Canter Resources Highlights Boron's Addition to U.S. Critical Minerals List-Unlocking Strategic Advantages for the Columbus Lithium-Boron Project in Nevada

Rhea-AI Summary

Canter Resources (OTC: CNRCF) announced that boron was added to the USGS 2025 List of Critical Minerals, increasing eligibility for strategic federal support for boron projects and elevating the strategic profile of the Columbus Lithium-Boron Project in Nevada.

Key disclosed facts: an estimated 8 km by 6.5 km lithium-boron mineralized footprint; surface boron up to 30,000 ppm; shallow brine values up to 1,730 mg/L total and 820 mg/L dissolved; proximity (~27 km) to Ioneer’s Rhyolite Ridge and a recent nearly $1 billion DOE funding package for that project. Canter targets exploration and potential discovery exposure in H1 2026.

Positive

- Boron added to USGS 2025 Critical Minerals List

- Estimated 8 km by 6.5 km lithium-boron mineralized footprint

- Surface sediment boron up to 30,000 ppm

- Shallow brine results up to 1,730 mg/L total B and 820 mg/L dissolved B

- Proximity (~27 km) to DOE-backed Rhyolite Ridge project with nearly $1B funding

Negative

- Historic nearby production and neighboring projects do not guarantee Columbus mineralization

- Key higher-grade lithium at depth is unproven

News Market Reaction

On the day this news was published, CNRCF gained 4.23%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - November 17, 2025) - Canter Resources Corp. (CSE: CRC) (OTC Pink: CNRCF) (FSE: 6010) ("Canter" or the "Company") Canter Resources is pleased to announce the addition of boron ("B") to the United States Geological Survey's (USGS) 2025 List of Critical Minerals. This significant development elevates boron alongside lithium and fifty-eight additional commodities eligible for strategic government funding and policy support due to the vital role they play in the technology, energy, national security, and advanced manufacturing sectors.

Long considered a strategic mineral by the Department of War, boron's new classification as a critical mineral is expected to further accelerate domestic investment in boron projects across the U.S., as seen with the recent nearly

Joness Lang, CEO of Canter, commented: "We believe Columbus features one of North America's most prospective untapped sources of both lithium and boron, two minerals now both recognized as critical by the U.S. government. Boron is essential for high-strength glass, permanent magnets, fertilizers and EV battery chemistries, making it increasingly strategic for decarbonization and U.S. critical minerals supply security. The need for more domestic supply of critical minerals has never been more salient, and we look forward to providing shareholders with exploration and discovery exposure during H1/2026."

Boron & Lithium Highlights

Widespread Boron System Across a Large Footprint: Historic and modern drilling/sampling confirm a broad lithium-boron mineralized system extending across an estimated 8 km by 6.5 km area of the Columbus Basin, with both sediment-hosted and brine-hosted B anomalism indicating a significant, basin-scale evaporative footprint.

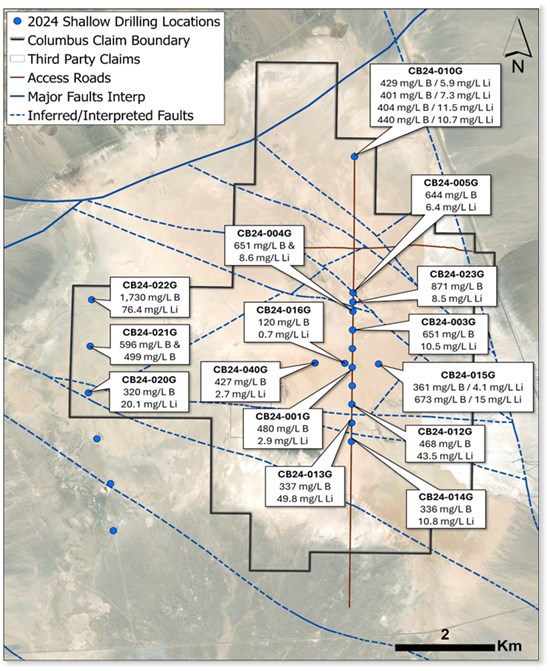

High-Grade Boron Values in Multiple Media: Field programs returned up to 30,000 ppm B in solid sediment samples, complemented by up to 1,730 mg/L B (Total) and 820 mg/L (Dissolved) in shallow brine samples, demonstrating strong enrichment in both clastic units and active brine generation (see news release dated October 15, 2024 and Figure 1). These results align with historical accounts of late-1800s borate brine production in the district (see Image 1).

