Dakota Gold Provides Feasibility Study Metallurgy Testing Plan and Initial Results for Richmond Hill

Rhea-AI Summary

Dakota Gold (NYSE American: DC) updated its Feasibility Study metallurgical program for the Richmond Hill oxide heap leach project, reporting initial column test results and program scope.

Key facts: two MW3 composites graded 0.96 g/t Au (23.1 g/t Ag) and 0.53 g/t Au (17.3 g/t Ag); column recoveries of 61%–65% achieved in under 60 days; ~4,000 kg of material to be shipped representing 28 geo-metallurgical domains; over 30 column tests planned and FS completion targeted for Q3 2026. The company will update the resource in 2026 to include 200 drill holes from the 2025 campaign. The July 2025 IACF shows NPV5% sensitivity exceeding $4 billion at gold prices above $4,000/oz.

Positive

- Two MW3 composites graded 0.96 g/t and 0.53 g/t

- Column recoveries of 61%–65% achieved in <60 days

- Shipping 4,000 kg covering 28 geo-metallurgical domains

- FS metallurgical program completion targeted by Q3 2026

- IACF shows NPV5% >$4 billion at gold >$4,000/oz

Negative

- Current column recoveries (61%–65%) below historical oxide average (89%)

- Historical column-test variability persists and is anticipated

- Resource model currently excludes 2025 high-grade intercepts; update in 2026

News Market Reaction

On the day this news was published, DC gained 1.93%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

DC is up 1.45% while key gold peers show mixed moves: NFGC -3.32%, GAU -0.41%, CMCL -1.88%, GROY +0.25%, ODV +1.91%, pointing to a company-specific response to Richmond Hill metallurgy/NAV sensitivity.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 01 | Drill results update | Positive | -1.3% | High-grade step-out and surface intercepts plus permitting well progress. |

| Nov 19 | Expansion drilling | Positive | +2.5% | Multiple high-grade holes and continued resource expansion drilling plan. |

| Oct 16 | Infill drill results | Positive | +2.9% | Significant intercepts supporting initial-year mine targeting and FS inputs. |

| Sep 24 | Drill and met progress | Positive | -2.5% | Strong metallurgical hole grades and engagement of Forte Dynamics for FS work. |

| Sep 09 | Drill program update | Positive | -1.3% | High-grade intercept above resource grade and FS/2025 drilling plans. |

Positive Richmond Hill updates have produced mixed reactions, with both rallies and selloffs on good drill and project news.

Over the last few months, Dakota Gold has repeatedly highlighted Richmond Hill drilling and metallurgical progress. Updates on Sep 9, Sep 24, Oct 16, Nov 19, and Dec 1 all reported significant intercepts and Feasibility Study groundwork, including water wells and metallurgical samples. Price reactions to these generally positive updates ranged from about -2.55% to +2.92%, indicating no consistent pattern of buying or selling on good news. Today’s metallurgy/NPV sensitivity detail fits into that same Richmond Hill de-risking narrative.

Regulatory & Risk Context

Dakota Gold has an active Form S-3 shelf filed on 2025-07-24, with one recorded usage via a 424B5 prospectus supplement dated 2025-11-13 supporting an at-the-market equity program. This structure allows the company to issue registered securities over the shelf’s remaining term as needed.

Market Pulse Summary

This announcement adds important detail to Dakota Gold’s Richmond Hill de-risking process, outlining column recoveries of 61%–65%, favorable characterization results, and NPV5% sensitivity that exceeds $4 billion at higher gold prices. It builds on prior Richmond Hill drilling and metallurgical updates feeding into the Feasibility Study, scheduled metallurgical completion in Q3 2026, and a production target in 2029. Investors may watch future recovery results, resource updates, and FS milestones to gauge how these metallurgy findings translate into project economics.

Key Terms

heap leach technical

column tests technical

preg-robbing technical

QEMSCAN technical

ICP-OES technical

Run-of-Mine technical

NPV5% financial

Initial Assessment with Cash Flow financial

AI-generated analysis. Not financial advice.

Lead, South Dakota--(Newsfile Corp. - December 18, 2025) - Dakota Gold Corp. (NYSE American: DC) ("Dakota Gold" or the "Company") is providing an update on the metallurgical testing program (the "Met Program") designed to inform the Feasibility Study ("FS") at the Richmond Hill Oxide Heap Leach Gold Project ("Richmond Hill" or the "Project").

