Elemental Altus Expands Royalty Portfolio with Cornerstone Laverton Acquisition and Dugbe Development Asset

Elemental Altus Royalties (OTCQX:ELEMF) has announced significant expansions to its royalty portfolio through two major acquisitions. The company will acquire a 2% Gross Revenue Royalty (GRR) over Genesis Minerals' Focus Laverton Project in Western Australia for approximately US$52 million, creating a cornerstone gold royalty asset. This acquisition includes an additional 2% GRR on Brightstar Resources' producing Jasper Hills Project.

In parallel, Elemental Altus will acquire a 2.0-2.5% Net Smelter Return (NSR) royalty on Pasofino Gold's Dugbe Project in Liberia for US$16.5 million plus contingent payments of up to US$3.5 million. The Laverton royalty covers ~2.1Moz of Measured and Indicated Resources and 1.5Moz of Inferred Resources, while the Dugbe Project contains 3.3Moz Measured and Indicated Resources with a projected 14-year mine life producing ~162koz gold annually.

Elemental Altus Royalties (OTCQX:ELEMF) ha annunciato l'espansione significativa del proprio portafoglio di royalty con due acquisizioni principali. Acquisirà una royalty del 2% sui ricavi lordi (GRR) sul Focus Laverton Project di Genesis Minerals in Australia Occidentale per circa US$52 milioni, ottenendo così un asset aurifero fondamentale. L'accordo include inoltre un'ulteriore GRR del 2% sul progetto produttivo Jasper Hills di Brightstar Resources.

Parallelamente, Elemental Altus acquisirà una royalty NSR del 2,0-2,5% sul Dugbe Project di Pasofino Gold in Liberia per US$16,5 milioni più pagamenti contingentati fino a US$3,5 milioni. La royalty di Laverton copre circa 2,1 Moz di risorse Misurate e Indicate e 1,5 Moz di risorse Inferred, mentre il Dugbe Project contiene 3,3 Moz di risorse Misurate e Indicate con una vita mineraria prevista di 14 anni e una produzione stimata di ~162 koz d'oro all'anno.

Elemental Altus Royalties (OTCQX:ELEMF) ha anunciado ampliaciones significativas de su cartera de regalías mediante dos adquisiciones importantes. La compañía adquirirá una regalía del 2% sobre ingresos brutos (GRR) del Focus Laverton Project de Genesis Minerals en Australia Occidental por aproximadamente US$52 millones, creando un activo clave en oro. Esta adquisición incluye además un 2% de GRR sobre el proyecto en producción Jasper Hills de Brightstar Resources.

Paralelamente, Elemental Altus adquirirá una regalía NSR del 2,0-2,5% sobre el Dugbe Project de Pasofino Gold en Liberia por US$16,5 millones más pagos contingentes de hasta US$3,5 millones. La regalía de Laverton cubre ~2,1 Moz de recursos Medidos e Indicados y 1,5 Moz de recursos Inferidos, mientras que el Dugbe Project contiene 3,3 Moz de recursos Medidos e Indicados con una vida útil proyectada de 14 años y una producción estimada de ~162 koz de oro anuales.

Elemental Altus Royalties (OTCQX:ELEMF)는 두 건의 대규모 인수를 통해 로열티 포트폴리오를 크게 확장했다고 발표했습니다. 회사는 호주 웨스턴오스트레일리아에 위치한 Genesis Minerals의 Focus Laverton 프로젝트에 대해 약 미화 5,200만 달러총수익(GrR) 2% 로열티를 인수하여 핵심 금(黃) 로열티 자산을 확보합니다. 이 거래에는 Brightstar Resources의 생산 중인 Jasper Hills 프로젝트에 대한 추가 2% GRR도 포함됩니다.

