Colosseum BFS Drilling Returns Wide Intercepts in North Pipe

Rhea-AI Summary

Dateline Resources (OTCQB:DTREF / ASX:DTR) reported further reverse circulation drilling results at its 100% owned Colosseum Gold‑REE Project in San Bernardino County, California on December 3, 2025. Two holes beneath the North Pit returned intercepts that exceed the current Indicated block grades and are expected to improve nearby mineral resource grades in a new estimate planned for early 2026.

Key intercepts: RC25‑001: 64.0m @ 1.24 g/t Au from 0m (incl. 7.66m @ 3.16 g/t Au from 53.34m). RC25‑004: 132.58m @ 0.95 g/t Au from 3.05m (incl. 3.05m @ 7.09 g/t Au from 112.8m). Drilling paused for Thanksgiving and will resume shortly; a bankable feasibility study continues.

Positive

- RC25-004: 132.58m @ 0.95 g/t Au from 3.05m

- RC25-001: 64.0m @ 1.24 g/t Au from 0m

- High-grade zones including 3.05m @ 7.09 g/t Au

- Intercepts exceed current Indicated block grades

- New mineral resource estimate planned early 2026

Negative

- None.

News Market Reaction

On the day this news was published, DTREF gained 2.44%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Gold peers showed mixed moves, with OREZONE GOLD CORP up 1.47%, G2 GOLDFIELDS INC up 5.83%, while ROBEX RES INC fell 2.58%. No consistent sector-wide direction suggests this was more stock-specific.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 03 | Drilling results update | Positive | +2.4% | North Pit RC holes exceeded Indicated grades, supporting resource upgrade potential. |

| Oct 27 | BFS progress update | Positive | -18.7% | BFS drilling 67% complete and stockpile work advanced ahead of mine planning. |

| Oct 27 | BFS drill program | Positive | -18.7% | Details on 32-hole BFS program and stockpile drilling for mine plan inclusion. |

| Oct 20 | Geophysical review | Positive | +9.2% | Independent 3D geophysical work ranked six breccia-pipe targets for drilling. |

| Sep 24 | REE target validation | Positive | -4.3% | Second MT model confirmed a high-priority REE target at line 2200N. |

Project updates and technical progress at Colosseum have produced mixed reactions, with both strong gains and sharp declines, indicating inconsistent alignment between positive news flow and short-term price moves.

Over the last few months, Dateline has focused on advancing the Colosseum Gold‑REE Project with drilling, geophysics, and BFS work. On Sep 24, REE targeting news saw a -4.34% move. A 3D geophysical review on Oct 20 coincided with a 9.24% gain. BFS drilling and stockpile updates on Oct 27 linked to a -18.7% reaction. Today’s Dec 3 drilling results, which exceeded Indicated grades, saw a more modest 2.44% gain, continuing the pattern of variable responses to generally constructive project news.

Market Pulse Summary

This announcement highlights broad, higher-grade intercepts from RC25‑001 and RC25‑004 that exceeded existing Indicated block grades at the Colosseum North Pipe, supporting potential resource improvement in a planned early‑2026 estimate. It builds on months of BFS drilling and geophysical work at the 100%‑owned Gold‑REE project. Investors may watch for follow-up assay results, progress of the Bankable Feasibility Study, and how updated resource figures compare with prior Colosseum targets and historical stock reactions.

Key Terms

reverse circulation technical

rare earth element medical

indicated mineral resource technical

assay technical

bankable feasibility study financial

open pit technical

AI-generated analysis. Not financial advice.

SAN BERNARDINO, CALIFORNIA / ACCESS Newswire / December 3, 2025 / Dateline Resources Limited (ASX:DTR)(OTCQB:DTREF)(FSE:YE1) is pleased to announce further drilling results at its

Highlights

Strong gold intercepts confirm the continuity of mineralisation at depth in the North Pipe:

RC25-001 returned 64.0m @ 1.24 g/t Au from 0m (beneath the existing north pit)

Incl. 1.52m @ 3.17g/t Au from 3.05m

And 1.52m @ 5.68g/t Aufrom 30.48m

And 7.66m @ 3.16g/t Aufrom 53.34m

RC25-004 returned 132.58m @ 0.95 g/t Au from 3.05m

Incl. 3.05m @ 3.25g/t Aufrom 27.43m

Incl 3.05m @ 7.09g/t Aufrom 112.8m

RC25-001 returned a broad intercept of 64.0m @ 1.24g/t Aufrom surface, including a high-grade zone of 7.66m @ 3.16g/t Aufrom 53.34m.

