CompoSecure Reports First Quarter 2025 Financial Results

Rhea-AI Summary

CompoSecure (NASDAQ: CMPO) reported its Q1 2025 financial results, with consolidated net sales of $103.9 million compared to $104.0 million in Q1 2024. The company completed the spin-off of Resolute Holdings Management (NASDAQ: RHLD) on February 28, 2025, affecting accounting methods. Gross profit was $54.5 million (52.5% margin), slightly down from $55.2 million (53.1%) year-over-year. Adjusted net income increased 21% to $28.4 million, with diluted adjusted EPS of $0.25.

The company's financial position showed $71.7 million in cash and $195.0 million in total debt as of March 31, 2025. CompoSecure maintained its 2025 guidance, projecting mid-single digit growth in both consolidated net sales and Pro Forma Adjusted EBITDA. Notable achievements include successful partnerships with MetaMask, MoneyGram, and Circular for Arculus implementation.

Positive

- Adjusted net income increased 21% to $28.4 million vs $23.3 million YoY

- Record results for Arculus with net positive contribution in Q1

- Strong partnerships established with MetaMask, MoneyGram, and Circular

- Improved debt position with leverage ratio decreasing to 1.05x from 1.34x YoY

- Maintained positive outlook with mid-single digit growth guidance for 2025

Negative

- Slight decline in net sales to $103.9M from $104.0M YoY

- Gross margin decreased to 52.5% from 53.1% YoY due to product mix

- Higher general and administrative expenses impacting EBITDA

- Pro Forma Adjusted EBITDA decreased to $33.7M from $34.5M YoY

News Market Reaction

On the day this news was published, CMPO gained 3.28%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

- Operating results in line with expectations

- Reiterating previously issued full-year 2025 guidance

- Completed spin-off of Resolute Holdings Management, Inc. (Nasdaq: RHLD)

- Accounting standards related to the spin-off require the Company to report results using equity method of accounting in accordance with U.S. GAAP

- Non-GAAP results are also included below and provide a clearer picture of the underlying financial performance of the operating business consistent with historical reporting

SOMERSET, N.J., May 12, 2025 (GLOBE NEWSWIRE) -- CompoSecure, Inc. (Nasdaq: CMPO), a leader in metal payment cards, security, and authentication solutions, today announced its financial and operating results for the first quarter ended March 31, 2025.

“We started the year with solid execution across our payment card and Arculus business,” said Jon Wilk, President and CEO of CompoSecure. “Demand has continued to strengthen throughout the second quarter, reflecting strong sales momentum, and we anticipate this sustained growth trajectory will carry through the remainder of the year. Our team remains focused on continuing to implement the CompoSecure Operating System (“COS”) throughout the business and we are beginning to see these ongoing efforts yield results.”

Mr. Wilk added, “We delivered record results for Arculus, generating another net positive contribution in Q1 as we are seeing metal card customers beginning to future-proof their offerings by bundling Arculus Authenticate with payment capabilities. As previously stated, we expect a net positive contribution for the full year as Arculus remains a powerful differentiator that sets CompoSecure apart in the digital asset and evolving Web3 payments landscape.”

Dave Cote, CompoSecure’s Executive Chairman, stated: “I am pleased with our first quarter results and with the team’s continued engagement implementing COS. Our metal cards enhance brand loyalty and deliver accelerated returns for our customers through superior acquisition, spending, and retention. As more issuers recognize the value our products deliver, we see significant opportunities for continued growth and are planting seeds through strategic investments to execute on the market opportunity we see while leveraging the COS to enhance efficiency and execution. Taken together, we are excited about the work at CompoSecure and believe the Company is well positioned for the remainder of 2025.”

