$17.5 million Capital Raise Led by Franklin Templeton

Rhea-AI Summary

Barton Gold Holdings (ASX:BGD) (OTCQB:BGDFF) has secured a $15.0 million Placement at $1.25 per share led by Franklin Templeton, plus a $2.5 million SPP at the same price, targeting total gross proceeds of $17.5 million.

The Placement issues 12 million shares (≈5% dilution) with Franklin Templeton subscribing for $11.25 million (~3.8% expanded equity interest). Pro-forma cash is estimated at $23 million after completion. Placement price is a 3.8% discount to the last traded price and a 7.6% premium to 1-month VWAP.

Proceeds will fund reinstatement and commissioning of the Central Gawler Mill (target: end of 2026), DFS work, Tunkillia reserve and PFS activities, upgrade drilling, and mining lease submissions.

Positive

- Placement raised $15.0M at $1.25 per share

- Franklin Templeton committed $11.25M (~3.8% post-raise interest)

- Pro-forma cash balance estimated at $23M

- SPP targets additional $2.5M at same price (no brokerage)

- Funds to advance CGM commissioning targeted by end of 2026

Negative

- Equity dilution of ~5% from Placement and full SPP

- Placement price is a 3.8% discount to last trade (10 Oct 2025)

- Targeted timelines (CGM commissioning, PFS, mining lease) remain subject to DFS and approvals

News Market Reaction

On the day this news was published, BGDFF declined 21.30%, reflecting a significant negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Targeting commissioning of 'Stage 1' production by the end of 2026

HIGHLIGHTS

$15m Placement led by Franklin Templeton, one of the world's largest precious metals fundsShare Purchase Plan (SPP) targeting

$2.5 million to be offered at same price as the PlacementPlacement and SPP price of

$1.25 / share represents a:Discount of

3.8% to Barton's last traded price of$1.30 / share on Thursday, 9 October 2025Premium of

7.6% to Barton's 1 month (20 trading day) VWAP of$1.16 / share

Definitive Feasibility Study (DFS) underway for reinstatement of Barton's fully permitted Central Gawler Mill (CGM) to operations, where JORC Mineral Resources include 194koz @ 3.23 g/t Au on existing open pit and underground mine development; targeting commissioning by the end of 20261

Upgrade drilling underway on Tunkillia's 'Starter Pits' which are modelled to yield ~

$1.3b n operating free cash during the first 2.5 years alone, targeting Ore Reserves, completion of a Pre-Feasibility Study (PFS), and submission of a Mining Lease application by the end of calendar year 20262$23 million estimated pro-forma cash balance after completion of Placement and SPP

ADELAIDE, AU, AU / ACCESS Newswire / October 13, 2025 / Barton Gold Holdings Limited (ASX:BGD)(OTCQB:BGDFF)(FRA:BGD3) (Barton or the Company) is pleased to announce that the Company has received firm commitments to raise

The Placement is priced at

The Placement is led by Franklin Templeton, one of the world's largest institutional precious metals funds, which will invest

Commenting on the capital raise, Barton Managing Director Alexander Scanlon said:

"Barton has worked diligently during the past five years to lay the foundation for large-scale regional gold production, doing so expeditiously and with minimal dilution, in order to create and preserve maximum future shareholder value. We now have the opportunity to leverage our existing mill to operations at record gold prices, and unlock that value.

"We are greatly honoured to have Franklin Templeton's support as we pivot to the next stage of Barton's evolution, and target the re-rating of Barton's equity profile to that of a 'producer' with a strong, self-funded growth pathway."

Capital raise to accelerate key value-add programs

Since the Company's last

Stage 1 Operations | Central Gawler Mill (CGM)

Dual JORC (2012) Mineral Resources upgrades to over 300koz Au adjacent to the CGM, with a preliminary A

$26m (±30% ) capital cost estimate for reinstatement of the CGM (with upgrades);3The start of a Definitive Feasibility Study (DFS) targeting commissioning by the end of 2026;4

Stage 2 Development | Tunkillia Gold Project

The start of ~18,000m reverse circulation (RC) upgrade drilling on the 'Starter Pits' modelled to yield ~

$1.3b n operating free cash and pay back development 3x over during the first 2.5 years;5

Tolmer high-grade silver discovery

High-grade drilling assays extending the 'western silver zone', and adding high-grade gold;6

Soil sampling assays indicating expansive Au-Ag-Pb anomalism and potential extensions;7

Completion of diamond drilling (DD) to investigate controls and guide follow up targeting;8

Regional M&A | Wudinna Gold Project

Acquisition of the Wudinna Gold Project (Wudinna) adding 279koz Au regional mineralisation;9

The granting of new tenements at Wudinna, providing a long-term exploration platform;10 and

Preliminary metallurgical testwork indicating up to

99% gold recoveries, and the potential to produce a ~20 - 25 g/t Au concentrate for trucking to Barton's CGM and planned Tunkillia mill.11

Barton's ASX-listed shares have also recently become a member of the ASX All Ordinaries Index (All Ordinaries) of the 500 largest companies in the Australian equities market, administered by S&P Dow Jones Indices.12

Placement size and terms

The Company received expressions of interest exceeding its targeted placement amount of

The Placement issue price of

The new Placement Shares represent modest equity dilution of only

Placement and SPP proceeds will be used to advance programs targeting commissioning of the CGM for 'Stage 1' operations, and Tunkillia Ore Reserves, PFS completion and a Mining Lease application, by the end of 2026.