The FS Met Program is scheduled for completion in Q3 2026 with staged testing and milestone reporting throughout. Extensive metallurgical drilling was completed in 2025 (Map 1) and the Company expects to ship 4,000 kg of material to Forte Dynamics Lab (the "Lab") that represent 28 potential geo-metallurgical domains, and complete more than 30 column tests. To date, the Company has received results for two initial composites from the MW3 zone in the northern part of the property.

Highlights from this update:

- High-grade areas potential for early mining. The Company is evaluating mine plan sequence opportunities in the FS and will update the resource in 2026 to include 200 drill holes completed in the 2025 drill campaign. The two columns tested from the MW3 zone graded 0.96 grams per tonne gold ("g/t") ("Au") and 23.1 g/t silver ("Ag"), and 0.53 g/t Au and 17.3 g/t Ag, respectively. The current resource model for the MW3 zone does not yet include high-grade intercepts reported from drilling in 2025, such as RH25C-164 intersecting 1.94 g/t Au over 60.0 meters (116 gram meters) and RH25C-169 intersecting 2.78 g/t Au over 39.3 meters (109 gram meters).

- Column recoveries ranging between

61% -65% achieved within less than 60 days. Two columns of 0.96 g/t Au material were tested at a 1" and 0.5" crush size and two columns of material grading 0.53 g/t Au were tested at a 0.75" and 0.5" crush size. Historic column testing focused on the Richmond Hill mine demonstrated material classified as oxide by St. Joe achieved an average recovery of89% , and the current results are complimentary and consistent with historical variability testing (Appendix A). The samples were chosen to perform first pass characterization and classification. Deportment analysis has provided guidance on further test work required to optimize recoveries and process design.

- Potential CAPEX and OPEX efficiencies with positive response to heap leaching amenability factors. The preliminary compact permeability tests have properties which provide better flexibility for equipment selection and stacking methodology. Further testing of crush size including a "Run-of-Mine" test program has been initiated to study the impact of eliminating crushing for certain material.

"The FS and Met Program represent an important step in the evaluation and de-risking process for Richmond Hill. Historical metallurgical tests exhibited variability in column recoveries, and similar variability is anticipated in the current Program. The results are consistent with my experience with comparable heap leach gold deposits and support the potential for low-cost leach heap processing as envisioned in our July IACF. Over the next 12 months, we will finalize our FS metallurgical testing and trade-off studies to support the FS and to inform future permitting activities," said Jack Henris, President and COO of Dakota Gold.

Project leverage to Gold Prices and Recovery

Richmond Hill exhibits strong leverage to increasing gold prices. The Initial Assessment with Cash Flow ("IACF") published in July 2025 demonstrates that at gold prices exceeding

"I'm very excited to be part of the team that is advancing the Richmond Hill gold project towards a potential multi-billion NPV opportunity, in possibly the best gold price environments we've seen in decades. We will continue to advance the Project with urgency as we work towards production in 2029," said Shawn Campbell, CFO of Dakota Gold.

Table 1 – IACF; After-tax NPV

| Gold Recovery | |||||

| Gold Price | NPV | ||||

| | | | | ||

| | | | |||

| | | ||||

| | | | |||

| | | | |||

Metallurgical Program

The scope of work to complete the FS study includes ore characterization; column leach testing; comminution and crushing studies; process optimization and recovery; and deleterious elements and environmental testing. The Company has shipped approximately

Samples from 12 drill holes from the Company's 2025 drill campaign were composited for the current MW3 zone tests. Two columns of material grading 0.96 g/t Au were tested at a 1" and 0.5" crush size. The recoveries for those columns were

Characterization results announced today from the M3W zone material did not contain preg-robbing material. Additionally, based on QEMSCAN and ICP-OES, the material did not identify any deleterious elements or mineralogy. These results will guide future trade-off studies on the requirement for agglomeration.