Financial Results

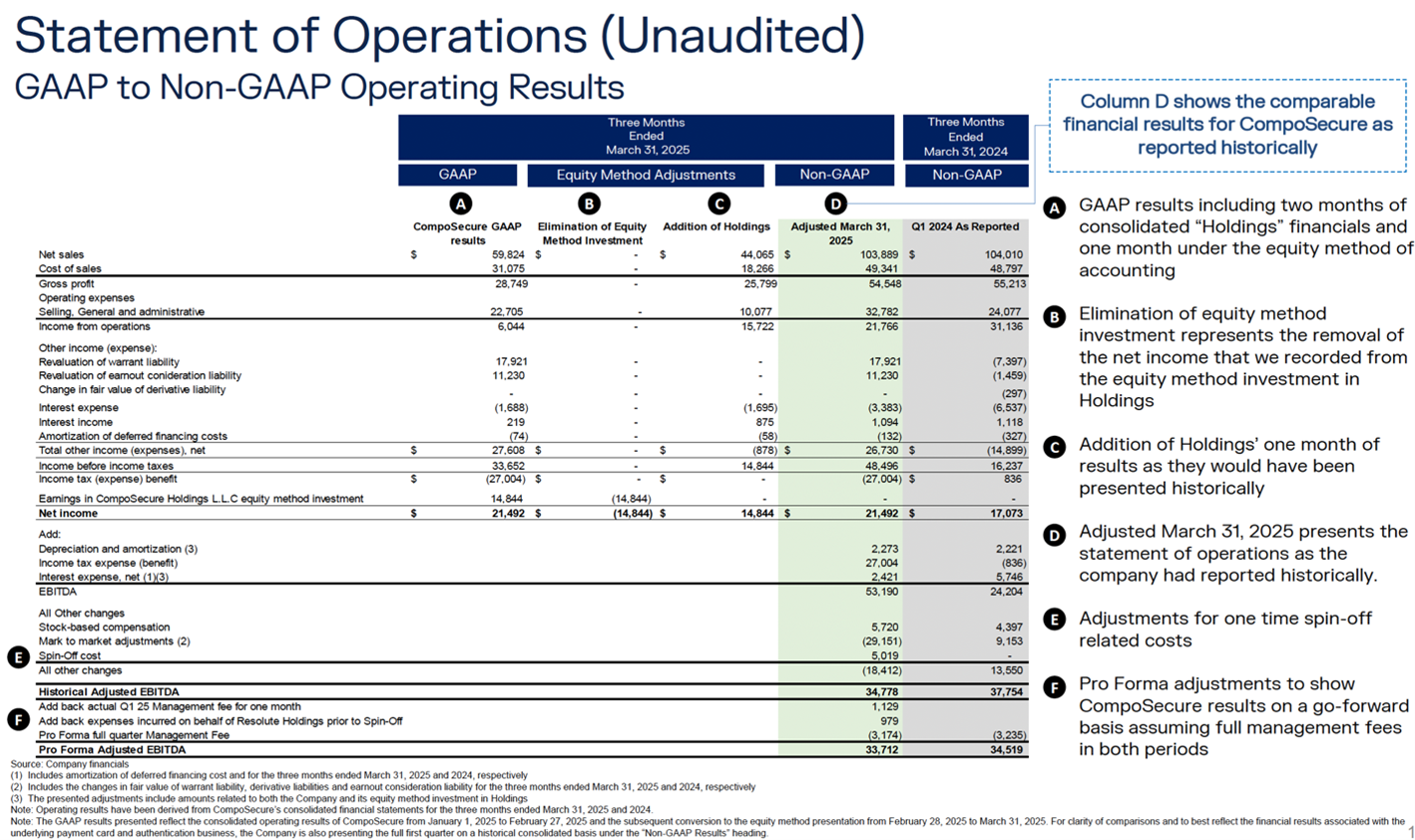

As a result of the spin-off of Resolute Holdings Management, Inc. (“Resolute Holdings”) on February 28, 2025 and the execution of the management agreement with Resolute Holdings, CompoSecure is required to account for the operating results of its wholly owned operating subsidiary, CompoSecure Holdings L.L.C. (“CompoSecure Holdings”), under the equity method in accordance with U.S. GAAP, effective February 28, 2025.

