Banyan Gold Intersects 3.66 g/t over 17.6 m Continuing to Extend High-Grade Mineralization in Airstrip Deposit, AurMac Project, Yukon, Canada

Rhea-AI Summary

Banyan Gold (OTCQB:BYAGF) reported November 13, 2025 drill results from the AurMac Airstrip deposit with multiple near-surface intercepts, including 3.66 g/t Au over 17.6 m (AX-25-708) and a very high-grade core interval of 35.98 g/t Au over 1.6 m. Company exploration extends the high-grade core to ~500 m strike and ~300 m down dip. The release reiterates the June 28, 2025 pit-constrained MRE of 2.274 Moz indicated and 5.453 Moz inferred Au across AurMac. 230,000 incentive stock options were granted at $0.91 with up to 18-month vesting. QA/QC procedures and lab methods (Bureau Veritas) were disclosed; some assays remain pending.

Positive

- AX-25-708: 3.66 g/t Au over 17.6 m

- AX-25-708 high-grade: 35.98 g/t Au over 1.6 m

- High-grade core extended to ~500 m along strike

- High-grade core extended to ~300 m down dip

- AurMac Indicated MRE: 2.274 Moz Au

- AurMac Inferred MRE: 5.453 Moz Au

Negative

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability

- MRE relies on assumptions (gold price US$2,050/oz, 90% recovery) that could materially change the estimate

- Several reported intervals are low grade and require further drilling to convert to higher-confidence categories

- Some assays remain pending, leaving portions of the new interpretation unconfirmed

News Market Reaction

On the day this news was published, BYAGF declined 6.15%, reflecting a notable negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, BC / ACCESS Newswire / November 13, 2025 / Banyan Gold Corp . (the " Company " or " Banyan ") ( TSX-V:BYN )( OTCQB:BYAGF ) continues to intersect high-grade mineralization in Airstrip (" Airstrip ") and extend the high-grade domains at its AurMac Project (" AurMac ").

Drill-hole highlights include:

AX-25-708 - 3.66 g/t Au over 17.6 metres ("m"), including 6.80 g/t Au over 9.3m, with high-grade interval of 35.98 g/t Au over 1.6m

AX-25-640 - 1.25 g/t Au over 5.4m within 0.72 g/t Au over 13.0m

AX-25-703 - 2.04 g/t Au over 11.4m, including 3.60 g/t Au over 5.6m with a high-grade interval of 7.98 g/t Au over 1.2m

AX-25-711 - 1.25 g/t Au over 7.00m

AX-25-712 - 1.36 g/t Au over 15.3m including 1.87 g/t Au over 9.1m

AX-25-714 - 1.12 g/t Au over 18.4m including 2.12 g/t Au over 6.7m and 1.49 g/t Au over 4.6m

"These results continue to highlight the >1g/t Au near-surface mineralized domains in AurMac," said Tara Christie, Banyan President and CEO.

