Geotechnical Drilling Starts at Central Gawler Mill

Barton Gold Holdings (OTCQB:BGDFF) has started geotechnical drilling to support a Definitive Feasibility Study for Stage 1 at the Challenger Gold Project.

The program comprises 5 sonic holes for TSF1 materials, 24 CPTu holes, and 3 push tube density holes, and is expected to take three weeks. Results will inform dry recovery of TSF1 tailings, detailed mine design, mining schedule and mining cost estimates for the Stage 1 DFS.

Following a $15m placement led by Franklin Templeton, the company reports approximately $20m cash on hand and says credit financing discussions are underway.

Barton Gold Holdings (OTCQB:BGDFF) ha iniziato perforazioni geotecniche per sostenere uno Studio di Fattibilita Definitiva per la Fase 1 del Challenger Gold Project.

Il programma comprende 5 fori sonici per i materiali TSF1, 24 fori CPTu e 3 fori di densità con tubo di spinta, e dovrebbe durare tre settimane. I risultati guideranno il recupero secco dei tailings TSF1, la progettazione dettagliata della miniera, il programma di estrazione e le stime dei costi di estrazione per la DFS della Fase 1.

Dopo una collocazione da 15 milioni di dollari guidata da Franklin Templeton, l'azienda riporta circa 20 milioni di dollari in contanti e afferma che sono in corso discussioni per finanziamenti a credito.

Barton Gold Holdings (OTCQB:BGDFF) ha iniciado perforaciones geotécnicas para respaldar un Estudio de Factibilidad Definitiva para la Fase 1 del Proyecto de Oro Challenger.

El programa comprende 5 hoyos sónicos para materiales TSF1, 24 hoyos CPTu y 3 hoyos de densidad con tubos de empuje, y se espera que dure tres semanas. Los resultados informarán la recuperación a seco de los relaves TSF1, el diseño detallado de la mina, el calendario de extracción y las estimaciones de costos de extracción para la DFS de la Fase 1.

Después de una colocación de 15 millones de dólares liderada por Franklin Templeton, la compañía reporta aproximadamente 20 millones de dólares en efectivo y dice que se están llevando a cabo conversaciones sobre financiamiento por crédito.

Barton Gold Holdings (OTCQB:BGDFF)가 Challenger 골드 프로젝트의 Phase 1 Definitive Feasibility Study를 지원하기 위한 지질공학 시추를 시작했습니다.

프로그램은 TSF1 재료용 5개의 소닉 구멍, 24개의 CPTu 구멍, 및 3개의 푸시 튜브 밀도 구멍으로 구성되며, 약 3주가 소요될 예정입니다.

결과는 TSF1 잔여물의 건식 회수, 상세한 채굴 설계, 채굴 일정 및 Phase 1 DFS의 채굴 원가 추정에 정보를 제공할 것입니다.

Franklin Templeton이 주도한 1500만 달러 규모의 주식 배치 이후, 회사는 약 2000만 달러의 현금 보유를 보고하고 있으며 신용 파이낸싱 논의가 진행 중이라고 밝힙니다.

Barton Gold Holdings (OTCQB:BGDFF) a commencé des forages géotechniques pour soutenir une étude de faisabilité définitive pour la Phase 1 du Challenger Gold Project.

Le programme comprend 5 forages soniques pour les matériaux TSF1, 24 forages CPTu et 3 forages de densité par tube de poussée, et devrait durer trois semaines. Les résultats informeront la récupération à sec des rebuts TSF1, la conception minière détaillée, le calendrier d'extraction et les estimations des coûts d'extraction pour le DFS de la Phase 1.

Suite à une placement de 15 M$ dirigée par Franklin Templeton, la société déclare disposer d'environ 20 M$ en liquidités et indique que des discussions de financement par crédit sont en cours.

Barton Gold Holdings (OTCQB:BGDFF) hat mit geotechnischen Bohrungen begonnen, um eine Definitive Feasibility Study für Phase 1 des Challenger-Goldprojekts zu unterstützen.

Das Programm umfasst 5 Sonic-Bohrungen für TSF1-Materialien, 24 CPTu-Bohrungen und 3 Push-Tube-Dichtheitsbohrungen, und soll drei Wochen dauern.

Ergebnisse werden die Trockenrückführung der TSF1-Rekorder, die detaillierte Minenplanung, den Abbauzeitplan und die Kostenschätzungen für Phase 1 DFS informieren.