The GAAP results presented below reflect the consolidated operating results of CompoSecure from January 1, 2025 to February 27, 2025 and the subsequent conversion to the equity method presentation from February 28, 2025 to March 31, 2025. For clarity of comparisons and to best reflect the financial results associated with the standalone payment card and Arculus business, the Company is also presenting the full first quarter on a historical consolidated basis under the “Non-GAAP Results” heading below.

| 1Q 2025 | 1Q 2024 | ||||||

| Accounting Treatment | GAAP | Non-GAAP | GAAP | Non-GAAP | |||

| Net Sales ($ in millions) | |||||||

| Gross Profit ($ in millions) | |||||||

| Gross Margin (%) | 48.1 | 52.5(1) | 53.1(1) | 53.1(1) | |||

| Pro-Forma Adjusted EBITDA ($ in millions) | |||||||

| EPS/Adjusted EPS – Diluted | |||||||

| Cash ($ in millions) | |||||||

| Total Debt ($ in millions) | |||||||

| (1) Refers to a Consolidated Non-GAAP Measure. For 1Q24, Net Sales, Gross Profit, Gross Margin, and Cash are identical on a GAAP and Non-GAAP basis, because such measures have historically been shown on a consolidated basis; (2) Pro-Forma Adjusted EBITDA in the table includes (~ | |||||||

GAAP Results: Q1 2025 Financial Highlights (vs. Q1 2024)

Important Note: These GAAP results reflect the consolidation of CompoSecure Holdings, L.L.C. through February 27, 2025, and the application of equity method accounting beginning February 28, 2025, following the completion of the Resolute Holdings Management, Inc. spin-off.

- Net Sales: Net Sales in CompoSecure Inc., were

$59.8 million from January 1, 2025 through February 27, 2025; and Net Sales of CompoSecure Holdings were$44.1 million from February 28, 2025 through March 31, 2025 (which is reflected in the Company’s financial statements as an equity method investment from February 28, 2025). - Net Income: Net Income was

$21.5 million compared to$17.1 million in the year-ago period. - Earnings Per Share: EPS attributable to Class A common shareholders was

$0.21 (Basic) and$0.07 (Diluted) compared to$0.20 (Basic) and$0.17 (Diluted) in the year-ago period. The increase was primarily driven by non-cash gains related to the revaluation of warrant and earnout liabilities.

Non-GAAP Results: Q1 2025 Financial Highlights (vs. Q1 2024)

- Consolidated Net Sales: Consolidated Net Sales were

$103.9 million compared to$104.0 million in the year-ago period. - Consolidated Gross Profit: Consolidated Gross Profit was

$54.5 million or52.5% of Net Sales, compared to$55.2 million or53.1% in the year-ago period. The decrease in gross margin was primarily driven by product mix. - Adjusted Net Income Adjusted Net Income increased

21% to$28.4 million compared to$23.3 million in the year-ago period. - Adjusted Earnings Per Share: Adjusted Earnings Per Share was

$0.28 (Basic) and$0.25 (Diluted) compared to$0.29 (Basic) and$0.24 (Diluted) in the year-ago period. - Pro Forma Adjusted EBITDA: Pro Forma Adjusted EBITDA was

$33.7 million compared to$34.5 million in the year-ago period, with the decrease primarily due to higher general and administrative expenses due to growth investments.

Financial Condition

- GAAP Financial Condition: At March 31, 2025, CompoSecure had

$9.5 million of cash and cash equivalents. The Company's liquidity needs are expected to be met with funding from the operations of CompoSecure Holdings. - Non-GAAP Financial Condition: At March 31, 2025, CompoSecure had

$71.7 million of cash and cash equivalents and$195.0 million of total debt, resulting in net debt of$180.7 million . This compares to cash and cash equivalents of$55.1 million and total debt of$335.6 million at March 31, 2024. CompoSecure’s bank agreement senior secured debt leverage ratio was 1.05x at March 31, 2025 compared to 1.34x at March 31, 2024.