동시에 Elemental Altus는 라이베리아의 Pasofino Gold의 Dugbe 프로젝트에 대해 순제련수익(NSR) 2.0–2.5% 로열티를 미화 1,650만 달러

Elemental Altus Royalties (OTCQX:ELEMF) a annoncé des expansions significatives de son portefeuille de redevances via deux acquisitions majeures. La société va acquérir une redevance de 2% sur le chiffre d'affaires brut (GRR) relative au Focus Laverton Project de Genesis Minerals en Australie-Occidentale pour environ 52 M$ US, constituant un actif aurifère central. Cette acquisition inclut également une GRR supplémentaire de 2% sur le projet en production Jasper Hills de Brightstar Resources.

Parallèlement, Elemental Altus va acquérir une NSR de 2,0–2,5% sur le Dugbe Project de Pasofino Gold au Liberia pour 16,5 M$ US plus des paiements conditionnels allant jusqu'à 3,5 M$ US. La redevance de Laverton couvre ~2,1 Moz de ressources Mesurées et Indiquées et 1,5 Moz de ressources Inferred, tandis que le Dugbe Project contient 3,3 Moz de ressources Mesurées et Indiquées avec une durée de vie minière projetée de 14 ans et une production annuelle estimée à ~162 koz d'or.

Elemental Altus Royalties (OTCQX:ELEMF) hat umfangreiche Erweiterungen seines Royalty-Portfolios durch zwei Großakquisitionen angekündigt. Das Unternehmen wird eine 2% Gross Revenue Royalty (GRR) auf das Focus Laverton Project von Genesis Minerals in Western Australia für rund US$52 Millionen erwerben und damit ein zentrales Gold-Royalty-Asset schaffen. Diese Transaktion umfasst zudem eine zusätzliche 2% GRR auf das produzierende Jasper Hills Project von Brightstar Resources.

Parallel dazu erwirbt Elemental Altus eine 2,0–2,5% Net Smelter Return (NSR)-Royalty auf das Dugbe Project von Pasofino Gold in Liberia für US$16,5 Millionen plus bedingte Zahlungen von bis zu US$3,5 Millionen. Die Laverton-Royalty deckt etwa 2,1 Moz an Measured and Indicated Resources und 1,5 Moz an Inferred Resources ab, während das Dugbe Project 3,3 Moz Measured and Indicated Resources aufweist und eine projizierte Bergbau-Lebensdauer von 14 Jahren mit einer jährlichen Goldproduktion von ~162 koz bietet.

- Creation of third cornerstone asset alongside Karlawinda and Caseronos through US$52M Laverton acquisition

- Immediate cash flow from producing Jasper Hills Project through toll treatment agreement

- Laverton royalty covers substantial 2.1Moz M&I and 1.5Moz Inferred Resources, 99% on granted mining leases

- Dugbe Project Feasibility Study projects 162koz annual gold production over 14-year mine life

- Strong financial position with US$32M cash and US$50M undrawn credit facility to support acquisitions

- Significant upfront capital commitment of US$68.5M plus contingent payments

- Dugbe Project still requires updated Feasibility Study and construction decision

- Laverton acquisition closing delayed until Q4 2025

Vancouver, British Columbia--(Newsfile Corp. - September 2, 2025) - Elemental Altus Royalties Corp. (TSXV: ELE) (OTCQX: ELEMF) ("Elemental Altus" or the "Company") is pleased to announce the creation of a cornerstone gold royalty at Laverton in Western Australia. The Laverton royalty acquisition builds on the Company's existing coverage to create a cornerstone gold royalty in a Tier 1 jurisdiction. Elemental Altus has signed binding agreements to acquire an existing uncapped

In parallel, the Company is acquiring an existing uncapped 2.0

Highlights:

- Focus Laverton Royalty (Western Australia)

~US

$52 million acquisition of an uncapped2% GRR over Genesis' recently acquired multi-million-ounce Focus Laverton Project to create third cornerstone asset alongside Karlawinda and CaseronesThe Focus Laverton Royalty covers ~2.1Moz of Measured and Indicated Resources and 1.5Moz of Inferred Resources adjacent to Genesis' operating Laverton mill,

99% on granted mining leases and positioned for rapid inclusion into Genesis' mine planThe Focus Laverton

