Cosa Announces Option of Aurora Project to Traction Uranium for Over $10 Million in Consideration and Project Expenditures

Rhea-AI Summary

Cosa Resources (TSXV: COSA / OTCQB: COSAF) has granted Traction Uranium (CSE: TRAC) an option to earn up to an 80% interest in the Aurora uranium project effective February 10, 2026. Consideration includes over $9 million in partner-funded exploration, $1.5 million in cash payments and 5 million shares of Traction.

Cosa will act as initial project operator and collect an operator fee. Aurora has not been drilled since 1979; recent geophysics by Cosa identified priority targets. Cosa says its primary focus remains on Darby and Murphy Lake North JV programs.

Positive

- Partner-funded exploration >$9 million committed

- Traction can earn up to an 80% project interest

- Cosa to receive $1.5 million cash consideration

- Cosa to receive 5 million Traction shares

- Cosa to act as initial project operator and earn operator fee

Negative

- Aurora not drilled since 1979, indicating early-stage technical risk

- Cosa states primary focus remains on Darby and Murphy Lake North

Vancouver, British Columbia--(Newsfile Corp. - February 11, 2026) - Cosa Resources Corp. (TSXV: COSA) (OTCQB: COSAF) (FSE: SSKU) ("Cosa" or the "Company") is pleased to report it has signed an option agreement (the "Agreement") with Traction Uranium Corp. ("Traction") (CSE: TRAC) (OTCQB: TRCTF) (FSE: Z1K) pursuant to which Traction has a right to earn up to an

Highlights

Total consideration and expenditure commitments for up to

80% of the Aurora Project includes over$9 million in partner funded exploration,$1.5 million in cash payments, and 5 million shares of TractionCosa to be initial project operator and collect an operator fee

Aurora has not been drilled since 1979 with few drill holes effectively evaluating basement stratigraphy; geophysical work completed by Cosa has identified initial target areas

Keith Bodnarchuk, President and CEO of Cosa commented: "Cosa's primary focus remains on testing high-priority drill targets at the Darby and Murphy Lake North Joint Ventures with Denison Mines, including the ongoing fully funded drill program at the Darby Project. Advancing Darby and Murphy Lake North will continue to be a top priority for the Company, however we are committed to advancing the remainder of our eastern Athabasca portfolio with dedicated partners. Aurora is well located in the southeastern Athabasca Basin, and initial work by Cosa has identified several priority target areas. We are excited to work with the team at Traction Uranium to advance Aurora."

About the Agreement

Traction can earn up to an

Table 1 - Aurora Option Terms

| Exploration Expenditures | Cash Payments | Shares of Traction | Traction Total Ownership | Deadline | |

| Signing | 250,000 | ||||

| Phase 1 | 500,000 | 31 December 2026* | |||

| Phase 2 | 500,000 | 31 December 2027 | |||

| Phase 3 | 750,000 | 31 December 2028 | |||

| Phase 4 | 1,000,000 | 31 December 2029 | |||

| Phase 5 | 2,000,000 | 31 December 2030 | |||

| 5,000,000 |

*Includes cash payments of

Upon completion of each of phases 2 through 5, Traction will have the option to continue the earn-in or elect to enter a Joint Venture with Cosa. Traction is entitled to expedite the earn-in and advance the exploration work plan as desired. Should Traction terminate the Agreement before completion of phases 1 and 2, all consideration paid to Cosa will be forfeited and Cosa's ownership of Aurora will revert to

Shares of Traction that are issued to Cosa will be subject to a standard hold period of four months and one day following the date of issuance, pursuant to Canadian securities regulations.

