Art's Way Reports Improved Results With Modular Buildings Growth Offsetting Ag Market Challenges

Rhea-AI Summary

Art's Way Manufacturing (Nasdaq:ARTW) reported Q3 fiscal 2025 consolidated sales of $6.43M

Positive

- Consolidated Q3 sales +9.5% to $6.43M

- Nine‑month net income $1.68M, up $2.107M year‑over‑year

- Modular Buildings Q3 sales +19.4% and nine‑month sales +21.4%

- Nine‑month consolidated gross margin improved by 1.2 percentage points

Negative

- Agricultural Products nine‑month sales down 15.5%

- Agricultural nine‑month gross margin down 3.4 percentage points

- Modular Buildings operating expenses +40.3% for nine months

- Company cites higher steel and tariff costs requiring a 3–5% price increase

News Market Reaction

On the day this news was published, ARTW gained 3.27%, reflecting a moderate positive market reaction. Argus tracked a peak move of +4.6% during that session. Our momentum scanner triggered 2 alerts that day, indicating moderate trading interest and price volatility. This price movement added approximately $488K to the company's valuation, bringing the market cap to $15M at that time.

Data tracked by StockTitan Argus on the day of publication.

ARMSTRONG, IA, IA / ACCESS Newswire / October 7, 2025 / Art's Way Manufacturing Co., Inc. (Nasdaq:ARTW) (the "Company"), a diversified manufacturer and distributor of equipment serving agricultural and research needs, announces its financial results for the third quarter of fiscal 2025.

Marc McConnell, the Company's President, CEO, and Chairman, reports, "We continue to be pleased by operational progress and improved profitability during our third quarter and year to date despite persistent headwinds in the ag equipment space. During the quarter, we again benefited greatly from strong performance by our Modular Buildings segment while our Agricultural Products segment continued to experience modest demand. We remain focused on enhancing our products and customer experience to improve our market position in both segments while also further improving our balance sheet and cashflow positions. We are cautiously optimistic that strong profitability among livestock producers will lead to improvement in demand in the near term and into 2026."

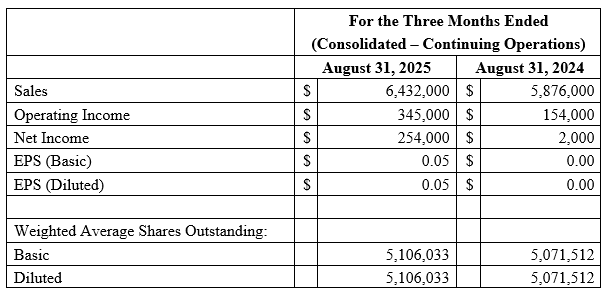

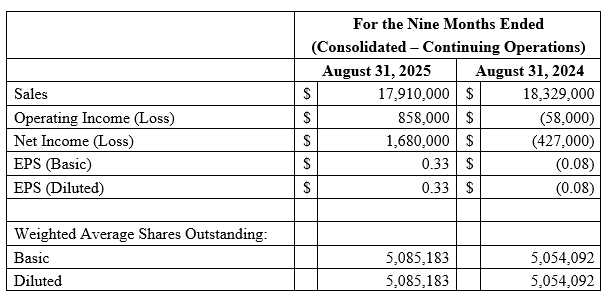

Consolidated - continuing operations

Sales of

$6,432,000 for Q3 of fiscal 2025, a9.5% increase from Q3 2024, and sales of$17,910,000 for the nine months ended August 31, 2025, a2.3% decline from the same period of 2024.Nine-month gross profit as a percentage of sales improved

1.2% compared to the first nine months of fiscal 2024.Operating expenses decreased by

13.1% for the nine months ended August 31, 2025 compared to the same period in fiscal 2024.Net income of

$1,680,000 for the nine months ended August 31, 2025, a$2,107,000 improvement from the same period in fiscal 2024. We received an Employee Retention Credit refund during the nine months ending August 31, 2025 that positively impacted net income by$1,154,000.

Agricultural Products

Sales of

$2,983,000 for Q3 of fiscal 2025, a0.2% decline from the same period of 2024, and sales of$9,956,000 for the nine months ended August 31, 2025, a15.5% decline from the first nine months of fiscal 2024.Nine-month gross profit as a percentage of sales declined

3.4% compared to the first nine months of fiscal 2024.Operating expenses decreased by

23.0% for the nine months ended August 31, 2025 compared to the same period in fiscal 2024.Net income of

$139,000 for the nine months ended August 31, 2025, an improvement of$1,337,000 from the same period in fiscal 2024. We received an Employee Retention Credit refund during the nine months ended August 31, 2025 that positively impacted net income by$976,000 in this segment.

