Centerra Gold’s Mount Milligan PFS Outlines Mine Life to 2045, Delivering Growth with a Fully Funded, Disciplined $186 Million Growth Capital Plan

Rhea-AI Summary

Centerra Gold (NYSE:CGAU) has announced positive results from a Pre-Feasibility Study (PFS) for its Mount Milligan mine, extending the mine life by approximately 10 years to 2045. The extension plan includes a $186 million capital investment program, featuring increased process plant capacity and a second tailings storage facility.

The PFS outlines average annual production from 2026 to 2042 of 150,000 ounces of gold and 69 million pounds of copper. The study confirms a significant increase in mineral reserves, with 4.4 million ounces of gold and 1.7 billion pounds of copper, representing increases of 56% and 52% respectively from 2024 levels.

The project demonstrates robust economics with an after-tax NPV (5%) of $1.5 billion at base case prices, increasing to $2.1 billion at spot prices. The plan includes a 10% increase in process plant throughput to 66,300 tonnes per day by 2029.

Positive

- 56% increase in gold reserves to 4.4 million ounces and 52% increase in copper reserves to 1.7 billion pounds

- Robust after-tax NPV of $1.5 billion, potentially reaching $2.1 billion at spot prices

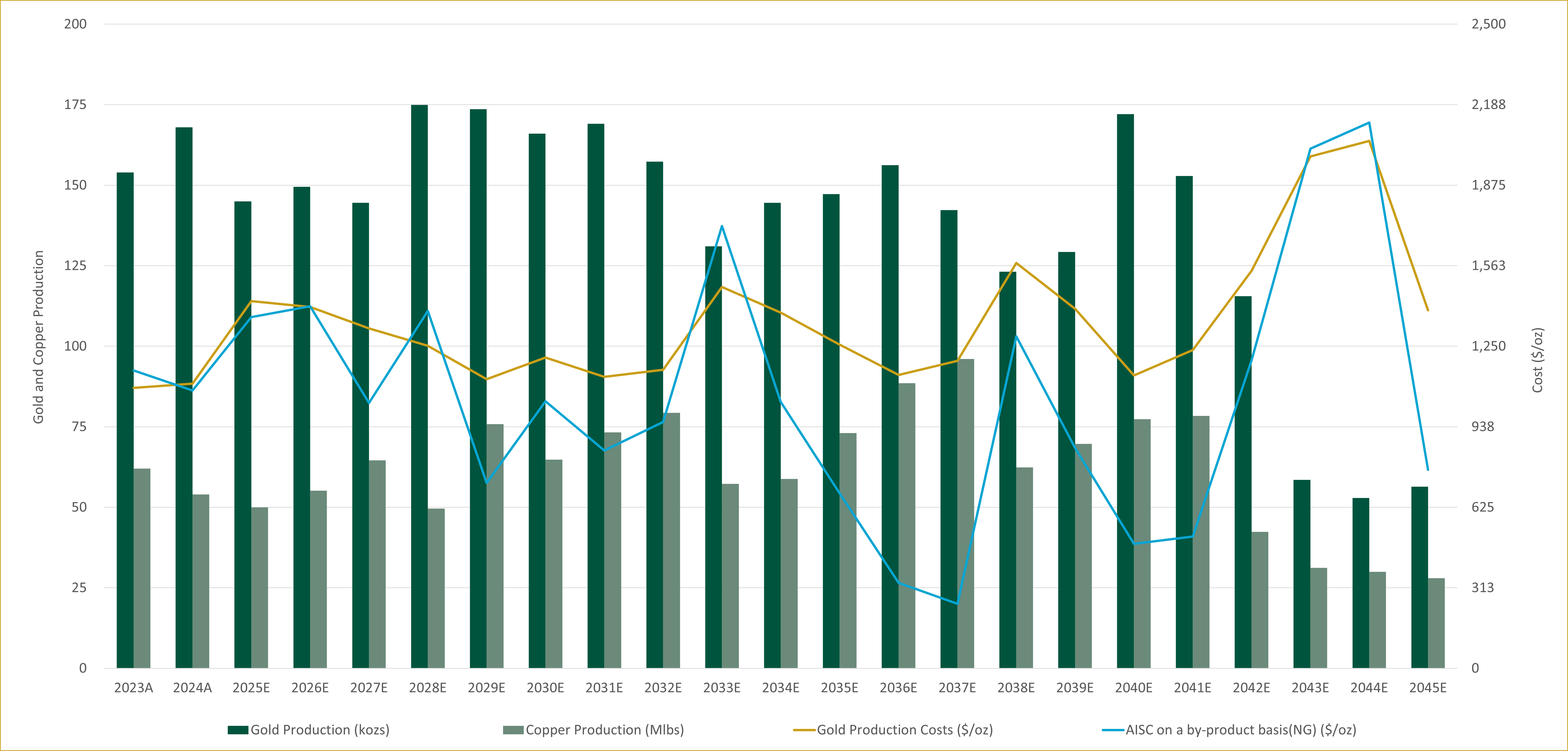

- Low all-in sustaining costs of $950 per ounce on a by-product basis

- 10% increase in process plant throughput capacity by 2029

- Mineralization remains open to the west with exploration upside potential

- Fully funded capital plan with most expenditures not required until 2030s

Negative

- Significant capital expenditure of $186 million required for expansion

- Declining production profile in final years (2043-2045) with processing of low-grade stockpiles

- New tailings storage facility requires $114 million investment and regulatory approvals

News Market Reaction – CGAU

On the day this news was published, CGAU gained 0.87%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

This news release contains forward-looking information about expected future events that is subject to risks and assumptions set out in the “Cautionary Statement on Forward-Looking Information” below. All figures are in United States dollars unless otherwise stated. All production figures reflect payable metal quantities and are on a

TORONTO, Sept. 11, 2025 (GLOBE NEWSWIRE) -- Centerra Gold Inc. (“Centerra” or the “Company”) (TSX: CG) (NYSE: CGAU) is pleased to announce the results of a Pre-Feasibility Study (“PFS”) for its Mount Milligan mine (“Mount Milligan”) in British Columbia, confirming a life of mine (“LOM”) extension of approximately 10 years, to 2045. The extension is driven by disciplined future investments, including increasing process plant capacity in 2029 and constructing a second tailings storage facility (“TSF”) in the first half of the 2030s. These initiatives reinforce Mount Milligan as a long-term, low-cost contributor to Centerra’s production profile and cash flow generation in a top tier mining jurisdiction.

President and CEO, Paul Tomory, commented, “Mount Milligan’s LOM extension marks a key milestone in advancing Centerra’s organic gold growth strategy. Recent step-out and infill drilling programs have confirmed the continuation of mineralization to the west of the current open pit. Incorporating this drilled inventory, the PFS outlines a 10-year LOM extension, to 2045, supported by phased, manageable non-sustaining capital expendituresNG totaling

Mount Milligan PFS Highlights

- LOM Extension and Optimized Mine Plan: The PFS indicates the extension of the LOM by approximately 10 years, to 2045, supported by an optimized mine plan. The average annual production from 2026 to 2042, is expected to be approximately 150,000 ounces of gold and 69 million pounds of copper, followed by the processing of low-grade stockpiles from 2043 to 2045.

- Disciplined, Fully Funded, Low Capital Investment: Approximately

$186 million in non-sustaining capital expendituresNG are planned, most of which are not required until the early-to-mid-2030s, all fully funded from available liquidity and future cash flow from operations. Key investments include$114 million for a second TSF to be spent across 2032 and 2033,$36 million for ball mill motor upgrades and flotation cells in 2028 to increase process plant throughput by about10% to 66,300 tonnes per day (“tpd”) and increase recovery by approximately1% , and$28 million for five new haul trucks to support longer haul distances, higher material movement, and stockpile development. The planned second TSF also provides the potential for future raises, which could add multiple decades of storage capacity beyond the 2045 LOM. - Significant Increase in Mineral Reserves: An updated proven and probable mineral reserve totalling 483.2 million tonnes, with an average grade of 0.28 grams per tonne (“g/t”) gold and

