Cabral Gold Drills 23m @ 4.7 g/t gold at the PDM target, Cuiú Cuiú Gold District, Brazil

Cabral Gold (OTCQB: CBGZF) reported diamond drill hole DDH346 at the PDM target returned 22.3m @ 4.7 g/t Au from 57.2m, including 1m @ 91.3 g/t Au and 1.1m @ 8.1 g/t Au. The mineralized zone remains open down-dip and along strike and likely correlates with previous hole DDH22.

Recent work expanded the surface area of the gold-in-oxide blanket at PDM by 50% (0.26 to 0.39 km2). Cabral noted US$45 million in construction financing for Phase 1 heap-leach processing at Cuiú Cuiú; PDM oxide was not included in that PFS.

Cabral Gold (OTCQB: CBGZF) ha riferito che il pozzo di perforazione diamantata DDH346 sull'obiettivo PDM ha restituito 22,3 m @ 4,7 g/t Au a partire da 57,2 m, includendo 1 m @ 91,3 g/t Au e 1,1 m @ 8,1 g/t Au. La zona mineralizzata rimane aperta in orizzontale e lungo la dislocazione e probabilmente si correla con il precedente pozzo DDH22. Un lavoro recente ha ampliato l'area superficiale della copertura di ossidazione dell'oro a PDM del 50% (0,26 a 0,39 km2). Cabral ha indicato un finanziamento per la costruzione di US$45 milioni per la fase 1 del processo di lisciviazione a cumulo a Cuiú Cuiú; l'ossido di PDM non è stato incluso in quel PFS.

Cabral Gold (OTCQB: CBGZF) informó que la perforación con broca de diamante DDH346 en el objetivo PDM arrojó 22,3 m a 4,7 g/t Au desde 57,2 m, incluyendo 1 m a 91,3 g/t Au y 1,1 m a 8,1 g/t Au. La zona mineralizada permanece abierta hacia abajo en la bajada y a lo largo de la falla y probablemente se correlaciona con la perforación previa DDH22. Un trabajo reciente expandió el área superficial de la manta de oro en óxido en PDM em 50% (0,26 a 0,39 km2). Cabral indicó US$45 millones en financiamiento para la construcción de la fase 1 del procesamiento por lixiviación en montón en Cuiú Cuiú; el óxido de PDM no fue incluido en ese PFS.

Cabral Gold (OTCQB: CBGZF) 은 PDM 표적에서 DDH346 다이아몬드 드릴 구멍이 57.2m에서 22.3m @ 4.7 g/t Au를 반환했다고 보고했으며, 1m @ 91.3 g/t Au 및 1.1m @ 8.1 g/t Au를 포함합니다. 이 광상은 아래쪽으로 열려 있고 스트라이크 방향으로도 열려 있으며 이전 구멍 DDH22와 상관관계가 있을 가능성이 있습니다. 최근 작업으로 PDM의 산화 금층 표면적이 50% 확장되었습니다(0.26에서 0.39 km2까지). Cabral은 Cuiú Cuiú에서 제1단계 힙-리치 공정의 건설 자금으로 미화 4,500만 달러를 확보했다고 밝혔으며, PDM 산화물은 해당 PFS에 포함되지 않았습니다.

Cabral Gold (OTCQB : CBGZF) a annoncé que le forage diamant DDH346 sur la cible PDM a donné 22,3 m à 4,7 g/t d'Au à partir de 57,2 m, y compris 1 m à 91,3 g/t d'Au et 1,1 m à 8,1 g/t d'Au. La zone minéralisée reste ouverte en dip et le long de la faille et pourrait probablement se corréler avec le puits DDH22 précédent. Des travaux récents ont élargi la surface du manteau d'or oxydé à PDM de 50% (0,26 à 0,39 km2). Cabral a indiqué un financement de construction de 45 millions de dollars US pour la phase 1 du traitement par lixiviation en tas à Cuiú Cuiú; l'oxyde de PDM n'a pas été inclus dans cette étude de faisabilité préliminaire (PFS).

Cabral Gold (OTCQB: CBGZF) meldete, dass bei DDH346 am PDM-Ziel der Diamantbohrkern 22,3 m bei 4,7 g/t Au ab 57,2 m zurückkehrte, einschließlich 1 m bei 91,3 g/t Au und 1,1 m bei 8,1 g/t Au. Die mineralisierte Zone bleibt nach unten im Dip und längs der Streichung offen und korreliert wahrscheinlich mit dem vorherigen Loch DDH22. Jüngste Arbeiten haben die Oberfläche des Gold- bzw. Oxiddeckels am PDM um 50% erweitert (0,26 bis 0,39 km2). Cabral wies auf eine Finanzierung von US$45 Millionen für die Phase 1 des Heap-Leach-Verarbeitungsprozesses in Cuiú Cuiú hin; das PDM-Oxid wurde in diesem PFS nicht berücksichtigt.

