how the company participates in the infrastructure construction sector, particularly in water, wastewater, bridges, tunneling, marine, and related end markets.

Stock Performance

Latest News

SEC Filings

Financial Highlights

Upcoming Events

Short Interest History

Short interest in Southland Holdings (SLND) currently stands at 326.2 thousand shares, down 0.6% from the previous reporting period, representing 2.6% of the float. Over the past 12 months, short interest has increased by 71.7%. This relatively low short interest suggests limited bearish sentiment. The 8.2 days to cover indicates moderate liquidity for short covering.

Days to Cover History

Days to cover for Southland Holdings (SLND) currently stands at 8.2 days, up 21.9% from the previous period. This moderate days-to-cover ratio suggests reasonable liquidity for short covering, requiring about a week of average trading volume. The days to cover has decreased 34.6% over the past year, suggesting improved liquidity for short covering. The ratio has shown significant volatility over the period, ranging from 1.1 to 12.6 days.