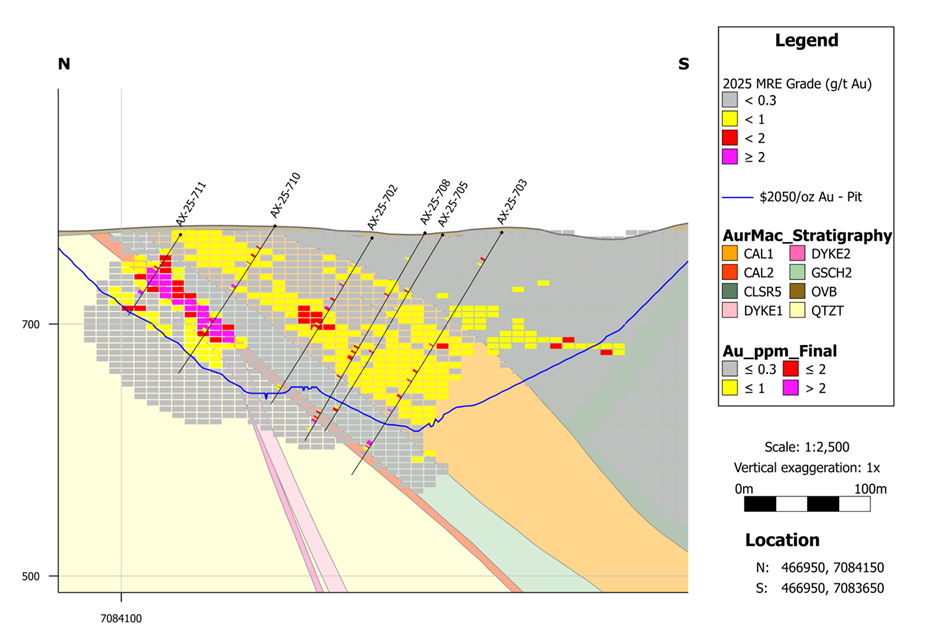

"We continue to see strong replacement (skarn) style mineralization at Airstrip in the lower calcareous metasedimentary unit that contacts the felsic dyke (Cal 2) that was intersected in hole AX-25-650 (see News Release dated June 25, 2025)," stated Duncan Mackay, Vice President of Exploration. "Extending very high-grade mineralization over 100m down dip with an interval of 35.98 g/t Au over 1.6m (calculated true thickness is approx. 1.5m) highlights the potential to continue to add ounces to the Airstrip deposit and improve areas of the existing Mineral Resource Estimate. The high-grade core of Airstrip associated with the felsic dyke contact now extends over 500m along strike and nearly 300m down dip."

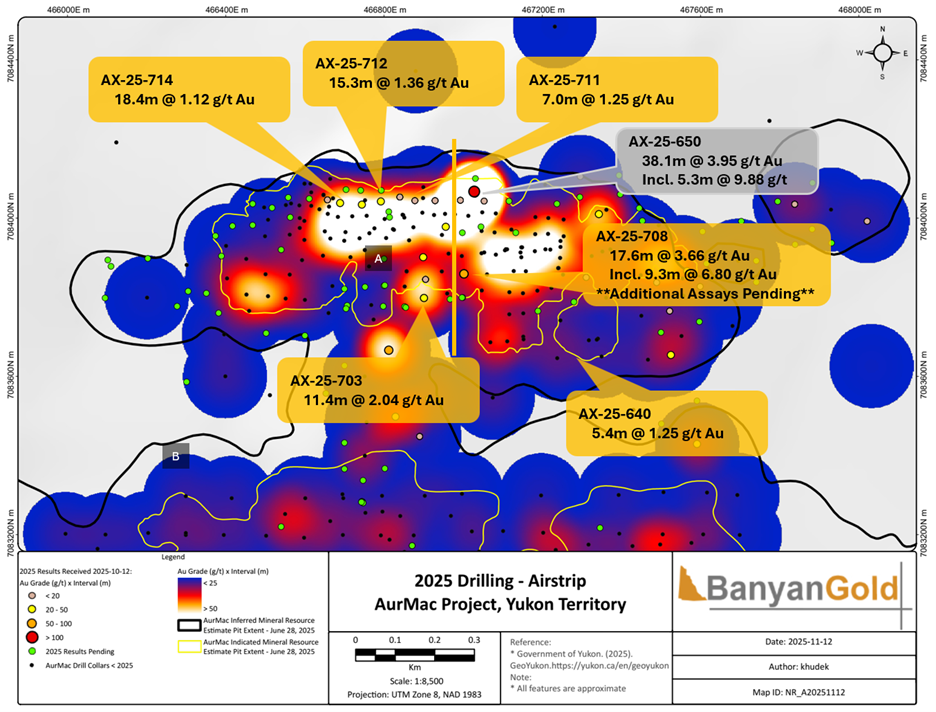

Figure 1: Plan map of the Airstrip Deposit. Drillholes with assays pending denoted by green dots.

