AbraSilver Consolidates Diablillos Footprint with Multiple Acquisitions to Add Future Exploration Upside and Expansion Potential

Rhea-AI Summary

AbraSilver (OTCQX: ABBRF) agreed to acquire multiple mining properties around its Diablillos project, expanding its land package by more than 6,200 hectares and securing water and infrastructure optionality for potential future expansion.

Total consideration is approximately US$4.65 million (US$3.70M cash and ~US$0.95M in common shares). Several acquisitions include upfront payments and optioned follow-on payments exercisable by March and May 2026.

Positive

- Land expanded by more than 6,200 hectares around Diablillos

- Total consideration approximately US$4.65 million (US$3.70M cash, ~US$0.95M shares)

- Water infrastructure optionality added to support potential expansion beyond 9,000 tpd

- Contiguous footprint improves path for large-scale development and infrastructure siting

Negative

- Cash outlay of US$3.70 million reduces near-term liquidity

- Additional contingent payments up to US$2.5 million remain option-based and payable if exercised

- Consideration shares issued (~US$0.95M) create modest shareholder dilution and are subject to a hold period

Toronto, Ontario--(Newsfile Corp. - February 17, 2026) - AbraSilver Resource Corp. (TSX: ABRA) (OTCQX: ABBRF) ("AbraSilver" or the "Company") is pleased to announce that it has entered into agreements with multiple arms' length parties to acquire several strategic mining properties in the vicinity of its flagship Diablillos project in Argentina (the "Project"). These acquisitions will significantly expand the Company's exploration pipeline and secure critical infrastructure optionality for future production expansion scenarios.

John Miniotis, President and CEO, commented, "These strategic acquisitions represent a proactive step in de-risking and enhancing the long-term value of the Diablillos district. By expanding our land position and securing essential infrastructure rights now, we are providing the Company with the flexibility and optionality required to scale the Project well beyond the base-case parameters of our upcoming Definitive Feasibility Study, including life of mine extension and throughput expansion."

The total consideration to be paid is approximately US

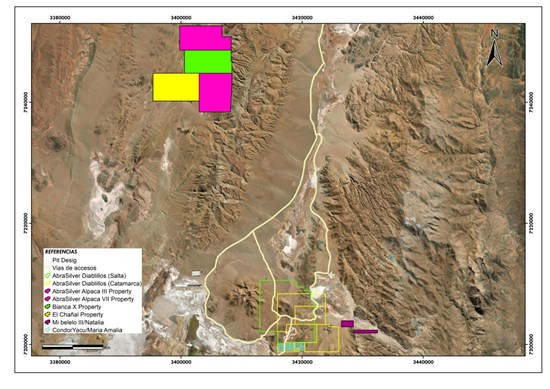

Bianca X & El Chanal: Securing Access to Additional Water Resources

The Company has acquired the Bianca X mining property and has entered into an option agreement to acquire the El Chanal mining property, each located in San Antonio de los Cobres, Salta Province, Argentina.

While the Company's upcoming Definitive Feasibility Study (DFS) in respect of the Project focuses on a robust production scenario based on secured water rights, these land parcels provide the Company with additional access to water to support potential future expansions at the Project beyond the base-case throughput of 9,000 tonnes per day.

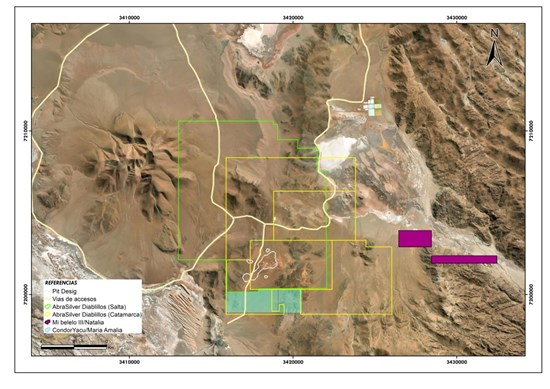

Condoryacu & Maria Amalia: Future Exploration Targets

The Company has entered into agreements to acquire the Condoryacu project along with the María Amalia I concession. Condoryacu is located adjacent to the existing Diablillos land package and is considered a district-scale target with both exploration and potential water resource significance.