Additional Highlights

- Vertical industry successes for Arculus include MetaMask (crypto payments), MoneyGram (cross-border payment services), and Circular (healthcare).

2025 Financial Outlook

CompoSecure is reiterating its previously issued full year 2025 guidance, which calls for mid-single digit growth in both Consolidated Net Sales and Pro Forma Adjusted EBITDA with sales momentum building through the year. This guidance includes payment of the Resolute Holdings management fee in 2025 and 2024, on a pro forma basis.

Conference Call

CompoSecure will host a conference call and live audio webcast today at 5:00 p.m. Eastern time to discuss its financial and operational results, followed by a question-and-answer session.

Date: Monday, May 12, 2025

Time: 5:00 p.m. Eastern time

Dial-in registration link: here

Live webcast registration link: here

If you have any difficulty registering or connecting with the conference call, please contact Elevate IR at (720) 330-2829.

A live webcast and replay of the conference call will be available on the investor relations section of CompoSecure’s website at https://ir.composecure.com/news-events/events.

About CompoSecure

Founded in 2000, CompoSecure (Nasdaq: CMPO) is a technology partner to market leaders, fintechs and consumers enabling trust for millions of people around the globe. The company combines elegance, simplicity and security to deliver exceptional experiences and peace of mind in the physical and digital world. CompoSecure’s innovative payment card technology and metal cards with Arculus security and authentication capabilities deliver unique, premium branded experiences, enable people to access and use their financial and digital assets, and ensure trust at the point of a transaction. For more information, please visit www.CompoSecure.com and www.GetArculus.com.

Forward-Looking Statements

This press release contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and assumptions of management. Although CompoSecure believes that its plans, intentions, and expectations reflected in or suggested by these forward-looking statements are reasonable, CompoSecure cannot assure you that it will achieve or realize these plans, intentions, or expectations. Forward-looking statements are inherently subject to risks, uncertainties, and assumptions. Generally, statements that are not historical facts, including statements concerning CompoSecure’s possible or assumed future actions, business strategies, events, or results of operations, are forward-looking statements. In some instances, these statements may be preceded by, followed by, or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends” or the negatives of these terms or variations of them or similar terminology. Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements which speak only as of the date hereof. You should understand that the following important factors, among others, could affect CompoSecure’s future results and could cause those results or other outcomes to differ materially from those expressed or implied in CompoSecure’s forward-looking statements: the ability of CompoSecure to grow and manage growth profitably, maintain relationships with customers, compete within its industry and retain its key employees; the possibility that CompoSecure may be adversely impacted by other global economic, business, competitive and/or other factors, including tariffs; the outcome of any legal proceedings that may be instituted against CompoSecure or others; future exchange and interest rates; changes in our accounting and/or financial presentation; and other risks and uncertainties, including those under “Risk Factors” in filings that have been made or will be made with the Securities and Exchange Commission. CompoSecure undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Use of Non-GAAP Financial Measures

Due to the spin-off of Resolute Holdings Management, Inc. and the resulting shift to equity method accounting under GAAP beginning February 28, 2025, CompoSecure is presenting a broader set of non-GAAP measures, including an Adjusted Statement of Operations (Unaudited), an Adjusted Balance Sheet (Unaudited), Consolidated Net Sales, Consolidated Gross Profit, Consolidated Gross Margin, Consolidated Total Cash, Consolidated Net Debt and related measures, to provide investors with financial information that we believe allows for greater comparability with our historical financial presentation and better represents the underlying performance of the standalone business across reporting periods.

