Banyan Gold Drills 1.90 g/t Au over 17.3m, Adds Fourth Drill Rig and Extends High-Grade Domains in Core of Powerline Deposit, Yukon, Canada

Rhea-AI Summary

Banyan Gold (OTCQB:BYAGF, TSXV:BYN) reports new drill results at the Powerline Deposit, AurMac Project, Yukon dated October 21, 2025. Key intercepts include 2.69 g/t Au over 11.8m and 1.90 g/t Au over 17.3m, plus multiple high-grade visible-gold intervals. The company announced an upsized 40,000 m drill program, added a fourth drill rig after a $31.4M strategic investment, and has completed >30,000 m so far in 2025. The AurMac MRE (effective June 28, 2025) reports Indicated 2.274 Moz Au and Inferred 5.453 Moz Au. Mineralized domains remain open and modelling aims to convert inferred ounces to indicated.

Positive

- Indicated MRE 2.274 Moz Au (112.5 Mt at 0.63 g/t)

- Inferred MRE 5.453 Moz Au (280.6 Mt at 0.60 g/t)

- Drill program upsized to 40,000 m with fourth drill rig

- Notable intercept: 2.69 g/t Au over 11.8 m (AX-25-697)

Negative

- Majority of resource is inferred: 5.453 Moz vs 2.274 Moz indicated

- Mineral Resources do not have demonstrated economic viability

- MRE uses assumptions including US$2,050/oz gold price which affect economics

VANCOUVER, BC, AB / ACCESS Newswire / October 21, 2025 / Banyan Gold Corp. (the "Company" or "Banyan") (TSXV:BYN)(OTCQB:BYAGF) is pleased to announce it has intersected high-grade gold at surface in the core of the Powerline Deposit ("Powerline") at its AurMac Project ("AurMac") in the prolific Tombstone Belt, Yukon, Canada.

Selected Highlights Demonstrate Continuity of High-Grade in Core of Central Powerline Deposit:

AX-25-697 - 2.69 g/t gold ("Au") over 11.8 metres ("m") within 0.65 g/t gold over 72.5m; including 29.3 g/t Au over 0.4m, 21.04 g/t Au over 0.4m, and 2.26 g/t Au over 3.4m.

AX-25-700 - 3.07g/t Au over 3.6m within 0.69 g/t Au over 29.3m, and 1.90 g/t Au over 17.3m; including 33.00 g/t Au over 0.8m