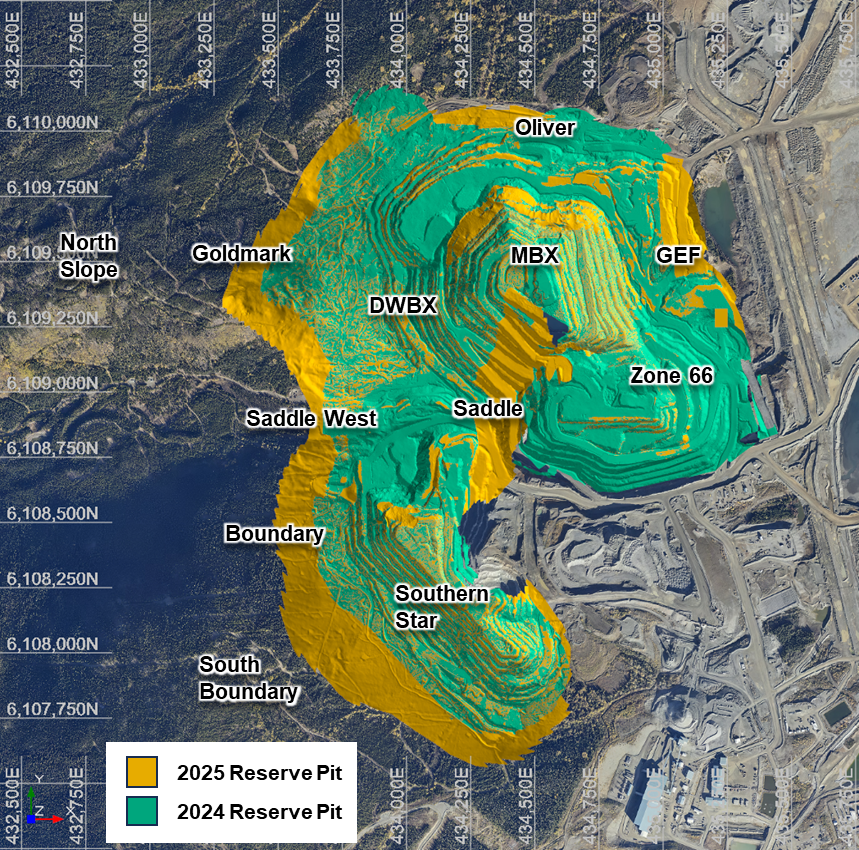

0.16% copper, containing 4.4 million ounces of gold and 1.7 billion pounds of copper was included in the PFS. This represents a56% increase from the 2.8 million ounces of gold reserves and a52% increase from the 1.2 billion pounds of copper reserves reported at the end of 2024, driven mainly by resource conversion related to increased tailings capacity and infill drilling. - Strong Exploration Upside: Recent drilling confirms mineralization remains open to the west of the current resource pit. Centerra plans to continue exploring with a focus on expanding the mineral resource and evaluating opportunities to extend the mine life beyond the updated plan.

- Robust Economics: The PFS reaffirms Mount Milligan’s solid economics, supported by consistent production, disciplined capital investment and low all-in sustaining costs (“AISC”) on a by-product basisNG. Mount Milligan’s after-tax NPV (

5% ) (“NPV5% ”) is approximately$1.5 billion , based on long-term gold and copper price assumptions of$2,600 per ounce and$4.30 per pound, respectively. At spot commodity prices of approximately$3,500 per ounce of gold and$4.50 per pound of copper, the after-tax NPV5% increases to approximately$2.1 billion . For additional detail, refer to “Summary of Mount Milligan PFS Key Metrics” table and footnotes below. - Cornerstone Asset Driving Long-Term Value: Mount Milligan remains a strategic cornerstone asset in Centerra’s portfolio, with 20 years of mine life, meaningful gold and copper production, strong cash flow generation, and significant opportunity for future exploration potential in a top tier mining jurisdiction.

Summary of Mount Milligan PFS Key Metrics

| Summary of Mount Milligan PFS Key Metrics | |

| Production | |

| Mine Life (years) | 20 |

| Total gold production (kozs) | 2,791 |

| Average annual gold production – 2026-2042(1) (kozs) | 150 |

| Average annual gold production – LOM (kozs) | 136 |

| Total copper production (Mlbs) | 1,282 |

| Average annual copper production – 2026-2042(1) (Mlbs) | 69 |

| Average annual copper production – LOM (Mlbs) | 63 |

| Total mill feed (M tonnes) | 483 |

| Average mill throughput(2) (tpd) | 66,300 |

| Average gold grade – 2026-2042(1) (g/t) | 0.31 |

| Average gold grade – LOM (g/t) | 0.28 |

| Average copper grade – 2026-2042(1) (%) | 0.18 |

| Average copper grade – LOM (%) | 0.16 |

| Average gold recovery (%) | 64.8 |

| Average copper recovery (%) | 78.0 |

| Costs | |

| Mining cost per tonne mined(3) ($/tonne) | 2.50 |

| Processing cost per tonne processed ($/tonne) | 5.57 |

| General & Administrative (“G&A”) cost per tonne processed(4) ($/tonne) | 2.11 |

| Gold production costs per ounce sold ($/oz) | 1,312 |

| All-in sustaining costs on a by-product basisNG per ounce sold ($/oz) | 950 |

| Capital Expenditures | |

| LOM Total capital expendituresNG ($ millions) | 925 |

| Non-sustaining capital expendituresNG ($ millions) | 186 |

| Sustaining capital expendituresNG(8) ($ millions) | 739 |

| PFS Economics(5,7) | |

| After-tax NPV | 1,492 |

| Economics at Spot Commodity Prices(6,7) | |

| After-tax NPV | 2,127 |

(1) Averages reflect production and grades for 2026-2042. The period from 2043 to 2045 has been excluded, as it represents low-grade stockpile processing. (2) Average mill throughput starting in 2030 and beyond. (3) On the basis of gross mining costs, prior to the allocation to TSF, divided by total tonnes mined. (4) Excludes corporate allocations. (5) PFS economics are based on commodity prices of

Mount Milligan PFS Summary

Centerra has completed a PFS for Mount Milligan that contemplates a 10-year LOM extension, to 2045, supported by an optimized mine plan, with average annual production, from 2026 to 2042, of approximately 150,000 ounces of gold and 69 million pounds of copper, followed by the processing of low-grade stockpiles from 2043 to 2045. Centerra’s recent infill drilling program, targeting tighter drill spacing in key areas of the deposit, has been incorporated into the PFS, improving confidence in the geology and mine plan.

Mount Milligan will continue to be mined as a conventional truck-shovel open pit mine. Total mining rates of ore and waste are expected to average 156 ktpd between 2026 and 2042. The strip ratio over the same period is expected to average 1.0. Mining will continue through 2042, at which time, lower grade stockpiles are expected to feed the process plant from 2043 through 2045.

Mine operations will incorporate in-pit dumping of potentially acid-generating (“PAG”) waste, reducing the environmental footprint, lowering operating costs, and optimizing tailings storage capacity. This approach reinforces Centerra’s commitment to delivering long-term value for all Mount Milligan stakeholders.

Operational improvements, including in-pit dumping and enhanced stockpile management, will increase efficiency as mining rates are expected to reach 200 ktpd at points during the LOM, requiring only a modest fleet expansion of five additional trucks. Regular equipment replacements and the five additional trucks will support the material movements for the remainder of the mine life.

In 2029, process plant throughput is expected to increase by

A second tailings facility is required to support the LOM expansion and is planned north of the existing facility, subject to consultation with First Nations, with an estimated cost of approximately

Over the LOM, open pit mining costs are expected to average

Mount Milligan PFS Production and Cost Profile(1)

(1) AISC on a by-product basisNG in 2030s is low due to higher copper credits in those years.

Royal Gold Additional Agreement

In February 2024, Centerra announced an additional agreement (the “Additional Agreement”) with RGLD Gold AG, a subsidiary of Royal Gold, Inc. (“Royal Gold”) related to Mount Milligan, which established favourable parameters for potential future mine life extensions. Under the Additional Agreement, the percentage of gold and copper production streamed to Royal Gold over the mine life remains unchanged at

Gold Stream

| Gold Delivery Threshold (after January 1, 2024) | Approximate Period(1) | Gold Payments Received from Royal Gold |

| Until either 375,000 ounces of gold or 30,000 tonnes of copper have been delivered to Royal Gold (the “First Threshold”) | 2024 - 2029 | |

| After the First Threshold until 665,000 ounces of gold have been delivered to Royal Gold (the “Second Gold Threshold”) | 2030 - 2035 | Lower of |

| After 665,000 ounces of gold have been delivered to Royal Gold | 2036+ | Lower of |

(1) Approximate period estimates are based on PFS production profile.

