Centerra Gold Announces Updated Mineral Resources at Kemess; Advancing Studies on the Project

Rhea-AI Summary

Positive

- Significant existing infrastructure in place reduces execution risk and capital requirements

- Doubled exploration budget to $10-12M for 2025 shows commitment to project advancement

- Potential 250,000 gold equivalent ounces annual production over 15-year mine life

- Large resource base with 2.7M oz indicated gold and 971M lbs indicated copper resources

- Strategic location in top-tier mining jurisdiction with potential synergies with nearby projects

Negative

- Processing plant requires refurbishment and equipment replacements

- New crushing, conveying, and mine infrastructure needed for operations

- PEA still pending, indicating early stage of project development

- Some existing infrastructure requires refurbishment

News Market Reaction

On the day this news was published, CGAU gained 15.59%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

This news release contains forward-looking information about expected future events that is subject to risks and assumptions set out in the “Cautionary Statement on Forward-Looking Information” below. All figures are in United States dollars unless otherwise stated.

TORONTO, May 06, 2025 (GLOBE NEWSWIRE) -- Centerra Gold Inc. (“Centerra” or the “Company”) (TSX: CG) (NYSE: CGAU) announces an updated mineral resource at Kemess, which includes results from the 2024 drilling campaign, and outlines a plan to advance studies on the project. In 2024, Centerra completed over 11,400 meters of core drilling for exploration, geotechnical, and metallurgical testing purposes. Those results have been included in the updated mineral resource as of April 15, 2025. Gold mineral resources at Kemess are estimated to contain 2.7 million ounces of indicated resources and 2.2 million ounces of inferred resources. Copper mineral resources are estimated to contain 971 million pounds of indicated resources and 821 million pounds of inferred resources (see the tables below for tonnage and grades).

President and CEO, Paul Tomory, commented, “We are pleased to be moving forward with studies on the Kemess project. The updated mineral resource published today demonstrates robust mineralization in the highly prospective Toodoggone district in the northern interior of British Columbia. In addition, we have doubled our 2025 exploration guidance at Kemess to between

Paul Tomory concluded, “With the Kemess project, we are advancing the studies for a potential gold-copper mine with a possible 15-year operation in a top tier mining jurisdiction. We are targeting a project with a potential average annual production of approximately 250,000 gold equivalent ounces, which along with Mount Milligan, would give Centerra two long-life gold-copper assets in British Columbia. Recently, we supported Thesis Gold Inc. with a strategic equity investment. Given the proximity of Kemess to the Lawyers-Ranch Project, we see substantial opportunities for synergies, including the ability to leverage existing infrastructure to unlock regional potential.”

British Columbia’s Minister for Mining and Critical Minerals, The Honourable Jagrup Brar, commented, “Centerra’s latest results and expanded exploration at Kemess show what responsible development can achieve. Our government welcomes investments that help grow our economy, create well-paying jobs, and respect community and environmental values.”

Updated Kemess Gold and Copper Mineral Resources(1,2,3)

| Gold | Copper | |||||

Property | Tonnes (kt) | Grade (g/t) | Contained Gold (koz) | Tonnes (kt) | Grade (% Copper) | Contained Copper (Mlbs) |

| Indicated Mineral Resources | ||||||

| Kemess Open Pit | 142,570 | 0.32 | 1,467 | 142,570 | 0.16 | 503 |

| Kemess Underground | 25,347 | 0.91 | 745 | 25,347 | 0.39 | 217 |

| Kemess East | 25,074 | 0.66 | 531 | 25,074 | 0.45 | 251 |

| Total Indicated | 192,990 | 0.44 | 2,742 | 192,990 | 0.23 | 971 |

| Inferred Mineral Resources | ||||||

| Kemess Open Pit | 124,428 | 0.31 | 1,232 | 124,428 | 0.14 | 395 |

| Kemess Underground | 10,821 | 0.96 | 335 | 10,821 | 0.40 | 95 |

| Kemess East | 34,010 | 0.60 | 661 | 34,010 | 0.44 | 331 |

| Total Inferred | 169,260 | 0.41 | 2,228 | 169,260 | 0.22 | 821 |

NOTE: Numbers may not add due to rounding. (1) As of April 15, 2025. Refer to Tables “Centerra Gold Updated Kemess Resources Summary”, including the respective footnotes and the “Additional Footnotes” section below. (2) Mineral resources do not have demonstrated economic viability. (3) The updated resource is generally consistent with the Company’s previous understanding of the resource estimate.