This press release also includes certain non-GAAP financial measures that are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and that may be different from non-GAAP financial measures used by other companies. CompoSecure believes EBITDA, Adjusted EBITDA, Pro Forma Adjusted EBITDA, Adjusted Net Income, Adjusted EPS, Consolidated Net Sales, Consolidated Gross Profit, Consolidated Gross Margin, Consolidated Total Cash, Consolidated Net Debt and related measures are useful to investors in evaluating CompoSecure’s financial performance. Specifically, we believe EBITDA, Adjusted EBITDA, and Pro Forma Adjusted EBITDA provide valuable insight into operational efficiency independent of capital structure and tax environment; Adjusted Net Income and Adjusted EPS offer investors a clearer view of ongoing profitability by excluding non-recurring and non-operational items; and Consolidated Net Sales, Consolidated Gross Profit, Consolidated Gross Margin, Consolidated Total Cash, Consolidated Net Debt and related measures provide greater comparability with CompoSecure’s historical results, following the change in accounting presentation required as a result of the spin-off of Resolute Holdings. CompoSecure uses these non-GAAP measures internally to establish forecasts, budgets and operational goals to manage and monitor its business, as well as evaluate its underlying historical performance and/or measure incentive compensation. We believe that these non-GAAP financial measures depict the true performance of the business by encompassing only relevant and controllable events, enabling CompoSecure to evaluate and plan more effectively for the future.

EBITDA, Adjusted EBITDA, Pro Forma Adjusted EBITDA, Adjusted Net Income, Adjusted EPS, Consolidated Net Sales, Consolidated Gross Profit, Consolidated Gross Margin, Consolidated Total Cash, Consolidated Net Debt and related measures should not be considered as measures of financial performance under U.S. GAAP, and the items excluded from these measures are significant components in understanding and assessing CompoSecure’s financial performance. Accordingly, these key business metrics have limitations as an analytical tool. They should not be considered as an alternative to net income or any other performance measures derived in accordance with U.S. GAAP or as an alternative to cash flows from operating activities as a measure of CompoSecure’s liquidity. These non-GAAP measures may be different from similarly titled non-GAAP measures used by other companies. Additionally, CompoSecure’s debt agreements contain covenants based on variations of these measures for purposes of determining debt covenant compliance. CompoSecure believes that investors should have access to the same set of tools that its management uses in analyzing operating results. Please refer to the tables below for the reconciliation of GAAP measures to these non-GAAP measures.

Due to the forward-looking nature of the financial guidance included above, the charges excluded from the non-GAAP financial measures, including with respect to depreciation, amortization, interest, and taxes that would be required to reconcile the non-GAAP financial measures to GAAP measures are inherently uncertain or difficult to predict, so it is not feasible to provide accurate forecasted non-GAAP reconciliations without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included, and no reconciliation of the forward-looking non-GAAP financial measures is included.

Corporate Contact

Anthony Piniella

Head of Communications, CompoSecure

(917) 208-7724

apiniella@composecure.com

Investor Relations Contact

Sean Mansouri, CFA

Elevate IR

(720) 330-2829

CMPO@elevate-ir.com

| Non-GAAP Adjusted Balance Sheet | |||||||||

| (unaudited) | |||||||||

| $ Thousands | |||||||||

| GAAP | Non GAAP | ||||||||

| March 31, 2025 | March 31, 2025 | December 31, 2024 | |||||||

| ASSETS | |||||||||

| CURRENT ASSETS | |||||||||

| Cash and cash equivalents | $ | 9,506 | $ | 71,676 | $ | 77,461 | |||

| Accounts Receivable | - | 54,188 | 47,449 | ||||||

| Inventories, net | - | 47,501 | 44,833 | ||||||

| Prepaid expenses and other current assets | 1,321 | 4,138 | 4,159 | ||||||

| Total current assets | 10,827 | 177,503 | 173,902 | ||||||

| Property and equipment, net and right of use asset | - | 31,045 | 28,852 | ||||||