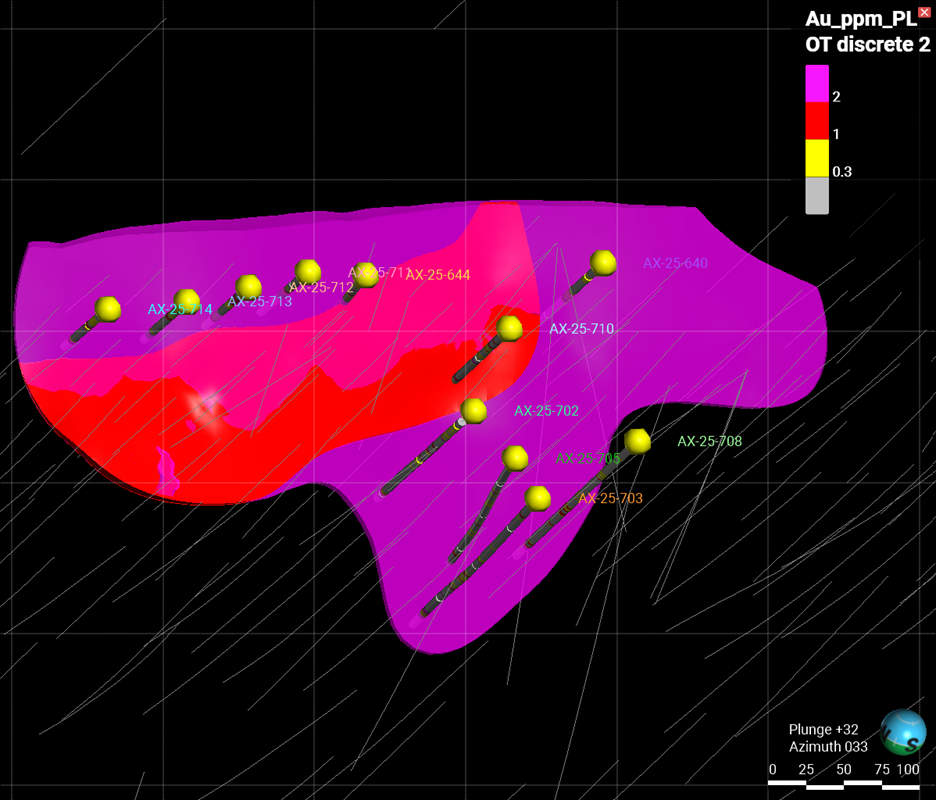

Figure 2: Oblique view of 3D mineralized domain (mineralized calcareous metasediment; Cal 2; see figure 3) in Airstrip. Magenta shape indicates expanded high-grade core of the airstrip deposit (see news release dated June 25, 2025; select drill holes in blue). Yellow dots indicate drillholes in this news release. The intersection in AX-25-708 extends very high-grade mineralization in Cal 2 down dip by over 100m, with potential to continue expanding the Cal2 Zone. Cross-section line for Figure 2 shown by gold line.

Figure 3: Cross-section looking east, showing drillhole AX-25-708, extending high-grade mineralization down dip from AX-25-650 and AX-24-590.

