Aqua Metals Expands Vision for Commercial Giga-Scale Lithium Battery Recycling – More than Doubling the Output of Battery Grade Lithium at Sierra ARC Phase 1

Rhea-AI Summary

Aqua Metals (NASDAQ: AQMS) has announced an accelerated strategy for its commercial-scale AquaRefining™ facility at the Tahoe-Reno industrial center. The company plans to more than double its initial production targets for battery grade lithium carbonate, while also producing Mixed Hydroxide Precipitate (MHP) containing nickel and cobalt, along with copper and manganese.

The revised strategy aims to streamline market entry, optimize capital efficiency, and meet customer demands. The company has already demonstrated its capability to recover battery grade lithium and high-purity metals at its pilot facility. This new approach is expected to accelerate commercialization, reduce capital requirements, and position Aqua Metals as a key supplier of domestic, low-carbon, battery-grade materials.

The optimized plan is projected to achieve a ~3 year payback at current metals prices, with lower capital and operational intensity than the previous design. The company maintains its long-term vision while adapting to market conditions, with plans for modular expansion and continued engagement with financial backers, feedstock suppliers, and off-take partners.

Positive

- More than doubled production targets for battery grade lithium carbonate

- Reduced capital requirements and operational costs

- Projected ~3 year payback period at current metal prices

- Successfully demonstrated battery grade lithium recovery at pilot facility

- Scalable technology allows future expansion to full metal refining

Negative

- Delayed full metal refining capabilities to future phases

- Strategy shift indicates possible challenges with original plan

- Dependent on securing financial backers and partnerships

News Market Reaction

On the day this news was published, AQMS gained 16.48%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Company positions itself for a multi-gigawatt-hour scale facility designed to produce higher margins and targeting a ~3 year payback, while enabling faster commercialization of battery-grade materials

RENO, Nev., Feb. 04, 2025 (GLOBE NEWSWIRE) -- Aqua Metals, Inc. (NASDAQ: AQMS), a pioneer in sustainable lithium battery recycling, today announced an accelerated pathway intended to increase revenue and margin at its planned commercial-scale AquaRefining™ facility at the Tahoe-Reno industrial center. To streamline market entry, optimize capital efficiency, scale core patented and licensable technology, and meet evolving customer demands, the Company intends to prioritize the production of battery grade lithium carbonate, more than doubling the initial production targets. Mixed Hydroxide Precipitate (MHP), a widely traded, high-value nickel and cobalt product, along with copper and manganese, will make up the rest of its product suite at its Sierra ARC recycling campus.

This near-term focus should enable faster and larger revenue generation, additional technology validation at scale, and expanded industry partnership potential while maintaining a clear roadmap for scaling toward high-purity metal refining that will eventually complement the lithium carbonate production.

Aqua Metals’ Strategy for Scaling a Low-Cost, Decarbonized Critical Minerals Supply Chain, while Creating Highly Desirable Jobs

Aqua Metals has already proven its ability to recover battery grade lithium as well as high purity nickel and cobalt from spent batteries and manufacturing scrap at its pilot facility. By prioritizing lithium carbonate and MHP production, the Company believes it can accelerate commercialization, reduce remaining capital requirements to complete the Sierra ARC, and position itself as a key supplier of domestic, low-carbon, battery-grade materials. The scalable nature of AquaRefining™ is the basis upon which Aqua Metals believes that full metal refining remains within reach as part of future scaling. The Company will continue qualifying battery-grade materials with its pilot program and through ongoing engagements with OEMs, cell, and CAM manufacturers.

“We are taking a smart, market-driven approach that we believe will allow us to scale faster, generate revenue sooner, and strengthen our position in the domestic critical minerals supply chain,” said Steve Cotton, CEO of Aqua Metals. “Our proven technology can already refine MHP into pure metals, but prioritizing a higher-throughput facility should allow us to increase the production of our highest margin material, battery grade lithium carbonate. This plan is designed to accelerate commercialization while maintaining full compatibility with our long-term vision for battery-grade materials that close the loop domestically.”

