Cerrado Gold Announces First Quarter 2025 Financial Results

Rhea-AI Summary

Positive

- Record heap leach production of 6,897 GEO in Q1

- Revenue increased to $28.8M from $20.4M YoY

- Strong cash balance over $20M maintained

- Net loss improved to $4.2M from $7.3M YoY

- Total cash costs decreased by 7% to $1,902/oz from $2,042/oz YoY

- Successful expansion of crushing infrastructure completed

- Underground development initiated, production to start in Q3

Negative

- AISC remains high at $1,932/oz

- Higher production costs due to increased equipment rentals and labor costs

- Processing of lower-grade stockpiles continuing through Q2

- Increased costs expected due to underground mining and continued inflationary pressure in Argentina

News Market Reaction

On the day this news was published, CRDOF gained 2.72%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Gold equivalent production of 11,163 Gold Equivalent Ounces ("GEO") for Q1

Full year guidance of 55,000-60,000 GEO maintained

Adjusted EBITDA of

$4.8 million for Q1, 2025 and Cash balance over US$20m Management to host conference call on 29th of May, 11AM EDT

TORONTO, ON / ACCESS Newswire / May 29, 2025 / Cerrado Gold Inc. (TSX.V:CERT)(OTCQX:CRDOF)(FRA:BAI0) ("Cerrado" or the "Company") announces its operational and financial results for the first quarter ("Q1/25") including its Minera Don Nicolas ("MDN") gold mine in Santa Cruz Province, Argentina, and its Mont Sorcier High Purity DRI Iron Project in Quebec.

Production results for MDN were previously released on April 15, 2025. The Company's financial results are reported and available on SEDAR+ (www.sedarplus.com) and the Company's website (www.cerradogold.com).

Q1/25 MDN Operating Highlights

Q1/25 production of 11,163 GEO and AISC of

$1,932 /ozUnit costs set to decline as production increases (target US

$1,500 -1,700)

Q1/25 Adjusted EBITDA of

$4.8 million Record heap leach production of 6,897 GEO During the Quarter

Secondary crusher operational and underground development started

Operational results for the first quarter saw gold production in line with Q1/24, with the heap leach operation reaching a new production record of 6,897 GEO for the quarter. The expanded crusher is now fully operational and the quantity of ore being placed on the pad has increased. With higher gold prices, the CIL plant continues to process lower-grade stockpiles and is planned to continue processing low grade stockpiles through Q2/25, after which it will be blended with new high-grade material from the underground mining operations which will increase the average grade throughput at the mill.

Mark Brennan, CEO and Chairman commented, "The results from the first quarter demonstrate robust and improving production from our Heap leach operations; delivering strong cashflow to support our growth initiatives. We have successfully expanded and improved our crushing capacity at MDN, which will yield greater production and cashflows moving forward. Likewise, the preparation for underground development and production have added costs but will add to our production and cash flows starting in July. The strong cash flow combined with our cash balance has enabled us to continue to pay down debt at MDN, and will allow us to continue to deploy capital at our high-grade Mont Sorcier DRI iron project and our well advanced and highly prospective Lagoa Salgada Project."

Operating Results for the Quarter

The addition of the new crusher circuit was completed just after quarter end, providing increased ore availability to the pad. While supporting higher production, additional crushing facilities are also expected to reduce the feed size to the pad and thus improve recoveries. As the reduced size feed and larger pad stockpiles are leached, it should lead to higher production rates and unit costs are expected to decline as a result.

Post quarter end saw the initiation of activities at our underground operation. The Paloma pit has been dewatered, orders for long lead items have been placed and initial development of the portal commenced in May. The development of the underground remains on schedule for initial production during the 3rd quarter of this year.

Cerrado has continued to make improvements to its balance sheet during the quarter. The cash balance remained strong at over US

The focus at MDN remains to ramp up production rates at its heap leach operation to 4,000-4,500 GEO per month, initiate underground production from the Paloma area in Q3, and ramp up a new targeted exploration program across our 330k Ha property targeted to increase resources and mine life. The Company is well positioned to continue its debt and payables reduction program at MDN as well as to fund future development and exploration at MDN and push forward its development projects in Quebec and in Portugal. In Portugal, we aim to complete the optimized feasibility study in Q3 and reach a construction decision by year end. In Quebec, work on advancing the feasibility study for the Mont Sorcier High grade iron project formally commenced during the quarter and remains on target for completion in Q1/2026.