RC25-004 had a broad intercept of 132.58m @ 0.95g/t Aufrom 3.05m. incl 3.05m @ 3.25g/t Aufrom 27.43m and 3.05m @ 7.09g/t Aufrom 112.8m).

Both of these holes have returned higher grades than currently estimated in the Indicated mineral resource blocks they intercepted.

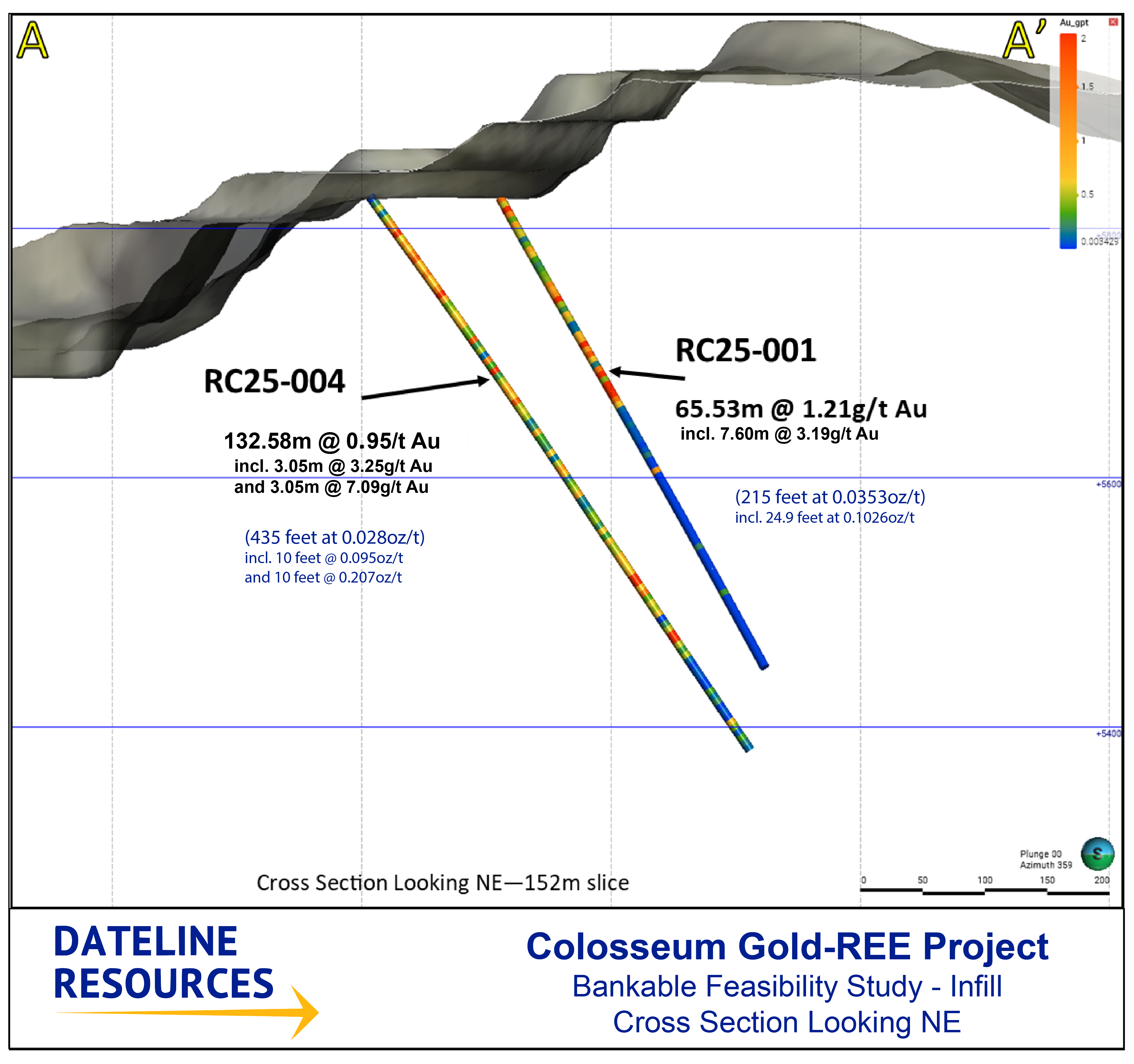

Figure 1: Plan view showing the drillholes mentioned in this announcement as well as the orientation of the cross section shown in Figure 2.