Copper Stream

| Gold Delivery Threshold (after January 1, 2024) | Approximate Period(1) | Gold Payments Received from Royal Gold |

| Until either 375,000 ounces of gold or 30,000 tonnes of copper have been delivered to Royal Gold (the “First Threshold”) | 2024 - 2029 | |

| After the First Threshold until 60,000 tonnes of copper have been delivered to Royal Gold (the “Second Copper Threshold”) | 2030 - 2035 | |

| After 60,000 tonnes of copper have been delivered to Royal Gold | 2036+ |

(1) Approximate period estimates are based on PFS production profile.

Capital ExpendituresNG

The total non-sustaining capital expendituresNG required for the Mount Milligan LOM extension is

Approximately

Approximately

Approximately

In addition, sustaining capitalNG of approximately

A breakdown of the non-sustaining capitalNG is included in the table below.

| Non-Sustaining CapitalNG Breakdown | Total ($M) |

| TSF Expansion | 114 |

| Process Plant Expansion | 36 |

| Fleet Additions | 28 |

| Site Infrastructure | 7 |

| Total Non-Sustaining CapitalNG | 186 |

NOTE: Totals may not sum due to rounding.

Mineral Reserve and Mineral Resource Estimate

An updated proven and probable mineral reserve totalling 483.2 million tonnes, with an average grade of 0.28 grams per tonne gold and

Mount Milligan Gold Mineral Reserve and Resources

| June 30, 2025 | December 31, 2024 | |||||

| Tonnes (kt) | Grade (g/t Au) | Contained Metal (kozs) | Tonnes (kt) | Grade (g/t Au) | Contained Metal (kozs) | |

| Mineral Reserves | ||||||

| Proven | 190,315 | 0.31 | 1,880 | 187,961 | 0.34 | 2,056 |

| Probable | 292,842 | 0.27 | 2,537 | 76,551 | 0.31 | 770 |

| Proven and Probable | 483,157 | 0.28 | 4,417 | 264,512 | 0.33 | 2,826 |

| Mineral Resources (inclusive of Mineral Reserves)(1) | ||||||

| Measured | 363,982 | 0.28 | 3,309 | 291,187 | 0.30 | 2,835 |

| Indicated | 310,110 | 0.27 | 2,661 | 176,323 | 0.29 | 1,622 |

| Measured and Indicated | 674,092 | 0.28 | 5,970 | 467,510 | 0.30 | 4,457 |

| Inferred Resources | 12,056 | 0.28 | 110 | 27,924 | 0.44 | 395 |

(1) Mineral resources inclusive of mineral reserves, as of December 31, 2024, is for comparative purposes only. See 2024 year-end mineral reserves and resources news release dated February 20, 2025, for mineral resources exclusive of mineral reserves as of December 31, 2024. NOTE: Refer to “Reserve and Resource Additional Footnotes” at the end of this news release. Totals may not sum due to rounding.

Mount Milligan Copper Mineral Reserve and Resources

| June 30, 2025 | December 31, 2024 | |||||

| Tonnes (kt) | Grade (% Cu) | Contained Metal (Mlbs) | Tonnes (kt) | Grade (% Cu) | Contained Metal (Mlbs) | |

| Mineral Reserves | ||||||

| Proven | 190,315 | 0.17 | 698 | 187,961 | 0.19 | 808 |

| Probable | 292,842 | 0.16 | 1,051 | 76,551 | 0.20 | 342 |

| Proven and Probable | 483,157 | 0.16 | 1,749 | 264,512 | 0.20 | 1,150 |

| Mineral Resources (inclusive of Mineral Reserves)(1) | ||||||

| Measured | 363,982 | 0.17 | 1,378 | 291,187 | 0.19 | 1,212 |

| Indicated | 310,110 | 0.14 | 979 | 176,323 | 0.18 | 703 |

| Measured and Indicated | 674,092 | 0.16 | 2,357 | 467,510 | 0.19 | 1,915 |

| Inferred Resources | 12,056 | 0.11 | 30 | 27,924 | 0.12 | 74 |

(1) Mineral inventory inclusive of mineral reserves, as of December 31, 2024, is for comparative purposes only. See 2024 year-end mineral reserves and resources news release dated February 20, 2025, for mineral resources exclusive of mineral reserves as of December 31, 2024. NOTE: Refer to “Reserve and Resource Additional Footnotes” at the end of this news release. Totals may not sum due to rounding.

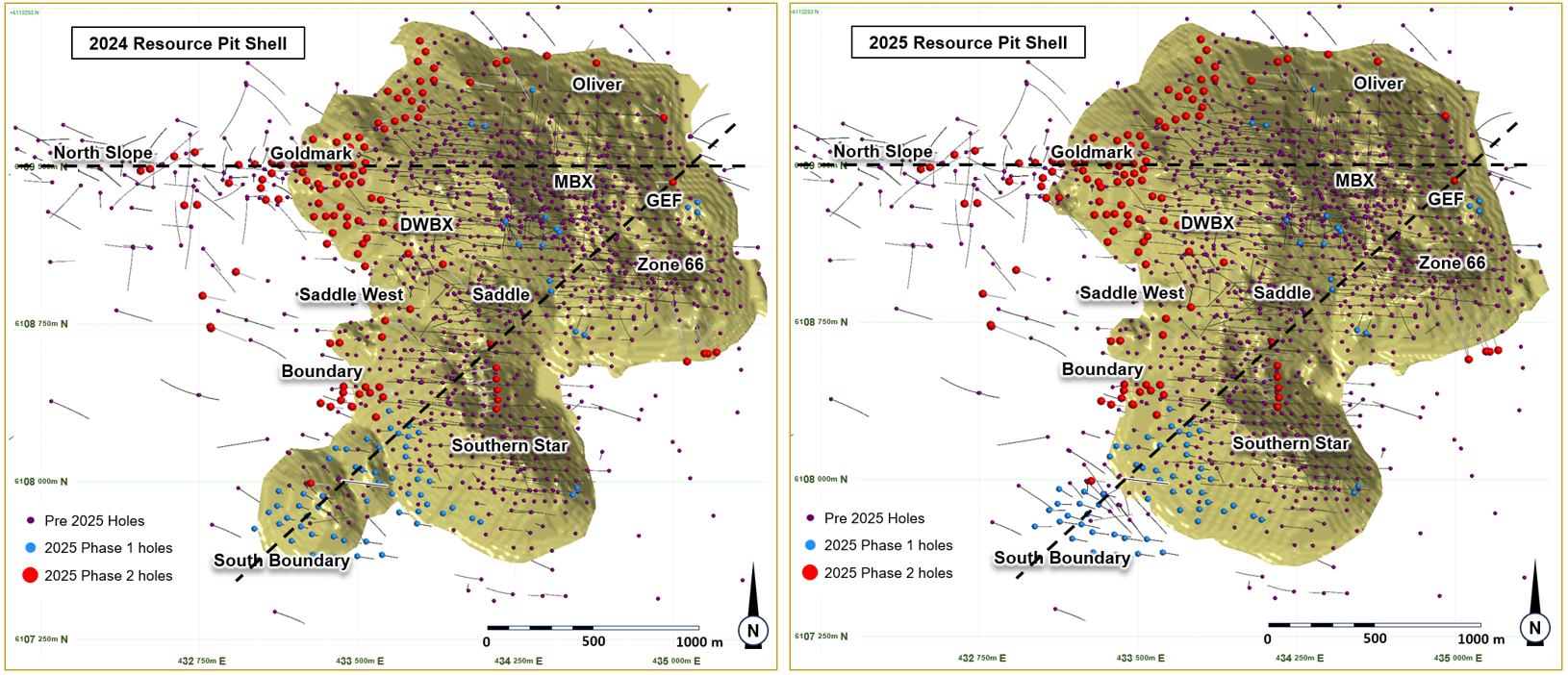

Figure 1: Plan view comparing the 2024 reserve pit to the 2025 reserve pit. Gold areas illustrate the areas of expansion beyond the previous pit limits.

