Art's Way Reports Fiscal 2025 Results, Delivers Improved Profitability and Positive Net Income Driven by Strong Modular Buildings Performance

Rhea-AI Summary

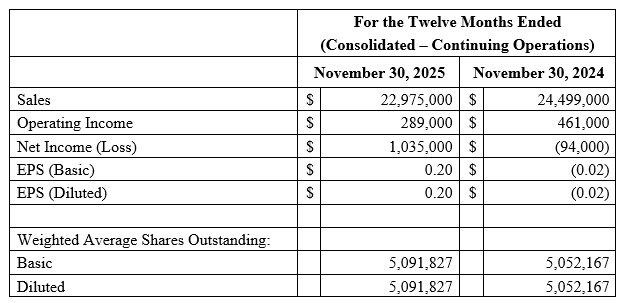

Art's Way (Nasdaq:ARTW) reported fiscal 2025 results with consolidated sales of $22.975M, down 6.2% from fiscal 2024, and net income from continuing operations of $1.035M. Operating expenses fell ~12.7% and EPS was $0.20 vs a loss of $0.02 prior year.

Modular Buildings grew sales 4.0% to $10.226M and remained profitable; Agricultural Products sales fell 13.1% to $12.749M. An Employee Retention Credit refund materially boosted 2025 net income.

Positive

- Net income from continuing operations of $1.035M in fiscal 2025

- Modular Buildings sales +4.0% to $10.226M with continued profitability

- Operating expenses reduced ~12.7% consolidated, showing cost control

Negative

- Consolidated sales declined 6.2% to $22.975M year-over-year

- Agricultural Products sales down 13.1% to $12.749M, reflecting weak crop commodity demand

- Gross profit margin contracted (12-month gross profit as percentage of sales declined 2.5%)

Key Figures

Market Reality Check

Peers on Argus

Peers show mixed moves: HYFM +1.99%, UGRO +2.10%, HCAI +0.85%, while GP -3.85% and XOS -8.71%. With no clear sector direction and limited peer momentum, ARTW’s setup appears company-specific.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Oct 07 | Quarterly results | Positive | +3.3% | Q3 2025 results with modular growth and ERC-driven net income improvement. |

Limited recent history: the last earnings-related update saw a modest positive price reaction aligned with constructive fundamentals.

In the prior key event on Oct 07, 2025, Art’s Way highlighted Q3 2025 strength in Modular Buildings, with segment sales growth and margin expansion offsetting Agricultural Products weakness. Consolidated nine‑month net income improved with help from Employee Retention Credit refunds. The stock rose about 3.27% on that news. Today’s full‑year 2025 results extend that narrative of modular strength versus ag softness and continued ERC support.

Market Pulse Summary

This announcement details fiscal 2025 results showing improved profitability, with net income from continuing operations of $1,035,000 and EPS of $0.20 despite a sales decline to $22.98M. Modular Buildings remained a key profit driver, while Agricultural Products continued to face commodity and cost headwinds. Investors may watch how demand evolves in 2026, the sustainability of cost reductions, and whether segment trends converge toward more balanced growth.

Key Terms

employee retention credit financial

xenotransplantation medical

forward-looking statements regulatory

AI-generated analysis. Not financial advice.

ARMSTRONG, IA / ACCESS Newswire / February 4, 2026 / Art's Way Manufacturing Co., Inc. (Nasdaq:ARTW) (the "Company"), a diversified manufacturer and distributor of equipment serving agricultural and research needs, announces its financial results for fiscal 2025.

Marc McConnell, the Company's President, CEO, and Chairman, reports, "Despite another year of significant market challenges and uncertainty, I am pleased with the progress we made as a company in 2025 building the Company for future growth in both business units. While we continued weathering the storm in the Agricultural Products segment, we managed to have yet another very robust year in our Modular Buildings segment. We remain focused on enhancing our products and customer experience to improve our market position in each segment while maintaining focus on balance sheet health and cashflow. We enter 2026 with a sense of optimism and see some improving conditions that could drive demand growth for our products."

Consolidated - continuing operations

Sales of

$22,975,000 in fiscal 2025 compared to$24,499,000 in fiscal 2024, a$1,524,000 , or6.2% , decrease.Twelve-month gross profit as a percentage of sales declined

2.5% compared to fiscal 2024.Operating expenses decreased by approximately

$872,000 , or12.7% , in fiscal 2025 compared to fiscal 2024.Net income from continuing operations of

$1,035,000 for fiscal 2025 compared to net loss from continuing operations of$94,000 in fiscal 2024. We received an Employee Retention Credit refund in fiscal 2025 that positively impacted net income from continuing operations by$1,052,000.