AX-25-706 - 16.68 g/tAu over 1.1m within 2.39 g/t Au over 8.1m at surface

AX-25-709B - 2.55 g/t Au over 6.4m within 0.85 g/t Au over 22.9m

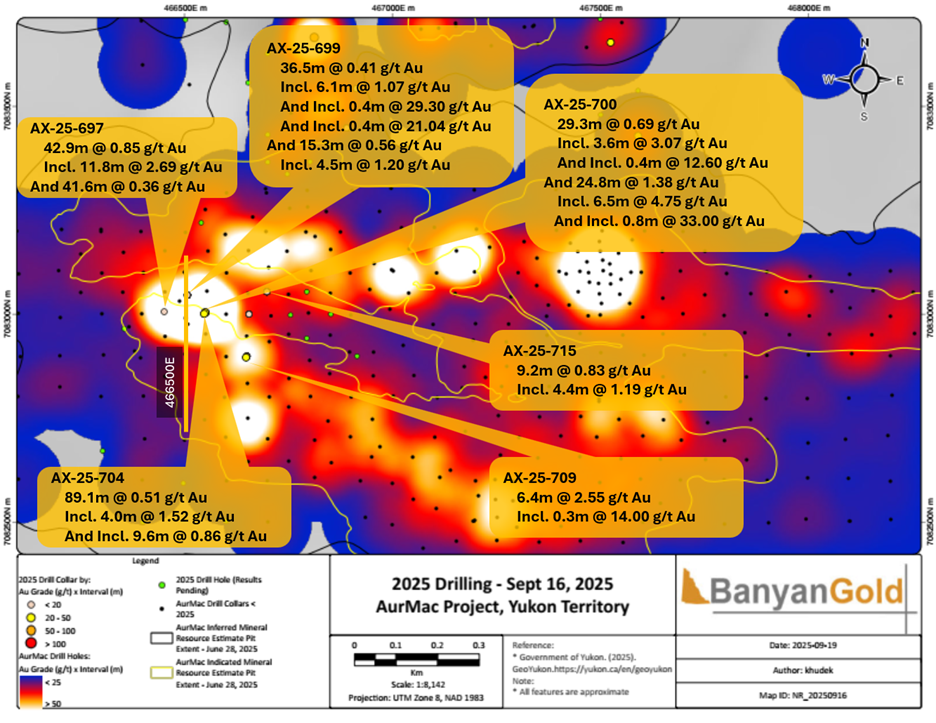

High-grade gold in drillholes AX-25-697, 700, 706, and 709B, as outlined above, highlight the potential for very high-grade gold intervals in Powerline and continue to reinforce continuity in the core of the deposit and confirm new 3D modelling of the high-grade mineralized domains. These intersections also have the potential to convert inferred ounces from the current Mineral Resource Estimate ("MRE") (Table 3) into indicated resources in the Powerline Deposit (Figure 1; Tables 1 and 2). To date, the Company has drilled over 30,000m (130 holes) on AurMac this year, with current drill program ongoing.