Exploration Potential

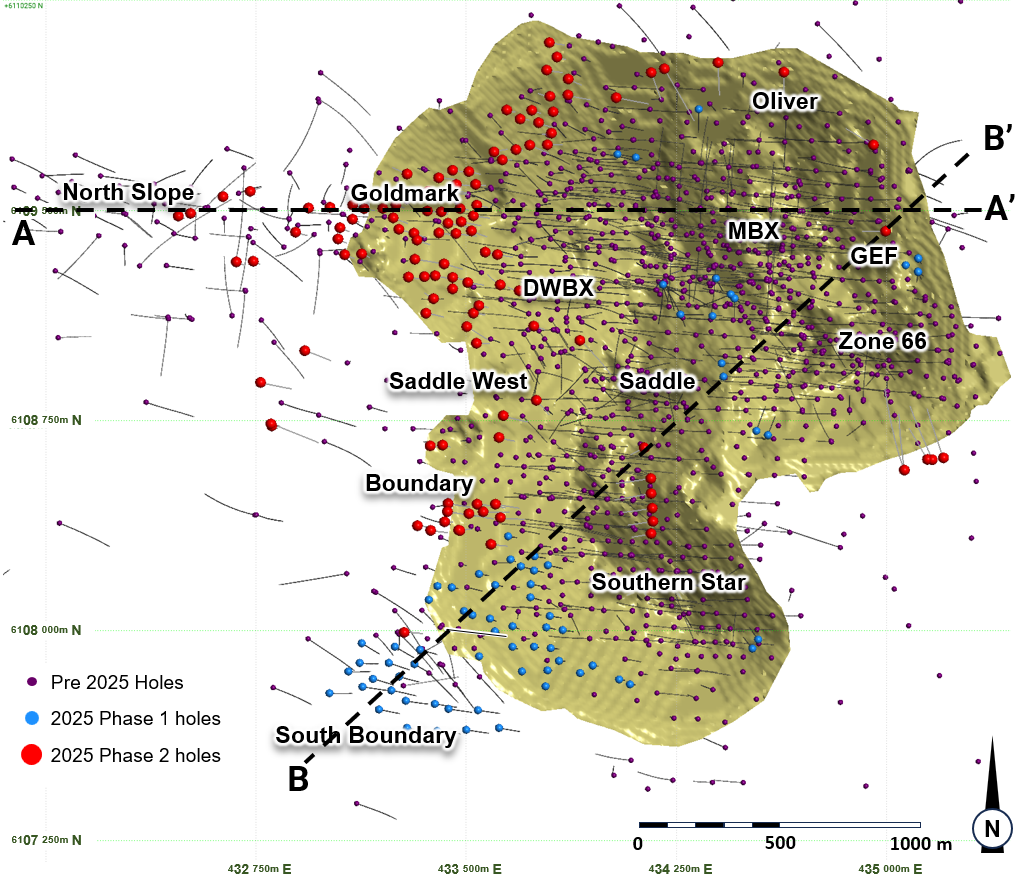

Exploration drilling in 2025 was completed in two phases. Phase 1 focused on upgrading inferred resources to the indicated category for inclusion in the PFS. Drilling was concentrated within the conceptual resource pit, with 83 holes totaling approximately 23 kilometres (“km”) completed and incorporated into the updated model. The Phase 1 program, completed in the first quarter of 2025, targeted Zone 66, GEF, Saddle, WBX, MBX, Southern Star and South Boundary.

Figure 2: Plan view of Mount Milligan deposit showing 2025 resource shell.

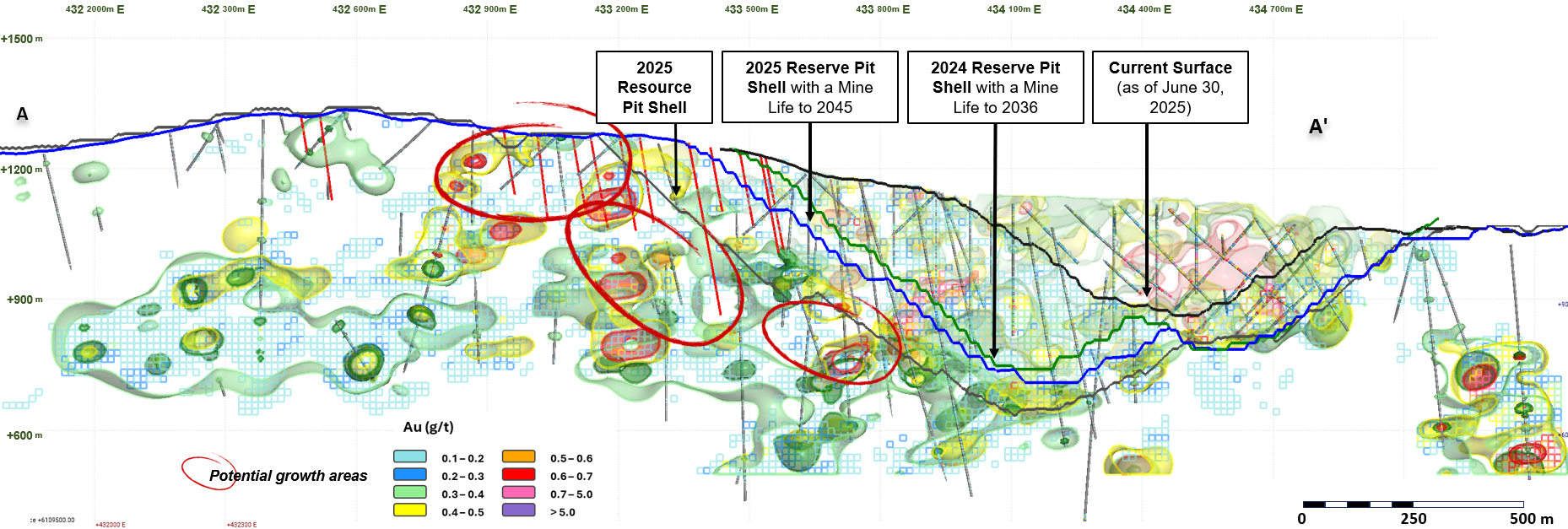

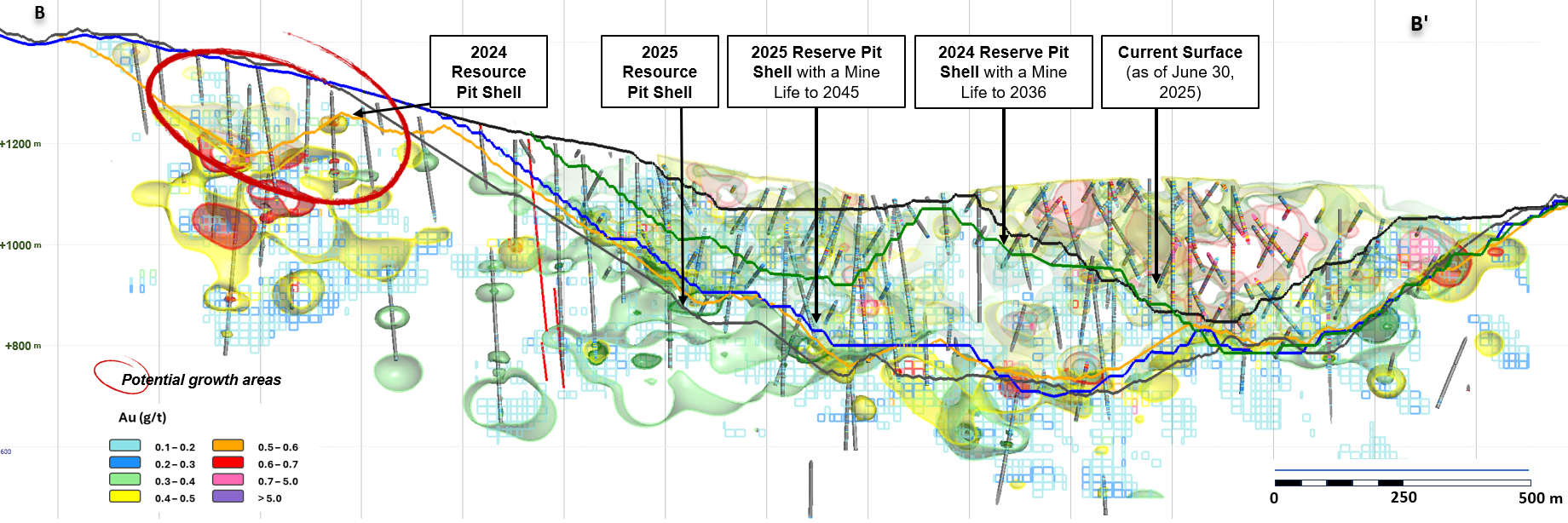

Figure 3: East-west cross section of the Mount Milligan 2025 resource pit (looking north), showing gold and copper grade contours. Red traces show holes drilled, but assays not yet received.

Figure 4: Cross section of the Mount Milligan 2025 resource pit (looking northwest), showing gold and copper grade contours. Red traces show holes drilled, but assays not yet received.

At South Boundary, infill drilling revealed more complex mineralogical controls of the vein mineralization compared to other areas of the deposit. Additional detailed work is planned to better understand this zone. Due to these geological complexities, as well as the less favourable economics of the high gold-low copper mineralization style and pyrite recovery challenges, the South Boundary mineralization is not currently included in the PFS mineral resources estimate.