| Deferred tax asset | 266,652 | 266,652 | 264,815 | ||||||

| Other assets | - | 5,953 | 6,349 | ||||||

| Equity method Investment | 14,844 | - | - | ||||||

| Total Assets | $ | 292,323 | $ | 481,153 | $ | 473,918 | |||

| GAAP | Non GAAP | ||||||||

| March 31, 2025 | March 31, 2025 | December 31, 2024 | |||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||||

| CURRENT LIABILITIES | |||||||||

| Accounts payable | $ | 4,025 | $ | 15,263 | $ | 11,544 | |||

| Accrued expenses | 28,594 | 50,865 | 25,711 | ||||||

| Current portion of long-term debt | - | 12,500 | 11,250 | ||||||

| Other current liabilities | 14,474 | 16,513 | 27,817 | ||||||

| Total current liabilities | 47,093 | 95,141 | 76,322 | ||||||

| Long-term debt, net of deferred finance costs | - | 180,713 | 184,389 | ||||||

| Warrant liability | 84,003 | 84,003 | 104,231 | ||||||

| Lease liabilities, operating leases | - | 7,723 | 3,888 | ||||||

| Tax receivable agreement liability | 248,534 | 248,534 | 248,534 | ||||||

| Total liabilities | 379,630 | 616,114 | 617,364 | ||||||

| Shareholder's deficit | (87,307 | ) | (134,961 | ) | (143,446 | ) | |||

| Total liabilities and shareholder's deficit | $ | 292,323 | $ | 481,153 | $ | 473,918 | |||

| Source: Company financials | |||||||||

| Note: Financial position has been derived from CompoSecure’s consolidated financial statements for the quarter ended March 31, 2025 and December 31, 2024, respectively. | |||||||||

Consolidated Statement of Operations

(in thousands, expect per share amounts)

(unaudited)

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0c465be5-5786-474a-8786-405d31f54c99

| Consolidated Statements of Cash Flows | ||||||

| (in thousands) | ||||||

| (unaudited) | ||||||

| Three Months Ended March 31, | ||||||

| 2025 | 2024 | |||||

| CASH FLOWS FROM OPERATING ACTIVITES: | ||||||

| Net (loss) income | $ | 21,492 | $ | 17,073 | ||

| Adjustments to reconcile net income to net cash provided by operating activities | ||||||

| Depreciation and amortization | 2,273 | 2,221 | ||||

| Stock-based compensation expense | 5,721 | 4,397 | ||||

| Amortization of deferred finance costs | 131 | 345 | ||||

| Non-cash operating lease expense | 615 | 584 | ||||

| Revaluation of earnout consideration liability | (11,230 | ) | 1,459 | |||

| Revaluation of warrant liability | (17,921 | ) | 7,397 | |||

| Change in fair value of derivative liability | - | 297 | ||||

| Deferred tax expense | (1,837 | ) | (1,867 | ) | ||

| Changes in assets and liabilities | ||||||

| Accounts receivable | (6,739 | ) | 5,378 | |||

| Inventories | (2,668 | ) | (2,657 | ) | ||

| Prepaid expenses and other assets | 21 | (119 | ) | |||

| Accounts payable | 3,719 | (446 | ) | |||

| Accrued expenses | 29,585 | 1,486 | ||||

| Lease liabilities | (578 | ) | (603 | ) | ||

| Other liabilities | (4,430 | ) | (1,194 | ) | ||

| Net cash provided by operating activities | 18,154 | 33,751 | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||

| Purchase of property and equipment | (576 | ) | (1,613 | ) | ||

| Capitalized software expenditures | (580 | ) | - | |||

| Net cash used in investing activities | (1,156 | ) | (1,613 | ) | ||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||

| Proceeds from warrants and exercise of options | 5,009 | 107 | ||||

| Payments for taxes related to net share settlement of equity awards | (15,284 | ) | (3,476 | ) | ||

