DMG Blockchain Solutions Reports Fourth Quarter and Full Year 2025 Audited Results

Rhea-AI Summary

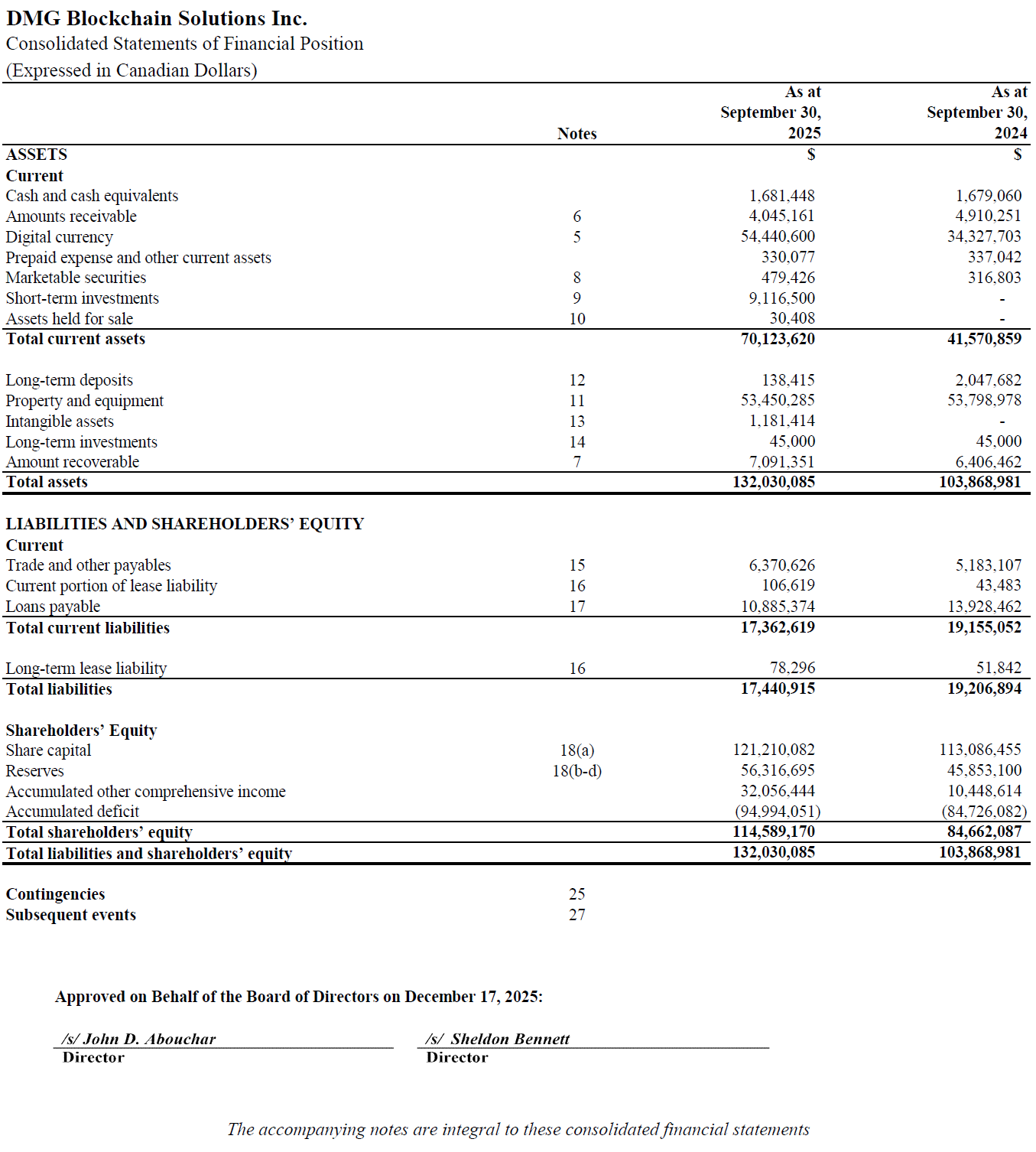

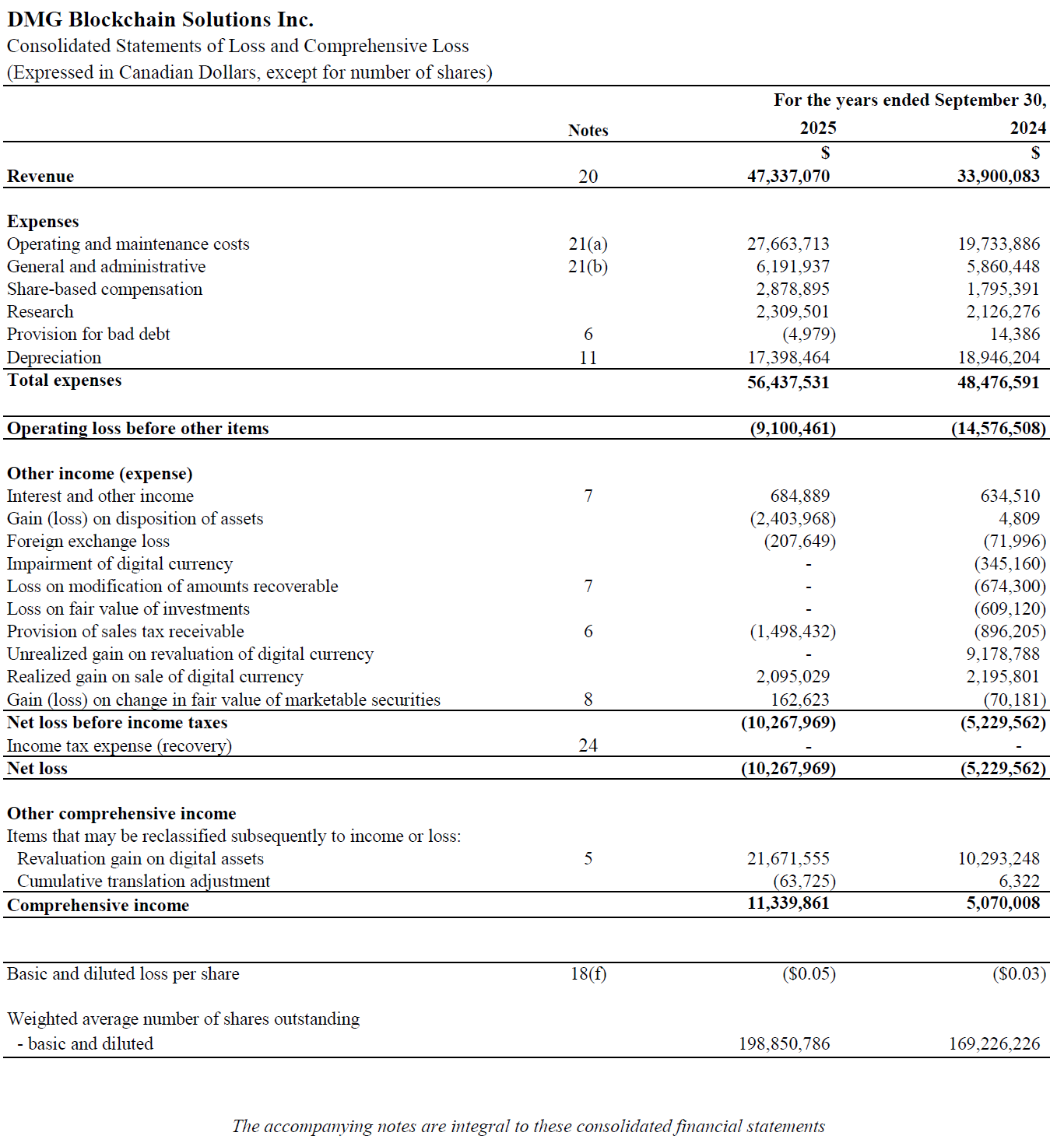

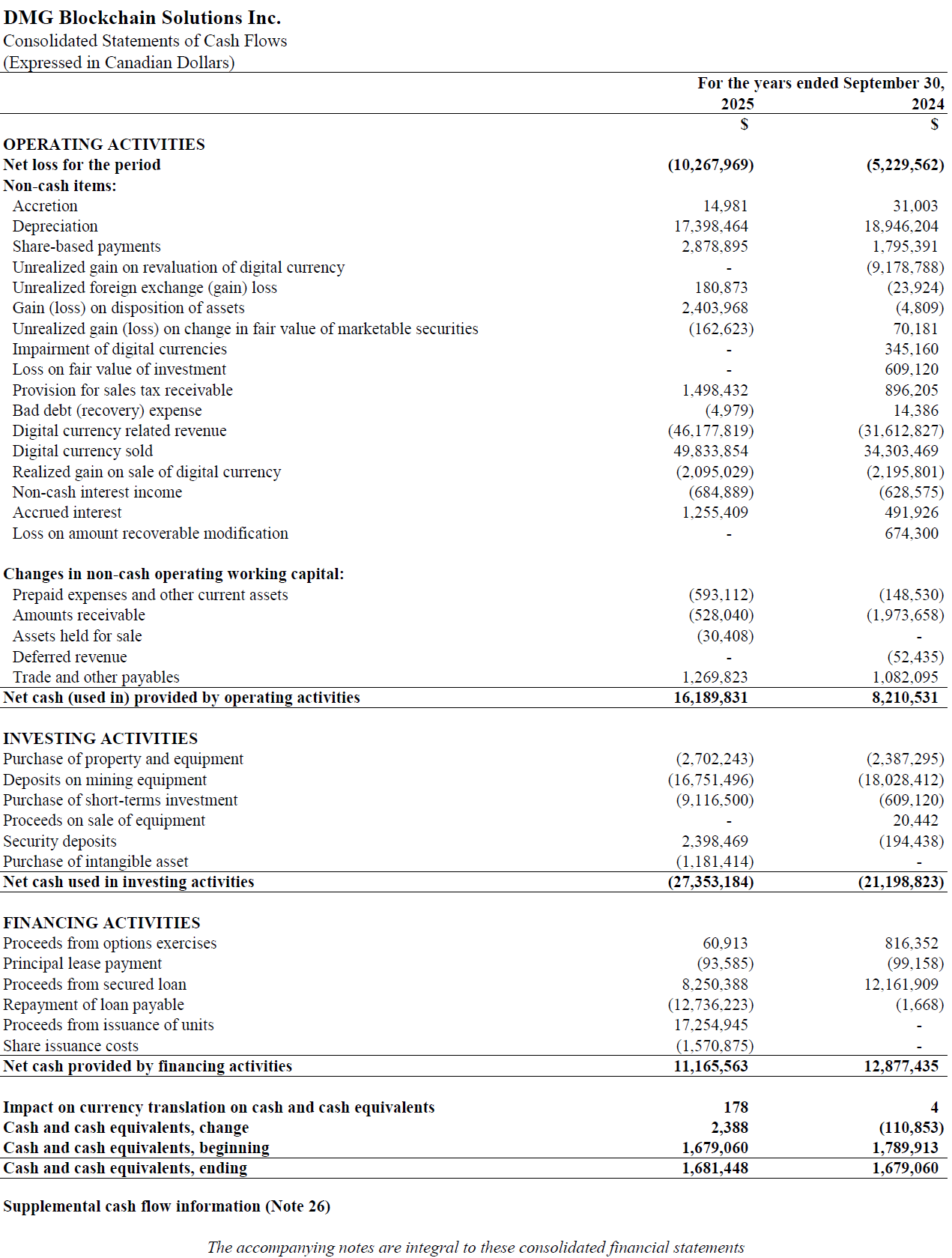

DMG Blockchain Solutions (OTCQB: DMGGF) reported audited fourth-quarter and full-year results for fiscal 2025, ending Sept 30, 2025. Full-year revenue was $47.3M, +40% vs 2024, driven by a $12.2M increase in digital currency mining revenue. The company mined 344 bitcoin (ending balance 342 BTC) with average hashrate 1.70 EH/s and fleet efficiency 22.7 J/TH. Cash, short-term investments and digital assets totaled $65.2M, up 81% year-end. Cash flow from operations was $16.2M, +97% YoY. Net loss widened to $10.3M while comprehensive income was $11.3M due to unrealized digital currency revaluation. Total assets were $132.0M, +27% YoY.

