PMET Resources to Expand Land Position in James Bay Region

Rhea-AI Summary

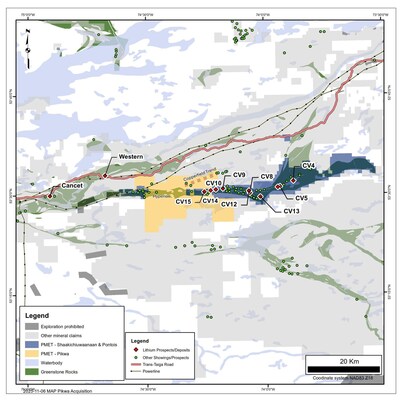

PMET Resources (OTCQX: PMETF; TSX: PMET) agreed to acquire a 100% interest in the Pikwa Property from Azimut (OTCQX: AZMTF) and SOQUEM, expanding its James Bay land position west of Shaakichiuwaanaan.

The Pikwa package comprises 509 claims (~10 km) along a greenstone belt, bringing PMET's contiguous control to over 70 km across Shaakichiuwaanaan, Pikwa and Pontois. Targets include LCT pegmatites (Li-Cs-Ta), spodumene occurrences, orogenic gold and porphyry-style Cu-Au-Ag prospects.

Consideration: 841,916 PMET shares at a deemed $3.68/share plus two separate 1% NSR royalties. Closing is subject to TSX approval and customary conditions.

Positive

- Acquisition adds 509 claims (~10 km) to PMET land package

- Consolidated contiguous greenstone trend now >70 km

- Targets include LCT pegmatite and spodumene plus base/precious metals

- Consideration partly equity: 841,916 shares issued at $3.68

Negative

- Transaction grants two separate 1% NSR royalties on Pikwa

- Closing subject to TSX approval and customary conditions

- Issued 841,916 shares will dilute existing shareholders on closing

News Market Reaction

On the day this news was published, AZMTF gained 1.23%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

The Pikwa Property is comprised of 509 Exclusive Exploration Rights (a.k.a. mineral claims) covering approximately 10 km of highly prospective greenstone belt trend extending immediately west of the Company's flagship Shaakichiuwaanaan Property. The Pikwa Property hosts a geological setting with strong potential for multiple commodities over several different deposit styles including orogenic gold (Au), porphyry (Au, Cu, Ag), and LCT pegmatite (Li, Cs, Ta, Ga, Rb).

With the acquisition, the Company consolidates its land position in the region and now controls over 70 km of highly prospective greenstone trend, extending continuously across its Shaakichiuwaanaan, Pikwa, and Pontois properties (Figure 1). On the Shaakichiuwaanaan Property, this greenstone belt hosts numerous Li-Cs-Ta ("LCT") pegmatite occurrences including the world class CV5 and CV13 deposits, highlighting the potential of the overall trend. Additionally, historical exploration at the Pikwa Property has documented the presence of spodumene-bearing pegmatite, along with the identification of spodumene grains in till, further enhancing the potential of the Pikwa Property.

In addition to the strong LCT pegmatite potential, the Pikwa Property hosts multiple base and precious metal targets – which have been the focus of historical exploration – including the Hyperion and Copperfield Prospects.

Darren L. Smith, Executive Vice President of Exploration for the Company, comments: "The acquisition of the Pikwa Property is a strategic addition to our significant land holdings in the region and consolidates some of the most prospective LCT pegmatite trend globally. The Pikwa Property includes over 10 km of greenstone belt, including its northern and southern margins, in addition to numerous base and precious metal prospects where historical work has been focused. We look forward to integrating the Pikwa Property into our 2026 exploration programs in the region."

TERMS OF THE ACQUISITION

Pursuant to a property purchase agreement dated November 11, 2025, the Company has agreed to acquire a

- an aggregate of 841,916 common shares in the capital of the Company at a deemed issue price of

$3.68 - a

1% net smelter return ("NSR") royalty interest in the Pikwa Property granted to Azimut; and - a

1% NSR royalty interest in the Pikwa Property granted to SOQUEM.

The completion of the Acquisition is subject to customary closing conditions for a transaction of this nature, including obtaining the approval of the Toronto Stock Exchange (the "TSX"), obtaining all necessary consents and the absence of material adverse change occurring in respect of the Pikwa Property.

The PMET Shares to be issued on Closing will be subject to a statutory hold period expiring four months and one day following Closing, as well as additional contractual resale restrictions expiring 12 months after Closing with respect to

No finder's fees or commissions were paid in connection with the Acquisition.

About PMET Resources Inc.