| Payment due to Spin-Off | (10,008 | ) | - | |||

| Payment of term loan | (2,500 | ) | (4,688 | ) | ||

| Tax distributions to non-controlling members | - | (10,151 | ) | |||

| Net cash used in financing activities | (22,783 | ) | (18,208 | ) | ||

| Net increase (decrease) in cash and cash equivalents | (5,785 | ) | 13,930 | |||

| Cash and cash equivalents, beginning of period | 77,461 | 41,216 | ||||

| Cash and cash equivalents, end of period | $ | 71,676 | $ | 55,146 | ||

| Supplementary disclosure of cash flow information | ||||||

| Cash paid for interest expense | $ | 3,299 | $ | 4,175 | ||

| Supplemental disclosure of non-cash financing activity: | ||||||

| Derivative asset - interest rate swap | $ | (753 | ) | $ | 452 | |

| Source: Company financials | ||||||

| Note: Operating results have been derived from CompoSecure's consolidated financial statements for the three months ended March 31, 2025 and 2024, respectively. | ||||||

| Q1 Earnings Per Share: Non-GAAP Reconciliation | |||||||||||||

| Basic | Diluted | ||||||||||||

| Three Months Ended March 31, | Three Months Ended March 31, | ||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||

| (in thousands) | (in thousands) | ||||||||||||

| Net income | $ | 21,492 | $ | 17,073 | Adjusted net income | $ | 28,412 | $ | 23,317 | ||||

| Add(less): provision (benefit) for income taxes | 27,004 | (836 | ) | Add: Interest on Exchangeable Notes net of tax | - | 1,781 | |||||||

| Income before Income taxes | 48,496 | 16,237 | Adjusted net income used in computing net income per share, diluted (5) | 28,412 | 25,098 | ||||||||

| Add (Less): mark-to-market adjustments (1) | (29,151 | ) | 9,153 | Common shares outstanding used in computing earnings per share, diluted: | 102,040 | 80,525 | |||||||

| Add: stock-based compensation | 5,720 | 4,397 | Warrants (4) | 9,878 | 8,094 | ||||||||

| Add: spin-off cost | 5,019 | - | Exchangeable Notes (5) | - | 13,000 | ||||||||

| Adjusted net income before tax | 30,084 | 29,787 | Equity awards | 3,533 | 2,710 | ||||||||

| Income tax expense (2) | 1,672 | 6,470 | Total Shares outstanding used in computing adjusted earnings per share-Diluted | 115,451 | 104,329 | ||||||||

| Adjusted net income | 28,412 | 23,317 | Adjusted net income per share - Diluted | $ | 0.25 | $ | 0.24 | ||||||

| Common shares outstanding used in computing net income per share, basic: | |||||||||||||

| Class A and Class B common shares (3) | 102,040 | 80,525 | |||||||||||

| Adjusted net income per share - basic | $ | 0.28 | $ | 0.29 | |||||||||

| Source: Company Financials | |||||||||||||

| 1) Includes the changes in fair value of warrant liability, make-whole provision of Exchangeable Notes and earnout consideration liability. | |||||||||||||

| 2) Reflects current and deferred income tax expenses. For the three months ended March 31, 2024 it was calculated using the Company's blended tax rate as if the Company did not have any non-controlling interest associated with its historical Up-C structure. For the three months ended March 31, 2025, it was calculated by applying the Company's blended tax rate to the presented adjustments and including the Company's provision less tax associated with a taxable gain from the distribution of appreciated property related to the Spin-Off. | |||||||||||||

| 3) Assumes both Class A and Class B shares participate in earnings and are outstanding at the end of the period. There were no Class B shares outstanding as of March 31, 2025. | |||||||||||||

| 4) Assumes treasury stock method, valuation at assumed fair market value of | |||||||||||||

| 5) The Exchangeable Notes were included through the application of the "if-converted" method. Interest related to the Exchangeable Notes, net of tax was excluded from net income. No Exchangeable notes were outstanding during the three months ended March 31, 2025. | |||||||||||||