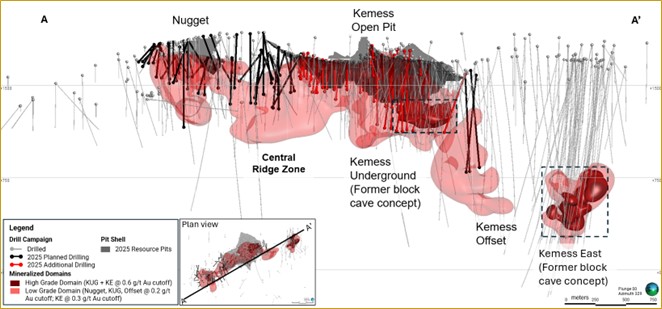

- Kemess Concept: The Kemess updated mineral resources are based on a potential concept for the project which includes an open pit and underground operation using longhole open stoping and backfill.

- Kemess Open Pit: The Kemess Open Pit incorporates mineralized material previously considered part of a block cave concept for Kemess Underground, which has increased the size and quality of the resources considered for open pit mining. The Kemess Open Pit is assumed to be a traditional truck and shovel operation.

- Kemess Underground and Kemess East: The tonnages and mineral inventory in Kemess Underground have decreased due to Kemess Open Pit mining out a portion of the previous block cave, as well as the change of mining method to longhole open stoping. The tonnages in Kemess East also decreased, however the mineral inventory only declined slightly due to the higher grades and lower dilution of longhole open stoping compared with the previous block cave mining method. The grades of Kemess Underground and Kemess East have increased due to a change in the mining method, from block cave to longhole open stoping. The mining method considers paste backfill of the stopes for stability.

- Kemess Drilling Programs: In 2024, Centerra completed over 11,400 meters of core drilling for exploration, geotechnical, and metallurgical testing purposes. The drill program targeted the area between the known mineralization at Nugget and the upper portion of the Kemess Underground zones. Geological modeling and the updated resource estimate show continuous mineralization along the five-kilometre trend from Nugget to Kemess East. Those results have been included in the updated mineral resource as of April 15, 2025. Centerra has increased its 2025 exploration guidance at Kemess to between

$10 and$12 million , up from$4 t o$6 million previously, with a total of 28,500 meters of drilling planned. The focus is expected to be on infill drilling for Kemess Open Pit and Kemess Underground resources and to test high grade mineralization in the deeper Kemess Offset zone, which is currently not included in the stated mineral resource.

Kemess Study Plan

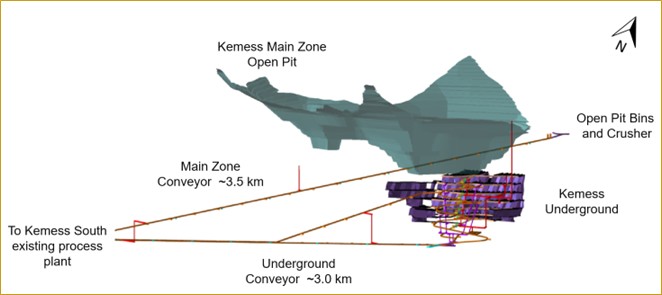

Centerra has initiated a Preliminary Economic Assessment (“PEA”) on the Kemess project, which is expected to be completed by the end of 2025. The PEA will be based on a combined open pit and conventional underground mine concept, using a longhole open stoping underground mining method, rather than the previous block cave concept. This is expected to have improved economics as it is less capital intensive and reduces overall dilution of the higher underground grades.

The PEA is expected to focus on a subset of the mineral resources at Kemess Open Pit and Kemess Underground. Kemess East is expected to be evaluated as future upside potential.

Kemess has significant infrastructure already in place, including: a 380 kilometer, 230 kilovolt power line; a 50,000 tonnes per day nameplate processing plant in need of some refurbishment and equipment replacements; “mothballed” site infrastructure including a water treatment plant, camp, administration facilities, air strip, truck shop and warehouse which will require some refurbishment; and tailings storage using the previously mined pit as well as an existing tailings facility, which is capable of expansion. To complement this existing infrastructure, it is anticipated that new crushing, conveying, and mine infrastructure will be required for the open pit and underground operations. The existing infrastructure is expected to lower the execution risk for the project when compared to typical greenfield projects of this scale.