2% GRR overlaps the Company's existing2% GRR covering approximately 0.75Moz of Measured and Indicated Resources and 1.1Moz of Inferred Resources at the same projectThe combination of Elemental Altus' existing Laverton royalty and the Focus Laverton Royalty create a cornerstone 2

-4% GRR for the Company in a Tier 1 jurisdiction with a proven mid-tier operator in Genesis MineralsRoyalty tenure has been near-dormant for over a decade with Genesis highlighting the compelling exploration upside across ~300km² of highly prospective licences

Genesis have also announced studies are ongoing into staged processing plant expansions at their Laverton mill

As part of the same transaction, the Company acquired an uncapped

2% GRR on Brightstar's producing Jasper Hills Project in the same Laverton districtThe Jasper Hills Royalty is currently in production with mineralised materials being toll treated through Genesis' Laverton mill while Brightstar advance standalone development plans

- Dugbe (Liberia)

Initial US

$16.5 million acquisition of an uncapped2.0% NSR royalty over the 3.3Moz Measured and Indicated Resource at the Dugbe Project, increasing to2.5% under certain production and gold price conditionsPasofino's 2022 Feasibility Study outlined a 14-year mine life producing ~162koz gold per annum at US

$1,700 /oz assumptionsAn updated Feasibility Study is underway and the Project is expected to be reinvigorated with the support of the new indirect majority owner, Coris Bank International

Mineral Reserves of 2.8Moz gold and significant exploration upside across up to 1,257km² of royalty coverage

Pasofino well placed to accelerate the development of the project over 2026 and updated studies will de-risk the asset going forwards

Frederick Bell, CEO of Elemental Altus, commented:

"These multi-million-ounce acquisitions highlight our strategy of securing both cornerstone and growth-stage gold royalties in quality jurisdictions. Laverton enhances our near-term cash flow profile through exposure to one of Western Australia's most well-known gold districts, while Dugbe adds a large-scale feasibility-stage project with long-life, multi-million-ounce potential. Together, they expand our near-term revenues and reinforce our long-term pipeline, positioning Elemental Altus as the most compelling royalty growth story in the sector. We continue to demonstrate our ability to transact on value-accretive opportunities that deliver both scale and diversification for our shareholders".

Terms of the Acquisitions

The Laverton acquisition is structured as an agreement to acquire a private Australian company which holds the Laverton and Jasper Hills royalties for cash consideration of A

The Dugbe acquisition is structured as an agreement to acquire a wholly owned subsidiary of Ecora Resources PLC, which holds the Dugbe Royalty, for an initial consideration of US

- US

$700,000 upon the commencement of project construction; and - US

$2,800,000 upon the commencement of commercial production; or, - A cumulative 150,000 ounces of royalty-linked gold production at Dugbe

As at September 1, 2025, Elemental Altus has over US

The Dugbe acquisition is expected to close shortly with the Laverton acquisition closing prior to the end of Q4 2025. Royalty revenue from the Jasper Hill royalties, part of the Laverton acquisition, will be attributable to the Company from completion of the transaction.

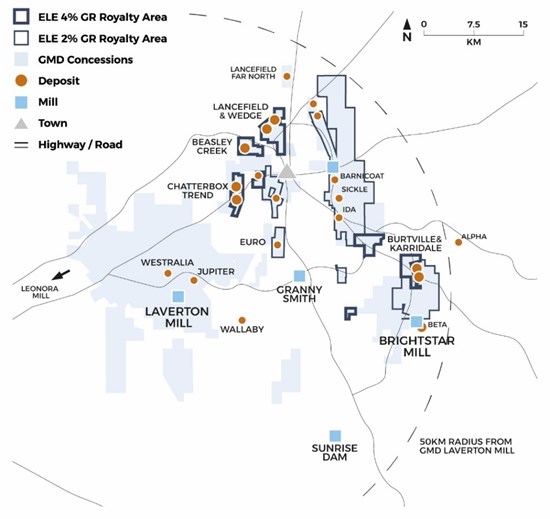

Laverton -

The Laverton Project covers several Archaean greenstone belts north-northeast of Kalgoorlie which host a range of orogenic lode gold deposits, typical of the Western Australian Yilgarn Eastern Goldfields. The Laverton district is one of the best endowed gold regions in Australia, hosting a number of major deposits, such as Gold Fields' Granny Smith and AngloGold Ashanti's Sunrise Dam.