Cabral Gold (OTCQB: CBGZF) أبلغت أن الحفر الماسي DDH346 في هدف PDM أعاد 22.3 م عند 4.7 ج/ط Au من 57.2 م، بما في ذلك 1 م عند 91.3 ج/ط Au و 1.1 م عند 8.1 ج/ط Au. تبقى المنطقة المعدنية مفتوحة للأسفل عند الانحدار وعلى طول الاتجاه، وربما ترتبط بالحفر DDH22 السابق. الأعمال الأخيرة وسّعت سطح بطانة الذهب المؤكسد في PDM بمقدار 50% (من 0.26 إلى 0.39 كلم2). أشارت Cabral إلى تمويل بنحو 45 مليون دولار أمريكي للمرحلة 1 من معالجة الترشيح بالتسرب في Cuiú Cuiú؛ لم يُدرج أكسيد PDM في ذلك PFS.

Cabral Gold (OTCQB: CBGZF) 报告称在 PDM 目标的 DDH346 岩心钻孔中,从 57.2m 出发返回 22.3m @ 4.7 g/t Au,其中包含 1m @ 91.3 g/t Au 和 1.1m @ 8.1 g/t Au。矿化带在下部倾角和走向方向仍然开放,可能与先前的 DDH22 钻孔相关。最近的工作将 PDM 的氧化层金表面积扩大了 50%(从 0.26 km2 增至 0.39 km2)。Cabral 指出在 Cuiú Cuiú 的第一阶段以堆浸法加工的建设融资为 美元 4500 万,但该 PFS 未将 PDM 的氧化物纳入其中。

- 22.3m @ 4.7 g/t Au reported in DDH346

- Includes a 1m @ 91.3 g/t Au high-grade intercept

- PDM oxide blanket area expanded +50% (0.26 km2 to 0.39 km2)

- Mineralized zones at PDM remain open along strike and at depth

- Company secured US$45M construction financing for Phase 1 heap-leach

- PDM oxide was not included in the Phase 1 PFS study

- Key drill results at Mutum and Machichie NE are still pending, creating short-term uncertainty

Vancouver, British Columbia--(Newsfile Corp. - October 22, 2025) - Cabral Gold Inc. (TSXV: CBR) (OTCQB: CBGZF) ("Cabral" or the "Company") is pleased to announce drill results from a recently completed diamond drill hole at the Pau de Merena ("PDM") target. PDM is located 2.5km NW of the Central gold deposit and within the Cuiú Cuiú district.

Highlights

- Diamond drill hole DDH346 intersected 23.3m @ 4.7 g/t gold from 57m depth in hard rock below the gold-in-oxide blanket, including 1m @ 91.3 g/t gold and 1m @ 8.1 g/t gold. The mineralized zone remains open at depth and along strike

- The mineralized zone is most likely the strike extension of the zone intersected in DDH22 which returned 8.5m @ 5.1 g/t gold including 0.7m @ 30.4 g/t gold, and is one of four zones thus far identified in intrusive rocks below the gold-in-oxide blanket at PDM

- Drill results are pending on the Mutum and Machichie NE targets, and diamond drilling is currently in progress at the Machichie Main and Jerimum Cima targets

Alan Carter, Cabral's President and CEO, commented, "The results from diamond drill hole DDH346 at the PDM target at Cuiú Cuiú highlight the presence of several very high-grade structures in the intrusive rocks below the gold-in-oxide blanket at PDM. These four discrete structures remain open along strike and down-dip. Whilst a significantly larger gold-in-oxide blanket occurs at PDM than previously envisaged, there is increasing evidence of down-dip and along strike continuity of the four known zones of primary mineralization within the intrusive rocks below the gold-in-oxide blanket. Additional drilling is planned to determine the size of the hard rock gold resource at PDM, which is located only 2.5km northwest of the Central gold deposit.