"With our recent

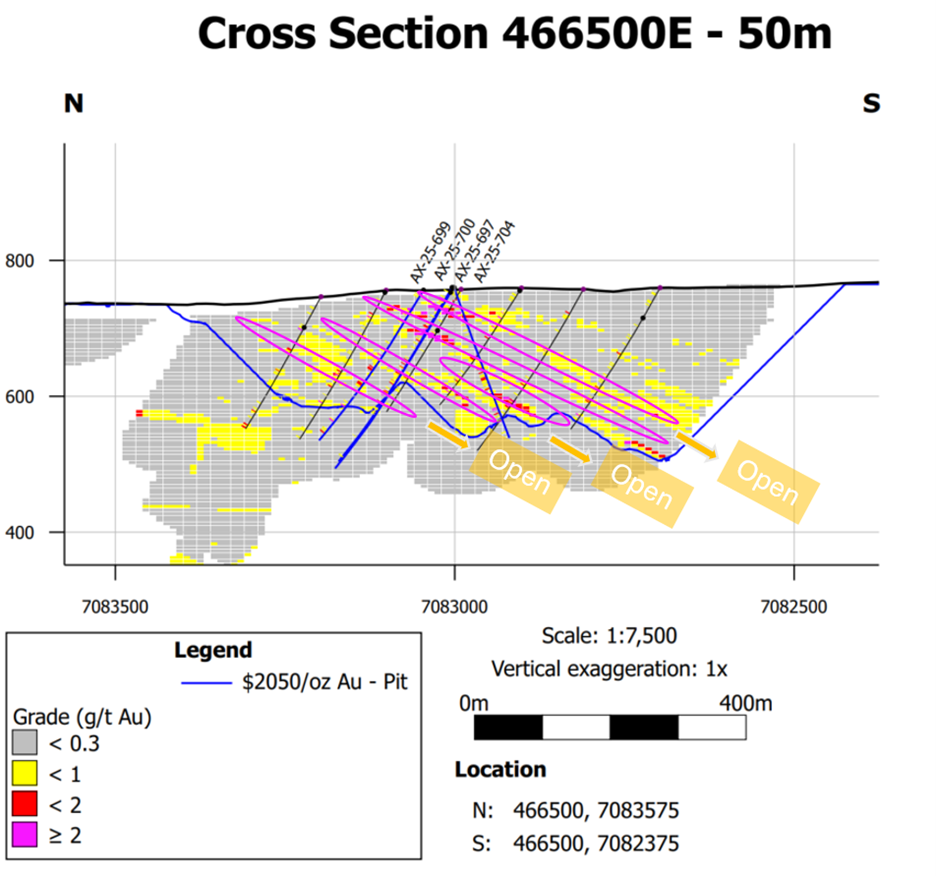

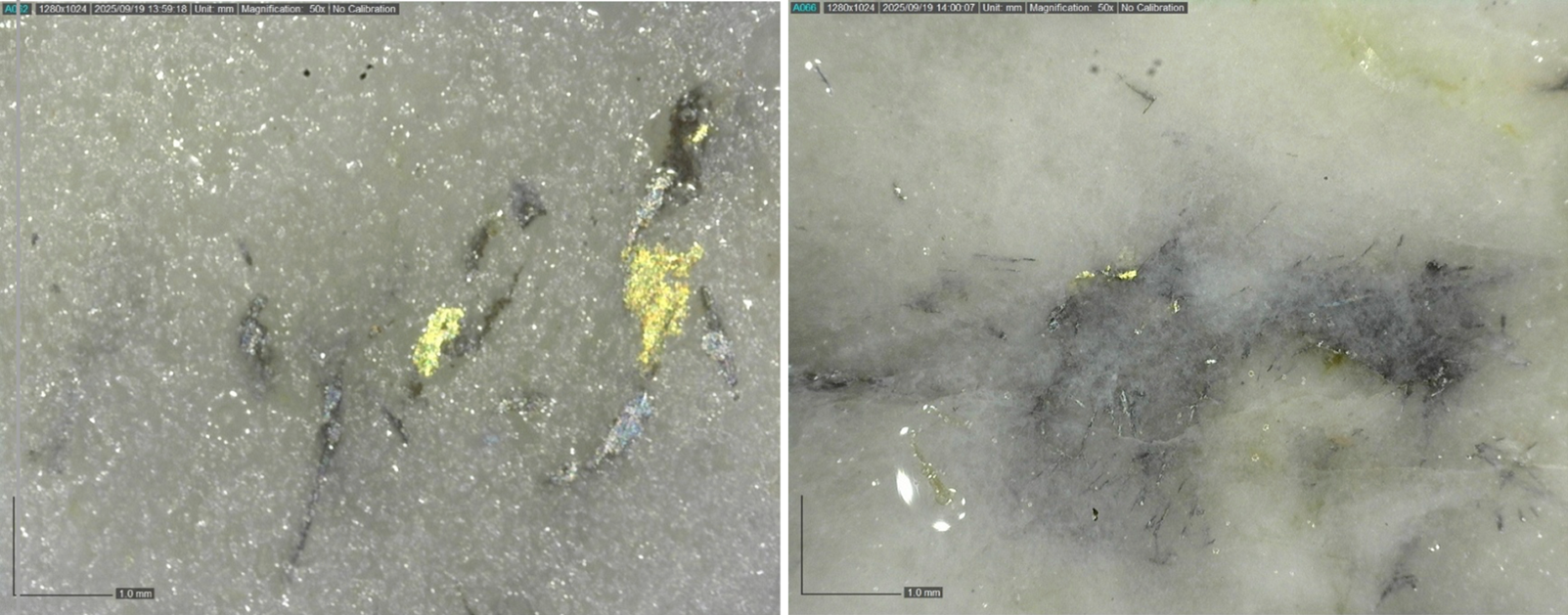

"Our drilling in the core of Powerline (Figure 1) continues to confirm continuity of refined and high-grade mineralized domains," added Duncan Mackay, Vice President of Exploration. "With mineralized domains open down-dip (Figure 2) we also have the potential to add additional high-grade ounces while converting inferred ounces to indicated. We continue to intersect visible gold, in zones of high-grade mineralization (Figures 3 and 4), and throughout the Powerline deposit."

Figure 1: Plan map of the northeast portion of the Powerline Deposit. High-grade mineralization is associated with emplacement of sheeted veins in favourable host rocks, primarily based on rheology; more brittle rocks are favourable hosts for sheeted vein emplacement. Cross-section line for Figure 2 shown by gold line.

Sheeted-veins with visible gold, bismuth sulphosalts, and arsenopyrite are localized in higher concentrations in zones of more competent, brittle rocks (Figures 3 and 4). Veins are centimetre to decimetre in scale, generally with trace to

Figure 2: Cross-section of the Powerline Deposit at 466500 E. Refined mineralized domains (in magenta) intersected in the drillholes in this release reinforce continuity of high-grade mineralization. Down-drip extensions of mineralized domains have potential to convert additional waste blocks into ore as well as flatten the conceptual pit floor.

Figure 3: Zones of sheeted-veins in drillhole AX-25-697 in central Powerline.

Figure 4: Visible gold associated with aggregates of acicular bismuth sulphosalts and fine-grained arsenopyrite. Intervals from drillhole AX-25-697 at 14.80-15.24m depth.

