Blue Moon Advances Four Core Assets with Comprehensive 40,000 Meter 2026 Infill and Step-Out Drilling Programs

Rhea-AI Summary

Blue Moon Metals (TSXV: MOON; NASDAQ: BMM) plans a comprehensive 2026 drilling program of ~35,000–45,000 metres across four core projects in the US and Norway, including Nussir, Blue Moon polymetallic, NSG Rupsi/Avilon, and the Springer tungsten mine. Work includes surface and underground infill and step-out diamond drilling, re‑assays, and resource evaluation programs.

Key objectives are resource conversion, expansion (including historic Springer resource confirmation), testing extensions and high‑grade zones, and supporting updated MREs and follow‑up studies.

Positive

- Planned drilling of 35,000–45,000 m in 2026

- 10,000 m staged underground program at Rupsi (NSG)

- 16,000 m focused program at Blue Moon polymetallic VMS

Negative

- Historic Springer WO3 estimate is not NI 43-101 current

- Significant drilling cost and execution risk from deep holes

- Resource conversion depends on forthcoming assays and re-logging

Key Figures

Market Reality Check

Peers on Argus

No peers with momentum or same-day headlines were detected, so the slight -0.82% move appears stock-specific rather than part of a sector rotation.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Feb 10 | Mine acquisition | Positive | -0.8% | Closed US$18.5M Springer tungsten mine and plant acquisition in Nevada. |

Limited history shows the stock declining (-0.82%) on the recent Springer acquisition, suggesting a tendency for cautious reactions even to ostensibly constructive asset news.

On Feb 10, 2026, Blue Moon closed the acquisition of the Springer tungsten and critical metals mine and processing plant in Nevada for aggregate consideration of US$18.5 million. The current announcement outlines an expansive 2026 drilling campaign of up to 40,000 meters across four projects, including Springer. Together, these events mark a rapid shift from transaction closing to aggressive technical de-risking and resource-definition work across the portfolio.

Market Pulse Summary

This announcement outlines an aggressive 2026 campaign of up to 35,000–45,000 meters of drilling across Blue Moon’s four core projects, including Nussir, Blue Moon, NSG, and Springer. It follows the recent Springer acquisition on Feb 10, 2026, signaling a rapid move into technical de-risking and resource work. Investors may watch for updated mineral resource estimates, confirmation of historical Springer figures, and evidence that infill and step-out drilling improves project confidence.

Key Terms

CuEq technical

volcanogenic massive sulphide medical

NI 43-101 regulatory

indicated resources technical

inferred resources technical

cutoff grade technical

AI-generated analysis. Not financial advice.

The VP Exploration of Blue Moon, Theodore Veligrakis stated:

''Our 2026 drilling plans underscore the commodity diversity of our portfolio, including our tungsten assets, while maintaining a clear focus on advancing our core projects. Our ongoing and planned 2026 exploration, re-assaying and drilling programs reflect the diversity of our asset base, with exposure to multiple commodities, including a growing focus on tungsten and other critical metals while continuing to advance our copper projects in

NUSSIR PROJECT DRILLING

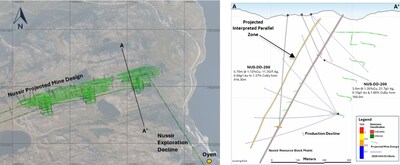

At the Nussir Copper-Gold-Silver Project, the planned infill drilling program will focus on the eastern portion of the current mineral resource. The program is expected to include approximately 3,000 meters of surface drilling designed to achieve nominal drill spacing of approximately 75 by 75 meters in the upper part of the mineralized zone (see Figure 1.1). In addition, approximately 7,000 meters of underground drilling is planned, comprising up and down dip oriented drillholes from five underground drill stations, targeting the deeper, copper-rich portion of the mineralization. The Nussir underground exploration decline continues to advance steadily. Since June 2025, the Company's mining contractor, Leonhard Nilsen & Sønner AS ("LNS"), has advanced a total of 1,125 meters as of February 9th.

By design, the infill drilling program will also allow the Company to test the eastern parallel zone, a thinner, copper-rich horizon located approximately 80 meters above the main mineralized body, which extends for approximately 10 kilometers along strike.