Barton has continued to receive further interest in the Placement and reserves the right to increase its size.

Pro-forma capital structure and treasury balance

Upon completion of the Placement and SPP, the Company estimates that it will have a pro-forma equity capital structure of approximately 239,961,810 fully paid ordinary shares, with an estimated

Share Purchase Plan

The Company also intends to offer an SPP to target an additional

SPP Shares will be issued at the same price as the Placement Shares (SPP Issue Price) and can be purchased from the Company without incurring brokerage or other transaction costs.13 Upon issue, SPP Shares will rank equally with all others existing fully paid ordinary shares on issue.

The SPP is not underwritten. The Company may raise more or less than

Eligible Barton shareholders, being those with a registered address in Australia or New Zealand (Eligible Shareholders) and recorded on the Company's share register as at 5:00pm (AEDT) on Monday, 13 October 2025 (Record Date), will have the opportunity to apply for up to

The full terms and conditions of the SPP will be detailed in an offer booklet which is expected to be released to the ASX and dispatched to Eligible Shareholders via their preferred contact method on Thursday, 23 October 2025 (SPP Offer Booklet).

Barton's Directors have indicated that, where eligible, they intent to participate in the SPP subject to any Director participation not displacing general public demand from Eligible Investors.

The SPP Offer is expected to open on Thursday, 23 October 2025, and close at 5:00pm (AEDT) on Thursday, 6 November 2025. The SPP Offer may be closed early by the Company without notice.

The Company notes that the Company's last SPP, opened on Tuesday, 9 April 2024 was heavily oversubscribed and closed early after only one week.14 Interested Eligible Shareholders are therefore encouraged to apply as soon as possible following the opening of the SPP.

Barton will coordinate with its share registry (Computershare) to provide online application facilities to allow expedited applications by all interested Eligible Investors. Further details of these facilities will be provided in the SPP Offer Booklet published to the ASX on Thursday, 23 October 2025.

Indicative Timeline - Placement & SPP

Event | Date* |

SPP Record Date (5:00pm AEDT) | Monday, 13 October 2025 |

Announcement of Placement and SPP and lodgement of Appendix 3B | Tuesday, 14 October 2025 |

Allocation of new Shares under the Placement | Tuesday, 21 October 2025 |

Announcement of final Placement results | Wednesday, 22 October 2025 |

Official quotation and commencement of trading of Placement Shares | Wednesday, 22 October 2025 |

Publish SPP Offer Booklet on ASX and Despatch to Eligible Shareholders | Thursday, 23 October 2025 |

SPP Offer opening date | Thursday, 23 October 2025 |

SPP Offer closing date (5:00pm AEDT) | Thursday, 6 November 2025 |

Announcement of SPP Offer results | Tuesday, 11 November 2025 |

Allocation of new Shares under the SPP | Wednesday, 12 November 2025 |

Official quotation and commencement of trading of SPP Shares | Thursday, 13 November 2025 |

* Note: This timetable is indicative only and subject to change. The quotation and trading of new Placement Shares and SPP Shares is subject to confirmation from the ASX. Subject to the requirements of the Corporations Act, the ASX Listing Rules and other applicable rules, Barton reserves the right to amend this timetable at any time, without notice, including to extend or shorten the period during which Placement or SPP applications will be accepted. Accordingly, eligible parties are encouraged to submit applications as early as possible.

1 Refer to ASX announcement dated 29 September 2025

2 Refer to ASX announcements dated 5 May and 18 September 2025

3 Refer to ASX announcements dated 30 June, 21 July and 8 September 2025

4 Refer to ASX announcement dated 29 September 2025

5 Refer to ASX announcements dated 5 May and 18 September 2025

6 Refer to ASX announcement dated 5 August 2025

7 Refer to ASX announcement dated 24 September 2025

8 Refer to ASX announcement dated 25 August 2025

9 Refer to ASX announcements dated 30 June and 2 July 2025

10 Refer to ASX announcement dated 6 August 2025

11 Refer to ASX announcement dated 10 September 2025

12 Refer to ASX announcements dated 5 and 22 September 2025; further information here: All Ordinaries | S&P Dow Jones Indices

13 Noting however that the Company may incur costs associated with undertaking the SPP

14 Refer to ASX announcements dated 27 March and 5 / 9 / 15 / 16 / 19 / 23 April 2024

For further information, please contact:

Alexander Scanlon | Jade Cook |

Additional Notices

This announcement has been prepared for publication in Australia and may not be released to US wire services or distributed in the United States. This announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States or any other jurisdiction. Any securities described in this announcement have not been, and will not be, registered under the US Securities Act of 1933 and may not be offered or sold in the United States except in transactions exempt from, or not subject to, the registration requirements of the US Securities Act and applicable US state securities laws.