Nach einer 15 Mio. USD schweren Platzierung, geführt von Franklin Templeton, meldet das Unternehmen ungefähr 20 Mio. USD liquide Mittel und sagt, dass Gespräche über eine Kreditfinanzierung im Gange sind.

بارتون جولد هولدنجز (OTCQB:BGDFF) بدأت حفرًا جيوتقنيًا لدعم دراسة جدوى نهائية للمرحلة 1 من مشروع تشالنجر للذهب.

المخطط يتكون من 5 آبار صوتية للمواد TSF1، و24 آبار CPTu، و3 آبار كثافة بأنبوب الدفع، ومن المتوقع أن يستغرق ثلاثة أسابيع.

ستوجه النتائج استرداد التيار الجاف لخامات TSF1، والتصميم المعدني التفصيلي، وجدول التعدين وتقديرات تكاليف التعدين لـ DFS المرحلة 1.

بعد إدراج بقيمة 15 مليون دولار بقيادة Franklin Templeton، تؤكد الشركة أن لديها نحو 20 مليون دولار نقدًا وتذكر أن مناقشات التمويل الائتماني جارية.

Barton Gold Holdings (OTCQB:BGDFF) 已启动地质技术钻探,以支持 Challenger 金矿项目阶段 1 的最终可行性研究。

该计划包括用于 TSF1 材料的 5个声波孔、24个 CPTu 孔 和 3个推管密度孔,预计用时 三周。

结果将为 TSF1 尾矿的干法回收、详细的矿山设计、开采计划以及阶段 1 DFS 的开采成本估算提供依据。

在由 Franklin Templeton 主导的一轮 1500万美元 配售之后,该公司表示手头现金约为 2000万美元,并称信贷融资谈判正在进行中。

- Geotechnical program: 5 sonic, 24 CPTu, 3 push tube holes

- Program timeline: expected to take three weeks

- Stage 1 DFS underway to inform TSF1 mine design and costs

- $15m placement led by Franklin Templeton

- Approximately $20m cash on hand

- None.

Results to inform detailed TSF1 mine design, schedule and costs

ADELAIDE, AU / ACCESS Newswire / October 22, 2025 / Barton Gold Holdings Limited (ASX:BGD)(OTCQB:BGDFF)(FRA:BGD3) (Barton or the Company) is pleased to confirm that geotechnical drilling has started in support of a recently launched Definitive Feasibility Study for 'Stage 1' production (Stage 1 DFS) at the Company's South Australian Challenger Gold Project (Challenger).1