Figure 5: Comparison of 2024 and 2025 resource shells.

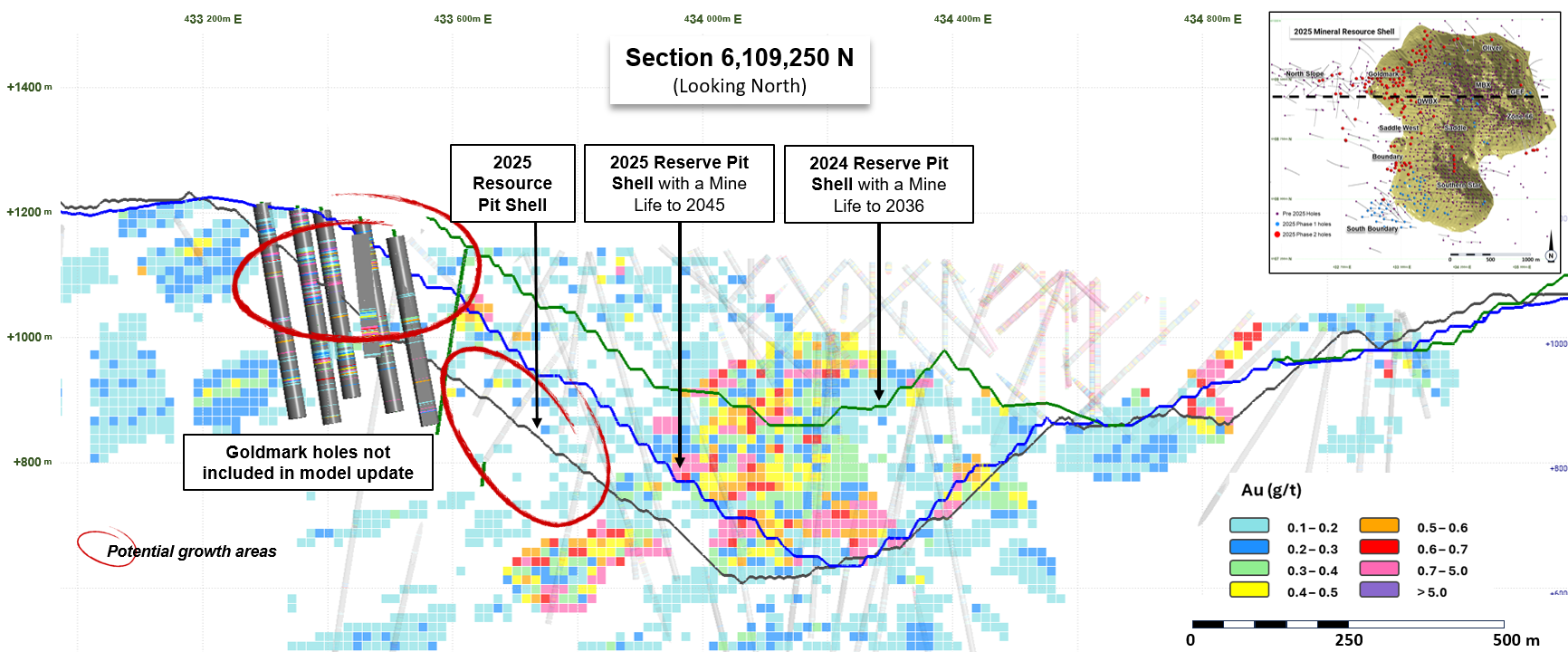

Phase 2 drilling, completed in the third quarter 2025, comprised 117 holes totaling 33 km and focused on the Goldmark, North Slope, Oliver, Saddle, Boundary, and Southern Star areas. Assays from this phase were not included in the most recent model update for the PFS, however, results received to date highlight encouraging mineralization. Significant near-surface grades were intersected between Goldmark and North Slope in areas where earlier wide- spaced drilling did not identify appreciable shallow grades. At depth, drilling also intersected strong mineralization in zones previously modelled as waste on the periphery of the Saddle stock, suggesting potential continuity between the Goldmark and Saddle zones. In the Oliver area, located near the northern margins of the reserve pit, drilling intersected mineralization in areas previous classified as waste.

Figure 6: Section 6,109,250N showing new drill results not included in the model update.

Based on Phase 2 results, Centerra plans to continue drilling to upgrade resources both near surface and at depth, focusing on areas to the west and southwest of the Mount Milligan reserve pit.

Permitting and Community Relations

Since 2014, Mount Milligan has been a significant producer of copper and gold, establishing its status as an essential critical mineral asset for British Columbia (“BC”). In early 2025, the BC Government designated Mount Milligan as one of the province’s priority projects, which supports a more streamlined permitting process under the newly established Ministry of Mining and Critical Minerals.

In March 2025, Centerra submitted its amendment application for key permits to extend operations through 2035, including a process plant throughput expansion of approximately

The extended LOM is expected to provide consistent employment to more than 1,000 workers and increase business opportunities to First Nations, surrounding communities, and the province, representing a significant economic driver for northern communities in British Columbia.

Sensitivity Analysis

The PFS reaffirms Mount Milligan’s solid economics, supported by consistent production, disciplined capital investment and low AISC on a by-product basisNG. Mount Milligan’s after-tax NPV

Mount Milligan PFS After-Tax NPV

| - | - | PFS(1) | |||

| Gold Price | 1,280 | 1,386 | 1,492 | 1,597 | 1,701 |

| Copper Price | 1,287 | 1,390 | 1,492 | 1,594 | 1,694 |

| Canadian Dollar | 1,146 | 1,331 | 1,492 | 1,633 | 1,759 |

| Capital Costs | 1,569 | 1,531 | 1,492 | 1,453 | 1,415 |

| Operating Costs | 1,510 | 1,501 | 1,492 | 1,483 | 1,474 |

(1) PFS economics are based on commodity prices of

Mount Milligan PFS After-Tax NPV

| Gold Price ($/oz) | |||||

(PFS) | |||||

| NPV | 898 | 1,492 | 1,685 | 2,061 | 2,435 |

(1) PFS economics are based on commodity prices of

Mount Milligan PFS After-Tax NPV

| Copper Price ($/lb) | |||||

(PFS) | |||||

| NPV | 1,206 | 1,325 | 1,429 | 1,560 | 1,676 |

(1) PFS economics are based on commodity prices of

Mount Milligan PFS LOM Summary

| LOM Total | H2 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | 2036 | 2037 | 2038 | 2039 | 2040 | 2041 | 2042 | 2043 | 2044 | 2045 | 2046+ | |

| Assumptions | |||||||||||||||||||||||

| Gold price ($/oz) | 3,205 | 3,263 | 3,078 | 2,928 | 2,600 | 2,600 | 2,600 | 2,600 | 2,600 | 2,600 | 2,600 | 2,600 | 2,600 | 2,600 | 2,600 | 2,600 | 2,600 | 2,600 | 2,600 | 2,600 | 2,600 | 2,600 | |

| Copper price ($/lb) | 4.35 | 4.48 | 4.60 | 4.67 | 4.30 | 4.30 | 4.30 | 4.30 | 4.30 | 4.30 | 4.30 | 4.30 | 4.30 | 4.30 | 4.30 | 4.30 | 4.30 | 4.30 | 4.30 | 4.30 | 4.30 | 4.30 | |

| Silver price ($/oz) | 33.80 | 35.06 | 34.65 | 33.23 | 35.00 | 35.00 | 35.00 | 35.00 | 35.00 | 35.00 | 35.00 | 35.00 | 35.00 | 35.00 | 35.00 | 35.00 | 35.00 | 35.00 | 35.00 | 35.00 | 35.00 | 35.00 | |

| USD to CAD Exchange rate | 1.39 | 1.38 | 1.37 | 1.36 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | |

| Mine Production | |||||||||||||||||||||||

| Ore mined (Mt) | 479 | 12 | 23 | 22 | 28 | 28 | 26 | 36 | 32 | 21 | 22 | 33 | 37 | 36 | 25 | 28 | 31 | 30 | 9 | - | - | - | - |

| Waste mined (Mt) | 478 | 11 | 27 | 31 | 23 | 27 | 34 | 34 | 31 | 39 | 41 | 29 | 23 | 24 | 35 | 32 | 24 | 13 | 1 | - | - | - | - |

| Total material mined (Mt) | 957 | 22 | 49 | 53 | 51 | 55 | 60 | 70 | 63 | 60 | 63 | 62 | 60 | 60 | 60 | 60 | 55 | 44 | 10 | - | - | - | - |

