Corporación América Airports S.A. Reports March 2024 Passenger Traffic

Total passenger traffic up

International passenger traffic

LUXEMBOURG--(BUSINESS WIRE)--

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”), one of the leading private airport operators in the world, reported today a

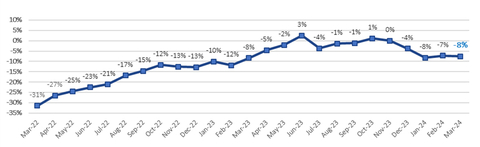

2-Year Passenger Traffic Monthly Performance (vs. 2019) (Graphic: Business Wire)

| Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2024 vs. 2023) | |||||||

Statistics |

Mar'24 |

Mar'23 |

% Var. |

|

YTD’24 |

YTD'23 |

% Var. |

Domestic Passengers (thousands) |

3,401 |

3,644 |

- |

|

10,230 |

10,525 |

- |

International Passengers (thousands) |

2,373 |

2,101 |

|

|

6,956 |

6,137 |

|

Transit Passengers (thousands) |

609 |

587 |

|

|

1,798 |

1,837 |

- |

Total Passengers (thousands) |

6,383 |

6,332 |

|

|

18,984 |

18,498 |

|

Cargo Volume (thousand tons) |

31.3 |

33.4 |

- |

|

87.9 |

85.2 |

|

Total Aircraft Movements (thousands) |

67.4 |

70.1 |

- |

|

200.1 |

199.8 |

|

| Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2024 vs. 2019) | |||||||

Statistics |

Mar'24 |

Mar'19 |

% Var. |

|

YTD’24 |

YTD'19 |

% Var. |

Domestic Passengers (thousands) |

3,401 |

3,945 |

- |

|

10,230 |

11,545 |

- |

International Passengers (thousands) |

2,373 |

2,267 |

|

|

6,956 |

6,754 |

|

Transit Passengers (thousands) |

609 |

694 |

- |

|

1,798 |

2,272 |

- |

Total Passengers (thousands) |

6,383 |

6,906 |

- |

|

18,984 |

20,571 |

- |

Cargo Volume (thousand tons) |

31.3 |

38.3 |

- |

|

87.9 |

105.1 |

- |

Total Aircraft Movements (thousands) |

67.4 |

71.5 |

- |

|

200.1 |

212.7 |

- |

Passenger Traffic Overview

Total passenger traffic grew

In

In

In

In

In

In

Cargo Volume and Aircraft Movements

Cargo volume decreased

Aircraft movements decreased

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2024 vs. 2023) |

|||||||

|

Mar'24 |

Mar'23 |

% Var. |

|

YTD'24 |

YTD'23 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

|

|

|

|

3,612 |

3,481 |

|

|

10,812 |

10,269 |

|

|

575 |

487 |

|

|

1,477 |

1,296 |

|

|

1,215 |

1,405 |

- |

|

3,905 |

4,250 |

- |

|

202 |

160 |

|

|

639 |

497 |

|

|

412 |

436 |

- |

|

1,110 |

1,142 |

- |

|

366 |

363 |

|

|

1,043 |

1,045 |

- |

TOTAL |

6,383 |

6,332 |

|

|

18,984 |

18,498 |

|

(1) |

Following the friendly termination process concluded in February 2024, CAAP no longer operates Natal airport. Statistics for Natal are available up to February 18, 2024. |

| Cargo Volume (tons) | |||||||

|

14,591 |

17,527 |

- |

|

44,234 |

43,621 |

|

|

1,078 |

1,254 |

- |

|

3,115 |

3,362 |

- |

|

5,755 |

6,250 |

- |

|

15,407 |

16,047 |

- |

|

2,596 |

2,920 |

- |

|

6,893 |

6,981 |

- |

|

3,629 |

2,734 |

|

|

9,294 |

7,915 |

|

|

3,654 |

2,734 |

|

|

8,999 |

7,239 |

|

TOTAL |

31,303 |

33,418 |

- |

|

87,943 |

85,165 |

|

Aircraft Movements |

|||||||

|

38,489 |

39,159 |

- |

|

114,015 |

110,355 |

|

|

5,290 |

4,675 |

|

|

13,695 |

12,520 |

|

|

11,548 |

13,397 |

- |

|

35,607 |

38,710 |

- |

|

2,907 |

2,702 |

|

|

9,720 |

9,181 |

|

|

6,407 |

6,922 |

- |

|

18,987 |

19,652 |

- |

|

2,763 |

3,271 |

- |

|

8,089 |

9,416 |

- |

TOTAL |

67,404 |

70,126 |

- |

|

200,113 |

199,834 |

|

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2024 vs. 2019) |

|||||||

|

Mar'24 |

Mar'19 |

% Var. |

|

YTD'24 |

YTD'19 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

|

|

|

|

3,612 |

3,741 |

- |

|

10,812 |

11,103 |

- |

|

575 |

531 |

|

|

1,477 |

1,420 |

|

|

1,215 |

1,582 |

- |

|

3,905 |

4,968 |

- |

|

202 |

185 |

|

|

639 |

643 |

- |

|

412 |

410 |

|

|

1,110 |

1,105 |

|

|

366 |

200 |

|

|

1,043 |

579 |

|

|

|

258 |

- |

|

- |

753 |

- |

TOTAL |

6,383 |

6,906 |

- |

|

18,984 |

20,571 |

- |

(1) |

Following the friendly termination process concluded in February 2024, CAAP no longer operates Natal airport. Statistics for Natal are available up to February 18, 2024. |

| Cargo Volume (tons) | |||||||

|

14,591 |

20,145 |

- |

|

44,234 |

56,057 |

- |

|

1,078 |

1,064 |

|

|

3,115 |

3,081 |

|

|

5,755 |

9,042 |

- |

|

15,407 |

23,524 |

- |

|

2,596 |

2,343 |

|

|

6,893 |

6,379 |

|

|

3,629 |

3,955 |

- |

|

9,294 |

11,313 |

- |

|

3,654 |

1,331 |

|

|

8,999 |

3,558 |

|

|

- |

404 |

- |

|

- |

1,191 |

- |

TOTAL |

31,303 |

38,282 |

- |

|

87,943 |

105,102 |

- |

Aircraft Movements |

|

|

|

|

|

|

|

|

38,489 |

39,347 |

- |

|

114,015 |

115,890 |

- |

|

5,290 |

5,206 |

|

|

13,695 |

14,152 |

- |

|

11,548 |

13,371 |

- |

|

35,607 |

40,751 |

- |

|

2,907 |

2,548 |

|

|

9,720 |

9,337 |

|

|

6,407 |

6,937 |

- |

|

18,987 |

20,636 |

- |

|

2,763 |

1,826 |

|

|

8,089 |

5,326 |

|

|

- |

2,308 |

- |

|

- |

6,646 |

- |

TOTAL |

67,404 |

71,543 |

- |

|

200,113 |

212,738 |

- |

About Corporación América Airports

Corporación América Airports acquires, develops and operates airport concessions. Currently, the Company operates 52 airports in 6 countries across

View source version on businesswire.com: https://www.businesswire.com/news/home/20240417878204/en/

Investor Relations Contact

Patricio Iñaki Esnaola

Email: patricio.esnaola@caairports.com

Phone: +5411 4899-6716

Source: Corporación América Airports