Following the acquisition, Elemental Altus will hold a total

Elemental Altus' to be acquired royalty covers a total of 307 km2 of the Laverton Project, encompassing the following deposits:

- Beasley Creek and Beasley Creek South

- The Chatterbox Trend, including Apollo, Eclipse, Innuendo, Rumor

- The Gladiator Trend, including Gladiator and Murrays

- The Lancefield-Wedge Trend, including Telegraph, Wedge-Lancefield North

- The historic underground Lancefield Gold Mine

- The Karridale-Burtville Project

- The Euro Trend, comprising both North and South deposits

- The Cragiemore-Mary Mac Trend, including the Golden Pinnacles, Mary Mac and Craigiemore

- The West Laverton-Bulldog Trend

- The Barnicoat Project, including Barnicoat, Admiral Hill, Bells, Castaway, Grouse and Sickle

The wider Laverton project has the following JORC 2012 compliant Mineral Resource and Ore Reserve Estimates, over which Elemental Altus has significant coverage:

- Indicated Mineral Resource Estimate of 45.0 Mt @ 1.5 g/t Au for 2,100,000 ounces

- Inferred Mineral Resource Estimate of 23.0 Mt @ 2.1 g/t Au for 1,600,000 ounces

Including:

- Probable Ore Reserve Estimate of 13.0 Mt @ 1.3 g/t Au for 546,000 ounces

The newly acquired royalty area also includes an additional combined 240,000 ounces of historical gold resources at the Barnicoat Project and South Lancefield, reported to a JORC-2004 Compliant standard only.

Genesis notes the clear potential for Laverton to supply open pit and underground ore to Genesis' operating 3 Mtpa Laverton mill approximately 30 km away. The mill is currently designed for standard CIL/CIP processing of free milling ores, comprising a jaw crusher and ball mill, leach tanks and an elution circuit. Genesis is investigating staged expansion opportunities, including an additional ball mill, increased leaching capacity and a crushing circuit upgrade. The new operator is also investigating the possible inclusion of refractory gold deposits, and these studies could potentially include restarting the Lancefield underground mine, with an Inferred Resource of 790,000 ounces at 6.3 g/t Au within Elemental Altus' royalty area, which could be used to supplement future mill feed.

Figure 1 - Elemental Altus royalty coverage over the Laverton Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8358/264731_2895771f54ab7a52_001full.jpg

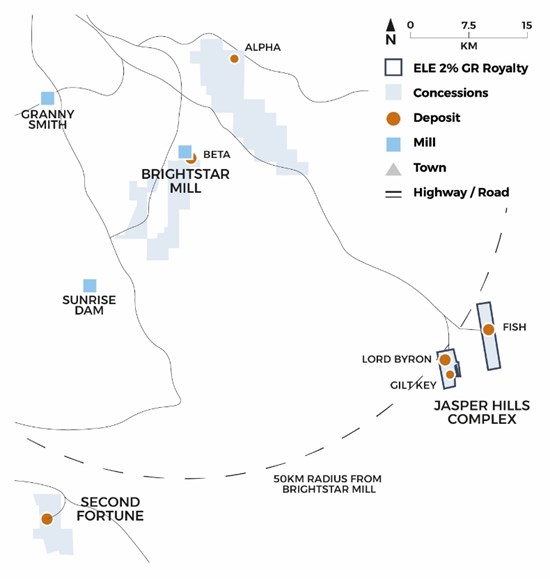

Jasper Hills -

The Jasper Hills Project consists of the Lord Byron, Fish and Gilt Key gold deposits approximately 100 km southeast of Laverton, Western Australia. The Mineral Resources lie in an underexplored greenstone belt SE of Laverton approximately 70km southeast of Brightstar's processing plant, itself located ~30km southeast of Laverton, WA. Mining has previously occurred at Jasper Hills, with Crescent Gold Limited ("Crescent") extracting 350,000t @ 3.83 g/t Au from the Fish open pit from 2011 to 2012, with ore being processed at Granny Smith. Crescent also mined 280,150t @ 1.5g/t Au for 13,510 oz gold produced from two shallow laterite pits at Lord Byron in 2012. Post 2012, Blue Cap Mining completed a further cutback at Lord Byron, with 190,400t @ 2.04g/t sold for processing at Sunrise Dam.