With the Kemess project, Centerra is advancing the studies for a potential gold-copper mine with a possible 15-year operation in a top tier mining jurisdiction. The Company is targeting a project with a potential average annual production of approximately 250,000 gold equivalent ounces, which along with Mount Milligan, would give Centerra two long-life gold-copper assets in British Columbia.

Kemess Study Technical Concept

Figure 1: A long sectional view of the Kemess deposit. Centerra has increased 2025 exploration guidance at Kemess to between

Figure 2: An isometric view of the open pit and conventional underground mine concept, using a longhole open stoping underground mining method.

Kemess Existing Infrastructure

Figure 3: Aerial photo of the existing infrastructure at Kemess, including a processing plant, truck shop and warehouse.

Figure 4: 50,000 tonnes per day nameplate processing plant in need of some refurbishment and equipment replacements.

Figure 5: Kemess camp.

Figure 6: Kemess tailings storage using the previously mined pit as well as an existing tailings facility, which is capable of expansion.

Figure 7: Kemess water treatment plant.

| Centerra Gold Updated Kemess Resource Summary(1,4,5) as of April 15, 2025 (see additional footnotes below) | |||||||

| Indicated Mineral Resources(2) | |||||||

| Tonnes (kt) | Gold Grade (g/t) | Contained Gold (koz) | Copper Grade (%) | Contained Copper (Mlbs) | Silver Grade (g/t) | Contained Silver (koz) | |

| Kemess Open Pit | 142,570 | 0.32 | 1,467 | 0.16 | 503 | 1.16 | 5,308 |

| Kemess Underground | 25,347 | 0.91 | 745 | 0.39 | 217 | 2.60 | 2,122 |

| Kemess East | 25,074 | 0.66 | 531 | 0.45 | 251 | 1.94 | 1,564 |

| Total Kemess Indicated | 192,990 | 0.44 | 2,742 | 0.23 | 971 | 1.45 | 8,994 |

| Inferred Mineral Resources(3) | |||||||

| Tonnes (kt) | Gold Grade (g/t) | Contained Gold (koz) | Copper Grade (%) | Contained Copper (Mlbs) | Silver Grade (g/t) | Contained Silver (koz) | |

| Kemess Open Pit | 124,428 | 0.31 | 1,232 | 0.14 | 395 | 1.06 | 4,228 |

| Kemess Underground | 10,821 | 0.96 | 335 | 0.40 | 95 | 2.45 | 851 |

| Kemess East | 34,010 | 0.60 | 661 | 0.44 | 331 | 1.97 | 2,156 |

| Total Kemess Inferred | 169,260 | 0.41 | 2,228 | 0.22 | 821 | 1.33 | 7,235 |

(1) Mineral resources are stated in accordance with CIM (2014) Definitions as incorporated by reference into NI 43-101. Mineral Resources are estimated and have an effective date of April 15, 2025.

(2) Mineral resources do not have demonstrated economic viability.

(3) Inferred mineral resources have a lower level of confidence as to their existence and as to whether they can be mined economically. It cannot be assumed that all or part of the inferred mineral resources will ever be upgraded to a higher category.

(4) Centerra’s equity interests as of this news release are as follows: Kemess Open Pit, Kemess Underground and Kemess East

(5) Numbers may not add due to rounding.

Additional Footnotes

General

- A conversion factor of 31.1035 grams per troy ounce of gold is used in the mineral resource estimates.

- The mineral resources are reported based on a gold price of

$2,000 per ounce, copper price of$4.00 per pound and an exchange rate of 1USD:1.33CAD. - Samples were prepared and analyzed by independent, ISO-accredited laboratories. Quality control programs include the insertion of blanks, certified reference materials, duplicate samples, internal and external reviews and checks by umpire laboratories.

- Development of geological and mineralized domains, geostatistical analysis, block model construction and grade estimates were done using industry standard methods and commercially available software packages. Grade estimates used ordinary kriging with capped and composited assay grades.

Kemess Open Pit

- The mineral resources are reported within a constraining pit shell and a NSR cut-off value of C

$14.60 per tonne that takes into consideration metallurgical recoveries, concentrate grades, transportation costs, and smelter treatment charges.

Kemess Underground

- Underground resources are reported with an NSR cut-off value of C

$54.10 per tonne that takes into consideration metallurgical recoveries, concentrate grades, transportation costs, and smelter treatment charges. - The mineral resources are reported within a constraining volume of software-generated stope shapes including “must take”, subeconomic material. An orphan analysis was performed to remove isolated and discontinuous blocks from the resource.