Positive

- Revenue +40% to $47.3M year-over-year

- Cash, short-term investments and digital assets +81% to $65.2M

- Cash flow from operations +97% to $16.2M

- Hashrate average 1.70 EH/s with improved efficiency (22.7 J/TH)

Negative

- Net loss widened to $10.3M from $5.2M in 2024

- Operating and maintenance expenses increased to $27.7M (utilities +$6.3M)

- Hosting service revenue declined to $574K from $1.18M

News Market Reaction

On the day this news was published, DMGGF declined 1.11%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, British Columbia, Dec. 18, 2025 (GLOBE NEWSWIRE) -- DMG Blockchain Solutions Inc. (TSX-V: DMGI) (OTCQB US: DMGGF) (FRANKFURT: 6AX) (“DMG”), a vertically integrated blockchain and data center technology company, today announces its fiscal fourth quarter and full year audited 2025 financial results. All financial references are in Canadian Dollars unless specified otherwise. Readers are encouraged to review the Company’s September 30, 2025 full year audited financial statements and management’s discussion and analysis thereof for an assessment of the Company’s performance and applicable risk factors, available at www.sedarplus.ca.

Full Year 2025 Financial Results Highlights

- Revenue:

$47.3 million , up40% from$33.9 million in 2024 - Bitcoin Mined: 344 bitcoin with an ending balance of 342 bitcoin

- Hashrate: average 1.70 EH/s with fleet efficiency of 22.7 J/TH versus 2024 average of 0.96 EH/s with fleet efficiency of 26.7 J/TH

- Cash Flow from Operations:

$16.2 million in 2025, up97% from$8.2 million in 2024 - Cash, Short-term Investments and Digital Assets:

$65.2 million at year-end, up81% from$36.0 million at year-end 2024 - Total Assets:

$132.0 million at year-end, up27% from$103.9 million at year-end 2024 - Net Income: -

$10.3 million or -$0.05 per share versus -$5.2 million or -$0.03 per share in 2024 - Comprehensive Income:

$11.3 million vs$5.1 million in 2024

DMG’s CEO, Sheldon Bennett, commented: “In 2025, we positioned the Company to enter the high-value Artificial Intelligence (AI) infrastructure market and grow our digital asset financial services offerings. We cultivated relationships with the Canadian government, enterprises and Indigenous communities to capture unique sovereign AI opportunities with a strategic focus on a colocation business model. In addition, our digital asset custody subsidiary achieved qualified custodian status as well as SOC 2 Type II certification, positioning it for revenue growth in the calendar 2026. We believe our strong balance sheet can help us weather the current crypto market downturn while we remain focused on long-term growth and cash generation.”

Full Year 2025 Financial Results Review

Revenue increased by

Operating and maintenance expenses for the year ended September 30, 2025 was

Research costs for the year ended September 30, 2025 increased by

Net loss of

Comprehensive income increased by

Total assets as of September 30, 2025 was

Fourth Quarter and Full Year 2025 Results Conference Call Details

The Company will host a conference call to review its results and provide a corporate update on December 18, 2025 at 4:30 PM ET. Participants should register for the call via the link.

In addition to a live Q&A session via chat, management will also address pre-submitted questions. Those wishing to submit a question may do so via email at investors@dmgblockchain.com, using the subject line ‘Conference Call Question Submission,’ through 2:00 PM ET on December 18, 2025.

About DMG Blockchain Solutions Inc.

DMG is a publicly traded and vertically integrated blockchain and data center technology company that manages, operates and develops end-to-end digital solutions to monetize the digital asset and artificial intelligence compute ecosystems. Systemic Trust Company, a wholly owned subsidiary of DMG, is an integral component of DMG’s carbon-neutral Bitcoin ecosystem, which enables financial institutions to move bitcoin in a sustainable and regulatory-compliant manner. DMG’s Blockseer Explorer is a feature-rich, freely available Bitcoin blockchain explorer, available at blockseer.com.

For more information on DMG Blockchain Solutions visit: www.dmgblockchain.com

Follow @dmgblockchain on X and subscribe to DMG's YouTube channel.