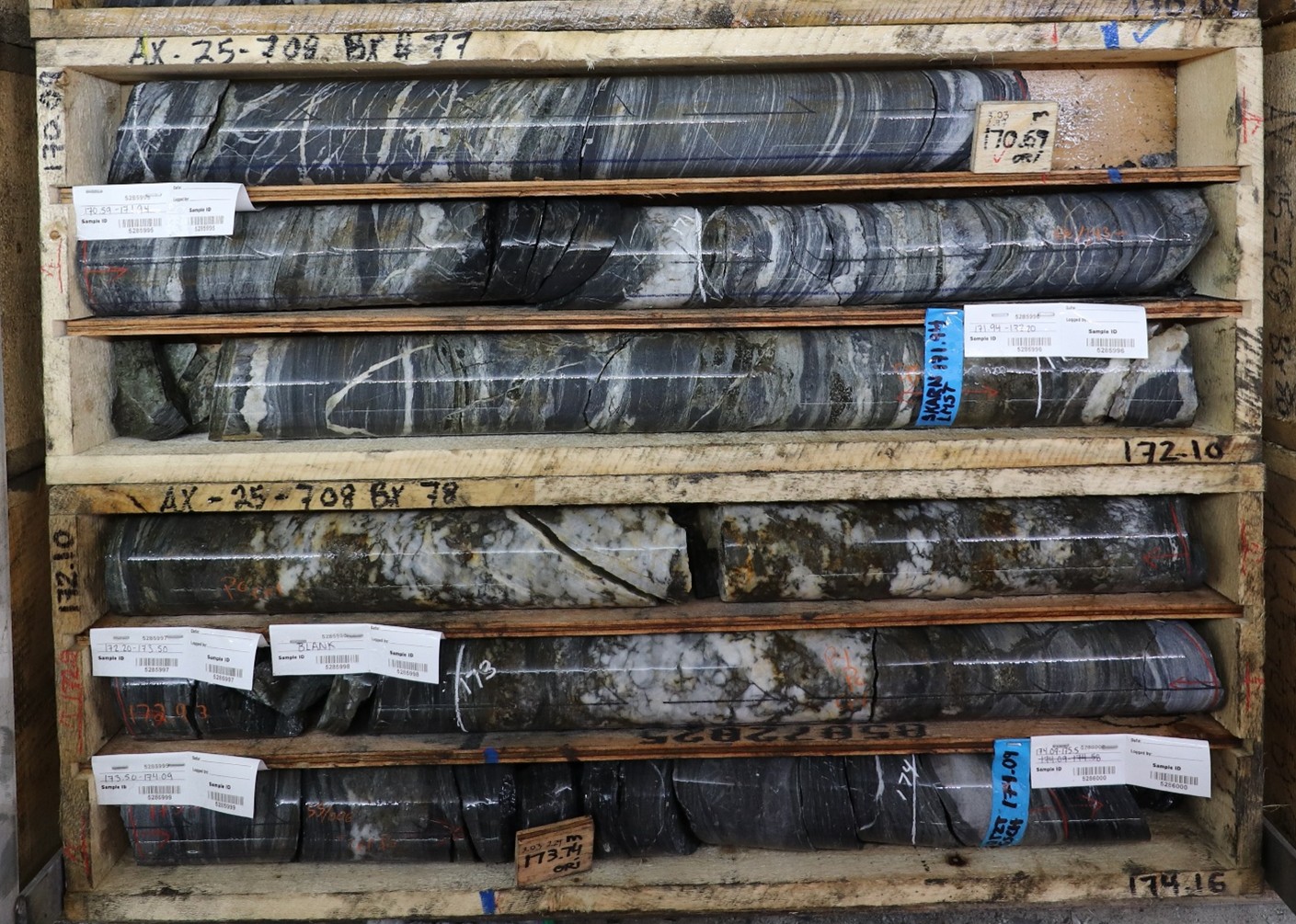

Figure 4: High-grade skarn mineralization in drill hole AX-25-708 associated with pyrrhotite and quartz replacement.

Table 1: Significant diamond drill hole assay intercepts for Powerline in this release