- Dilution factors applied to all stope shapes were 1.25 meters for in-situ side walls, 0.25 meters for filled floor/back and 1.0 meters for walls against fill. A mining recovery factor of

93% was assumed for all volumes.

Kemess East

- The mineral resources are reported within a constraining volume of software-generated stope shapes. An orphan analysis was performed to remove isolated and discontinuous blocks from the resource.

- Dilution factors applied to all stope shapes were 1.25 meters for in-situ side walls, 0.25 meters for filled floor/back and 1.0 meters for walls against fill. A mining recovery factor of

93% was assumed for all volumes. - Underground resources are reported with an NSR cut-off value of C

$54.10 per tonne that takes into consideration metallurgical recoveries, concentrate grades, transportation costs, and smelter treatment charges.

Mineral reserve and mineral resource estimates are forward-looking information and are based on key assumptions and are subject to material risk factors. If any event arising from these risks occurs, the Company’s business, prospects, financial condition, results of operations or cash flows, and the market price of Centerra’s shares could be adversely affected. Additional risks and uncertainties not currently known to the Company, or that are currently deemed immaterial, may also materially and adversely affect the Company’s business operations, prospects, financial condition, results of operations or cash flows, and the market price of Centerra’s shares. See the section entitled “Risk That Can Affect Centerra’s Business” in the Company’s Management’s Discussion and Analysis (MD&A) for the three months ended March 31, 2025, available on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar and see also the discussion below under the heading “Cautionary Statement on Forward-Looking Information”.

About Centerra Gold

Centerra Gold Inc. is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold and copper properties in North America, Türkiye, and other markets worldwide. Centerra operates two mines: the Mount Milligan Mine in British Columbia, Canada, and the Öksüt Mine in Türkiye. The Company also owns the Kemess Project in British Columbia, Canada, the Goldfield Project in Nevada, United States, and owns and operates the Molybdenum Business Unit in the United States and Canada. Centerra’s shares trade on the Toronto Stock Exchange (“TSX”) under the symbol CG and on the New York Stock Exchange (“NYSE”) under the symbol CGAU. The Company is based in Toronto, Ontario, Canada.

For more information:

Lisa Wilkinson

Vice President, Investor Relations & Corporate Communications

(416) 204-3780

Lisa.Wilkinson@centerragold.com

Additional information on Centerra is available on the Company’s website at www.centerragold.com, on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar.

Cautionary Statement on Forward-Looking Information

All statements, other than statements of historical fact contained or incorporated by reference in this news release, which address events, results, outcomes or developments that the Company expects to occur are, or may be deemed to be, forward looking information or forward-looking statements within the meaning of certain securities laws, including the provisions of the Securities Act (Ontario) and the provisions for “safe harbor” under the United States Private Securities Litigation Reform Act of 1995 and are based on expectations, estimates and projections as of the date of this news release. Such forward-looking information involves risks, uncertainties and other factors that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking statements are generally, but not always, identified by the use of forward-looking terminology such as “assume”, “believes”, “continue”, “encouraged”, “estimate”, “expect”, “future”, “ongoing”, “plan”, “potential”, “target” or “update”, or variations of such words and phrases and similar expressions or statements that certain actions, events or results “may”, “could”, “would” or “will” be taken, occur or be achieved or the negative connotation of such terms. Such statements include but may not be limited to: the estimation of mineral resources, including inferred mineral resources, at Kemess and the potential of eventual economic extraction of minerals from the project; the identification of future mineral resources at the project; the Company’s ability to convert existing mineral resources into categories of mineral resources or mineral reserves of increased geological confidence; life of mine estimates; future exploration potential; timing and scope of future exploration (brownfields or greenfields); the future success of Kemess including the timing and content of a preliminary economic assessment and accompanying update on its technical concept including mining methods including the possibility of constructing either or both of an open pit and underground mines; the potential for expanding the mineral resources and the potential for identifying additional mineralization in areas of intercepts and conceptual areas for extension and expansion; any potential synergies between the Kemess project and the Lawyers-Ranch project.