For further information, please contact:

On behalf of the Board of Directors,

Sheldon Bennett, CEO & Director

Tel: +1 (778) 300-5406

Email: investors@dmgblockchain.com

Web: www.dmgblockchain.com

For Investor Relations:

investors@dmgblockchain.com

For Media Inquiries:

communications@dmgblockchain.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Information

This news release contains forward-looking information or statements based on current expectations. Forward-looking statements contained in this news release include hosting a conference call, potential AI opportunities, the potential growth in revenue from Systemic Trust, the expected strong balance sheet to weather a crypto downturn, the Company’s strategy for growth, the planned monetization of certain product and service offerings, developing and executing on the Company’s products, services and business plans, the launch of products and services, events, courses of action, and the potential of the Company’s technology and operations, among others, are all forward-looking information.

Future changes in the Bitcoin network-wide mining difficulty or Bitcoin hashrate may materially affect the future performance of DMG’s production of bitcoin, and future operating results could also be materially affected by the price of bitcoin and an increase in hashrate and mining difficulty.

Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Such information can generally be identified by the use of forwarding-looking wording such as "may", "expect", "estimate", "anticipate", "intend", "believe" and "continue" or the negative thereof or similar variations. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company, including but not limited to, market and other conditions, volatility in the trading price of the common shares of the Company, business, economic and capital market conditions; the ability to manage operating expenses, which may adversely affect the Company's financial condition; the ability to remain competitive as other better financed competitors develop and release competitive products; regulatory uncertainties; access to equipment; market conditions and the demand and pricing for products; the demand and pricing of bitcoin; security threats, including a loss/theft of DMG's bitcoin; DMG's relationships with its customers, distributors and business partners; the inability to add more power to DMG's facilities; DMG's ability to successfully define, design and release new products in a timely manner that meet customers' needs; the ability to attract, retain and motivate qualified personnel; competition in the industry; the impact of technology changes on the products and industry; failure to develop new and innovative products; the ability to successfully maintain and enforce our intellectual property rights and defend third-party claims of infringement of their intellectual property rights; the impact of intellectual property litigation that could materially and adversely affect the business; the ability to manage working capital; and the dependence on key personnel. DMG may not actually achieve its plans, projections, or expectations. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the demand for its products, the ability to successfully develop software, that there will be no regulation or law that will prevent the Company from operating its business, anticipated costs, the ability to secure sufficient capital to complete its business plans, the ability to achieve goals and the price of bitcoin. Given these risks, uncertainties, and assumptions, you should not place undue reliance on these forward-looking statements. The securities of DMG are considered highly speculative due to the nature of DMG's business. For further information concerning these and other risks and uncertainties, refer to the Company’s filings on www.sedarplus.ca. In addition, DMG’s past financial performance may not be a reliable indicator of future performance.

Factors that could cause actual results to differ materially from those in forward-looking statements include, failure to obtain regulatory approval, the continued availability of capital and financing, equipment failures, lack of supply of equipment, power and infrastructure, failure to obtain any permits required to operate the business, the impact of technology changes on the industry, the impact of viruses and diseases on the Company's ability to operate, secure equipment, and hire personnel, competition, security threats including stolen bitcoin from DMG or its customers, consumer sentiment towards DMG's products, services and blockchain technology generally, failure to develop new and innovative products, litigation, adverse weather or climate events, increase in operating costs, increase in equipment and labor costs, equipment failures, decrease in the price of Bitcoin, failure of counterparties to perform their contractual obligations, government regulations, loss of key employees and consultants, and general economic, market or business conditions. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The reader is cautioned not to place undue reliance on any forward-looking information. The forward-looking statements contained in this news release are made as of the date of this news release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Additionally, the Company undertakes no obligation to comment on the expectations of or statements made by third parties in respect of the matters discussed above.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/71e815c9-c920-4552-8295-ec9737b33ad5

https://www.globenewswire.com/NewsRoom/AttachmentNg/77b44c67-8adb-4947-bda1-8597ef388b16

https://www.globenewswire.com/NewsRoom/AttachmentNg/6ac14d19-b417-4c5f-a739-aff54f4f22ee