Silver47 Completes Successful Red Mountain Drill Program and Intersects Massive Sulfides in Multiple Holes

Rhea-AI Summary

Silver47 Exploration (OTCQB: AAGAF) has completed its summer 2025 drill program at the wholly-owned Red Mountain Project in Alaska, intersecting massive sulfides in multiple holes. The program included eight holes at Dry Creek and seven at West Tundra Flats, targeting areas near historical high-grade intercepts.

The project currently has an inferred resource of 168.6 million silver equivalent ounces (336 g/t AgEq) at Dry Creek and West Tundra Flats. Previous drilling highlights include intercepts of up to 2,003 g/t AgEq over 4.26m. The company is evaluating potentially significant concentrations of critical minerals antimony and gallium.

Silver47 maintains a strong financial position with $27 million in working capital for continued exploration across its American silver projects, with plans to drill at Mogollon in Q4 2025 and Hughes in early 2026.

Positive

- Strong treasury with $27 million in working capital for aggressive exploration

- Inferred resource of 168.6 million silver equivalent ounces at 336 g/t AgEq

- Previous high-grade intercepts up to 2,003 g/t AgEq over 4.26m

- Project contains critical minerals antimony and gallium important for U.S. defense

- Multiple untested targets across 55 km trend with 35 mineralized prospects

Negative

- All drill results from 2025 program still pending assays

- Resource currently only in inferred category

News Market Reaction

On the day this news was published, AAGAF gained 5.18%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

The Red Mountain Deposit Remains Open to Expansion in Multiple Directions with Assays Pending

Vancouver, British Columbia--(Newsfile Corp. - October 1, 2025) - Silver47 Exploration Corp. (TSXV: AGA) (OTCQB: AAGAF) ("Silver47" or the "Company") is pleased to announce the completion of its summer 2025 drill program at its wholly-owned Red Mountain Project in south-central Alaska.

Highlights:

- Significant Mineralization Intersected: Completed eight holes at Dry Creek and seven holes at West Tundra Flats, intersecting massive, semi-massive, and disseminated sulfides in step-out and infill drilling, with assays pending (see Figure 2-5 of core photos below).

- Establishing a Strong Alaskan High-Grade Resource Base: The 2025 program targeted untested areas near historical high-grade intercepts to enhance Red Mountain's inferred 168.6 million silver equivalent ounce resource (336 g/t AgEq*) at Dry Creek and West Tundra Flats.

- Red Mountain Deposit Open to Expansion: Both the Dry Creek and West Tundra Flats zones remain open to expansion in multiple directions and the Company is completing detailed geological modelling to guide vectoring towards additional mineralization in 2026.

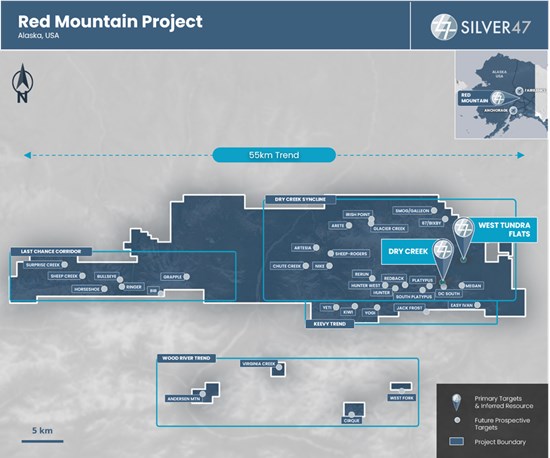

- Multiple Untested Targets: There are at least 35 mineralized prospects across the Red Mountain Project covering a 55 km trend many of which are undrilled or represent preliminary drilled discoveries.

- High-Value Critical Minerals: An ongoing metallurgical study is evaluating Red Mountain's potentially significant concentrations of antimony and gallium, critical for U.S. defense, where current supply chains are at risk from foreign dominance.

- Fully Capitalized: The Company is fully funded with approximately

$27 million in working capital to deploy towards aggressive growth-oriented drilling on our American silver projects.