The Company cautions that forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by the Company at the time of making such statements, are inherently subject to significant business, economic, technical, legal, political and competitive uncertainties and contingencies, which may prove to be incorrect, include but are not limited to: there being no significant disruptions affecting the activities of the Company whether due to extreme weather events and other or related natural disasters, labour disruptions, supply disruptions, power disruptions, damage to equipment or otherwise; permitting and development of the project being consistent with the Company’s expectations; political and legal developments in British Columbia and Canada being consistent with its current expectations; the accuracy of the current mineral resource estimates of the Company; certain price assumptions for gold and copper and foreign exchange rates; the Company’s future relationship with Indigenous groups being consistent with the Company’s expectations; and inflation and prices for diesel, natural gas, fuel oil, electricity and other key supplies being approximately consistent with anticipated levels. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information.

Market price fluctuations in gold, copper, and other metals, as well as increased capital or production costs or reduced recovery rates may render ore reserves containing lower grades of mineralization uneconomic and may ultimately result in a restatement of mineral reserves. The extent to which mineral resources may ultimately be reclassified as proven or probable mineral reserves is dependent upon the demonstration of their profitable recovery. Economic and technological factors, which may change over time, always influence the evaluation of mineral reserves or mineral resources. Centerra has not adjusted mineral resource figures in consideration of these risks and, therefore, Centerra can give no assurances that any mineral resource estimate will ultimately be reclassified as proven and probable mineral reserves.

Mineral resources are not mineral reserves, and do not have demonstrated economic viability, but do have reasonable prospects for economic extraction. Measured and indicated mineral resources are sufficiently well defined to allow geological and grade continuity to be reasonably assumed and permit the application of technical and economic parameters in assessing the economic viability of the resource. Inferred mineral resources are estimated on limited information not sufficient to verify geological and grade continuity or to allow technical and economic parameters to be applied. Inferred mineral resources are too speculative geologically to have economic considerations applied to them to enable them to be categorized as mineral reserves. There is no certainty that mineral resources of any category can be upgraded to mineral reserves through continued exploration.

Centerra’s mineral reserve and mineral resource figures are estimates, and Centerra can provide no assurances that the indicated levels of gold or copper will be produced, or that Centerra will receive the metal prices assumed in determining its mineral reserves. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results, and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. While Centerra believes that these mineral reserve and mineral resource estimates are well established, and the best estimates of Centerra’s management, by their nature mineral reserve and mineral resource estimates are imprecise and depend, to a certain extent, upon analysis of drilling results and statistical inferences, which may ultimately prove unreliable. If Centerra’s mineral reserve or mineral reserve estimates for its properties are inaccurate or are reduced in the future, this could have an adverse impact on Centerra’s future cash flows, earnings, results, or operations and financial condition.

There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are provided for the purpose of providing information about management’s expectations and plans relating to the future. All of the forward-looking statements made in this news release are qualified by these cautionary statements and those made in our other filings with the securities regulators of Canada and the United States including, but not limited to, those set out in the Company’s latest 40-F/Annual Information Form and Management’s Discussion and Analysis, each under the heading “Risk Factors”, which are available on SEDAR+ (www.sedarplus.ca) or on EDGAR (www.sec.gov/edgar). The foregoing should be reviewed in conjunction with the information, risk factors and assumptions found in this news release.

The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether written or oral, or whether as a result of new information, future events or otherwise, except as required by applicable law.

Other Information

Christopher Richings, Professional Engineer, member of the Engineers and Geoscientists British Columbia and Centerra’s Vice President, Technical Services, has reviewed and approved the scientific and technical information contained in this news release. Mr. Richings is a “qualified person” within the meaning of the Canadian Securities Administrator’s NI 43-101 Standards of Disclosure for Mineral Projects.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/302eae3b-ab27-4b3d-a64d-261788386e76

https://www.globenewswire.com/NewsRoom/AttachmentNg/7fa388d6-8933-414a-85c8-49b16d1b570b

https://www.globenewswire.com/NewsRoom/AttachmentNg/a4fa394e-37c8-4670-b90f-db87f29e799a

https://www.globenewswire.com/NewsRoom/AttachmentNg/0598cc66-19cf-457c-8641-2e7ee5472d77

https://www.globenewswire.com/NewsRoom/AttachmentNg/efcf9e41-c789-466a-b1fc-0be7084e0039

https://www.globenewswire.com/NewsRoom/AttachmentNg/4a646fe2-a146-44d9-854b-750d9eff5755

https://www.globenewswire.com/NewsRoom/AttachmentNg/7c1076f7-c838-47ac-b477-91d1b3fcfee1