Optimized Strategy for Near-Term Growth & Long-Term Market Leadership

Aqua Metals' updated strategy reflects the Company's ability to adapt to market conditions while staying focused on long-term goals:

- Faster Path to Market, Lower CAPEX – Prioritizing lithium carbonate along with MHP as the product suite should reduce capital and operational intensity, enable a larger-scale facility that generates more revenue at a higher margin than our previous design – and achieve an attractive ~3 year payback even at today’s lower metals prices.

- Strengthened Industry Partnerships – Aqua Metals is in active discussions with feedstock suppliers and offtake partners, aligning with this accelerated commercialization and product suite plan.

- Future-Ready, Modular Expansion – The Company’s scalable technology should provide an easy transition to refining battery-grade nickel and cobalt sulfates and lithium hydroxide as market conditions and partner demand evolve.

Aqua Metals is continuing its engagement with several prospective financial backers, feedstock supply, and off-take partners, and expects to be able to provide updates later in Q1.

To listen to a Q&A on this topic visit our blog here: https://aquametals.com/blog/

Aqua Metals team standing with battery grade lithium produced at the Pilot facility in Tahoe-Reno Industrial Center

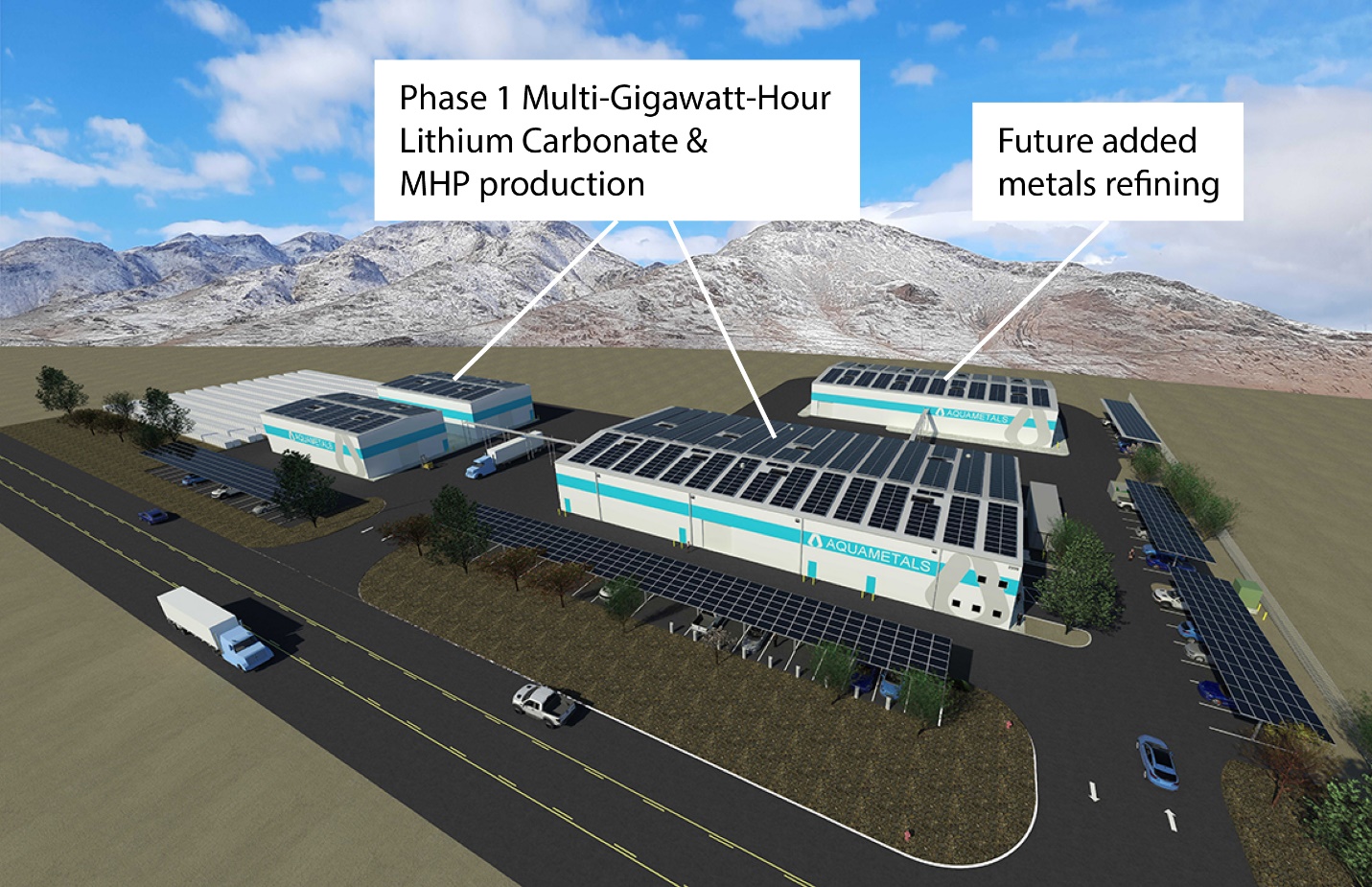

Rendering of Sierra ARC campus with layout to support Lithium Carbonate and MHP production along with future AquaRefining™ to metals

About Aqua Metals

Aqua Metals, Inc. (NASDAQ: AQMS) is reinventing metals recycling with its patented AquaRefining™ technology. The Company is pioneering a sustainable recycling solution for materials strategic to energy storage and electric vehicle manufacturing supply chains. AquaRefining™ is a low-emissions, closed-loop recycling technology that replaces polluting furnaces and hazardous chemicals with electricity-powered electroplating to recover valuable metals and materials from spent batteries with higher purity, lower emissions, and minimal waste. Aqua Metals is based in Reno, NV and operates the first sustainable lithium battery recycling facility at the Company’s Innovation Center in the Tahoe-Reno Industrial Center. To learn more, please visit www.aquametals.com.

Aqua Metals Social Media