| Rehandle material moved (Mt) | 247 | 2 | 3 | 2 | 0 | 4 | 10 | 4 | 4 | 14 | 11 | 6 | 4 | 4 | 4 | 8 | 4 | 4 | 43 | 49 | 48 | 20 | - |

| Total material moved (Mt) | 1,205 | 24 | 52 | 55 | 52 | 59 | 70 | 74 | 67 | 74 | 74 | 68 | 64 | 64 | 64 | 68 | 58 | 47 | 53 | 49 | 48 | 20 | - |

| Strip ratio (Waste:Ore) | 1.0 | 0.9 | 1.2 | 1.4 | 0.8 | 0.9 | 1.3 | 1.0 | 1.0 | 1.9 | 1.8 | 0.9 | 0.6 | 0.6 | 1.4 | 1.1 | 0.8 | 0.4 | 0.1 | - | - | - | - |

| Processing | |||||||||||||||||||||||

| Ore processed(1) (Mt) | 483.2 | 11.4 | 21.6 | 21.6 | 21.9 | 23.8 | 24.2 | 24.2 | 24.2 | 24.2 | 24.2 | 24.2 | 24.2 | 24.2 | 24.2 | 24.2 | 24.2 | 24.2 | 24.2 | 24.2 | 24.2 | 19.7 | - |

| Gold feed grade (g/t) | 0.28 | 0.33 | 0.34 | 0.33 | 0.43 | 0.35 | 0.34 | 0.33 | 0.31 | 0.27 | 0.30 | 0.30 | 0.30 | 0.27 | 0.24 | 0.26 | 0.34 | 0.29 | 0.25 | 0.13 | 0.12 | 0.16 | - |

| Copper feed grade (%) | 0.16% | - | |||||||||||||||||||||

| Gold recovery (%) | 64.8% | - | |||||||||||||||||||||

| Copper recovery (%) | 78.0% | - | |||||||||||||||||||||

| Gold recovered (kozs) | 2,860 | 76 | 153 | 149 | 179 | 178 | 170 | 173 | 161 | 134 | 148 | 151 | 160 | 146 | 126 | 133 | 176 | 157 | 118 | 60 | 54 | 58 | - |

| Copper recovered (Mlbs) | 1,364 | 28 | 60 | 70 | 53 | 81 | 69 | 78 | 84 | 61 | 63 | 78 | 94 | 102 | 66 | 74 | 82 | 83 | 45 | 33 | 32 | 30 | - |

| Dry concentrate produced (kdmt) | 3,104 | 78 | 164 | 192 | 117 | 178 | 152 | 172 | 187 | 135 | 138 | 172 | 208 | 226 | 147 | 164 | 182 | 184 | 100 | 73 | 70 | 66 | - |

| Gold payable produced (kozs) | 2,791 | 74 | 150 | 145 | 175 | 174 | 166 | 169 | 157 | 131 | 145 | 147 | 156 | 142 | 123 | 129 | 172 | 153 | 116 | 58 | 53 | 56 | - |

| Copper payable produced (Mlbs) | 1,282 | 26 | 55 | 65 | 50 | 76 | 65 | 73 | 79 | 57 | 59 | 73 | 88 | 96 | 62 | 70 | 77 | 78 | 42 | 31 | 30 | 28 | - |

| Metal Sales(2) | |||||||||||||||||||||||

| Gold ounces sold (kozs) | 2,791 | 74 | 150 | 145 | 175 | 174 | 166 | 169 | 157 | 131 | 145 | 147 | 156 | 142 | 123 | 129 | 172 | 153 | 116 | 58 | 53 | 56 | - |

| Copper pounds sold (Mlbs) | 1,282 | 26 | 55 | 65 | 50 | 76 | 65 | 73 | 79 | 57 | 59 | 73 | 88 | 96 | 62 | 70 | 77 | 78 | 42 | 31 | 30 | 28 | - |

| Revenue | |||||||||||||||||||||||

| Gold sales(3) ($M) | 5,694 | 166 | 341 | 311 | 361 | 321 | 316 | 337 | 313 | 261 | 288 | 293 | 320 | 293 | 254 | 266 | 355 | 315 | 238 | 121 | 109 | 116 | - |

| Copper sales(3) ($M) | 5,034 | 96 | 207 | 248 | 195 | 274 | 248 | 285 | 309 | 223 | 229 | 290 | 356 | 386 | 251 | 280 | 311 | 315 | 171 | 126 | 121 | 112 | - |

| Silver revenue ($M) | 408 | 5 | 12 | 16 | 25 | 27 | 27 | 21 | 23 | 19 | 21 | 22 | 20 | 17 | 17 | 22 | 20 | 28 | 23 | 14 | 14 | 14 | - |

| Smelting and refining costs ($M) | (207) | (3) | (6) | (8) | (6) | (9) | (9) | (10) | (11) | (9) | (9) | (12) | (15) | (17) | (11) | (13) | (15) | (16) | (9) | (6) | (6) | (6) | - |

| Total revenue ($M) | 10,929 | 264 | 553 | 567 | 574 | 612 | 583 | 633 | 634 | 494 | 528 | 593 | 681 | 680 | 511 | 555 | 671 | 643 | 423 | 254 | 237 | 237 | - |

| Unit Costs | |||||||||||||||||||||||

| Gold production costs ($/oz) | 1,312(5) | 1,418 | 1,403 | 1,318 | 1,251 | 1,122 | 1,206 | 1,131 | 1,159 | 1,480 | 1,380 | 1,256 | 1,138 | 1,194 | 1,573 | 1,395 | 1,137 | 1,235 | 1,549 | 1,986 | 2,047 | 1,389 | - |

| Copper production costs ($/lb) | 2.44(5) | 2.25 | 2.25 | 2.30 | 2.32 | 2.13 | 2.36 | 2.15 | 2.20 | 2.80 | 2.60 | 2.42 | 2.15 | 2.24 | 2.95 | 2.61 | 2.12 | 2.31 | 2.89 | 3.71 | 3.82 | 2.59 | - |

| AISC on a by-product basisNG ($/oz) | 950(5) | 1,494 | 1,454 | 1,080 | 1,187 | 746 | 1,067 | 906 | 623 | 1,274 | 1,065 | 710 | 363 | 284 | 1,325 | 891 | 510 | 537 | 1,234 | 2,056 | 2,146 | 770 | - |

| Outflows | |||||||||||||||||||||||

| Operating costs ($M) | (6,492) | (159) | (325) | (328) | (321) | (341) | (344) | (342) | (344) | (342) | (345) | (351) | (354) | (357) | (347) | (349) | (343) | (338) | (274) | (219) | (219) | (148) | - |

| Selling and marketing costs(4) ($M) | (159) | (5) | (8) | (10) | (6) | (9) | (8) | (9) | (9) | (7) | (7) | (9) | (11) | (11) | (7) | (8) | (9) | (9) | (5) | (4) | (4) | (3) | - |

| Royalties ($M) | (298) | (6) | (9) | (11) | (13) | (15) | (9) | (6) | (13) | (12) | (7) | (10) | (14) | (28) | (30) | (13) | (16) | (32) | (27) | (13) | (4) | (3) | (7) |

| Capital expenditures ($M) | (925) | (39) | (89) | (56) | (113) | (47) | (75) | (84) | (107) | (93) | (26) | (24) | (29) | (21) | (25) | (23) | (24) | (21) | (12) | (9) | (6) | (3) | - |

| Lease payments ($M) | (99) | (3) | (5) | (5) | (5) | (5) | (5) | (5) | (5) | (5) | (5) | (5) | (5) | (5) | (5) | (5) | (5) | (5) | (3) | (3) | (3) | (1) | - |

| Reclamation expenditures ($M) | (96) | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | (96) |

| Cash taxes ($M) | (733) | (2) | (4) | (5) | (5) | (5) | (5) | (39) | (58) | (14) | (35) | (60) | (91) | (89) | (33) | (54) | (98) | (87) | (35) | (2) | (1) | (11) | - |

| Total outflows ($M) | (8,802) | (213) | (441) | (414) | (463) | (422) | (446) | (486) | (536) | (474) | (427) | (459) | (504) | (511) | (448) | (453) | (497) | (492) | (357) | (250) | (237) | (169) | (103) |

| Net cash flow ($M) | 2,127 | 51 | 113 | 153 | 111 | 189 | 137 | 147 | 98 | 20 | 102 | 134 | 177 | 169 | 63 | 102 | 174 | 151 | 66 | 3 | 1 | 68 | (103) |

| NPV @ | 1,492 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

(1) Ore processed tonnes include processing stockpiled ore accumulated prior to July 1, 2025.