Galen McNamara, CEO, stated: "The 2025 Red Mountain drill program has intersected massive sulfides in multiple holes. With assays pending, we now look forward to drilling at Mogollon in Q4 of this year and Hughes in early 2026. Fully funded with

Highlights from Previous Drilling (see news releases dated November 21 and 26, 2024 and February 12, 2025):

- DC24-104: 15.24 m grading 546 g/t AgEq* plus 290 g/t antimony ("Sb") and 32 g/t gallium ("Ga") from 14.3 m depth (AgEq: 106 g/t silver, 0.45 g/t gold,

6.4% zinc,2.2% lead, and0.19% copper)

- DC24-105: 22.32 m grading 601 g/t AgEq plus 503 g/t Sb and 54 g/t Ga from 18.9 m (AgEq: 150.6 g/t silver, 0.82 g/t gold,

5.9% zinc,2.6% lead, and0.13% copper)

- WT24-33: 2.90 m grading 1,079 g/t AgEq plus 920 g/t Sb and 15 g/t Ga from 121.70 m depth

(AgEq: 418 g/t silver, 0.74 g/t gold,9.1% zinc,4.7% lead,0.105% copper)

- DC18-77: 4.26 m grading 2,003 g/t AgEq plus 4,432 g/t Sb and 97 g/t Ga 168.8 m depth

(AgEq: 1,435 g/t silver, 2.2 g/t gold,4.8% zinc,2.3% lead,0.5% copper)

*Notes: g/t=grams per tonne; AgEq=silver equivalent; ZnEq=zinc equivalent; m=metres; Ag=silver; Au=gold; Cu=copper; Zn=zinc; Pb=lead; 1ppm=1 g/t. Equivalencies are calculated using ratios with metal prices of US

Figure 1. Plan Map of Red Mountain Project showing over 35 targets highlighting the Dry Creek and West Tundra Flats target.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/268546_860a7d7c4431badc_002full.jpg

Figure 2: (see attached figure). Mineralized core from drill hole DC25-110 at the Dry Creek deposit showing disseminated, semi-massive and massive sulfide mineralization featuring pyrite, chalcopyrite, sphalerite and galena (148.5 to 170.9m downhole). Photo is not intended to be representative of broader mineralization.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/268546_860a7d7c4431badc_003full.jpg

Figure 3: (see attached figure). Mineralized core from drill hole DC25-112 at the Dry Creek deposit showing disseminated, semi-massive and massive sulfide mineralization featuring pyrite, chalcopyrite, sphalerite and galena (228.55 to 245.55m downhole). Photo is not intended to be representative of broader mineralization.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/268546_860a7d7c4431badc_004full.jpg

Figure 4: (see attached figure). Mineralized core from drill hole DC25-113 at the Dry Creek deposit showing disseminated, semi-massive and massive sulfide mineralization featuring pyrite, sphalerite and chalcopyrite (222.9 to 240.05m downhole). Photo is not intended to be representative of broader mineralization.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/268546_860a7d7c4431badc_005full.jpg

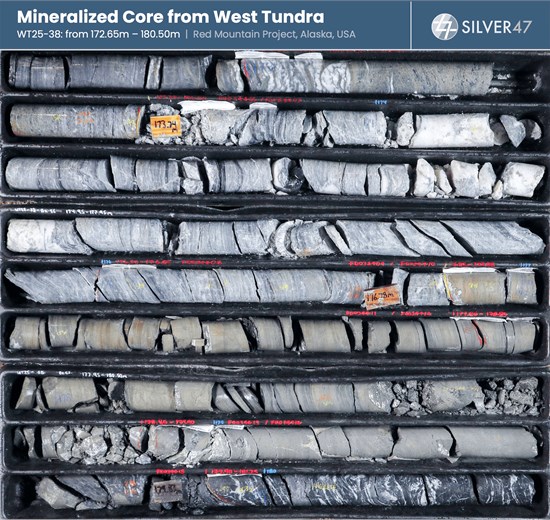

Figure 5: (see attached figure). Mineralized core from drill hole WTF-38 at the West Tundra Flats Deposit showing disseminated, semi-massive and massive sulfides consisting of pyrite, sphalerite, galena and chalcopyrite (172.65 to 180.5m downhole). Photo is not intended to be representative of broader mineralization.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/268546_860a7d7c4431badc_006full.jpg

Drill Program

The 2025 Red Mountain drill program consisted of fifteen drill holes - eight holes at the Dry Creek target (Figure 1) and seven holes were completed at the West Tundra Flats target (Figure 1). The Dry Creek and West Tundra Flat targets together account for an inferred resource of 15.6 Mt at 336 g/t AgEq* for 168.6 million silver equivalent ounces.

Drilling at both targets consisted of a series of infill and step-out holes designed to test areas near historical high-grade drill intercepts and modelled domains where the structural controls on high-grade mineralization were not fully resolved. Multiple holes at each target intersected mineralized zones consisting of variable proportions of massive, semi-massive, and disseminated sulfides (Figures 2, 3, 4, and 5). Assays are pending from all holes drilled.

Based on observations from drilling together with results from ongoing geological modelling, multiple mineralized lenses and domains at Dry Creek and West Tundra Flats targets remain open along strike and down-dip. The company will integrate all new assay data with the geological modelling to guide vectoring towards additional VMS-related, high-grade mineralization in 2026.