HOLE NUMBER | depth from | depth to | Au Interval (m) | Au Interval (g/t) |

AX-25-640 | 18.6 | 27.1 | 8.5 | 0.31 |

and | 46.0 | 59.0 | 13.0 | 0.72 |

including | 53.6 | 59.0 | 5.4 | 1.25 |

and | 92.5 | 104.7 | 12.2 | 0.29 |

AX-25-644 | 8.8 | 59.0 | 50.2 | 0.36 |

including | 20.7 | 29.3 | 8.6 | 0.37 |

and including | 42.4 | 49.7 | 7.3 | 0.91 |

and | 75.5 | 77.0 | 1.5 | 0.51 |

and | 142.9 | 143.8 | 0.9 | 0.34 |

AX-25-702 | 25.0 | 93.4 | 68.4 | 0.38 |

including | 43.5 | 45.0 | 1.5 | 3.72 |

and including | 57.0 | 78.5 | 21.5 | 0.47 |

including | 76.8 | 77.1 | 0.3 | 3.43 |

and | 137.9 | 141.4 | 3.5 | 0.51 |

including | 139.4 | 139.8 | 0.4 | 1.38 |

AX-25-703 | 25.2 | 31.5 | 6.3 | 0.59 |

including | 25.2 | 26.8 | 1.6 | 1.87 |

and | 80.8 | 82.3 | 1.5 | 0.39 |

and | 102.1 | 106.3 | 4.2 | 1.56 |

including | 105.1 | 106.3 | 1.2 | 4.28 |

and | 126.4 | 154.7 | 28.3 | 0.68 |

including | 129.3 | 131.1 | 1.8 | 1.47 |

and including | 138.3 | 139.7 | 1.4 | 5.31 |

and including | 152.5 | 154.7 | 2.2 | 1.56 |

and | 166.9 | 167.8 | 0.9 | 4.14 |

and | 196.2 | 207.6 | 11.4 | 2.04 |

including | 196.2 | 201.8 | 5.6 | 3.60 |

including | 197.5 | 201.8 | 4.3 | 3.99 |

including | 197.5 | 198.7 | 1.2 | 7.98 |

and including | 207.2 | 207.6 | 0.4 | 3.20 |

AX-25-705 | 51.6 | 78.2 | 26.6 | 0.30 |

including | 53.8 | 54.7 | 0.9 | 1.54 |

and | 105.9 | 112.0 | 6.1 | 0.47 |

including | 110.9 | 112.0 | 1.1 | 1.83 |

and | 122.0 | 130.8 | 8.8 | 0.34 |

and | 163.9 | 167.6 | 3.7 | 0.95 |

including | 165.4 | 167.6 | 2.2 | 1.30 |

AX-25-708** | 24.0 | 25.5 | 1.5 | 0.44 |

and | 49.5 | 58.3 | 8.8 | 1.49 |

including | 57.1 | 58.3 | 1.2 | 7.60 |

including | 57.9 | 58.3 | 0.4 | 18.90 |

and | 84.4 | 91.4 | 7.0 | Assay Pending |

and including | 104.9 | 133.5 | 28.6 | 0.62 |

including | 132.2 | 132.6 | 0.4 | 12.10 |

and | 163.9 | 181.5 | 17.6 | 3.66 |

including | 164.8 | 174.1 | 9.3 | 6.80 |

including | 171.9 | 173.5 | 1.6 | 35.98 |

AX-25-710 | 21.0 | 61.2 | 40.2 | 0.51 |

including | 21.0 | 36.2 | 15.2 | 0.41 |

and including | 57.0 | 59.0 | 2.0 | 4.52 |

including | 57.0 | 57.6 | 0.6 | 11.60 |

and | 89.6 | 107.9 | 18.3 | 0.51 |

including | 89.6 | 92.1 | 2.5 | 2.57 |

including | 91.2 | 92.1 | 0.9 | 3.85 |

AX-25-711 | 27.0 | 34.5 | 7.5 | 0.58 |

including | 31.5 | 33.0 | 1.5 | 1.50 |

and | 50.0 | 57.0 | 7.0 | 1.25 |

including | 54.0 | 57.0 | 3.0 | 2.39 |

AX-25-712 | 15.3 | 30.6 | 15.3 | 1.36 |

including | 15.3 | 24.4 | 9.1 | 1.87 |

including | 16.8 | 22.8 | 6.0 | 2.18 |

and | 47.6 | 53.4 | 5.8 | 0.55 |

including | 52.0 | 53.4 | 1.4 | 1.26 |

and | 65.5 | 67.0 | 1.5 | 0.42 |

AX-25-713 | 8.0 | 56.6 | 48.6 | 0.70 |

including | 9.2 | 11.3 | 2.1 | 8.81 |

and including | 24.9 | 27.3 | 2.4 | 1.62 |

and including | 55.3 | 56.6 | 1.3 | 2.71 |

AX-25-714 | 14.2 | 32.6 | 18.4 | 1.12 |

including | 25.9 | 32.6 | 6.7 | 2.12 |

including | 28.6 | 32.6 | 4.0 | 2.78 |

including | 32.2 | 32.6 | 0.4 | 6.18 |

and | 51.6 | 56.2 | 4.6 | 1.49 |

including | 54.2 | 56.2 | 2.0 | 2.78 |

including | 54.2 | 55.0 | 0.8 | 4.54 |

** - assay pending

Note: True widths are calculated to be approximately

Table 2: Collar Locations for drillholes in this release

HOLE ID | Easting (m) | Northing (m) | Elevation (m) | Depth (m) | Azimuth | Dip |