These drill results come soon after last weeks announcement of the US

PDM Drill Results

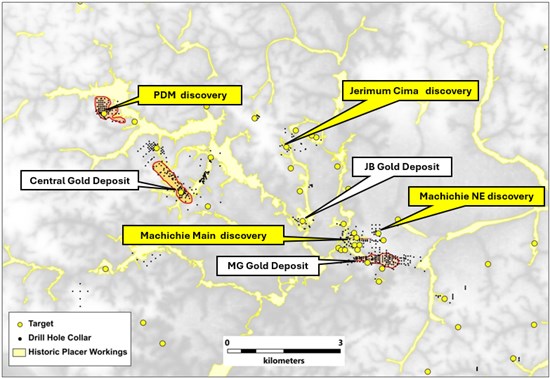

The PDM target is located 2.5km northwest of the Central gold deposit at Cuiú Cuiú (Figure 1) within a prominent northwest-trending +0.1 g/t gold-in-soil anomaly, which has been traced for more than 5km along strike, and remains open. The Central gold deposit, as well as the Central SE, Central North, PDM and Mutum targets all lie within this trend.

Figure 1 Map showing location of PDM discovery and primary gold deposits with 43-101 compliant Indicated and Inferred resources at Central, MG, and JB. The PDM, Machichie Main, Machichie NE and Jerimum Cima gold discoveries are also shown - all of these discoveries have along strike continuity. The main exploration targets (yellow dots) and distribution of historic placer gold workings (pale yellow outlines) are also shown.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3900/271428_ebfe470514c9cabb_002full.jpg

The objective of the current drill program at PDM is to add ounces to both the current gold-in-oxide resource base, and to calculate an initial resource for the mineralized zones in the underlying primary intrusive rocks.

Previous results from initial diamond-drill holes in granitic basement rocks below the gold-in-oxide blanket at PDM include; 22.4m @ 4.8 g/t, including: 1.35m @ 62.0 g/t gold, and 11.9m @ 3.3 g/t gold, including 0.5m @ 16.1 g/t gold, and 1.2m @ 16.0 g/t gold in DDH239; and 18.0m @ 2.5 g/t gold from 92.0m, including 3.0m @ 10.5 g/t gold, in DDH275. (see press releases dated December 15, 2021, January 12, 2022, and April 28, 2022). These higher-grade intercepts occur within brecciated structural zones and mostly remain open at depth as well as along strike.

Recent drilling at the PDM target has expanded the surface area of the gold-in-oxide mineralized blanket by

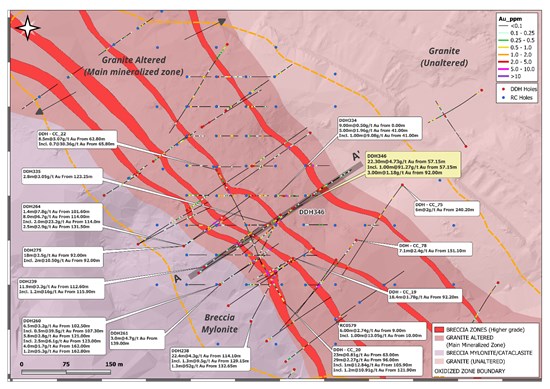

Results were recently received on diamond drill hole DDH346 at PDM which was drilled on section 9346907N at an angle of 60 degrees and an azimuth of 227 degrees. The hole was designed to test the down-dip continuation of the mineralized zone intersected in in DDH237 which returned 1.3m @ 1.9 g/t gold and 2m @ 2.4 g/t gold.

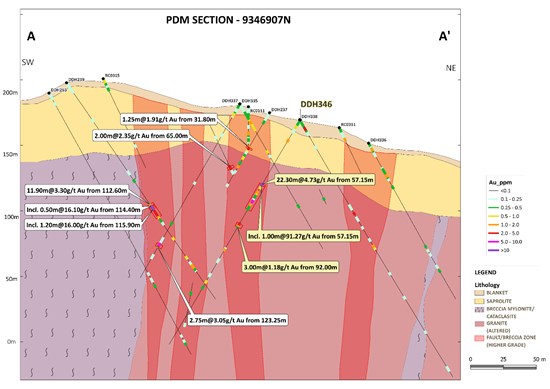

Drill hole DDH346 returned 8m @ 0.3 g/t gold within the colluvial blanket, as well as 22.3m @ 4.7 g/t gold from 57.2m depth including two higher grade intervals of 1m @ 91.3 g/t gold from 57.2m depth, and 1.1m @ 8.1 g/t gold from 72.0m depth in highly altered fractured granite intrusive (Figure 3). This mineralization occurs in hydrothermal breccia with intense quartz-sulfide veining. The hole also returned 3m @ 1.2 g/t gold from 92.0m depth and 1.6m @ 0.6 g/t gold from 114.0m depth (Figures 2 and 3, Table 1).