Figure 1.1 Notes | |

1. | Price deck used for CuEq is |

2. | The applied formula was: CuEq = Cu%_Grade + (Ag_Coeff * Ag_Grade) + (Au_Coeff * Au_Grade) |

In addition, the 4,000 meters surface directional drilling program at Nussir, as described in the December 1, 2025 press release, has recommenced following the holiday break. The aim of the program is to materially expand the current mineral resource estimate ("MRE") while testing for potential extensions of higher-grade mineralization at depth. Drilling is being completed from a single parent ("mother") drillhole, with the deepest daughter hole extending to approximately 1,250 meters below surface. The primary objective of the program is to infill an approximately 650-meter gap between the current MRE and the high-grade intersection in drillhole NUS-DD-14-001, which returned 9.7 meters (7.4 meters true width) grading

BLUE MOON PROJECT DRILLING

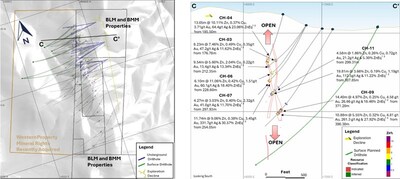

At the Blue Moon Polymetallic Project in

Figure 1.2 Notes: | |

1. | Price deck used for ZnEq is Au |

2. | The applied formula was: ZnEq = Zn%_Grade + ((Cu%_Grade * 78.20) + (Pb%_Grade * 0) + (Ag oz/t * 25.46) + (Au oz/t * 1896.40))/23.83. |

Diamond drilling has recently commenced from the underground exploration decline, with approximately 8,000 meters to be completed from three underground drill stations targeting the central and upper portions of the volcanogenic massive sulphide ("VMS") deposit. The remaining approximately 8,000 meters of drilling is planned from surface locations, targeting the deeper portions of the currently defined mineral resource. Selected drill holes will be completed with downhole geophysical surveys, including electromagnetic methods, to assist in identifying additional mineralization and generating new exploration targets, particularly to the northwest and along up-dip and down-dip extensions.

Historic drilling has returned encouraging polymetallic intercepts within the VMS system, such as drillhole CH-09 which has intersected 14.40 meters @

In January 2026, Blue Moon acquired the mineral rights to the Western Property, and the rights to drill from surface. We expect to drill 8,000 meters from surface from the NW area to expand the high-grade resources to the NW (see Figure 1.3).

The Company is currently undertaking a systematic re-logging and re-sampling program of the historic drill core, including previously unsampled mineralized intersections. The program is designed to validate the historical dataset, support an updated mineral resource estimate incorporating new assay data from this year's drill program, and refine the geological and structural interpretation of the mineralized system.

NSG PROJECT DRILLING

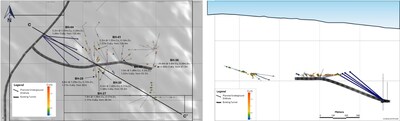

At the NSG Copper-Zinc VMS Project, following the review and relogging of historic Rupsi drill core at the Geological Survey of

The program is planned to commence with the extension of the existing Rupsi tunnel, with the first approximately 150 meters of development providing access to two underground drill stations. From these stations, approximately 1,600 meters of up-dip oriented drilling is planned on both sides of the tunnel to test the previously undrilled up-dip extension of the Rupsi mineralized body. Following this initial phase, underground development is planned to continue to a second set of drill stations, from which additional infill and step-out drilling is planned to further evaluate and potentially expand the currently defined mineral resource.

In parallel, the Company reports that all necessary permits have been obtained, from the Norwegian Directorate of Mining, to access the Avilon underground tunnel. Following an underground inspection and assessment of the existing infrastructure, the Company plans to complete approximately 1,500 meters of underground drilling at Avilon, targeting resource expansion (Sagmo deposit) to the west (Figure 1.5).

Figure 1.5 Notes: | |

1. | Price deck used for CuEq is Cu |

2. | The applied formula was: CuEq = Cu%_Grade + (Zn%_Grade x 0.16) |

SPRINGER HISTORIC TUNGSTEN MINE RESOURCE CONFIRMATION AND EXPANSION

The Springer Tungsten Mine is planned to be advanced through a multi-phase work program in 2026. The initial phase will focus on a detailed review of available historical information, including drill logs, core where accessible, cross-sections, assay data and the existing block model covering the Sutton I and Sutton II tungsten skarn deposits. This work will be used to refine the current geological interpretation and to guide the design of a follow-up drilling program.

Subject to the outcome of the data review, the Company plans to complete approximately 5,000 meters of resource evaluation drilling. The program is expected to include a combination of twinning, infill, and step-out drilling targeting the higher-grade scheelite skarn mineralization. Drilling will also test for base and precious metals, which have received limited attention in previous work and are largely absent from the existing dataset.