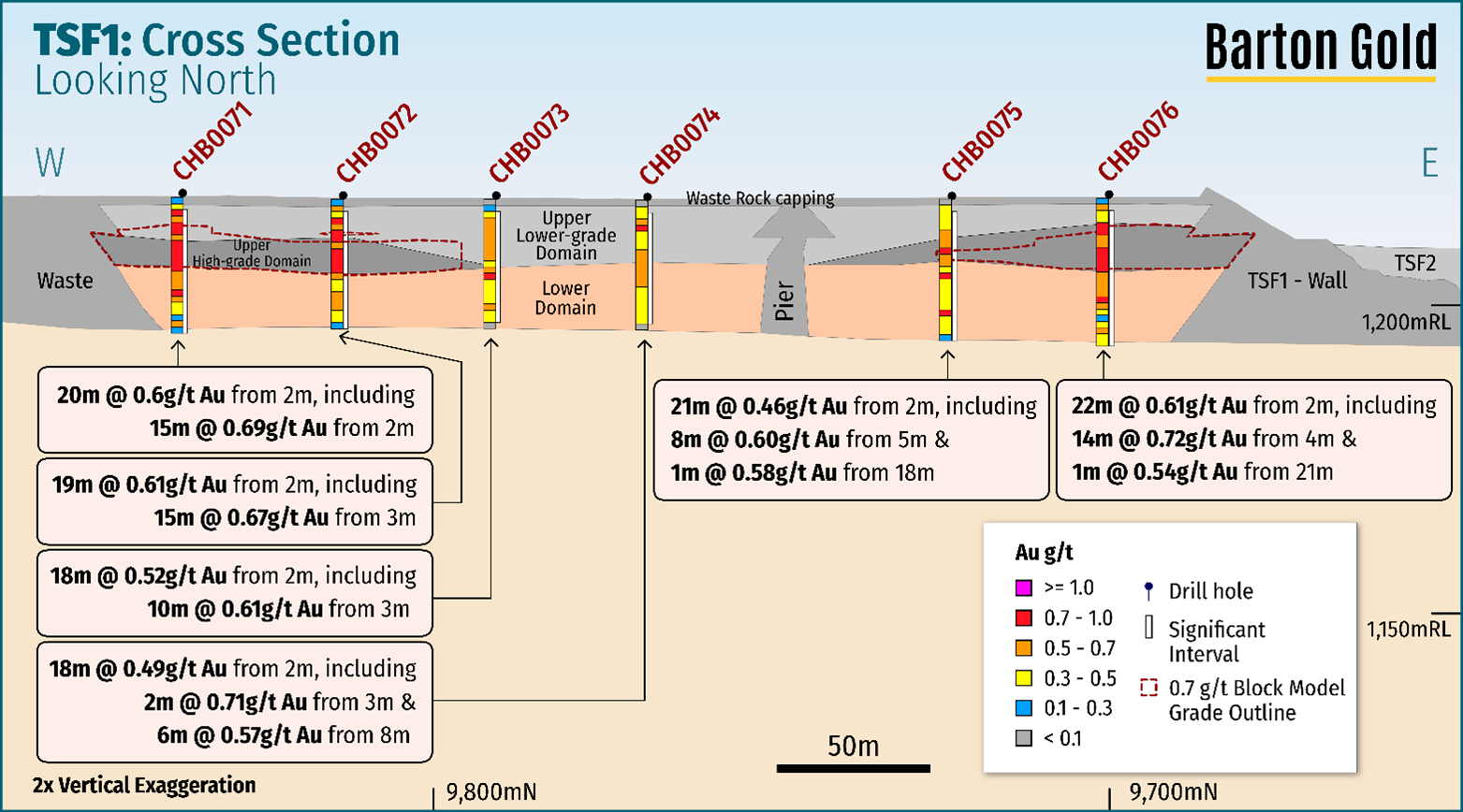

The planned program includes 5 sonic drilling holes to recover TSF1 materials for laboratory testing, 24 holes for Cone Penetration Testing (CPTu) and further laboratory testing, and 3 holes for push tube density testing.

The program is expected to take three weeks to complete, with the results to inform the dry recovery of TSF1 tailings materials, detailed mine design, a mining schedule and estimate of mining costs for the Stage 1 DFS.

Figure 1 - Cross section showing higher-grade peripheral TSF1 materials & 0.7g/t Au grade shell1

Commenting on the start of geotechnical drilling, Barton Managing Director Alexander Scanlon said:

"With the Stage 1 DFS now underway, we are excited to kick off the first of several production-related work programs that will inform key elements of mine design, scheduling, equipment selection and operating costs for tailings recovery.

"Following a

"We are now on the road to production, leveraging our fully permitted Central Gawler Mill to operations and growth. This is an invaluable stepping stone for our vision to become South Australia's largest independent gold producer."

Authorised by the Managing Director of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Jade Cook |

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000ozpa with 2.2Moz Au & 3.1Moz Ag JORC Mineral Resources (79.9Mt @ 0.87g/t Au), brownfield mines, and

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource (above 215mRL) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource (below 90mRL) | Mr Dale Sims | AusIMM / AIG | Fellow / Member |

Wudinna Mineral Resource (Clarke Deposit) | Ms Justine Tracey | AusIMM | Member |

Wudinna Mineral Resource (all other Deposits) | Mrs Christine Standing | AusIMM / AIG | Member / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

1Refer to ASX announcement dated 29 September 2025

* Refer to Barton Prospectus dated 14 May 2021 and ASX announcement dated 8 September 2025. Total Barton JORC (2012) Mineral Resources include 1,049koz Au (39.7Mt @ 0.82 g/t Au) in Indicated category and 1,186koz Au (40.2Mt @ 0.92 g/t Au) in Inferred category, and 3,070koz Ag (34.5Mt @ 2.80 g/t Ag) in Inferred category as a subset of Tunkillia gold JORC (2012) Mineral Resources.

SOURCE: Barton Gold Holdings Limited

View the original press release on ACCESS Newswire