We have experienced decreased demand for the last six fiscal quarters due to difficult agricultural market conditions highlighted by high interest rates, increasing input costs and low row crop prices. Although our inventory decreased from heightened levels in fiscal 2024, many dealers are still sitting on inventory from other equipment manufacturers, which hampers our ability to get these dealers to stock more of our equipment. We believe product availability will be key for the next two fiscal quarters to capitalize on retail opportunities and yearend tax buying. Strategically, we are continuing to build inventory through our fiscal year end despite low demand in order to be responsive to farmers needs this fall. Livestock prices, predominately cattle, continue to be at all-time highs in fiscal 2025 and have driven strong grinder mixer sales activity thus far in fiscal 2025. We expect cattle farmers to have strong earnings in 2025, and we could potentially see retail opportunities in an attempt to offset tax liability prior to the calendar year-end. The agriculture market is highly cyclical, and we believe this is the bottom of the cycle. We anticipate that conditions will start to improve in the next 9 to 15 months in our market. Our efforts in fiscal 2024 to right-size our production and administrative staff have reduced our operating expenses which is aiding in our efforts to weather the bottom of the cycle. Our fall early order program starts in October and runs through January 15th. The sales decreases for the three- and nine- months periods ended August 31, 2025 compared to the same periods in fiscal 2024, resulted in less variable margin to cover our fixed costs comparatively while inflationary forces also negatively affected our gross margin. Steel prices began to rise in February 2025 due to tariff uncertainty and infrastructure projects that impacted domestic demand. While steel prices have dropped from their peak in April 2025, we have not seen them return to 2024 levels. We are also paying higher prices from tariff charges for imported products, which is negatively affecting our margin. We are exploring reshoring options for these items in an attempt to reduce the gross margin impact. We expect to pass on a 3

Modular Buildings

Sales of

$3,449,000 for Q3 2025, up19.4% from Q3 2024. Nine-month sales of$7,954,000 , a21.4% increase from the first nine months of fiscal 2024.Nine-month gross profit as a percentage of sales improved

8.9% compared to the first nine months of fiscal 2024.Operating expenses increased by

40.3% for the nine months ended August 31, 2025 compared to the same period in fiscal 2024. The increase is due to overlap in sales positions discussed below and increased commission expense due to an increase in ag building sales.Net income of

$1,542,000 for the nine months ended August 31, 2025, an improvement of$771,000 from the same period in fiscal 2024. We received an Employee Retention Credit refund in the nine months ended August 31, 2025 that positively impacted net income by$179,000 in this segment.

Consistent execution on our backlog by our project managers and production team has driven sales up approximately

Income (Loss) per Share: Income per basic and diluted share for the first nine months of fiscal 2025 was

Art's-Way Manufacturing Co., Inc.

Art's Way Manufacturing is a small, publicly traded company that specializes in equipment manufacturing. For over 65 years, it has been committed to designing and building high-quality machinery for all operations. It has approximately 100 employees across two branch locations: Art's Way Manufacturing in Armstrong, Iowa and Art's Way Scientific in Monona, Iowa. Art's Way manure spreaders, forage boxes, high dump carts, bale processors, graders, land planes, sugar beet harvesters and grinder mixers are designed to optimize production, increase efficiency and meet the growing demands of customers. Art's Way Manufacturing has two reporting segments: Agricultural Products and Modular Buildings.

For more information, contact:

Marc McConnell, President, Chief Executive Officer and Chairman

712-208-8467

marc.mcconnell@artsway.com

Or visit the Company's website at www.artsway.com/

Caution Regarding Forward-Looking Statements

This release includes "forward-looking statements" within the meaning of federal securities laws. In some cases, you can identify forward-looking statements by the use of words such as "may," "should," "anticipate," "believe," "expect," "plan," "future," "intend," "could," "estimate," "predict," "hope," "potential," "continue," "foresee," "optimistic," "opportunity," or the negative of these terms or other similar expressions. Statements made in this release that are not strictly statements of historical facts, including the Company's expectations regarding: (i) the Company's business position; (ii) demand and potential growth within the Company's business segments; (iii) future results, including, but not limited to, revenue and margin expectations, expectations with respect to the impact of price increases and tariffs, and expectations with respect to backlog and product mix; (iv) the Company's ability to increase production with capital investments and other activities, (v) future agricultural sales and plans to enter into building contracts; (vi) cash flows and plans to fund strategic initiatives and pay down debt; and (vii) the benefits of the Company's business model and strategy, are forward-looking statements. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: customer demand for the Company's products; credit-worthiness of the Company's customers; the Company's ability to operate at lower expense levels; the Company's ability to complete projects in a timely and efficient manner in accordance with customer specifications; the Company's ability to renew or obtain financing on reasonable terms; the Company's ability to repay current debt, continue to meet debt obligations and comply with financial covenants; inflation and tariffs and their effect on the Company's supply chain and demand for its products; domestic and international economic conditions; the Company's ability to attract and maintain an adequate workforce in a competitive labor market; factors affecting the strength of the agricultural sector; the cost of raw materials; unexpected changes to performance by any of the Company's operating segments; and other factors detailed from time to time in the Company's public filings with the Securities and Exchange Commission. Actual results may differ materially from management's expectations. Readers are cautioned not to place undue reliance upon any such forward-looking statements. The Company does not intend to update forward-looking statements other than as required by law.

SOURCE: Art's-Way Manufacturing Co.

View the original press release on ACCESS Newswire