PMET Resources Inc. is a pegmatite critical mineral exploration and development company focused on advancing its district-scale

In late 2025, the Company announced a positive lithium-only Feasibility Study on the CV5 Pegmatite for the Shaakichiuwaanaan Property (the "Feasibility Study") and declared a maiden Mineral Reserve of 84.3 Mt at

The Project hosts a Consolidated Mineral Resource2 totalling 108.0 Mt at

|

____________________________________ |

|

2

The Consolidated MRE (CV5 + CV13 pegmatites), which includes the Rigel and |

|

3 Determination based on Mineral Resource data, sourced through July 11, 2025, from corporate disclosure. |

For further information, please contact us at info@pmet.ca or by calling +1 (604) 279-8709, or visit www.pmet.ca. Please also refer to the Company's continuous disclosure filings, available under its profile at www.sedarplus.ca and www.asx.com.au, for available exploration data.

This news release has been approved by

"KEN BRINSDEN"

Kenneth Brinsden, President, CEO, & Managing Director

QUALIFIED PERSON(S)

The technical and scientific information in this news release that relates to the Mineral Resource Estimate and exploration results for the Company's properties is based on, and fairly represents, information compiled by Mr. Darren L. Smith, M.Sc., P.Geo., who is a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"), and member in good standing with the Ordre des Géologues du

Mr. Smith is an Executive and Vice President of Exploration for PMET Resources Inc. and holds common shares, Restricted Share Units (RSUs), and Performance Share Units (PSUs) in the Company.

The information in this news release that relates to the Feasibility Study is based on, and fairly represents, information compiled by Mr. Frédéric Mercier-Langevin, Ing. M.Sc., who is a Qualified Person as defined by NI 43-101, and member in good standing with the Ordre des Ingénieurs du

Mr. Mercier-Langevin is the Chief Operating and Development Officer for PMET Resources Inc. and holds common shares and options in the Company.

The information in this news release that relates to the Feasibility Study ("FS") for the Shaakichiuwaanaan Project, which was first reported by the Company in a market announcement titled "PMET Resources Delivers Positive CV5 Lithium-Only Feasibility Study for its Large-Scale Shaakichiuwaanaan Project" dated October 20, 2025 (

The Mineral Resource and Mineral Reserve Estimates in this release were first reported by the Company in accordance with ASX Listing Rule 5.8 in market announcements titled "Worlds Largest Pollucite-Hosted Caesium Pegmatite Deposit" dated July 20, 2025 (

Disclaimer for Forward-looking Information

This press release contains "forward-looking information" or "forward-looking statements" within the meaning of applicable Securities Laws.

All statements, other than statements of present or historical facts, are forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and assumptions and accordingly, actual results could differ materially from those expressed or implied in such statements. You are hence cautioned not to place undue reliance on forward-looking statements. Forward-looking statements are typically identified by words such as "plan", "development", "growth", "continued", "intentions", "expectations", "strategy", "opportunities", "anticipated", "trends", "potential", "outlook", "ability", "additional", "on track", "prospects", "viability", "estimated", "reaches", "enhancing", "strengthen", "target", "will", "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements in this release include, but are not limited to, statements concerning: the Acquisition, including the timing, satisfaction of closing conditions, consummation and terms of the Acquisition, the potential of the Pikwa Property and, the integration of the Pikwa Property in PMET's 2026 exploration programs.

Although the Company believes its expectations are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Key assumptions upon which the Company's forward-looking information is based include without limitation, assumptions regarding the obtention of the approval of the TSX and other necessary consents; development and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company's ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the price and market for outputs; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used.

Forward-looking statements are also subject to risks and uncertainties facing the Company's business, any of which could have a material adverse effect on the Company's business, financial condition, results of operations and growth prospects. Some of the risks the Company faces and the uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements include, among others, requirements for additional capital, operating and technical difficulties in connection with mineral exploration and development activities; actual results of exploration activities, including on the Pikwa Property; the estimation or realization of mineral reserves and mineral resources; the timing and results of estimated future production; the costs of production, capital expenditures, the costs and timing of the development of new deposits, requirements for additional capital; future prices of spodumene; changes in general economic conditions; changes in the financial markets and in the demand and market price for commodities; lack of investor interest in future financings; the Company's ability to secure permits or financing for the completion of construction activities; and the Company's ability to execute on plans relating to the Pikwa Property. In addition, readers should review the detailed risk discussion in the Company's most recent Annual Information Form filed on SEDAR+ for a fuller understanding of the risks and uncertainties that affect the Company's business and operations. These risks are not exhaustive; however, they should be considered carefully. If any of these risks or uncertainties materialize, actual results may vary materially from those anticipated in the forward-looking statements found herein.

Forward-looking statements contained herein are presented for the purpose of assisting investors in understanding the Company's business plans, financial performance and condition and may not be appropriate for other purposes.

The forward-looking statements contained herein are made only as of the date hereof. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law. The Company qualifies all of its forward-looking statements by these cautionary statements.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/pmet-resources-to-expand-land-position-in-james-bay-region-302612569.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/pmet-resources-to-expand-land-position-in-james-bay-region-302612569.html

SOURCE PMET Resources Inc.