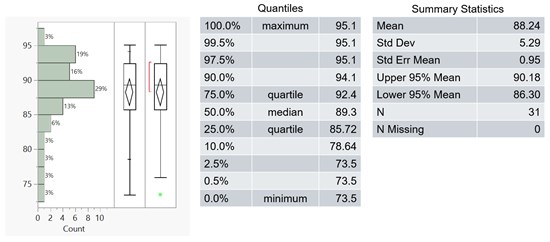

The Richmond Hill historical feasibility study was conducted by several labs as part of the metallurgical program to construct and operate the historic Richmond Hill mine. The 51-column tests that were performed, had a wide range of recovery in the column work, however, the sub-set once classified as oxides had an average recovery of

Map 1 – Location of historical heap leach samples and 2025 metallurgical drill holes

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8218/278564_cef71495a4a70a46_002full.jpg

About Dakota Gold Corp.

Dakota Gold is expanding the legacy of the 145-year-old Homestake Gold Mining District by advancing the Richmond Hill Oxide Heap Leach Gold Project to commercial production as soon as 2029, and outlining a high-grade underground gold resource at the Maitland Gold Project, both located on private land in South Dakota.

Subscribe to Dakota Gold's e-mail list at www.dakotagoldcorp.com to receive the latest news and other Company updates.

Shareholder and Investor Inquiries

For more information, please contact:

Jack Henris

President and COO

Tel: +1 605-717-2540

Shawn Campbell

Chief Financial Officer

Tel: +1 778-655-9638

Carling Gaze

VP of Investor Relations and Corporate Communications

Tel: +1 605-679-7429

Email: info@dakotagoldcorp.com

Qualified Person and S-K 1300 Disclosure

James M. Berry, a Registered Member of SME and Vice President of Exploration of Dakota Gold Corp., is the Company's designated qualified person (as defined in Subpart 1300 of Regulation S-K) for this news release and has reviewed and approved its scientific and technical content.

Quality Assurance/Quality Control consists of regular insertion of certified reference materials, duplicate samples, and blanks into the sample stream. Samples are submitted to the ALS Geochemistry sample preparation facility in Winnipeg, Manitoba. Gold and multi-element analyses are performed at the ALS Geochemistry laboratory in Vancouver, British Columbia. ALS Minerals is an ISO/IEC 17025:2017 accredited lab. Check samples are submitted to Bureau Veritas, Vancouver B.C. as an umpire laboratory. Assay results are reviewed, and discrepancies are investigated prior to incorporation into the Company database.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this communication, the words "plan," "target," "anticipate," "believe," "estimate," "intend," "potential," "will" and "expect" and similar expressions are intended to identify such forward-looking statements. Any express or implied statements contained in this communication that are not statements of historical fact may be deemed to be forward-looking statements, including, without limitation: our expectations regarding additional drilling, metallurgy and modeling; our expectations for the improvement and growth of the mineral resources and potential for conversion of mineral resources into reserves; completion of a feasibility study, and/or permitting; our expectations regarding free cash flow and future financing, and our overall expectation for the possibility of near-term production at the Richmond Hill project. These forward-looking statements are based on assumptions and expectations that may not be realized and are inherently subject to numerous risks and uncertainties, which could cause actual results to differ materially from these statements. These risks and uncertainties include, among others: the execution and timing of our planned exploration activities; our use and evaluation of historic data; our ability to achieve our strategic goals; the state of the economy and financial markets generally and the effect on our industry; and the market for our common stock. The foregoing list is not exhaustive. For additional information regarding factors that may cause actual results to differ materially from those indicated in our forward-looking statements, we refer you to the risk factors included in Item 1A of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, as updated by annual, quarterly and current reports that we file with the SEC, which are available at www.sec.gov. We caution investors not to place undue reliance on the forward-looking statements contained in this communication. These statements speak only as of the date of this communication, and we undertake no obligation to update or revise these statements, whether as a result of new information, future events or otherwise, except as may be required by law. We do not give any assurance that we will achieve our expectations.

All references to "$" in this communication are to U.S. dollars unless otherwise stated.

Appendix A - Historic Richmond Hill oxide metallurgical column test work by St. Joe

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8218/278564_cef71495a4a70a46_003full.jpg

Appendix B - Historic Richmond Hill metallurgical all column test work by St. Joe with red circle showing initial column results for M3W composite

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8218/278564_cef71495a4a70a46_004full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278564