Table 1: Significant diamond drillhole assay intercepts for Powerline in this release

HOLE NUMBER | depth from | depth to | Au Interval (m) | Au Interval (g/t) |

AX-25-697 | 13.5 | 86.0 | 72.5 | 0.65 |

Including | 13.5 | 15.2 | 1.7 | 4.20 |

and including | 60.2 | 86.0 | 25.8 | 1.30 |

Including | 60.2 | 72.0 | 11.8 | 2.69 |

Including | 61.4 | 61.8 | 0.4 | 29.30 |

Including | 63.8 | 64.2 | 0.4 | 21.04 |

And | 118.8 | 178.4 | 59.6 | 0.36 |

Including | 131.0 | 140.2 | 9.2 | 0.55 |

and including | 154.0 | 160.4 | 6.4 | 0.99 |

and including | 173.2 | 174.4 | 1.2 | 1.82 |

And | 201.9 | 212.4 | 10.5 | 0.52 |

Including | 208.4 | 208.7 | 0.3 | 9.43 |

And | 289.6 | 291.3 | 1.7 | 0.83 |

AX-25-699 | 9.1 | 14.0 | 4.9 | 0.51 |

and | 37.2 | 58.0 | 20.8 | 0.28 |

including | 56.2 | 56.5 | 0.3 | 7.24 |

and | 92.5 | 94.0 | 1.5 | 0.36 |

and | 105.2 | 141.7 | 36.5 | 0.41 |

including | 114.3 | 115.8 | 1.5 | 2.35 |

including | 135.6 | 141.7 | 6.1 | 1.07 |

and | 163.1 | 178.4 | 15.3 | 0.56 |

including | 164.5 | 169.0 | 4.5 | 1.20 |

and | 199.6 | 208.5 | 8.9 | 0.48 |

including | 207.0 | 208.5 | 1.5 | 2.02 |

and | 232.7 | 257.6 | 24.9 | 0.43 |

including | 234.2 | 236.0 | 1.8 | 3.01 |

including | 256.0 | 257.6 | 1.6 | 1.33 |

AX-25-700 | 8.0 | 37.3 | 29.3 | 0.69 |

including | 21.5 | 25.1 | 3.6 | 3.07 |

including | 23.0 | 24.0 | 1.0 | 4.49 |

and including | 36.9 | 37.3 | 0.4 | 12.60 |

and | 68.5 | 70.0 | 1.5 | 1.06 |

and | 86.0 | 91.0 | 5.0 | 0.32 |

and | 97.0 | 98.5 | 1.5 | 0.36 |

and | 104.5 | 106.0 | 1.5 | 0.44 |

and | 122.0 | 200.0 | 78.0 | 0.56 |

including | 132.4 | 133.5 | 1.1 | 1.45 |

and including | 148.5 | 150.0 | 1.5 | 1.59 |

including | 182.7 | 200.0 | 17.3 | 1.90 |

including | 188.4 | 189.2 | 0.8 | 33.00 |

and including | 198.6 | 200.0 | 1.4 | 1.06 |

and | 261.6 | 262.2 | 0.6 | 0.68 |

AX-25-704 | 17.5 | 42.5 | 25.0 | 0.32 |

including | 17.5 | 18.8 | 1.3 | 1.28 |

and including | 28.2 | 28.7 | 0.5 | 8.85 |

and | 55.9 | 56.9 | 1.0 | 0.38 |

and | 64.5 | 66.0 | 1.5 | 0.37 |

and | 71.0 | 72.0 | 1.0 | 0.31 |

and | 104.7 | 209.1 | 104.4 | 0.48 |

including | 104.7 | 105.2 | 0.5 | 7.98 |

and including | 124.6 | 143.2 | 18.6 | 0.67 |

and including | 156.7 | 158.2 | 1.5 | 1.41 |

and including | 187.3 | 196.8 | 9.5 | 0.86 |

and including | 208.0 | 209.1 | 1.1 | 2.06 |

and | 225.0 | 226.5 | 1.5 | 0.50 |

and | 232.3 | 232.8 | 0.5 | 0.37 |

AX-25-706 | 7.7 | 15.8 | 8.1 | 2.39 |

including | 14.7 | 15.8 | 1.1 | 16.68 |

and including | 15.2 | 15.8 | 0.6 | 24.80 |

and | 40.4 | 40.6 | 0.2 | 1.66 |

and | 92.4 | 92.7 | 0.3 | 0.31 |

and | 112.8 | 135.2 | 22.4 | 0.47 |

including | 114.2 | 115.8 | 1.6 | 1.72 |

and including | 126.6 | 131.2 | 4.6 | 0.92 |

and | 156.6 | 173.8 | 17.2 | 0.84 |

including | 159.4 | 165.9 | 6.5 | 1.57 |

AX-25-709B | 25.0 | 33.5 | 8.5 | 0.46 |

including | 32.0 | 33.5 | 1.5 | 1.30 |