The mineralized zone intercepted in DDH246 is almost certainly the same zone intercepted 100m to the NW in hole DDH22 which returned 8.5m @ 5.1 g/t gold including 0.7m @ 30.4 g/t gold. It also suggests that grades are increasing with depth on section 9346907N at PDM. Finally, and perhaps most importantly, it suggests the presence of narrow zones of higher-grade mineralization that may be continuous within the underlying intrusive rocks at PDM. Continuous zones of higher-grade mineralization at Cuiú Cuiú are frequently surrounded by lower-grade envelopes and have also been identified at the MG and Central gold deposits as well as at the Machichie Main, Machichie NE and Jerimum Cima discoveries. The mineralized zone intersected in DDH346 remains open down dip and along strike to the SE and to the NW.

Figure 2: Map showing the PDM target with recent drill results from DDH346 which returned 22.3m @ 4.7g/t gold as well as selected previous results. Terms: g/t = grams / tonne, m = metres, Au = gold

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3900/271428_ebfe470514c9cabb_003full.jpg

Figure 3: Cross section showing section 9346907N at the PDM target showing recent drill results from DDH346 which returned 22.3m @ 4.7g/t gold, as well as selected previous results. Terms: g/t = grams / tonne, m = metres, Au = gold

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3900/271428_ebfe470514c9cabb_004full.jpg

| Drill Hole # | Weathering | From | To | Thickness | Grade | |

| (m) | (m) | (m) | g/t gold | |||

| DDH346 | Blanket | 0.0 | 8.0 | 8.0 | 0.3 | |

| Fresh Rock | 57.2 | 75.5 | 22.3 | 4.7 | ||

| Incl. | 57.2 | 58.2 | 1.0 | 91.3 | ||

| Incl. | 72.0 | 73.1 | 1.1 | 8.1 | ||

| 92.0 | 95.0 | 3.0 | 1.2 | |||

| 114.0 | 115.6 | 1.6 | 0.6 |

Table 1: Drill results from diamond drill hole DDH346 at the PDM target. DDH346 was drilled at a dip of 60 degrees towards 227 degrees. The hole was drilled as PQ core (85mm diameter) to a depth of 39m and thereafter reduced to HQ (63.5mm diameter) to the end of hole at 225.0m. True widths may be

Drill results are pending on the Mutum and Machichie NE targets, and diamond drilling is currently in progress at the Machichie Main and Jerimum Cima targets.

About Cabral Gold Inc.

The Company is a junior resource Company engaged in the identification, exploration, and development of mineral properties, with a primary focus on gold properties located in Brazil. The Company has a

The Tapajós Gold Province is the site of the largest gold rush in Brazil's history which according to the ANM (Agência Nacional de Mineração or National Mining Agency of Brazil) produced an estimated 30 to 50 million ounces of placer gold between 1978 and 1995. Cuiú Cuiú was the largest area of placer workings in the Tapajós and produced an estimated 2Moz of placer gold historically.

FOR FURTHER INFORMATION PLEASE CONTACT:

"Alan Carter"

President and Chief Executive Officer

Cabral Gold Inc.

Tel: 604.676.5660

Quality Assurance / Quality Control

Cabral maintains a Quality Assurance / Quality Control ("QAQC") program for all its exploration projects using industry best practices. Key elements of the QAQC program include verifiable chain of custody for samples, regular insertion of certified reference materials, blanks, and duplicates, as well as check assays on results. RC samples are split, collected in plastic sample bags, and sealed on drill hole location. Drill core is halved by saw cut or slicer (in soft saprolite). RC and core samples are shipped in sealed bags by independent contractor to SGS GEOSOL Laboratorios in Vespasiano, Brazil, an independent analytical services provider with global certifications for Quality Management Systems (ISO 9001:2015 and ISO 14001:2015 (ABS Certificates 32982 and 39911) and ISO/IEC 17025:2017 accreditation (CRL-0386)). Gold analyses are routinely performed via 50g fire assay with secondary assay techniques applied on higher grade samples. Final assay results are validated by Cabral Geological Staff prior to insertion into the database. Additional information regarding the Company's data verification processes is set out in the CBR, 43-101, PFS Technical Report, July 2025, which can be found on the Company's website.

Qualified Person and Technical Information

Technical information included in this release was supervised and approved by Brian Arkell, B.S. Geology and M.S. Economic Geology, SME (Registered Member), AusIMM (Fellow) and SEG (Fellow), Cabral Gold's Vice President, Exploration and Technical Services, and a Qualified Person under NI 43-101.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statements

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively "forward-looking statements"). The use of the words "will", "expected" and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such forward-looking statements should not be unduly relied upon. The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/271428