Quality Assurance and Quality Control

Quality assurance and quality control (QAQC) protocols for drill core sampling at the Red Mountain Project followed industry standard practices. Core samples were typically taken at 1.0 m intervals in mineralized zones, and 3.0 m intervals outside of mineralized zones. Sample lengths were adjusted as necessary so as not to cross lithologic and mineralogic boundaries. QAQC check samples were inserted into the sample stream with one blank, one duplicate (coarse), and one certified reference material (CRM) occurring within every 20 samples. Drill core was cut in half, bagged, sealed and delivered directly to ALS Minerals Fairbanks, Alaska for transport to the ALS Minerals Laboratories labs in North Vancouver, British Columbia. ALS Minerals Laboratories are registered to ISO 9001:2008 and ISO 17025 accreditations for laboratory procedures. Core samples were analyzed at ALS Laboratory facilities in North Vancouver using four-acid digestion with an ICP-MS finish. Gold analysis was by fire assay with atomic absorption finish, or gravimetric finish for over-limit samples. Over-limits for silver, zinc, copper, and lead were analyzed using Ore Grade four-acid digestion. The standards, certified reference materials, were acquired from CDN Resource Laboratories Ltd. of Langley, British Columbia and selected to represent expected mineralization.

Corporate Update

Further to its news releases dated September 16, 2025, with respect to the closing of a brokered private placement of units for gross proceeds of

Qualified Person

The technical content of this news release has been reviewed and approved by Galen McNamara, P. Geo., the CEO of the Company and a qualified person as defined by National Instrument 43-101.

About Silver47 Exploration

Silver47 Exploration Corp is a mineral exploration company, focused on uncovering and developing silver-rich deposits in North America. The Company is creating a leading high-grade US-focused silver developer with a resource totaling 236 Moz AgEq at 334 g/t AgEq inferred and 10 Moz at 333 g/t AgEq indicated. With operations in Alaska, Nevada and New Mexico, Silver47 Exploration is anchored in America's most prolific mining jurisdictions. For detailed information regarding the resource estimates, assumptions, and technical reports, please refer to the NI 43-101 Technical Report and other filings available on SEDAR at www.sedarplus.ca. The Company trades on the TSXV under the ticker symbol AGA and OTCQB under the ticker symbol AAGAF.

For more information about the Company, please visit www.silver47.ca and see the Technical Report filed on SEDAR+ (www.sedarplus.ca) and titled "Technical Report on the Red Mountain VMS Property Bonnifield Mining District, Alaska, USA with an effective date January 12, 2024, and prepared by APEX Geoscience Ltd."

Follow us on social media for the latest updates:

- X: @Silver47co

- LinkedIn: Silver47

On Behalf of the Board of Directors

Mr. Galen McNamara

CEO & Director

For investor relations

Giordy Belfiore

604-288-8004

gbelfiore@silver47.ca

No securities regulatory authority has either approved or disapproved of the contents of this release. Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this news release constitute forward-looking statements or forward-looking information under applicable securities laws (collectively, "forward-looking statements"). Such statements relate to future events or the Company's future plans, performance, business prospects or opportunities that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "anticipate", "believe", "estimate", "expect", "intend", "plan", "potential", "could", "may", "will" and similar expressions) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements in this news release include, but are not limited to: the interpretation of exploration results; the significance of drill results; the potential for additional mineralization; the timing and success of future exploration activities, including drilling and sampling; the ability to expand or upgrade mineral resources through further exploration; the potential for future economic studies on the project; and the Company's plans and objectives in advancing its exploration properties.

These forward-looking statements are based on a number of assumptions considered reasonable by management as of the date of this news release, including assumptions regarding: the accuracy of geological interpretations; continuity of mineralization; the Company's ability to obtain necessary permits and approvals; availability of financing and personnel to carry out planned programs; future commodity prices; and general business and economic conditions.

Forward-looking statements are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied. Such risks include, but are not limited to: risks inherent in mineral exploration, including unexpected results or outcomes; delays or inability to obtain required permits and approvals; availability and cost of financing, labour and equipment; changes in commodity prices and foreign exchange rates; political, regulatory and environmental risks in the jurisdictions where the Company operates; community or social risks; and other risks described in the Company's continuous disclosure documents filed at www.sedarplus.com.

Although the Company believes the expectations expressed in such forward-looking statements are reasonable, no assurance can be given that these expectations will prove to be correct and such statements should not be unduly relied upon. Forward-looking statements speak only as of the date of this news release. The Company does not undertake any obligation to update or revise any forward-looking statements, except as required by applicable securities laws. Actual results may differ materially from those expressed or implied in forward-looking statements

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/268546