Q1 Financial Performance

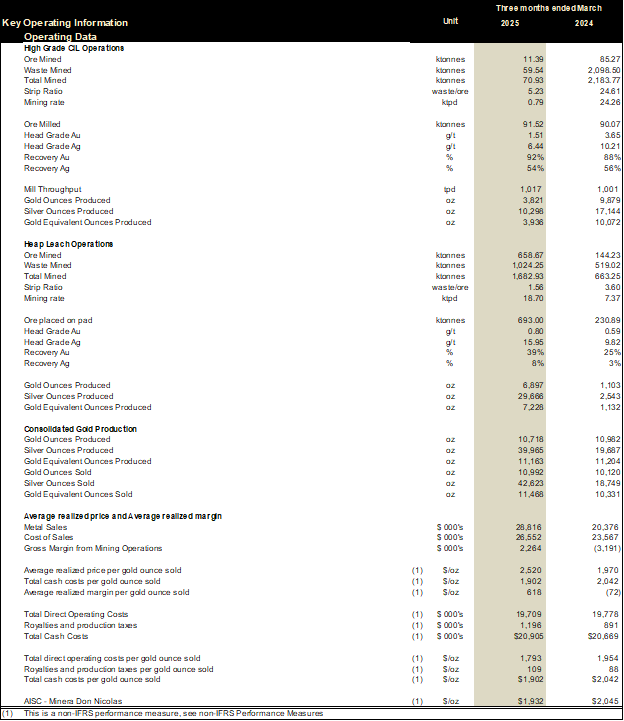

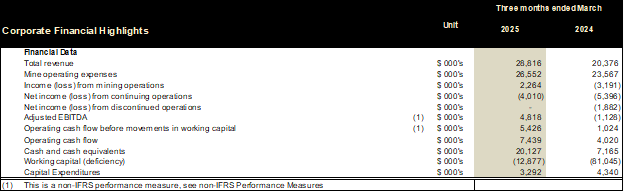

Table 1. Q1 2025 Operational and Financial Performance

The Company produced 11,163 gold equivalent ounces ("GEO") during the three months ended March 31, 2025, as compared to 11,204 GEO for the three months ended March 31, 2024. Production is consistent with the prior year period. In the period ended March 31, 2025, heap leach production was significantly higher compared to prior year due to

The Company generated revenue of

Cost of sales for the three months ended March 31, 2025, were

Total cash costs (including royalties) per ounce sold was

Net loss from continued and discontinued operations for the three months ended March 31, 2025, was

The Company incurred general and administrative expenses of

Other loss of

Hedging Program

On April 26, 2025 the Company extended its limited hedging program with Ocean Partners UK Ltd. The hedge is constructed as a zero-cost collar with lower and upper boundaries of US

Outlook

Entering the second quarter of 2025 and beyond, Cerrado's MDN Heap Leach operations are set to benefit from the completion of its crushing infrastructure to grow and improve production. Higher gold prices have enabled the plant to remain operational by processing lower grade stockpiles through March and April. The underground operations have begun and production is expected to begin in Q3.

As noted in the Press Release dated April 15, 2025, the Company raised its 2025 annual production guidance to 55,000 - 60,000 GEO. AISC costs are expected to be modestly higher than previously anticipated with an AISC of between

A new Exploration initiative began in Q1 with the focus on growing the known resources at MDN beyond those outlined in the recent Mineral Resource Estimate ("MRE"). The focus remains on defining high grade-near surface targets that can readily be brought into the mine plan, underground exploration and a regional program to better understand the potential of known anomalies on the significant land package Cerrado holds at MDN. Drilling is expected to commence in early June.

At the Mont Sorcier high grade and high purity DRI iron project operated by Cerrado's wholly owned subsidiary Voyager Metals Inc., work continued to advance the project with several workstreams related to permitting, social license and the initiation of the Feasibility Study which is targeted to be completed during Q1 2026. The high quality of the concentrate, grading over

The Company recently closed the acquisition of all of the outstanding common shares of Ascendant Resources Inc. not already owned by the Company. The Company will continue to advance the Lagoa Salgada VMS project through several key workstreams, including the ongoing metallurgical test work, which is currently on track to be completed towards the end of Q2 2025, completion of the optimized feasibility study by Q3 2025 and advancing the approval in the Environment Impact Assessment, expected to be received in June. The Company remains focused on advancing the Project to reach a construction decision , which is currently expected by year end.

Conference Call Details

Cerrado Management will host a conference call on May 29, 2025, at 11:00 AM EDT to discuss the Q1 Financial and Operational results. The presentation for the call can be found on the investor page on Cerrado Gold's website at cerradogold.com. Call details are as follows:

Pre-Registration for Conference Call

Participants can preregister for the conference by navigating to:

https://dpregister.com/sreg/10200183/ff3862e66f

Participants will receive dial-in numbers to connect directly upon registration completion.

Those without internet access or unable to pre-register may dial in by calling:

PARTICIPANT DIAL IN (TOLL FREE): 1-833-752-3576

PARTICIPANT INTERNATIONAL DIAL IN: 1-647-846-8340

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Andrew Croal P.Eng, Chief Technical Officer for Cerrado Gold, who is a Qualified Person as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company. The Company is the

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias heap leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Portugal, Cerrado focused on the exploration and development of the highly prospective Lagoa Salgada VMS project located on the prolific Iberian Pyrite Belt in Portugal. The Lagoa Salgada project is a high-grade polymetallic project, demonstrating a typical mineralization endowment of zinc, copper, lead, tin, silver, and gold. Extensive exploration upside potential lies both near deposit and at prospective step-out targets across the large 7,209-hectare property concession. Located just 80km from Lisbon and surrounded by exceptional infrastructure, Lagoa Salgada offers a low-cost entry to a significant exploration and development opportunity, already showing its mineable scale and cashflow generation potential.

In Canada, Cerrado holds a

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, anticipated continued improvements in operating results and working capital position, expectations regarding the CIL plant processing lower grade stockpiles, the potential for improvement at MDN's heap leach operation, expectations regarding improvements in operating costs at MDN including AISC, additional capacity being added at the heap leach operation, the potential of and timing for the anticipated underground operation at MDN the anticipated timing of completing the feasibility study at the Mont Sorcier project, the potential for a construction decision at Lagoa Salgada by year end and the expected timing and likelihood of receiving approval of the environmental impact assessment at Lagoa Salgada.. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View the original press release on ACCESS Newswire