About Aurora

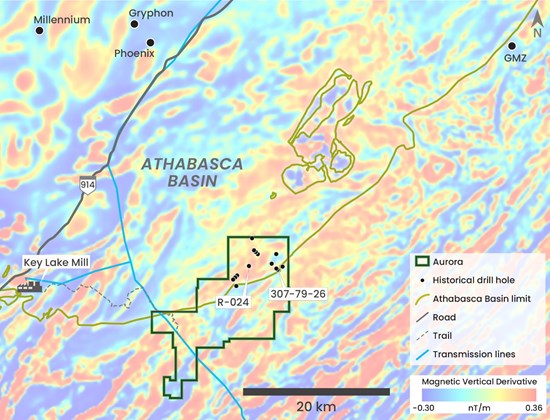

Aurora covers a 17-kilometre section of the southeastern rim of the Athabasca Basin located 16 kilometres east of Key Lake, the site of an operational uranium mill and past producing uranium mine, and 40 kilometres south of the GMZ (Figure 1). Sandstone cover is expected to be less than 100 metres thick in the northern third of Aurora and absent in the remainder. Though no diamond drilling has been completed on the Project since 1979, review of historical drill hole logs has identified several zones of hydrothermal alteration. Airborne gravity gradient and Versatile Transient Electromagnetic (VTEM) surveying completed by Cosa in 2024 identified initial target areas at Aurora.

Next Steps

Property-wide airborne radiometric surveying is expected to commence once conditions permit and follow up plans include ground-truthing, prospecting and surficial sampling. Cosa and Traction aim to undertake drilling at Aurora in 2027.

Figure 1 - The Aurora Project Location

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9865/283497_c021519574d24aae_003full.jpg

About Cosa Resources Corp.

Cosa Resources is a Canadian uranium exploration company operating in northern Saskatchewan. The portfolio comprises roughly 237,000 ha across multiple underexplored

In January of 2025, the Company entered a transformative strategic collaboration with Denison Mines (TSX: DML) (NYSE American: DNN) that has secured access to several additional highly prospective eastern Athabasca uranium exploration projects. As Cosa's largest shareholder, Denison gains exposure to Cosa's potential for exploration success and its pipeline of uranium projects.

Cosa's award-winning management team has a track record of success in Saskatchewan. In 2022, members of the Cosa team were awarded the AME Colin Spence Award for the discovery of the Hurricane uranium deposit. Cosa personnel led teams or had integral roles in the discovery of Denison's Gryphon deposit and held key roles in the founding of both NexGen and IsoEnergy.

The Company's focus throughout 2026 is drilling at the Darby and MLN projects in the eastern Athabasca Basin. Both projects are operated by Cosa and are 70/30 joint ventures between Cosa and Denison respectively. Drilling is ongoing at Darby and will evaluate target areas with anomalous uranium, clay alteration, and historical mineralization intersected nearby. Drilling at MLN will follow up 2025 drilling which intersected broad zones of structurally controlled alteration over roughly 2 kilometres of strike length.

About Traction Uranium Corp.

Traction Uranium Corp. (CSE: TRAC) (OTCQB: TRCTF) (FSE: Z1K) is in the business of mineral exploration and the development of discovery prospects in Canada, including its uranium project in the world-renowned Athabasca Region.

Technical Disclosure

Historical drilling results from Aurora are available within the Saskatchewan Mineral Assessment Database references 74H-0024, 74H07-0017, and 74H07-0031. Confirmatory relogging of these drill holes has not been completed as the core storage locations are unknown or have been destroyed by wildfire.

Qualified Person

The Company's disclosure of technical or scientific information in this press release has been reviewed and approved by Andy Carmichael, P.Geo., Vice President, Exploration for Cosa. Mr. Carmichael is a Qualified Person as defined under the terms of National Instrument 43-101.

Contact

Keith Bodnarchuk, President and CEO

info@cosaresources.ca

+1 888-899-2672 (COSA)

Cautionary Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains forward-looking information within the meaning of Canadian securities laws (collectively "forward-looking statements"). Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, plans, postulate and similar expressions, or are those, which, by their nature, refer to future events. All statements that are not statements of historical fact are forward-looking statements. Forward-looking statements in this press release include but are not limited to statements regarding, the Company's exploration and development plans. Although the Company believes any forward-looking statements in this press release are reasonable, it can give no assurance that the expectations and assumptions in such statements will prove to be correct. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, and other risks involved in the mineral exploration and development industry, including those risks set out in the Company's management's discussion and analysis as filed under the Company's profile at www.sedarplus.ca. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including the price of uranium and other commodities; costs of exploration and development; the estimated costs of development of exploration projects; the Company's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, other than as required by applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/283497