(2) Mount Milligan metal sold quantities are presented on

(3) Gold and copper revenues include impact from the Mount Milligan streaming arrangement with Royal Gold and the Additional Agreement.

(4) Selling and marketing costs include ocean freight.

(5) Unit cost LOM average.

“Mt” refers to millions of tonnes; “koz” to thousands of ounces; “Mlb” to millions of pounds; and “kdmt” to thousands of dry metric tonnes. NOTE: Totals may not add due to rounding.

Project Assumptions

The economic analysis of the Project was performed using the following assumptions and basis:

- Economic assessment of the project uses a discounted cash flow approach. Cash flows are estimated to occur at the mid-year of each period. NPV is calculated by discounting LOM cash flows from July 1, 2025 to the end of mine life to December 31, 2045, using

5% discount rate. - Project economics are based on a valuation date of July 1, 2025.

- Project economics are based on the following commodity price assumptions:

$3,205 /oz gold and$4.35 /lb copper in H2 2025,$3,263 /oz gold and$4.48 /lb copper in 2026,$3,078 /oz gold and$4.60 /lb copper in 2027,$2,928 /oz gold and$4.67 /lb copper in 2028, and a long-term assumption (2029+) of$2,600 /oz gold and$4.30 /lb copper. USD/CAD exchange rate assumptions are$1.39 :1 in H2 2025,$1.38 :1 in 2026,$1.37 :1 in 2027,$1.36 :1 in 2028 and$1.35 :1 from 2029 onward. - All costs presented are in constant US dollars as of July 1, 2025 with no price inflation or escalation factors applied.

- Economics assume amalgamation of various Canadian legal entities, including the subsidiary that owns Mount Milligan, to optimize tax deductions.

- No salvage values are assumed for the capital equipment at the end of mine life.

- Reclamation and closure costs for the site were estimated at approximately

$96 million , undiscounted.

Reserve and Resource Additional Footnotes

- A conversion factor of 31.1035 grams per troy ounce of gold is used in the mineral reserve and resource estimates.

- The mineral reserves are reported based on a gold price of

$1,800 per ounce, a copper price of$3.75 per pound and an exchange rate of 1USD:1.33CAD. - The open pit mineral reserves are reported based on a Net Smelter Return (“NSR”) cut-off of

$8.45 per tonne (C$11.24 per tonne) that considers metallurgical recoveries, concentrate grades, transportation costs, and smelter treatment charges to determine economic viability. Reserves include 31.7 million tonnes of marginal material to be processed at the end of mine life for closure purposes. - The mineral resources are reported based on a gold price of

$2,100 per ounce, a copper price of$4.00 per pound, and an exchange rate of 1USD:1.33CAD. - The open pit mineral resources are constrained by a pit shell and are reported based on a NSR cut-off of

$8.45 per tonne (C$11.24 per tonne) that considers metallurgical recoveries, concentrate grades, transportation costs, and smelter treatment charges to determine economic viability. - Mineral resources are reported inclusive of reserves.

Mineral reserve and mineral resource estimates are forward-looking information and are based on key assumptions and are subject to material risk factors. If any event arising from these risks occurs, the Company’s business, prospects, financial condition, results of operations or cash flows, and the market price of Centerra’s shares could be adversely affected. Additional risks and uncertainties not currently known to the Company, or that are currently deemed immaterial, may also materially and adversely affect the Company’s business operations, prospects, financial condition, results of operations or cash flows, and the market price of Centerra’s shares. See the section entitled “Risk That Can Affect Centerra’s Business” in the Company’s Management’s Discussion and Analysis (MD&A) for the three months ended June 30, 2025, available on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar and see also the discussion below under the heading “Cautionary Statement on Forward-Looking Information”.

NI 43-101 Technical Report

A technical report on Mount Milligan will be prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and will be filed within 45 days of this news release on SEDAR+ at www.sedarplus.ca and EDGAR www.sec.gov/edgar.

About Centerra Gold

Centerra Gold Inc. is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold and copper properties in North America, Türkiye, and other markets worldwide. Centerra operates two mines: the Mount Milligan Mine in British Columbia, Canada, and the Öksüt Mine in Türkiye. The Company also owns the Kemess Project in British Columbia, Canada, the Goldfield Project in Nevada, United States, and owns and operates the Molybdenum Business Unit in the United States and Canada. Centerra’s shares trade on the Toronto Stock Exchange (“TSX”) under the symbol CG and on the New York Stock Exchange (“NYSE”) under the symbol CGAU. The Company is based in Toronto, Ontario, Canada.

For more information:

Lisa Wilkinson

Vice President, Investor Relations & Corporate Communications

(416) 204-3780

Lisa.Wilkinson@centerragold.com

Additional information on Centerra is available on the Company’s website at www.centerragold.com, on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar.

Cautionary Statement on Forward-Looking Information

All statements, other than statements of historical fact contained or incorporated by reference in this news release, which address events, results, outcomes or developments that the Company expects to occur are, or may be deemed to be, forward looking information or forward-looking statements within the meaning of certain securities laws, including the provisions of the Securities Act (Ontario) and the provisions for “safe harbor” under the United States Private Securities Litigation Reform Act of 1995 and are based on expectations, estimates and projections as of the date of this news release. Such forward-looking information involves risks, uncertainties and other factors that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking statements are generally, but not always, identified by the use of forward-looking terminology such as “assume”, “believes”, “commenced”, “continue”, “estimate”, “evaluate”, “expect”, “finalizing”, “focus”, “forecast”, “future”, “ongoing”, “optimize”, “plan”, “potential”, “project”, “target” or “update”, or variations of such words and phrases and similar expressions or statements that certain actions, events or results “may”, “could”, “would” or “will” be taken, occur or be achieved or the negative connotation of such terms. Such statements include but may not be limited to: mineral reserve and mineral resource estimates; LOM estimates for Mount Milligan, including, but not limited to, gold and copper production, grades, mining rates, strip ratios and the costs thereof; the expectation to deploy phased, non-sustaining capital expenditures funded from the Company’s available liquidity leveraging existing infrastructure and the costs and timing thereof; the timing and ability of the Company to optimize the mine plan at Mount Milligan which involves, among other things, increasing process plant capacity, constructing a second TSF utilizing the cyclone sand method, sourcing new haul trucks and enhancing stockpile management; the expectation that the second TSF will deliver an improved water balance compared to the current facility; the ability of the Company to construct future raises for the second TSF that will be able to support storage capacity beyond the 2045 LOM; the impact Mount Milligan will have on the Company’s future production profile, cash flow and value to shareholders; future exploration potential at Mount Milligan and any further extension of the 2045 LOM; the anticipated economics and production expected over the LOM at Mount Milligan; the expectation that the BC government will continue to recognize Mount Milligan as a provincial priority project and support a more streamlined permitting process; the ability of the Company to receive any required authorizations and approvals concerning the second TSF; the ability of the Company to incorporate in-pit dumping of PAG waste; the expectations concerning employment and business opportunities resulting from the extended LOM; the timing and amount of future benefits and obligations in connection with the additional Royal Gold agreement; anticipated costs and expenditures and other information that is based on forecasts of future operational or financial results, estimates of amounts not yet determinable and assumptions of management; the Company’s ability to convert existing mineral resources into categories of mineral resources or mineral reserves of increased geological confidence; and, management’s expectations regarding the completion of the Mount Milligan technical report.

The Company cautions that forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by the Company at the time of making such statements, are inherently subject to significant business, economic, technical, legal, geopolitical and competitive uncertainties and contingencies, which may prove to be incorrect. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information.

