DoubleVerify Research Reveals Retail Media is an Opportunity for Safe Engagement Despite Some Viewability Challenges

Retail media exceeds benchmarks on brand suitability, fraud, and engagement, potentially fueling higher-performing ads

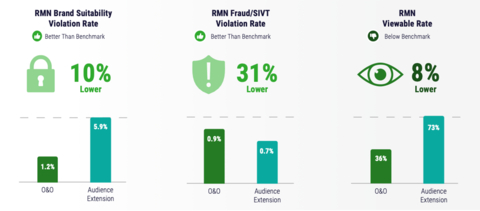

(Graphic: Business Wire)

A retail media network (RMN) is an advertising channel offered by a retailer that leverages their first-party consumer data to target audiences on their own properties and extended networks. RMNs combine two types of inventory for advertisers: Owned & Operated (O&O)—ads that run on the retailer's own sites or apps; and audience extension—ads that use the retailer's first-party data to reach shoppers across the web.

Brand Suitability & Ad Fraud

DV’s findings reveal that RMNs over-index for media quality in terms of brand suitability and ad fraud, with fraud rates nearly one-third (

“As retail media investments surge, these are encouraging numbers,” said Mark Zagorski, CEO of DoubleVerify. “In addition to being rich in first-party data, RMNs see lower fraud and brand suitability violations than do other environments. Ultimately, better media quality equates to better ad performance.”

Viewability & Engagement

While RMNs saw better than average brand suitability and fraud rates, viewability across RMNs is

Regardless, the low viewability score of O&O RMN inventory should not be a cause for concern. DV discovered that O&O inventory effectively targets shoppers when they are most likely to engage, resulting in engagement rates

“The distinct roles of audience extension and O&O inventory in RMNs necessitate a nuanced understanding of KPIs,” added Zagorski. “While audience extension ads boast higher viewability and exposure, it’s important not to overlook the high user engagement profile of O&O inventory.”

Method: The report employs DV technology to analyze over one trillion impressions, both pre and post-bid, and offers a detailed market-by-market analysis for

For more information about DV, visit: www.doubleverify.com.

About DoubleVerify

DoubleVerify (“DV”) (NYSE: DV) is the industry’s leading media effectiveness platform that leverages AI to drive superior outcomes for global brands. By creating more effective, transparent ad transactions, DV strengthens the digital advertising ecosystem, ensuring a fair value exchange between buyers and sellers of digital media.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240521475203/en/

Press Contact:

Chris Harihar, chris@crenshawcomm.com

Source: DoubleVerify