Adia Nutrition Inc. Files SEC Form 10 as Strategic Step Toward Full Reporting Status

Rhea-AI Summary

Adia Nutrition (OTCQB: ADIA) filed a Form 10 registration statement with the U.S. Securities and Exchange Commission on December 8, 2025, prepared with assistance from the company's CFO, auditing accountant, corporate accountant, and legal counsel.

The filing is a strategic step toward full reporting status; once the Form 10 becomes effective (expected ~60 days after submission), Adia will begin reporting under the Securities Exchange Act of 1934 with audited financials and regular annual and quarterly disclosures. The company said Form 10 does not guarantee immediate national exchange listing such as Nasdaq and expects to announce effectiveness in early 2026. Filing materials are available on EDGAR.

Positive

- Form 10 filed on December 8, 2025

- Effectiveness expected in ~60 days, enabling Exchange Act reporting

- Will provide audited financials and regular quarterly/annual disclosures

Negative

- Form 10 does not ensure immediate Nasdaq or other national exchange eligibility

- Effectiveness and timeline remain subject to SEC review and are not guaranteed

News Market Reaction

On the day this news was published, ADIA declined NaN%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

ADIA rose 13.67% while peers showed mixed moves: ETER up 111.76%, WRPT up 60%, BOREF up 12.58%, BDCC down 2.08%, and CRVH flat. The pattern points to stock-specific rather than broad sector-driven action.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 08 | Form 10 filing | Positive | +0.0% | Filed Form 10 to become a fully reporting SEC company. |

| Dec 01 | Media partnership | Positive | -12.6% | Media deal with Dr. Asa Andrew to spotlight stem cell therapies. |

| Nov 24 | Clinical protocol | Positive | +0.1% | Submitted patent‑pending autism protocol for independent IRB review. |

| Nov 19 | Educational webinar | Neutral | -28.6% | Announced HSCT webinar on MS and autoimmune conditions. |

| Nov 17 | SIC code change | Positive | -31.0% | Requested SIC update to biological products and noted 200%+ Q3 growth. |

Recent ADIA news often saw weak or negative reactions: several positive corporate and operational updates were followed by declines of 12.6%, 28.57%, and 31.03%, while only the autism protocol update had a slightly positive move.

This announcement continues a series of steps repositioning ADIA. In November 2025, the company requested an SIC change to 2836 Biological Products and highlighted 200%+ Q3 2025 revenue growth, followed by a webinar on HSCT and submission of a patent-pending autism protocol for IRB review. A media partnership with Dr. Asa Andrew then aimed to raise awareness of its regenerative therapies. Filing the Form 10 on December 8, 2025 advances the shift toward full SEC reporting and greater transparency.

Market Pulse Summary

This announcement highlights ADIA’s effort to strengthen governance by filing a Form 10, aiming for full reporting status under the Securities Exchange Act of 1934. It follows recent steps including an SIC change toward biological products and disclosure of $637,145 in nine‑month revenue alongside a substantial deficit over $15 million. Investors may watch for Form 10 effectiveness, future audited filings, and how the business addresses going concern and regulatory risks.

Key Terms

form 10 regulatory

u.s. securities and exchange commission regulatory

nasdaq financial

edgar regulatory

AI-generated analysis. Not financial advice.

Winter Park, Florida--(Newsfile Corp. - December 8, 2025) - Adia Nutrition Inc. (OTCQB: ADIA), announced today that, with the assistance of Adia's Chief Financial Officer, and following review by the Company's auditing accountant, its Form 10 registration statement was prepared and submitted by Adia's corporate accountant and legal counsel to the U.S. Securities and Exchange Commission (SEC).

The Form 10 filing can be viewed here: SEC FORM 10 FILING

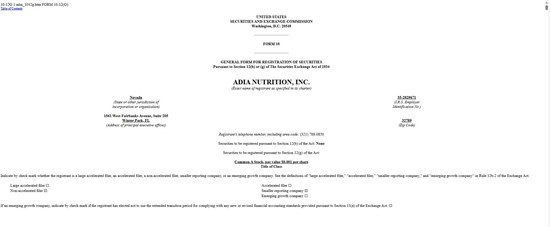

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10520/277078_adia_sec_form_10_screenshot.jpg

The filing represents a key milestone in Adia's ongoing effort to enhance transparency, improve corporate governance, and move toward becoming a fully reporting company under the SEC. While filing a Form 10 does not mean immediate eligibility for a national exchange listing such as Nasdaq, it is considered an important step in strengthening the company's regulatory standing and credibility within the public markets.

Once the Form 10 becomes effective, Adia will begin reporting under the Securities Exchange Act of 1934, providing investors with regular, standardized disclosures, including audited financials and ongoing reporting through annual and quarterly filings.

The Form 10 filing can be viewed here: SEC FORM 10 FILING

"This marks an important moment for Adia," said Larry Powalisz, Chief Executive Officer of Adia Nutrition Inc. "Becoming a fully reporting company has been a deliberate goal. This step is focused on transparency, long-term credibility, and opening our story to a broader and more informed investor audience. It is not about rushing into an exchange - it's about building the right foundation."

The Form 10 is expected to become effective approximately 60 days following submission.

ADIA will continue to update stakeholders throughout the SEC review process and anticipates announcing effectiveness in early 2026.

The Form 10 and related materials are also available through the SEC's EDGAR system.

Clinic owners and healthcare practitioners interested in licensing the Adia Med name or integrating Adia's regenerative therapies into their practice are encouraged to reach out directly. Strategic partnerships are welcomed as part of Adia's continued mission to expand access to advanced stem cell solutions.

For questions, inquiries, or additional information, please contact Larry Powalisz at ceo@adiamed.com or by phone at 321-788-0850.

About ADIA Nutrition Inc.:

Adia Nutrition Inc. (OTCQB: ADIA), based in Winter Park, Florida, is a publicly traded company advancing healthcare through innovation. The company specializes in sales of stem cell and regenerative products, such as AdiaVita and AdiaLink, through its lab division, Adia Labs LLC, which is expanding to include insurance-billable wound care products. Adia is also growing nationwide with Adia Med clinics, specializing in orthopedic, pain management, and wound repair. Adia Med clinics also offer specialized regenerative treatments like stem cell therapies and platelet-rich plasma (PRP), advanced treatments including therapeutic plasma exchange (TPE) and autologous hematopoietic stem cell transplantation (aHSCT), and wound repair services.

Revenue is generated through service fees, product sales, equity stakes, and billing insurance for healthcare treatments. Additionally, Adia Nutrition Inc. invests in aligned businesses such as Cement Factory LLC, a nutrition and supplement company with shared values and a focus on health and wellness. Through bold partnerships with top-tier medical entities and unwavering dedication to standardized, FDA-approved lab protocols, Adia Nutrition Inc. is revolutionizing healthcare, igniting a nationwide movement to empower communities with groundbreaking regenerative solutions and vibrant, holistic wellness.

Website: www.adianutrition.com

Website: www.adiamed.com

Website: www.adialabs.com

Website: www.cementfactory.co

Twitter (X): @ADIA_Nutrition

Safe Harbor: This Press Release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on the current plans and expectations of management and are subject to a few uncertainties and risks that could significantly affect the company's current plans and expectations, as well as future results of operations and financial condition. A more extensive listing of risks and factors that may affect the company's business prospects and cause actual results to differ materially from those described in the forward-looking statements can be found in the reports and other documents filed by the company with the Securities and Exchange Commission and OTC Markets, Inc. OTC Disclosure and News Service. The company undertakes no obligation to publicly update or revise any forward-looking statements, because of new information, future events or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/277078