Nothing contained in this announcement constitutes investment, legal, tax or other advice. Investors should seek appropriate professional advice before making any investment decision.

All dollar amounts in this announcement are expressed in Australian dollars (AUD) unless otherwise stated.

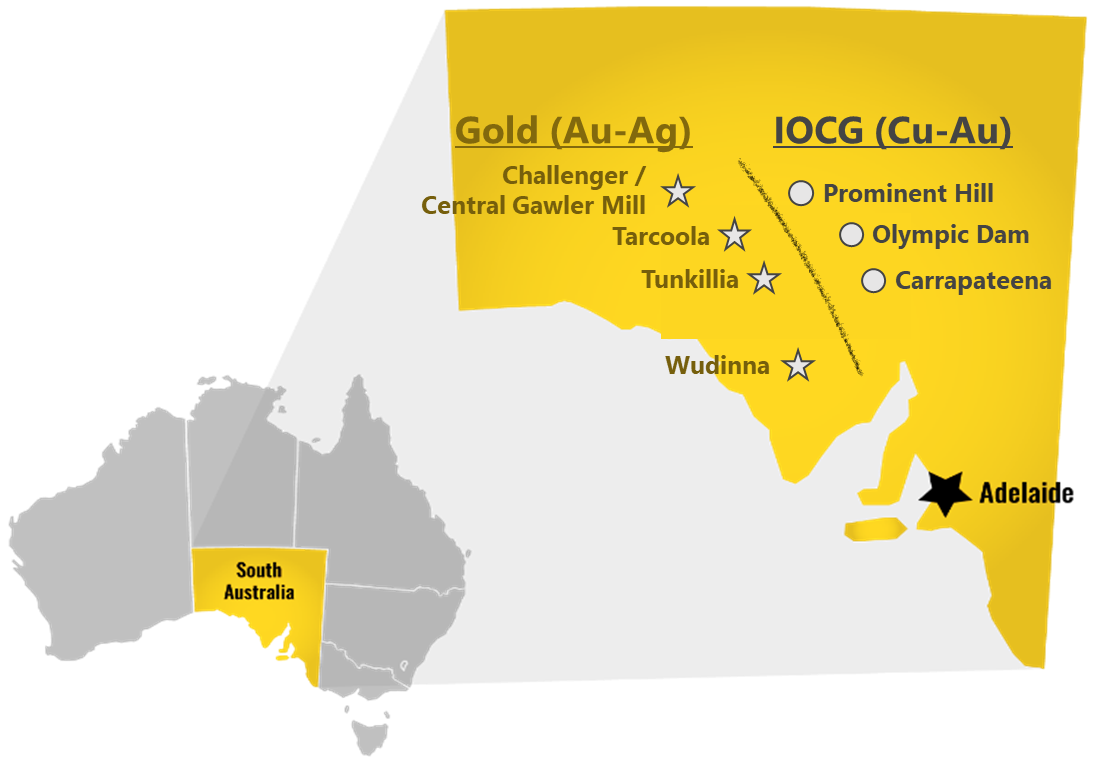

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000ozpa with 2.2Moz Au & 3.1Moz Ag JORC Mineral Resources (79.9Mt @ 0.87g/t Au), brownfield mines, and

Challenger Gold Project

Tarcoola Gold Project

Tunkillia Gold Project

Wudinna Gold Project

|  |

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource (above 215mRL) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource (below 90mRL) | Mr Dale Sims | AusIMM / AIG | Fellow / Member |

Wudinna Mineral Resource (Clarke Deposit) | Ms Justine Tracey | AusIMM | Member |

Wudinna Mineral Resource (all other Deposits) | Mrs Christine Standing | AusIMM / AIG | Member / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. The Company also confirms that it is not aware of any new information or data that materially affects the operating free cash which is mentioned on page 1 of this announcement and in the ASX announcements dated 5 May and 18 September 2025.

The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

* Refer to Barton Prospectus dated 14 May 2021 and ASX announcement dated 8 September 2025. Total Barton JORC (2012) Mineral Resources include 1,049koz Au (39.7Mt @ 0.82 g/t Au) in Indicated category and 1,186koz Au (40.2Mt @ 0.92 g/t Au) in Inferred category, and 3,070koz Ag (34.5Mt @ 2.80 g/t Ag) in Inferred category as a subset of Tunkillia gold JORC (2012) Mineral Resources.

SOURCE: Barton Gold Holdings Limited

View the original press release on ACCESS Newswire