Corporación América Airports S.A. Reports January 2024 Passenger Traffic

Total passenger traffic up

International passenger traffic

LUXEMBOURG--(BUSINESS WIRE)--

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”), one of the leading private airport operators in the world, reported today a

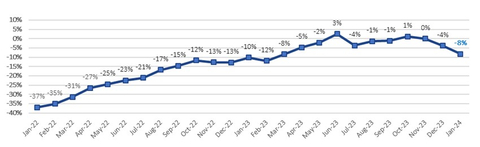

2-Year Passenger Traffic Monthly Performance (vs. 2019) (Graphic: Business Wire)

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2024 vs. 2023) |

|||

Statistics |

Jan'24 |

Jan'23 |

% Var. |

Domestic Passengers (thousands) |

3,610 |

3,639 |

- |

International Passengers (thousands) |

2,387 |

2,136 |

|

Transit Passengers (thousands) |

643 |

732 |

- |

Total Passengers (thousands) |

6,640 |

6,507 |

|

Cargo Volume (thousand tons) |

28.6 |

26.3 |

|

Total Aircraft Movements (thousands) |

69.8 |

69.1 |

|

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2024 vs. 2019) |

|||

Statistics |

Jan'24 |

Jan'19 |

% Var. |

Domestic Passengers (thousands) |

3,610 |

4,010 |

- |

International Passengers (thousands) |

2,387 |

2,380 |

|

Transit Passengers (thousands) |

643 |

850 |

- |

Total Passengers (thousands) |

6,640 |

7,240 |

- |

Cargo Volume (thousand tons) |

28.6 |

33.0 |

- |

Total Aircraft Movements (thousands) |

69.8 |

74.7 |

- |

(1) |

Note that preliminary passenger traffic figures for 2019, as well as January 2020 for Ezeiza Airport, in |

(2) |

Cargo volumes in |

Passenger Traffic Overview

Total passenger traffic grew

In

In

In

In

In

In

Cargo Volume and Aircraft Movements

Cargo volume increased

Aircraft movements increased

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2024 vs. 2023)

|

Jan'24 |

Jan'23 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

3,738 |

3,585 |

|

|

459 |

423 |

|

|

1,497 |

1,592 |

- |

|

232 |

183 |

|

|

345 |

361 |

- |

|

368 |

363 |

|

TOTAL |

6,640 |

6,507 |

|

(1) |

See Footnote 1 in previous table. (2) See Footnote 2 in previous table. |

Cargo Volume (tons) |

|

|

|

|

15,471 |

13,359 |

|

|

1,029 |

1,052 |

- |

|

4,653 |

4,958 |

- |

|

2,022 |

1,985 |

|

|

2,953 |

2,747 |

|

|

2,429 |

2,248 |

|

TOTAL |

28,557 |

26,348 |

|

Aircraft Movements |

|

|

|

|

39,352 |

37,642 |

|

|

4,359 |

4,113 |

|

|

12,665 |

13,602 |

- |

|

3,835 |

3,767 |

|

|

6,594 |

6,631 |

- |

|

2,961 |

3,380 |

- |

TOTAL |

69,766 |

69,135 |

|

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2024 vs. 2019)

|

Jan'24 |

Jan'19 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

3,738 |

3,853 |

- |

|

459 |

460 |

- |

|

1,497 |

1,866 |

- |

|

232 |

247 |

- |

|

345 |

353 |

- |

|

368 |

212 |

|

|

|

249 |

- |

TOTAL |

6,640 |

7,240 |

- |

(1) |

See Footnote 1 in previous table. (2) See Footnote 2 in previous table. |

Cargo Volume (tons) |

|

|

|

|

15,471 |

18,845 |

- |

|

1,029 |

1,027 |

|

|

4,653 |

6,042 |

- |

|

2,022 |

2,121 |

- |

|

2,953 |

3,733 |

- |

|

2,429 |

859 |

|

|

- |

370 |

- |

TOTAL |

28,557 |

32,996 |

- |

Aircraft Movements |

|

|

|

|

39,352 |

40,140 |

- |

|

4,359 |

4,644 |

- |

|

12,665 |

14,670 |

- |

|

3,835 |

3,941 |

- |

|

6,594 |

7,154 |

- |

|

2,961 |

1,948 |

|

|

- |

2,164 |

- |

TOTAL |

69,766 |

74,661 |

- |

About Corporación América Airports

Corporación América Airports acquires, develops and operates airport concessions. Currently, the Company operates 53 airports in 6 countries across

View source version on businesswire.com: https://www.businesswire.com/news/home/20240216193710/en/

Investor Relations Contact

Patricio Iñaki Esnaola

Email: patricio.esnaola@caairports.com

Phone: +5411 4899-6716

Source: Corporación América Airports