Welcome to our dedicated page for Xenon Pharmaceut SEC filings (Ticker: XENE), a comprehensive resource for investors and traders seeking official regulatory documents including 10-K annual reports, 10-Q quarterly earnings, 8-K material events, and insider trading forms.

This page provides access to U.S. Securities and Exchange Commission filings for Xenon Pharmaceuticals Inc. (Nasdaq: XENE), a neuroscience-focused biopharmaceutical company developing azetukalner and other ion channel modulators for epilepsy, major depressive disorder (MDD), bipolar depression (BPD), and pain. As a foreign private issuer incorporated in Canada and listed on The Nasdaq Global Market, Xenon uses SEC reports to disclose financial results, executive changes, and other material events.

Among the key documents available here are Form 8-K filings, which Xenon uses to report quarterly financial results, business updates, and corporate developments such as the appointment of its Chief Financial Officer and related employment and equity arrangements. These filings often reference the company’s Phase 3 clinical programs in focal onset seizures (FOS), primary generalized tonic-clonic seizures (PGTCS), MDD, and BPD, as well as its early-stage NaV1.7, Kv7, and NaV1.1 programs.

Investors can also review exhibits attached to 8-Ks, including press releases that summarize results of operations and financial condition, R&D spending, and cash runway expectations, along with risk-focused forward-looking statements. Additional filings detail governance and compensation matters, such as severance protections and equity inducement grants made under Xenon’s inducement equity incentive plans.

On Stock Titan, these SEC filings are updated in near real time from EDGAR and are paired with AI-powered summaries that highlight key points, explain technical language, and help users quickly identify information about Xenon’s clinical pipeline, executive changes, and financial disclosures. Users can also locate information relevant to insider and equity-related activity through option and restricted share unit grant disclosures contained in the company’s current reports.

Xenon Pharmaceuticals Inc. reported a new equity award for its Chief Medical Officer, Christopher John Kenney. On January 9, 2026, he received a share option covering 100,000 common shares with an exercise price of $42.15 per share. This option vests 25% on January 9, 2027, with the remaining 75% vesting in equal monthly installments over the next three years, encouraging longer-term retention.

On the same date, he was also granted 20,000 restricted share units, each representing a right to receive one common share. These RSUs vest in four equal 25% installments on each of the first four anniversaries of the grant date, beginning January 9, 2027. Both awards are reported as directly owned and reflect equity-based compensation rather than any sale of existing shares.

Xenon Pharmaceuticals Inc. reported new equity awards to its Chief Commercial Officer, Darren S. Cline. On January 9, 2026, he received a share option40,000 common shares with an exercise price of

On the same date, he was also awarded 20,000 restricted share units, each representing a contingent right to receive one common share. These RSUs vest in four equal installments of 25% on each of the first four anniversaries of the grant date, beginning on

Xenon Pharmaceuticals Inc. Chief Legal Officer Andrea DiFabio reported new equity awards. On January 9, 2026, DiFabio received share options covering 80,000 common shares at an exercise price of $42.15 per share, with no purchase price for the grant itself. These options vest 25% on January 9, 2027, with the remaining 75% vesting in equal monthly installments over the following three years.

On the same date, DiFabio was also granted 15,000 restricted share units, each representing a contingent right to receive one common share. These RSUs vest 25% on each of the first four anniversaries of the grant date, beginning January 9, 2027. Both awards are reported as directly held derivative securities.

Xenon Pharmaceuticals Inc. President & CEO Ian Mortimer reported new equity awards. On January 9, 2026, he received a stock option for 350,000 common shares at an exercise price of $42.15 per share. This option vests 25% on January 9, 2027, with the remaining 75% vesting in equal monthly installments over the following three years.

He also received 65,000 restricted share units, each representing a contingent right to receive one common share. These restricted share units vest 25% on each of the first four anniversaries of the grant date, beginning January 9, 2027. Both the option and the restricted share units are reported as directly owned.

Xenon Pharmaceuticals Inc.’s president and CEO, who is also a director, reported open-market sales of company common shares under a Rule 10b5-1 trading plan. On 12/05/2025 the insider sold 14,375 common shares at a weighted-average price of $45.03 per share. On 12/08/2025 additional trades involved 8,820 shares at a weighted-average $45.59 and 2,010 shares at a weighted-average $46.32, each executed in multiple transactions within stated price ranges. Following these sales, the insider beneficially owns 6,000 common shares directly and 14,300 common shares indirectly through a spouse; the Rule 10b5-1 trading plan was adopted on September 27, 2024.

Xenon Pharmaceuticals (XENE) reported Q3 2025 results with a net loss of

Operating expenses rose as late-stage programs advanced: R&D was

Pipeline updates: the Phase 3 X‑TOLE2 study in focal onset seizures completed enrollment (380 randomized) with topline data anticipated in early 2026; Phase 3 X‑TOLE3 (FOS) and X‑ACKT (PGTCS) continue. Phase 3 programs in MDD (X‑NOVA2/3) and bipolar depression (X‑CEED) are underway. Early-stage pain candidates include XEN1701 (Nav1.7) and XEN1120 (Kv7) in Phase 1.

Xenon Pharmaceuticals (XENE) furnished an update on its latest results. The company announced financial results for the three and nine months ended September 30, 2025 via a press release attached as Exhibit 99.1. The information under Item 2.02 and the exhibit are furnished, not filed with the SEC.

Xenon also notes it shares material updates through SEC filings, press releases, conference calls, its websites, and official social media channels.

Xenon Pharmaceuticals (XENE)10/15/2025, the officer received a stock option for 225,000 common shares at an exercise price of $41.9, expiring on 10/14/2035. The option vests 25% on October 15, 2026, with the remaining 75% vesting in equal monthly installments over the next three years.

The filing also reports 30,000 restricted share units (RSUs), vesting 25% on each of the first four anniversaries of the grant date, beginning October 15, 2026. The awards are reported as direct ownership.

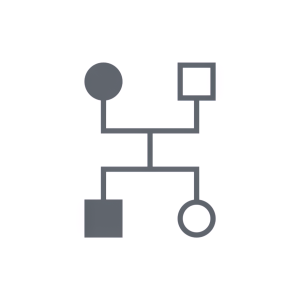

Xenon Pharmaceuticals (XENE) filed a Form 3 initial ownership report. The reporting person is an officer serving as Chief Financial Officer and indicated no securities are beneficially owned (0) and no derivative securities are held. The stated date of event is 10/15/2025. The filing reflects an individual submission by one reporting person.

Xenon Pharmaceuticals (XENE) appointed Thomas (Tucker) Kelly as Chief Financial Officer, effective October 15, 2025. He becomes the company’s principal financial and accounting officer, bringing prior CFO experience at Deciphera Pharmaceuticals and earlier roles across life sciences finance, banking, and law.

Under his employment terms, Mr. Kelly will receive a $540,000 annual base salary and is eligible for an annual incentive of up to 45% of base salary. He will receive a one-time grant of 225,000 options and 30,000 RSUs under the 2025 Inducement Equity Incentive Plan. Severance terms include up to 18 months of base salary depending on tenure, pro-rated Average Bonus, retirement contribution equivalents for the severance period, and equity vesting and exercisability provisions, with enhanced benefits upon a qualifying termination during a change of control period. Ian Mortimer ceases interim CFO duties and continues as President and CEO.