BrightSphere Investment Group Inc. Announces Agreement to Sell Campbell Global, LLC

BrightSphere Investment Group Inc. (NYSE: BSIG) today announced that it has entered into a definitive agreement to sell its

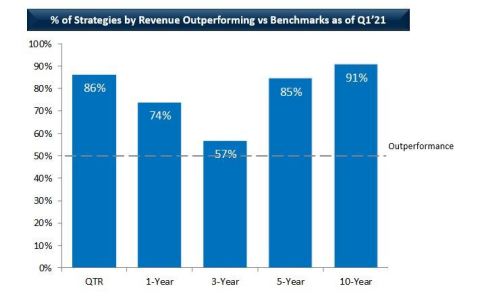

% of Strategies by Revenue Outperforming vs Benchmarks as of Q1'21 (Graphic: Business Wire)

In addition to acquiring BrightSphere’s equity interest in Campbell, J.P. Morgan has also agreed to acquire BrightSphere’s co-investments in Campbell Funds. The transaction is subject to customary closing conditions and is anticipated to close in the third quarter of 2021.

Suren Rana, BrightSphere’s President and Chief Executive Officer said, “This transaction decidedly transforms our business from a multi-boutique asset manager to Acadian, a single, full-scale differentiated business that is a market leader in the quant sector. After the completion of the sale of Campbell Global and the other announced sale transactions in the coming months, BrightSphere’s sole business will be Acadian, with AUM of

Morgan Stanley & Co. LLC acted as financial advisor to BrightSphere on the transaction, while Ropes & Gray LLP served as legal advisor to BrightSphere.

About BrightSphere

BrightSphere is a diversified, global asset management company. Through Acadian Asset Management, its sole operating subsidiary with approximately

1 Pro forma cash balance comprised of

2 Reflects the announced divestitures of Campbell Global, Thompson Siegal & Walmsley, and Investment Counselors of Maryland, and gives effect for the completed sale of Landmark Partners LLC, which was completed on June 2, 2021.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210621005708/en/