Agricultural Products

Sales of

$12,749,000 for fiscal 2025 compared to$14,663,000 in fiscal 2024, a decrease of$1,914,000 , or13.1% .Twelve-month gross profit as a percentage of sales declined

4.9% compared to fiscal 2024.Operating expenses decreased by

$1,226,000 , or21.6% , in fiscal 2025 compared to fiscal 2024.Net loss of

$341,000 in fiscal 2025 compared to net loss of$1,594,000 in fiscal 2024. We received an Employee Retention Credit refund in fiscal 2025 that positively impacted net income by$889,000 in this segment.

Commodity prices in the agricultural market, particularly on row crops, which dropped below five-year averages in fiscal 2024, continued to be weak in fiscal 2025. This led to a second straight fiscal year of decreased demand. Our cattle customers benefited from record beef prices in fiscal 2025, which helped offset some of the decreased demand. We believe our experience in fiscal 2025 was similar to many others in our industry. Our agriculture business is highly cyclical, and with forecasts of continued interest rate relief for farmers, as well as continued increases in commodity prices and easing of rising input costs, we believe market conditions could begin to improve in fiscal 2026. The price of steel was up

Modular Buildings

Sales of

$10,226,000 for fiscal 2025, an increase of$390,000 , or4.0% , from$9,836,000 in fiscal 2024.Twelve-month gross profit as a percentage of sales improved

0.1% compared to fiscal 2024.Operating expenses increased by

$355,000 in fiscal 2025, or30.0% , compared to fiscal 2024.Net income of

$1,376,000 for fiscal 2025 compared to net income of$1,500,000 in fiscal 2024. We received an Employee Retention Credit refund in fiscal 2025 that positively impacted net income by$163,000 in this segment.

We benefited from strong livestock prices in this segment, which increased our agricultural building sales by approximately

Net Income (Loss) per Share - continuing operations: Net income per basic and diluted share for fiscal 2025 was

Art's-Way Manufacturing Co., Inc.

Art's Way Manufacturing is a small, publicly traded company that specializes in equipment manufacturing. For over 70 years, it has been committed to designing and building high-quality machinery for all operations. It has approximately 100 employees across two branch locations: Art's Way Manufacturing in Armstrong, Iowa and Art's Way Scientific in Monona, Iowa. Art's Way manure spreaders, forage boxes, high dump carts, bale processors, graders, land planes, sugar beet harvesters and grinder mixers are designed to optimize production, increase efficiency and meet the growing demands of customers. Art's Way Manufacturing has two reporting segments: Agricultural Products and Modular Buildings.

For more information, contact:

Marc McConnell, President, Chief Executive Officer and Chairman

712-208-8467

marc.mcconnell@artsway.com

Or visit the Company's website at www.artsway.com/

Caution Regarding Forward-Looking Statements

This release includes "forward-looking statements" within the meaning of federal securities laws. In some cases, you can identify forward-looking statements by the use of words such as "may," "should," "anticipate," "believe," "expect," "plan," "future," "intend," "could," "estimate," "predict," "hope," "potential," "continue," "foresee," "optimistic," "opportunity, possibly," or the negative of these terms or other similar expressions. Statements made in this release that are not strictly statements of historical facts, including the Company's expectations regarding: (i) the Company's business position; (ii) demand and potential growth within the Company's business segments; (iii) future results, including, but not limited to, revenue and margin expectations, expectations with respect to the impact of price increases and tariffs, and expectations with respect to backlog and product mix; (iv) the Company's ability to increase production with capital investments and other activities, (v) future agricultural sales and plans to enter into building contracts; (vi) cash flows and plans to fund strategic initiatives and pay down debt; and (vii) the benefits of the Company's business model and strategy, are forward-looking statements. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: customer demand for the Company's products; credit-worthiness of the Company's customers; the Company's ability to operate at lower expense levels; the Company's ability to complete projects in a timely and efficient manner in accordance with customer specifications; the Company's ability to renew or obtain financing on reasonable terms; the Company's ability to repay current debt, continue to meet debt obligations and comply with financial covenants; inflation and tariffs and their effect on the Company's supply chain and demand for its products; domestic and international economic conditions; the Company's ability to attract and maintain an adequate workforce in a competitive labor market; factors affecting the strength of the agricultural sector; the cost of raw materials; unexpected changes to performance by any of the Company's operating segments; and other factors detailed from time to time in the Company's public filings with the Securities and Exchange Commission. Actual results may differ materially from management's expectations. Readers are cautioned not to place undue reliance upon any such forward-looking statements. The Company does not intend to update forward-looking statements other than as required by law.

SOURCE: Art's-Way Manufacturing Co.

View the original press release on ACCESS Newswire