Applied Digital Corporation Announces Closing of $450 Million of Convertible Notes Offering

Rhea-AI Summary

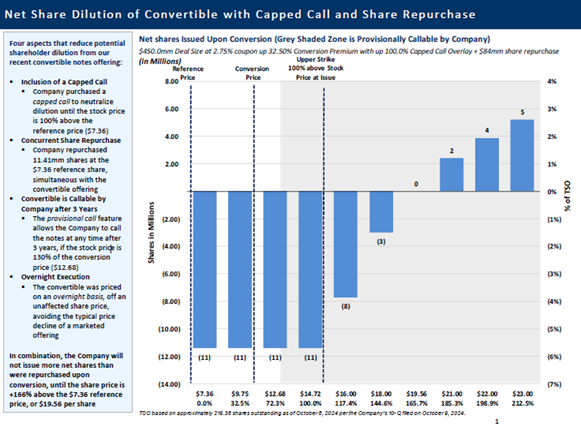

Applied Digital (APLD) has completed its previously announced offering of 2.75% Convertible Senior Notes due 2030, raising $450 million. The offering includes $75 million in additional notes from exercised options by initial purchasers. The company implemented capped call transactions with a cap price of $14.72 and repurchased approximately $84 million of common stock. Net proceeds were $434.5 million after expenses, with allocations of $84 million for share repurchases, $51.8 million for capped call transactions, and the remainder for general corporate purposes.

Positive

- Successfully raised $450 million through convertible notes offering

- Initial purchasers exercised full $75 million additional notes option

- Net proceeds of $434.5 million strengthen company's financial position

Negative

- Potential future dilution from convertible notes

- Increased debt liability with 2.75% interest rate

- Significant cash outlay of $84 million for share repurchases

News Market Reaction – APLD

On the day this news was published, APLD gained 6.70%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

DALLAS, Nov. 04, 2024 (GLOBE NEWSWIRE) -- Applied Digital Corporation (Nasdaq: APLD) (“Applied Digital” or the “Company”), a designer, builder, and operator of next-generation digital infrastructure designed for High-Performance Computing applications, today completed its previously announced offering of

In conjunction with the issuance of the Convertible Notes, the Company entered into capped call transactions with a cap price of

The table below illustrates the potential net dilution expectations from the overall transaction.

The net proceeds from the sale of the Convertible Notes were approximately

About Applied Digital

Applied Digital (Nasdaq: APLD) develops, builds and operates next-generation data centers and cloud infrastructure. Different by design, the company’s purpose-built facilities are engineered to unleash the power of accelerated compute and deliver secure, scalable and sustainable digital hosting, along with turnkey CSaaS and GPU-as-a-Service solutions. Backed by deep hyperscale expertise and a robust pipeline of available power, Applied Digital accommodates AI Factories and beyond to support the world’s most exacting AI/ML, blockchain and high-performance computing (HPC) workloads.

Forward-Looking Statements

This release contains "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 regarding, among other things, the intended use of the proceeds and the effects of entering into, the capped call transactions and prepaid forward repurchase described above. These statements use words, and variations of words, such as “continue,” “build,” “future,” “increase,” “drive,” “believe,” “look,” “ahead,” “confident,” “deliver,” “outlook,” “expect,” “intend,” “hope,” “remain,” “project” and “predict.” You are cautioned not to rely on these forward-looking statements. These statements are based on current expectations of future events and thus are inherently subject to uncertainty. If underlying assumptions prove inaccurate or known or unknown risks or uncertainties materialize, actual results could vary materially from the Company's expectations and projections. These risks, uncertainties, and other factors include: decline in demand for our products and services; the volatility of the crypto asset industry; the inability to comply with developments and changes in regulation; cash flow and access to capital; and maintenance of third-party relationships. The Company cannot provide any assurances regarding its ability to effectively apply the net proceeds as described above. Information in this release is as of the dates and time periods indicated herein, and the Company does not undertake to update any of the information contained in these materials, except as required by law.

Investor Relations Contacts

Matt Glover and Ralf Esper

Gateway Group, Inc.

(949) 574-3860

APLD@gateway-grp.com

Media Contact

Buffy Harakidas, EVP and Jo Albers

JSA (Jaymie Scotto & Associates)

jsa_applied@jsa.net

(856) 264-7827

Source: Applied Digital Corporation

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4892d38d-29e4-4243-89d3-18e692313154