and | 61.2 | 61.6 | 0.4 | 1.98 |

and | 86.0 | 157.0 | 71.0 | 0.32 |

including | 86.0 | 93.5 | 7.5 | 0.75 |

and | 126.8 | 127.8 | 1.0 | 1.03 |

and including | 143.8 | 149.5 | 5.7 | 1.03 |

and | 174.6 | 197.5 | 22.9 | 0.84 |

including | 174.6 | 181.0 | 6.4 | 2.55 |

including | 180.7 | 181.0 | 0.3 | 14.00 |

and | 196.0 | 197.5 | 1.5 | 1.20 |

and | 222.0 | 223.1 | 1.1 | 1.96 |

and | 242.8 | 244.0 | 1.2 | 0.61 |

AX-25-715 | 13.0 | 23.0 | 10.0 | 0.29 |

including | 21.9 | 23.0 | 1.1 | 1.38 |

and | 89.8 | 99.0 | 9.2 | 0.83 |

including | 94.6 | 99.0 | 4.4 | 1.19 |

including | 94.6 | 95.0 | 0.4 | 5.02 |

and | 110.4 | 111.0 | 0.6 | 0.44 |

and | 113.4 | 114.5 | 1.1 | 0.43 |

and | 119.0 | 125.0 | 6.0 | 0.30 |

and | 134.0 | 140.3 | 6.3 | 0.31 |

and | 157.0 | 177.8 | 20.8 | 0.39 |

including | 170.0 | 173.9 | 3.9 | 1.49 |

and | 189.9 | 191.0 | 1.1 | 0.54 |

and | 213.5 | 215.0 | 1.5 | 1.07 |

Note: True widths are estimated to be

Table 2: Collar Locations for drillholes in this release

HOLE ID | Easting (m) | Northing (m) | Elevation | Depth | Azimuth | Dip |

AX-25-697 | 466451 | 7083006 | 753 | 310.9 | 0 | -60 |

AX-25-699 | 466507 | 7083046 | 764 | 270.0 | 0 | -60 |

AX-25-700 | 466550 | 7083004 | 766 | 306.3 | 0 | -60 |

AX-25-706 | 466655 | 7083000 | 771 | 249.9 | 0 | -60 |

AX-25-709B | 466650 | 7082899 | 761 | 251.5 | 0 | -60 |

AX-25-715 | 466698 | 7083054 | 777 | 251.5 | 0 | -60 |

Analytical Method and Quality Assurance/Quality Control Measures

All diamond drill core was systematically logged and photographed by Banyan geology personnel. All core samples (HTW and NTW diameter) were split on-site at Banyan's core processing facilities. Once split, half samples were placed back in the core boxes with the other half of split samples sealed in poly bags with one part of a three-part sample tag inserted within. Samples were delivered by Banyan personnel or a dedicated expediter to the Bureau Veritas, Whitehorse preparatory laboratory where samples are prepared and then shipped to Bureau Veritas's Analytical laboratory in Vancouver, B.C. for pulverization and final chemical analysis.

Core splits reported in this news release were analysed by Bureau Veritas of Vancouver, B.C., utilizing the four-acid digestion ICP-ES 35-element MA-300 or ICP-ES/MS 59-element MA-250 analytical package with FA-450 50-gram Fire Assay with AAS finish for gold on all samples. Samples returning >10 g/t Au were reanalysed by fire assay with gravimetric finish on a 50g sample (FA-550). High-grade samples with documented visible gold are also analysed using metallic screen fire assay (FS-652). Bureau Veritas is an accredited lab following ISO/IEC 17025:2017 SCC File Number 15895. A robust system of standards, ¼ core duplicates and blanks has been implemented in the 2025 exploration drilling program and is monitored as chemical assay data becomes available.

