Critical Elements Lithium Summer Exploration Plans

Rhea-AI Summary

Positive

- Secured $20 million conditional funding from Natural Resources Canada's Critical Minerals Infrastructure Fund

- Received support letter for up to US$115 million in project debt financing from a Canadian financial institution

- Completed comprehensive 2,701-line kilometre VTEM survey across extensive 1,050 square kilometre portfolio

Negative

- None.

News Market Reaction

On the day this news was published, CRECF declined 0.32%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

MONTRÉAL, QC / ACCESS Newswire / May 12, 2025 / Critical Elements Lithium Corporation (TSX-V:CRE)(US OTCQX:CRECF)(FSE:F12) ("Critical Elements" or the "Corporation") is pleased to announce the recommencement of active exploration on its highly prospective, 1,050 square kilometre land portfolio, including the

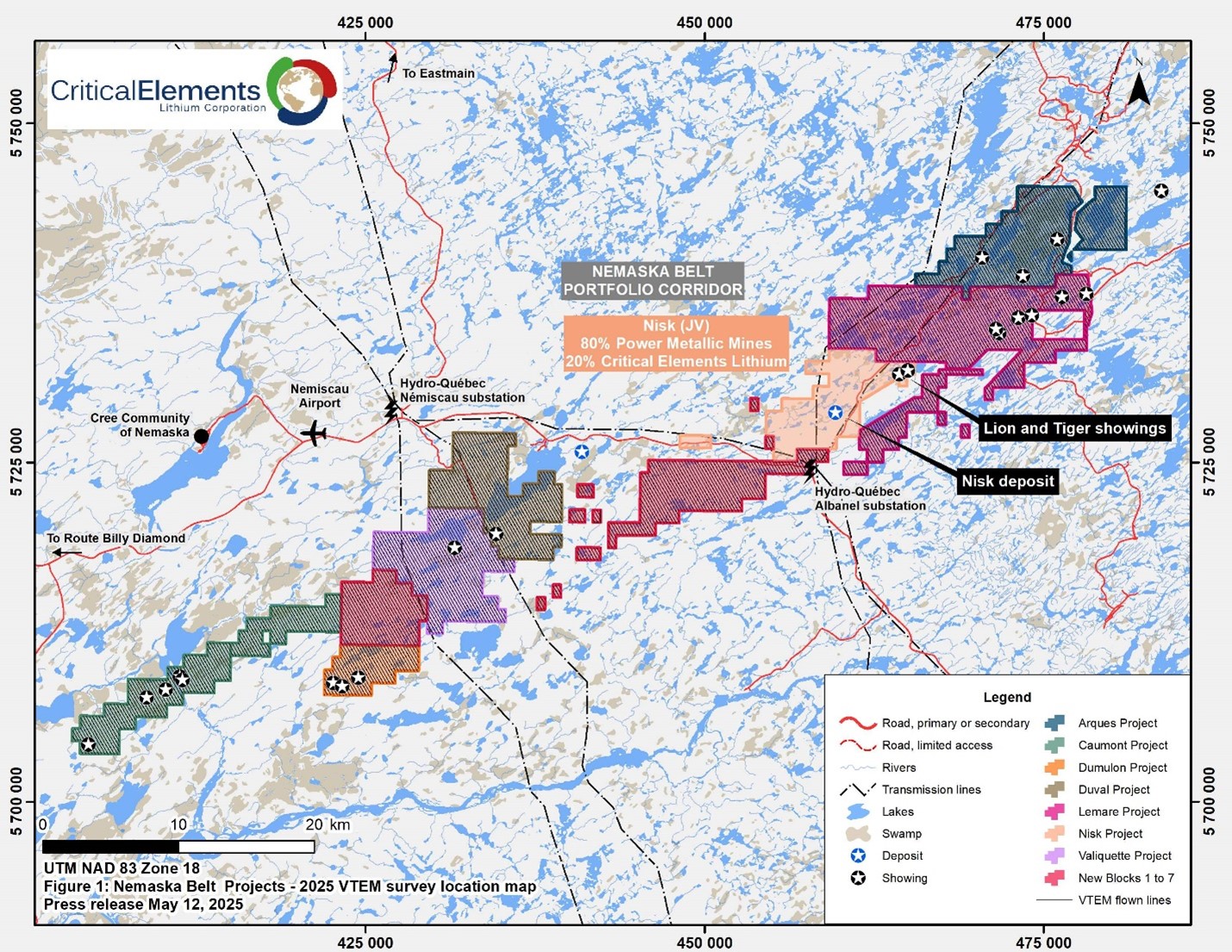

An important helicopter-borne electromagnetic VTEM plus time-domain system ("VTEM") survey covering the Nemaska Belt group of properties in the Eeyou Istchee region of Québec has been completed (Figure 1). The 2,701-line kilometre VTEM survey executed by Geotech Airborne Geophysical Survey covers the entirety of Critical Elements'

Figure 1: VTEM survey map Nemaska Belt properties

The Corporation plans to begin a surface exploration program on the Nemaska Belt portion of the portfolio and the Rose blocks at the end of May and intends to pursue a prospecting, mapping, and sampling program until late August. Dahrouge Geological Consulting Ltd. ("Dahrouge") has been mandated to perform the summer exploration program targeting potentially economic mineralization including high-grade Nickel-Copper-PGE as well as lithium-bearing spodumene.

Management continues to be engaged in assembling the funding required to make a final investment decision on the Corporation's flagship Rose Lithium-Tantalum project. These efforts build on the

Qualified Person

François Gagnon, P. Geo, Operations Director - Québec for Dahrouge Geological Consulting Ltd., is the Qualified Person who has reviewed and approved the technical content of this press release on behalf of the Corporation.

About Critical Elements Lithium Corporation

Critical Elements aspires to become a large, responsible supplier of lithium to the flourishing electric vehicle and energy storage system industries. To this end, Critical Elements is advancing the wholly-owned, high-purity Rose Lithium-Tantalum project in Québec, the Corporation's first lithium project to be advanced within a land portfolio of over 1,050 km2. On August 29, 2023, the Corporation announced results of a new Feasibility Study on Rose for the production of spodumene concentrate. The after-tax internal rate of return for the Project is estimated at

For further information, please contact:

Jean-Sébastien Lavallée, P. Géo.

Chief Executive Officer

819-354-5146

jslavallee@cecorp.ca

www.cecorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is described in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary statement concerning forward-looking statements

This news release contains "forward-looking information" within the meaning of Canadian Securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "scheduled", "anticipates", "expects" or "does not expect", "is expected", "scheduled", "targeted", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information contained herein include, without limitation, statements relating to the results and completion of the 2025 exploration program and its related objectives, securing a strategic partnership and project financing leading to a Final Investment Decision. Forward-looking information is based on assumptions management believes to be reasonable at the time such statements are made. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Although Critical Elements has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Factors that may cause actual results to differ materially from expected results described in forward-looking information include, but are not limited to: final and complete results of the Corporation's 2025 exploration program and effects on the Corporation's stated objectives, as well as those risk factors set out in the Corporation's Management Discussion and Analysis for its most recent quarter ended February 28, 2025 and other disclosure documents available under the Corporation's SEDAR profile. Forward-looking information contained herein is made as of the date of this news release and Critical Elements disclaims any obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Forward-looking information contained herein is made as of the date of this news release. Although the Corporation has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

SOURCE: Critical Elements Lithium Corp.

View the original press release on ACCESS Newswire