Figure 2: Cross-section of the Colosseum deposit illustrating the existing open pit outline and gold intercepts

Drilling was suspended for the Thanksgiving holiday in the United States and is planned to recommence in the coming days.

Dateline will continue to update shareholders as additional assay results are received and as the Bankable Feasibility Study progresses. The Company remains confident that the drilling program will confirm the feasibility of the Colosseum Gold-REE Project by better defining the mineral resource base and de-risking the path to production.

This press release has been authorized for release by the Board of Dateline Resources Limited.

For more information, please contact:

Stephen Baghdadi

Managing Director

+61 2 9375 2353

Andrew Rowell

Corporate & Investor Relations Manager

+61 400 466 226

a.rowell@dtraux.com

www.datelineresources.com.au

Follow Dateline on socials:

X - @Dateline_DTR

Truth Social - @dateline_resources

LinkedIn - dateline-resources

Youtube - @dateline.resources

About Dateline Resources Limited

Dateline Resources Limited (ASX:DTR)(OTCQB:DTREF)(FSE:YE1.F) is an Australian company focused on mining and exploration in North America. The Company owns

The Colosseum Gold Mine is located in the Walker Lane Trend in East San Bernardino County, California. On 6 June 2024, the Company announced to the ASX that the Colosseum Gold mine has a JORC-2012 compliant Mineral Resource estimate of 27.1Mt @ 1.26g/t Au for 1.1Moz. Of the total Mineral Resource, 455koz @ 1.47/t Au (

On 23 May 2025, Dateline announced that updated economics for the Colosseum Gold Project generated an NPV6.5 of US

The Colosseum is located less than 10km north of the Mountain Pass Rare Earth mine. Planning has commenced on drill testing the REE potential at Colosseum.

Dateline has also acquired the high-grade Argos Strontium Project, also located in San Bernadino County, California. Argos is reportedly the largest strontium deposit in the U.S. with previous celestite production grading

Forward-Looking Statements

This announcement may contain "forward-looking statements" concerning Dateline Resources that are subject to risks and uncertainties. Generally, the words "will", "may", "should", "continue", "believes", "expects", "intends", "anticipates" or similar expressions identify forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. Many of these risks and uncertainties relate to factors that are beyond Dateline Resources' ability to control or estimate precisely, such as future market conditions, changes in regulatory environment and the behavior of other market participants. Dateline Resources cannot give any assurance that such forward-looking statements will prove to have been correct. The reader is cautioned not to place undue reliance on these forward-looking statements. Dateline Resources assumes no obligation and does not undertake any obligation to update or revise publicly any of the forward-looking statements set out herein, whether as a result of new information, future events or otherwise, except to the extent legally required.

Competent Person Statement

Sample preparation and any exploration information in this announcement is based upon work reviewed by Mr Greg Hall who is a Chartered Professional of the Australasian Institute of Mining and Metallurgy (CP-IMM). Mr Hall has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the "Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves" (JORC Code). Mr Hall is a Non-Executive Director of Dateline Resources Limited and consents to the inclusion in the report of the matters based on this information in the form and context in which it appears.

Company Confirmations

The Company confirms it is not aware of any new information or data that materially affects the information included in the announcements dated 23 October 2024 with regard to the Colosseum MRE and 23 May 2025 with regard to Colosseum Project Economics. Similarly, the Company confirms that all material assumptions and technical parameters underpinning the estimates and the forecast financial information referred to in those previous announcements continue to apply and have not materially changed.

SOURCE: Dateline Resources Limited

View the original press release on ACCESS Newswire