A further phase of work is planned to assess additional mineralized horizons located to the east of the main skarn bodies. Historical work in these areas outlines multiple mineralized beds and indicates potential for resource growth, based on historic operations by General Electric when the mine was in production in the early 1980s. Available information suggests that molybdenum and tungsten grades increase at depth; however, no systematic assays have been recorded for these elements, there is limited historical data regarding associated gold and copper mineralization, and no mineral resource has been defined for molybdenum. The deposit setting also provides broader exploration potential, given the association of skarn mineralization with nearby porphyry, carbonate replacement, and epithermal systems.

The Springer Property consists of approximately 3,000 hectares of mineral claims and fee lands. The mineral resource is located entirely on private fee lands. The historical mineral resource (1)(2)(3) on the Property is:

Historical estimate of indicated resources of 355,000 tons @

Historical estimate of inferred resources of 1,933,600 tons @

The mine infrastructure includes a vertical shaft developed down to 1,600 feet, a headframe and 3 compartment hoist and associated equipment.

Qualified Persons

The technical and scientific information of this news release has been reviewed and approved by Mrs. Boi Linh Doig, P.Eng., a Blue Moon Officer, and a non-Independent Qualified Person, as defined by NI 43-101.

Notes:

- As at the date of this news release, a qualified person has not completed sufficient work to classify this historical estimate as current mineral resources or mineral reserves in accordance with NI 43-101 and Blue Moon is not treating the historical estimate as current mineral resources or mineral reserves. In order to verify the historical estimate, the Company needs to engage a qualified person to review the historical data, review any work completed on the property since the date of the estimate and complete a new technical report. Blue Moon views this historical data as an indicator of the potential size and grade of the mineralized deposits, and this data is relevant to Company's future plans with respect to the property.

- Resource classification was performed according to CIM guidelines for indicated and inferred resources at the time and are based on drill spacing and density; the estimate was presented at 0.20 WO3% cutoff grade based on approximate mining cost of

$40 $13.50 $7 82% and a WO3 price of$11.50 - The effective date of this estimate is August 20, 2012, and is contained in the "Preliminary Economic Assessment of the Springer Tungsten Mine,

Pershing County, Nevada , USA" dated December 31, 2013 and prepared by Keith McCandlish of DMT Geosciences Ltd.

About Blue Moon

Blue Moon is advancing 4 brownfield polymetallic projects, including the Nussir copper-gold-silver project in

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY DISCLAIMER - FORWARD LOOKING STATEMENTS

This news release contains forward-looking statements and forward-looking information (collectively "forward-looking information") within the meaning of applicable Canadian and

This news release contains forward-looking information, pertaining to, among other things, the advancement by the Company of multiple projects across jurisdictions. The Company cautions that all forward-looking information is inherently subject to change and uncertainty and that actual events, results and performance may differ materially from those expressed or implied by the forward-looking information. A number of risks, uncertainties and other factors could cause actual results and events to differ materially from those expressed or implied in the forward-looking information or could cause the Company's current objectives, strategies and intentions to change. These risks and uncertainties include but are not limited to: the risk that exploration activities will not result in finding economically viable mineralization; uncertainties inherent in exploration and drilling, including geological, technical, and metallurgical risks; inaccurate or incomplete geological models or interpretations; operational risks such as ground stability, ventilation, dewatering, power constraints, equipment failure, contractor performance, accidents, labour shortages; environmental, health and safety risks; adverse weather or seasonal access constraints; changes in laws, regulations, or government policies; community or stakeholder opposition; fluctuations in commodity prices and currency exchange rates; cost overruns; and risks related to the availability of capital and financing. A comprehensive discussion of other risks that impact Blue Moon can also be found in its public reports and filings which are available at www.sedarplus.ca and on the website of the

Any forward-looking information contained in this news release represents management's current expectations and are based on information currently available to management and are subject to change after the date of this news release. Accordingly, the Company warns investors to exercise caution when considering statements containing forward-looking information and that it would be unreasonable to rely on such statements as creating legal rights regarding the Company's future results or plans.

The Company cannot guarantee that any forward-looking information will materialize and readers are cautioned not to place undue reliance on this forward-looking information. The Company is under no obligation (and expressly disclaims any intention or obligation) to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law. All of the forward-looking information in this news release is qualified by the cautionary statements herein.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/blue-moon-advances-four-core-assets-with-comprehensive-40-000-meter-2026-infill-and-step-out-drilling-programs-302685701.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/blue-moon-advances-four-core-assets-with-comprehensive-40-000-meter-2026-infill-and-step-out-drilling-programs-302685701.html

SOURCE Blue Moon Metals