Historical data and surface sampling at Condoryacu have identified gold and silver mineralization adjacent to Diablillos associated with a hydrothermal breccia system with similarities to the deeper parts of the Oculto system. Mineralization at Condoryacu appears to include a sulphide component, which differs from the predominantly oxide mineralization currently defined at Diablillos and will require additional technical and metallurgical evaluation. In addition, the area is considered prospective for potential water resources, which could provide long-term strategic optionality for future Project expansion scenarios.Under the terms of the option agreement, the Company has made an initial payment and will complete certain technical work programs, prior to making a final decision to exercise the option. The remaining option payment is payable only at the Company’s election, subject to completion and internal approval of technical evaluations.

Mi Belelo III & Natalia: District Consolidation

The Company has further consolidated its regional footprint by acquiring the Mi Belelo III and Natalia properties. These concessions are strategically located to protect the Company's exploration upside and provide additional surface rights for future Project infrastructure. By securing these properties, the Company now controls a more contiguous and expanded land package, ensuring a clear path for large-scale development.

Transaction Details

The Company has reached the following terms for the acquisitions:

Bianca X: Acquired for US

$100,000 in cash and the issuance 94,650 common shares of AbraSilver (the "Consideration Shares").El Chanal: The Company has the option to acquire El Chanal for cash consideration of US

$350,000 , exercisable by May 7, 2026.Condoryacu: The Company has made an upfront cash payment of US

$250,000 and has the option to acquire the Condoryacu project for an additional payment of US$2,500,000 , exercisable by March 15, 2026.María Amalia I: The Company has the option to acquire the María Amalia concession for cash consideration of US

$250,000 , exercisable by March 15, 2026.Mi Belelo III: The Company has acquired the Mi Belelo III property for cash consideration of US

$250,000 Natalia: The Company has acquired the Natalia property for cash consideration of US

$250,000

The issuance of the Consideration Shares has been conditionally accepted by the Toronto Stock Exchange and the Consideration Shares are subject to a statutory hold period of four-months-and-one-day.

Figure 1 - Map Highlighting the Bianca X and El Chanal Properties

Located north of the Diablillos Project and adjacent to AbraSilver's existing Alpaca properties.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11792/284020_d96f5c87e4e9ba86_001full.jpg

Figure 2 - Map Highlighting the Condoryacu, María Amalia I, Mi Belelo III, Natalia Properties

Consolidates land position to the south of the Diablillos Project and add new areas to the east.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11792/284020_d96f5c87e4e9ba86_002full.jpg

About Diablillos

The Diablillos property is located within the Puna region of Argentina, in the southern part of Salta Province along the border with Catamarca Province, approximately 160 km southwest of the city of Salta and 375 km northwest of the city of Catamarca. AbraSilver acquired the property in 2016, which comprises 15 contiguous and overlapping mineral concessions with excellent year-round road access.

Exploration to date has outlined multiple occurrences of silver-gold oxide mineralization at Oculto, JAC, Laderas, and Fantasma, located within a 500 m to 1.5 km distance surrounding the Oculto/JAC epicentre. To date, over 150,000 metres have been drilled on the property, which continues to demonstrate the strong growth potential of shallow, oxide-hosted silver and gold resources. In addition, a large porphyry complex is centered approximately 4 km northeast of Oculto which includes outcropping porphyry intrusions within a major zone of alteration and associated gold rich epithermal mineralization.

Qualified Persons

David O'Connor P.Geo., Chief Geologist for AbraSilver, is the Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, and he has reviewed and approved the scientific and technical information in this news release.

About AbraSilver

AbraSilver is an advanced-stage exploration company focused on rapidly advancing its

For further information please visit the AbraSilver Resource website at www.abrasilver.com, our LinkedIn page at AbraSilver Resource Corp., and follow us on X at www.x.com/abrasilver

Alternatively, please contact:

John Miniotis, President and CEO

info@abrasilver.com

Tel: +1 416-306-8334

Cautionary Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. All statements that address future plans, activities, events or developments that the Company believes, expects or anticipates will or may occur are forward-looking information. Forward-looking statements in this news release include, but are not limited to, statements in respect of the Company's potential property acquisitions, potential mineralization at the Condoryacu project, the securing of additional surface rights for future Project infrastructure, and the potential life of mine extension and throughput expansion at the Project. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. When considering this forward-looking information, readers should keep in mind the risk factors and other cautionary statements in the Company's disclosure documents filed with the applicable Canadian securities regulatory authorities on SEDAR+ at www.sedarplus.ca. The risk factors and other factors noted in the disclosure documents could cause actual events or results to differ materially from those described in any forward-looking information. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this news release

[1] Based on 94,560 shares valued at the closing price of US

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/284020