Risk factors that may affect the Company’s ability to achieve the expectations set forth in the forward-looking statements in this document include, but are not limited to: (A) strategic, legal, planning and other risks, including: political risks associated with the Company’s operations in Türkiye, the USA and Canada; resource nationalism including the management of external stakeholder expectations; the impact of changes in, or to the more aggressive enforcement of, laws, government royalties, tariffs, regulations and government practices, including unjustified civil or criminal action against the Company, its affiliates, or its current or former employees; risks that community activism may result in increased contributory demands or business interruptions; the risks related to outstanding litigation affecting the Company; the impact of any sanctions or tariffs imposed by Canada, the United States or other jurisdictions; potential defects of title in the Company’s properties that are not known as of the date hereof; permitting and development of our projects, including tailings facilities, being consistent with the Company’s expectations; the inability of the Company and its subsidiaries to enforce their legal rights in certain circumstances; risks related to anti-corruption legislation; Centerra not being able to replace mineral reserves; Indigenous claims and consultative issues relating to the Company’s properties which are in proximity to Indigenous communities; and potential risks related to kidnapping or acts of terrorism; (B) risks relating to financial matters, including: sensitivity of the Company’s business to the volatility of gold, copper, molybdenum and other mineral prices; the use of provisionally-priced sales contracts for production at Mount Milligan; reliance on a few key customers for the gold-copper concentrate at Mount Milligan; use of commodity derivatives; the imprecision of the Company’s mineral reserves and resources estimates and the assumptions they rely on; the accuracy of the Company’s production and cost estimates; persistent inflationary pressures on key input prices; the impact of restrictive covenants in the Company’s credit facilities and in the Royal Gold streaming agreement which may, among other things, restrict the Company from pursuing certain business activities, including paying dividends or repurchasing shares under its normal course issuer bid, or making distributions from its subsidiaries; the Company’s ability to obtain future financing; sensitivity to fuel price volatility; the impact of global financial conditions; the impact of currency fluctuations; the effect of market conditions on the Company’s short-term investments; the Company’s ability to make payments, including any payments of principal and interest on the Company’s debt facilities, which depends on the cash flow of its subsidiaries; the ability to obtain adequate insurance coverage; changes to taxation laws or royalty structures in the jurisdictions where the Company operates, and (C) risks related to operational matters and geotechnical issues and the Company’s continued ability to successfully manage such matters, including: unanticipated ground and water conditions; the stability of the pit walls at the Company’s operations leading to structural cave-ins, wall failures or rock-slides; the integrity of tailings storage facilities and the management thereof, including as to stability, compliance with laws, regulations, licenses and permits, controlling seepages and storage of water, where applicable; there being no significant disruptions affecting the activities of the Company whether due to extreme weather events or other related natural disasters, labour disruptions, supply disruptions, power disruptions, damage to equipment or other force majeure events; the risk of having sufficient water to continue operations at Mount Milligan and achieve expected mill throughput; changes to, or delays in the Company’s supply chain and transportation routes, including cessation or disruption in rail and shipping networks, whether caused by decisions of third-party providers or force majeure events (including, but not limited to: labour action, flooding, landslides, seismic activity, wildfires, earthquakes, pandemics, or other global events such as wars); lower than expected ore grades or recovery rates; the success of the Company’s future exploration and development activities, including the financial and political risks inherent in carrying out exploration activities; inherent risks associated with the use of sodium cyanide in the mining operations; the adequacy of the Company’s insurance to mitigate operational and corporate risks; mechanical breakdowns; the occurrence of any labour unrest or disturbance and the ability of the Company to successfully renegotiate collective agreements when required; the risk that Centerra’s workforce and operations may be exposed to widespread epidemic or pandemic; seismic activity, including earthquakes; wildfires; long lead-times required for equipment and supplies given the remote location of some of the Company’s operating properties and disruptions caused by global events; reliance on a limited number of suppliers for certain consumables, equipment and components; the ability of the Company to address physical and transition risks from climate change and sufficiently manage stakeholder expectations on climate-related issues; regulations regarding greenhouse gas emissions and climate change; significant volatility of molybdenum prices resulting in material working capital changes and unfavourable pressure on viability of the molybdenum business; the Company’s ability to accurately predict decommissioning and reclamation costs and the assumptions they rely upon; the Company’s ability to attract and retain qualified personnel; competition for mineral acquisition opportunities; risks associated with the conduct of joint ventures/partnerships; risk of cyber incidents such as cybercrime, malware or ransomware, data breaches, fines and penalties; and, the Company’s ability to manage its projects effectively and to mitigate the potential lack of availability of contractors, budget and timing overruns, and project resources.

There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are provided for the purpose of providing information about management’s expectations and plans relating to the future. All of the forward-looking statements made in this document are qualified by these cautionary statements and those made in our other filings with the securities regulators of Canada and the United States including, but not limited to, those set out in the Company’s latest Annual Report on Form 40-F/Annual Information Form and Management’s Discussion and Analysis, each under the heading “Risk Factors”, which are available on SEDAR+ (www.sedarplus.ca) or on EDGAR (www.sec.gov/edgar). The foregoing should be reviewed in conjunction with the information, risk factors and assumptions found in this document.

The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether written or oral, or whether as a result of new information, future events or otherwise, except as required by applicable law.

Other Information

Christopher Richings, Professional Engineer, member of the Engineers and Geoscientists British Columbia and Centerra’s Vice President, Technical Services, has reviewed and approved the scientific and technical information contained in this news release. Mr. Richings is a “qualified person” within the meaning of the Canadian Securities Administrator’s NI 43-101 Standards of Disclosure for Mineral Projects.

All mineral reserve and resources have been estimated in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum and NI 43-101.

Non-GAAP Financial Measures

This document contains “specified financial measures” within the meaning of NI 52-112, specifically the non-GAAP financial measures, non-GAAP ratios and supplementary financial measures described below. Management believes that the use of these measures assists analysts, investors and other stakeholders of the Company in understanding the costs associated with producing gold and copper, understanding the economics of gold and copper mining, assessing operating performance, the Company’s ability to generate free cash flow from current operations and on an overall Company basis, and for planning and forecasting of future periods. However, the measures have limitations as analytical tools as they may be influenced by the point in the life cycle of a specific mine and the level of additional exploration or other expenditures a company has to make to fully develop its properties. The specified financial measures used in this document do not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other issuers, even as compared to other issuers who may be applying the World Gold Council (“WGC”) guidelines. Accordingly, these specified financial measures should not be considered in isolation, or as a substitute for, analysis of the Company’s recognized measures presented in accordance with IFRS.

Definitions

The following is a description of the non-GAAP financial measures, non-GAAP ratios and supplementary financial measures used in this document:

- All-in sustaining costs on a by-product basis per ounce is a non-GAAP ratio calculated as all-in sustaining costs on a by-product basis divided by ounces of gold sold. All-in sustaining costs on a by-product basis is a non-GAAP financial measure calculated as the aggregate of production costs as recorded in the consolidated statements of earnings, refining and transport costs, the cash component of capitalized stripping and sustaining capital expenditures, lease payments related to sustaining assets, corporate general and administrative expenses, accretion expenses, asset retirement depletion expenses, copper and silver revenue and the associated impact of hedges of by-product sales revenue. When calculating all-in sustaining costs on a by-product basis, all revenue received from the sale of copper from the Mount Milligan Mine, as reduced by the effect of the copper stream, is treated as a reduction of costs incurred. A reconciliation of all-in sustaining costs on a by-product basis to the nearest IFRS measure is set out below. Management uses these measures to monitor the cost management effectiveness of each of its operating mines.

- Sustaining capital expenditures and Non-sustaining capital expenditures are non-GAAP financial measures. Sustaining capital expenditures are defined as those expenditures required to sustain current operations and exclude all expenditures incurred at new operations or major projects at existing operations where these projects will materially benefit the operation. Non-sustaining capital expenditures are primarily costs incurred at ‘new operations’ and costs related to ‘major projects at existing operations’ where these projects will materially benefit the operation. A material benefit to an existing operation is considered to be at least a

10% increase in annual or life of mine production, net present value, or reserves compared to the remaining life of mine of the operation. A reconciliation of sustaining capital expenditures and non-sustaining capital expenditures to the nearest IFRS measures is set out below. Management uses the distinction of the sustaining and non-sustaining capital expenditures as an input into the calculation of all-in sustaining costs per ounce and all-in costs per ounce.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/29636600-afea-4893-8953-d5a3ab44f6a3

https://www.globenewswire.com/NewsRoom/AttachmentNg/8424d0cf-6063-4347-a570-e66eb9534016

https://www.globenewswire.com/NewsRoom/AttachmentNg/4385df2a-74dd-4b91-a548-663ffaf2cc18

https://www.globenewswire.com/NewsRoom/AttachmentNg/33d68cc2-91bc-4474-98c1-a09c2bf63ac4

https://www.globenewswire.com/NewsRoom/AttachmentNg/8a9ea201-0c33-4ed8-aee0-b440be1dc716

https://www.globenewswire.com/NewsRoom/AttachmentNg/fc1b6f9c-eb8c-467d-9d67-8687e5b0e9e1

https://www.globenewswire.com/NewsRoom/AttachmentNg/b31b85dd-b765-4a88-a39f-2bbf93095de5