AX-25-640 | 467053 | 7084043 | 782 | 111 | 0 | -60 |

AX-25-644 | 466878 | 7084044 | 774 | 151 | 0 | -60 |

AX-25-702 | 466899 | 7083901 | 768 | 154 | 0 | -60 |

AX-25-703 | 466901 | 7083798 | 773 | 227 | 0 | -60 |

AX-25-705 | 466905 | 7083845 | 771 | 186 | 0 | -60 |

AX-25-708* | 467002 | 7083859 | 772 | 191 | 0 | -60 |

AX-25-710 | 466956 | 7083978 | 778 | 140 | 0 | -60 |

AX-25-711 | 466840 | 7084053 | 771 | 76 | 0 | -60 |

AX-25-712 | 466792 | 7084042 | 767 | 70 | 0 | -60 |

AX-25-713 | 466744 | 7084034 | 763 | 70 | 0 | -60 |

AX-25-714 | 466689 | 7084038 | 754 | 69 | 0 | -60 |

*Pending Assays

Grant of Incentive Stock Options

The Board of Directors of the Company have granted 230,000 stock options to purchase 230,000 shares at an exercise price of

The stock options are being issued to consultants, advisors and exploration staff of the Company. The options were granted under and are subject to the terms and conditions of the Company's stock option plan.

Analytical Method and Quality Assurance/Quality Control Measures

All diamond drill core was systematically logged and photographed by Banyan geology personnel. All core samples (HTW and NTW diameter) were split on-site at Banyan's core processing facilities. Once split, half samples were placed back in the core boxes with the other half of split samples sealed in poly bags with one part of a three-part sample tag inserted within. Samples were delivered by Banyan personnel or a dedicated expediter to the Bureau Veritas, Whitehorse preparatory laboratory where samples are prepared and then shipped to Bureau Veritas's Analytical laboratory in Vancouver, B.C. for pulverization and final chemical analysis.

Core splits reported in this news release were analysed by Bureau Veritas of Vancouver, B.C., utilizing the four-acid digestion ICP-ES 35-element MA-300 or ICP-ES/MS 59-element MA-250 analytical package with FA-450 50-gram Fire Assay with AAS finish for gold on all samples. Samples returning >10 g/t Au were reanalysed by fire assay with gravimetric finish on a 50g sample (FA-550). High-grade samples with documented visible gold are also analysed using metallic screen fire assay (FS-652). Bureau Veritas is an accredited lab following ISO/IEC 17025:2017 SCC File Number 15895. A robust system of standards, ¼ core duplicates and blanks has been implemented in the 2025 exploration drilling program and is monitored as chemical assay data becomes available.

Qualified Persons

Duncan Mackay, M.Sc., P.Geo., is a " Qualified Person" as defined under National Instrument 43-101, Standards of Disclosure for Mineral Projects (" NI 43-101 "), and has reviewed and approved the content of this news release in respect of all disclosure other than the MRE. Mr. Mackay is Vice President Exploration for Banyan and has verified the data disclosed in this news release, including the sampling, analytical and test data underlying the information.

Upcoming Event's

Deutsche Goldmesse Fall, Frankfurt - November 14 to 15, 2025

Yukon Geoscience Forum, Whitehorse - November 16 to 19, 2025

121 Mining Investment Dubai - November 26-27, 2025

About Banyan

Banyan's primary asset, the AurMac Project is located in the Traditional Territory of First Nation of Na-Cho Nyäk Dun, in Canada's Yukon Territory. The current Mineral Resource Estimate (" MRE ") for the AurMac Project has an effective date of June 28, 2025 and comprises an Indicated Mineral Resource of 2.274 million ounces of gold (" Au ") (112.5 M tonnes at 0.63 g/t) and an Inferred Mineral Resource of 5.453 Moz of Au (280.6 M tonnes at 0.60 g/t ) (as defined in the Canadian Institute of Mining, Metallurgy and Petroleum (" CIM ") Definition Standards for Mineral Resources & Mineral Reserves incorporated by reference into NI 43‑101). The 303 square kilometres (" sq km ") AurMac Project lies 40 kilometres from Mayo, Yukon. The AurMac Project is transected by the main Yukon highway and benefits from a 3-phase powerline, existing power station and cell phone coverage.