Aqua Metals has used, and intends to continue using, its investor relations website (https://ir.aquametals.com), in addition to its Twitter, Threads, LinkedIn and YouTube accounts at https://twitter.com/AquaMetalsInc (@AquaMetalsInc), https://www.threads.net/@aquametalsinc (@aquametalsinc), https://www.linkedin.com/company/aqua-metals-limited and https://www.youtube.com/@AquaMetals respectively, as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Safe Harbor

This press release contains forward-looking statements concerning Aqua Metals, Inc. Forward-looking statements include, but are not limited to, our plans, objectives, expectations and intentions and other statements that contain words such as "expects," "contemplates," "anticipates," "plans," "intends," "believes", "estimates", "potential" and variations of such words or similar expressions that convey the uncertainty of future events or outcomes, or that do not relate to historical matters. The forward-looking statements in this press release include our expectations for our pilot and commercial-scale recycling plants, our acquisition of the necessary funding to fully develop the Sierra ARC facility, our ability to recycle lithium-ion batteries on a scaled and economically efficient basis and the expected benefits of recycling lithium-ion batteries. Those forward-looking statements involve known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially, including, but not limited to, (1) the risk that we may not be able to successfully acquire the funding necessary to develop our Sierra ARC facility, (2) even if we are to able acquire the necessary funding, the risk we may not be able to successfully develop the Sierra ARC facility or realize the expected benefits from such facility; (3) the risk that we may not be able to acquire the funding necessary to maintain our current level of operations; and (4) those risks disclosed in the section "Risk Factors" included in our Annual Report on Form 10-K filed on March 28, 2024. Aqua Metals cautions readers not to place undue reliance on any forward-looking statements. The Company does not undertake and specifically disclaims any obligation to update or revise such statements to reflect new circumstances or unanticipated events as they occur, except as required by law.

Contact Information

Investor Relations

Bob Meyers & Rob Fink

FNK IR

646-878-9204

aqms@fnkir.com

Media

David Regan

Aqua Metals

415-336-3553

david.regan@aquametals.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/696afff5-3463-4487-8de6-9eb1f6c27216

https://www.globenewswire.com/NewsRoom/AttachmentNg/2434d814-11ab-4948-a847-c95ecbc380ff