Clear Northerly Trend in Increasing B Grades: Geochemical mapping and stratigraphic correlations reveal a progressive increase in boron concentrations toward the northern structural corridor, coincident with the Company's two highest-priority targets for future exploration well drilling. This trend supports the presence of a concentrated, structurally focused boron-enriched brine domain.

Strategic Importance Elevated by U.S. Critical Mineral Status: Boron's addition to the 2025 U.S. Critical Minerals List enhances the strategic potential of the Columbus Project, positioning Canter to benefit from improved eligibility for federal funding, streamlined permitting pathways, and heightened institutional interest in domestic boron supply.

- Clear Potential for Higher-Grade Lithium at Depth: Structural and hydrological similarities between the Columbus Basin and Clayton Valley-Nevada's premier lithium-producing basin-indicate that deeper aquifers may host more concentrated lithium-boron brines. With shallow zones already returning substantial anomalous values and evidence of structural traps within a closed hydrological system, Columbus exhibits the hallmarks of a maturing lithium-boron brine basin capable of delivering significantly higher grades at depth.

Notes: B = Boron, mg/L = milligram per liter, ppm = parts per million, km = kilometre

Image 1. Historic marker at the Columbus Project entrance referencing historical borax operations

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10112/274668_ca7349b634e45a94_001full.jpg

Figure 1. Shallow (<120 feet) Boron brine results from Geoprobe Drilling Completed by Canter

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10112/274668_1599bc2f948db965_002full.jpg

Note: Mineralization at nearby or adjacent properties is not necessarily indicative of mineralization hosted at the Company's Columbus Project.

Qualified Person (QP)

The technical information contained in this news release was reviewed and approved by Eric Saderholm P.Geo, Director and Technical Advisor of Canter Resources, a Qualified Person (QP), as defined under National Instrument 43- 101 - Standards of Disclosure for Mineral Projects.

For more information about boron and lithium, please visit the Company's Boron 101 and Lithium 101 pages on the Company's website.

About Canter Resources Corp.

Canter Resources Corp. is a junior mineral exploration company advancing the Columbus Lithium-Boron Project and the Railroad Valley (RV) Lithium-Boron Project in Nevada, USA. The Company is completing a phased drilling approach at Columbus to test highly prospective brine targets at varying depths for lithium-boron enrichment and plans to leverage the Company's critical metals targeting database to generate a portfolio of high-quality projects with the aim of defining mineral resources that support the technology and domestic clean energy supply chains in North America.

On behalf of the Board of Directors.

For further information contact:

Joness Lang

Chief Executive Officer

Canter Resources Corp.

Tel: 778.382.1193

jlang@canterresources.com

For investor inquiries contact:

Kristina Pillon, High Tide Consulting Corp.

Tel: 604.908.1695

investors@canterresources.com

References:

USGS 2025 Critical Minerals List.: https://www.usgs.gov/programs/mineral-resources-program/science/about-2025-list-critical-minerals

The Canadian Securities Exchange has neither approved nor disapproved the contents of this news release. The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this news release.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking statements" within the meaning of applicable securities laws. All statements contained herein that are not clearly historical in nature may constitute forward-looking statements. Generally, such forward-looking information or forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or may contain statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "will continue", "will occur" or "will be achieved". The forward-looking information and forward-looking statements contained herein include, but are not limited to, statements regarding the Company's plans for the Project and the payments related thereto, the issuance of the Consideration Shares and the Company's expected exploration activities.

These statements involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements to differ materially from those expressed or implied by such statements, including but not limited to: requirements for additional capital; future prices of minerals; changes in general economic conditions; changes in the financial markets and in the demand and market price for commodities; other risks of the mining industry; the inability to obtain any necessary governmental and regulatory approvals; changes in laws, regulations and policies affecting mining operations; hedging practices; and currency fluctuations.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on any forward-looking statements or information. No forward-looking statement can be guaranteed. Except as required by applicable securities laws, forward-looking statements speak only as of the date on which they are made and the Company does not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/274668