Table 3: Pit-Constrained Indicated and Inferred Mineral Resources - AurMac Project

Deposit | Gold Cut-Off (g/t) | Tonnage | Average Gold Grade (g/t) | Contained Gold (Moz) |

Indicated MRE | ||||

Airstrip | 0.30 | 27.7 | 0.69 | 0.611 |

Powerline | 0.30 | 84.8 | 0.61 | 1.663 |

Total Combined Indicated MRE | 0.30 | 112.5 | 0.63 | 2.274 |

Inferred MRE | ||||

Airstrip | 0.30 | 10.1 | 0.75 | 0.245 |

Powerline | 0.30 | 270.4 | 0.60 | 5.208 |

Total Combined Inferred MRE | 0.30 | 280.6 | 0.60 | 5.453 |

Notes to Table 3 :

The effective date for the MRE is June 28, 2025, and was prepared by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc., an independent " Qualified Person " within the meaning of NI 43-101.

Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, changes in global gold markets or other relevant issues.

The CIM Definition Standards were followed for classification of Mineral Resources. The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated Mineral Resource.

Mineral Resources are reported at a cut-off grade of 0.30 g/t gold for all deposits, using a US$/CAN$ exchange rate of 0.73 and constrained within an open pit shell optimized with the Lerchs-Grossman algorithm to constrain the Mineral Resources with the following estimated parameters: gold price of US

$2,050 /ounce, US$2.50 /t mining cost, US$10.00 /t processing cost, US$2.00 /t G+A,90% gold recoveries, and 45° pit slopes. [1]The number of tonnes and ounces was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects.

In addition to the AurMac Project, the Company holds the Hyland Gold Project, located 70km Northeast of Watson Lake, Yukon, along the Southeast end of the Tintina Gold Belt (the " Hyland Project") in the Traditional Territory of the Kaska Nations, closest to the Liard First Nation and Daylu Dena Council.The Hyland Project represents a sediment hosted, structurally controlled, intrusion related gold deposit, within a large land package (over 125 sq km), accessible by a network of existing gravel access roads. The updated MRE comprises an Indicated Mineral Resource of 337 thousand (" k ") ounces (" oz ") of gold (" Au ") and 2.63 million (" M ") oz of silver (" Ag ") (11.3 M tonnes of ore at 0.93 g/t Au and 7.27 g/t Ag), and an Inferred Mineral Resource of 118 koz of Au and 0.86 Moz Ag (3.9 M tonnes of ore at 0.95 g/t Au and 6.94 g/t Ag)(as defined in the Canadian Institute of Mining, Metallurgy and Petroleum (" CIM ") Definition Standards for Mineral Resources & Mineral Reserves incorporated by reference into NI 43‑101) effective September 1, 2025 and with technical report filed on Sedar on October 27, 2025.

Banyan also holds the Nitra Gold Project, a grassroots exploration project located in the Mayo Mining district, approximately 10km west of the AurMac Gold Project. The Nitra Project lies in the northern part of the Selwyn basin and is underlain by metaclastic rocks of the Late Proterozoic Yusezyu Formation of the Hyland Group, similar to lithologies hosting portions of the AurMac Project. Middle Cretaceous Tombstone Plutonic suite intrusions occur along the property including the Morrison Creek and Minto Creek stocks. The property is

Banyan trades on the TSX-Venture Exchange under the symbol " BYN " and is quoted on the OTCQB Venture Market under the symbol " BYAGF ". For more information, please visit the corporate website at or contact the Company.

ON BEHALF OF BANYAN GOLD CORPORATION

(signed) "Tara Christie"

Tara Christie

President & CEO

For more information, please contact:

Tara Christie • 778 928 0556 • tchristie@banyangold.com

Jasmine Sangria • 604 312 5610 • jsangria@banyangold.com

CAUTIONARY STATEMENT: Neither the TSX Venture Exchange, its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) nor OTCQB Venture Market accepts responsibility for the adequacy or accuracy of this release.

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

FORWARD LOOKING INFORMATION: This video release contains forward-looking information, which is not comprised of historical facts and is based upon the Company's current internal expectations, estimates, projections, assumptions and beliefs and the Company's plans and timing for the closing the

[1] The gold price and cost assumptions are consistent with current pricing assumptions and costs and, in particular, with those employed for recent technical reports for similar pit-constrained Yukon gold projects.

SOURCE: Banyan Gold Corp.

View the original press release on ACCESS Newswire