Qualified Persons

Duncan Mackay, M.Sc., P.Geo., is a "Qualified Person" as defined under National Instrument 43-101, Standards of Disclosure for Mineral Projects ("NI 43-101"), and has reviewed and approved the content of this news release in respect of all disclosure other than the MRE. Mr. Mackay is Vice President Exploration for Banyan and has verified the data disclosed in this news release, including the sampling, analytical and test data underlying the information.

Upcoming Events

Hidden Gems Conference, New York - October 20 to 21, 2025

New Orleans Investment Conference - November 2 to 5, 2025

Corporate Update and Breakfast - November 5, 7:15 AM CST

Deutsche Goldmesse Fall, Frankfurt - November 14 to 15, 2025

Yukon Geoscience Forum, Whitehorse - November 16 to 19, 2025

About Banyan

Banyan's primary asset, the AurMac Project is located in the Traditional Territory of First Nation of Na-Cho Nyäk Dun, in Canada's Yukon Territory. The current Mineral Resource Estimate ("MRE") for the AurMac Project has an effective date of June 28, 2025 and comprises an Indicated Mineral Resource of 2.274 million ounces of gold ("Au") (112.5 M tonnes at 0.63 g/t) and an Inferred Mineral Resource of 5.453 M oz of Au (280.6 M tonnes at 0.60 g/t ) (as defined in the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards for Mineral Resources & Mineral Reserves incorporated by reference into NI 43‑101). The 303 square kilometres ("sq km") AurMac Project lies 40 km from Mayo, Yukon. The AurMac Project is transected by the main Yukon highway and benefits from a 3-phase powerline, existing power station and cell phone coverage

Table 3: Pit-Constrained Indicated and Inferred Mineral Resources - AurMac Project

Deposit | Gold Cut-Off (g/t) | Tonnage | Average Gold Grade (g/t) | Contained Gold (Moz) |

Indicated MRE | ||||

Airstrip | 0.30 | 27.7 | 0.69 | 0.611 |

Powerline | 0.30 | 84.8 | 0.61 | 1.663 |

Total Combined Indicated MRE | 0.30 | 112.5 | 0.63 | 2.274 |

Inferred MRE | ||||

Airstrip | 0.30 | 10.1 | 0.75 | 0.245 |

Powerline | 0.30 | 270.4 | 0.60 | 5.208 |

Total Combined Inferred MRE | 0.30 | 280.6 | 0.60 | 5.453 |

Notes to Table 1:

The effective date for the MRE is June 28, 2025 and was prepared by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc., an independent "Qualified Person" within the meaning of NI 43-101.

Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, changes in global gold markets or other relevant issues.

The CIM Definition Standards were followed for classification of Mineral Resources. The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated Mineral Resource.

Mineral Resources are reported at a cut-off grade of 0.30 g/t gold for all deposits, using a US$/CAN$ exchange rate of 0.73 and constrained within an open pit shell optimized with the Lerchs-Grossman algorithm to constrain the Mineral Resources with the following estimated parameters: gold price of US

$2,050 /ounce, US$2.50 /t mining cost, US$10.00 /t processing cost, US$2.00 /t G+A,90% gold recoveries, and 45° pit slopes.1The number of tonnes and ounces was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects.

1 The gold price and cost assumptions are consistent with current pricing assumptions and costs and, in particular, with those employed for recent technical reports for similar pit-constrained Yukon gold projects.

Banyan trades on the TSX-Venture Exchange under the symbol "BYN" and is quoted on the OTCQB Venture Market under the symbol "BYAGF". For more information, please visit the corporate website at or contact the Company.

ON BEHALF OF BANYAN GOLD CORPORATION

(signed) "Tara Christie"

Tara Christie

President & CEO

For more information, please contact:

Tara Christie • 778 928 0556 • tchristie@banyangold.com

Jasmine Sangria • 604 312 5610 • jsangria@banyangold.com

CAUTIONARY STATEMENT: Neither the TSX Venture Exchange, its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) nor OTCQB Venture Market accepts responsibility for the adequacy or accuracy of this release.

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

FORWARD LOOKING INFORMATION: This news release contains forward-looking information, which is not comprised of historical facts and is based upon the Company's current internal expectations, estimates, projections, assumptions and beliefs and the Company's plans and timing for the closing the

SOURCE: Banyan Gold Corp.

View the original press release on ACCESS Newswire