Elemental Altus' royalty covers 32 km2 of the Jasper Hills Project, encompassing the following JORC 2012 compliant Mineral Resource and Ore Reserve Estimates:

- Measured and Indicated Mineral Resource Estimate of 2.5 Mt @ 1.8 g/t Au for 147,000 ounces

- Inferred Mineral Resource Estimate of 3.2 Mt @ 1.6 g/t Au for 160,000 ounces

Including:

- Proven and Probable Ore Reserve Estimate of 1.5Mt @ 1.6 g/t Au for 77,000 ounces

Brightstar are actively developing the underground mine at Fish, with portal access established in April 2025, and first ore intersected in late June. Stoping is on track to commence in the September quarter, with ore to be hauled to Genesis' Laverton Mill, where a tolling agreement is in place to treat Brightstar material until Q1 2026. Two underground diamond drilling platforms have been established ahead of an exploration drill campaign this quarter. Inferred Resources are present beneath the currently planned development, with exploration targets identified at depth. The company believes that there is significant potential for reserve replacement, and for the life of mine to be extended beyond the current plan.

The Lord Byron open pit is scheduled to commence mining in Q3 2026, with ore to be treated at the Brightstar Mill, which is planned to be refurbished and restarted in H2 2026. It is expected that Lord Byron will provide the initial baseload feed to the expanded 1.0 Mtpa mill up to and including 2030. The current Reserve pit shell at Lord Byron is modelled using a A

Elemental Altus note clear intent from Brightstar to maximise efficiencies and productivity at the Jasper Hills complex, with the construction of a new camp and associated infrastructure being progressed to enhance synergies across the two operations. The Jasper Hills tenements are central to Brightstar's early production plan, using initial near-term revenue to fund exploration and develop the wider Laverton package, including at Second Fortune, Alpha and Cork Tree Well to the North.

Figure 2 - Elemental Altus royalty coverage over the Jasper Hills Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8358/264731_2895771f54ab7a52_002full.jpg

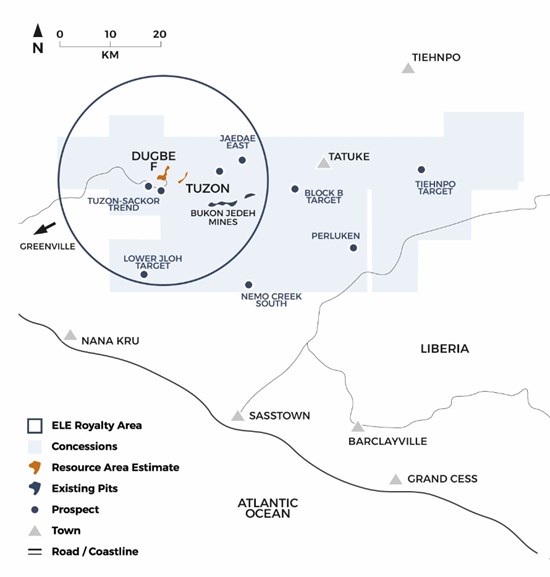

Dugbe - 2.0

Liberia is considered highly prospective for gold and is a geologically similar, yet underexplored jurisdiction compared to the neighbouring gold producing countries Côte d'Ivoire, Mali, Burkino Faso and Ghana. The 2,078km2 project area is situated in an established mining region - with Bonikro, Yaoure, Ity and Abujar gold deposits all present to the northeast. The royalty covers a circular area with a 20km radius from a defined point at the southern edge of current Dugbe F pit design. The royalty area covers 1,257km2, with approximately 850km2 overlapping with the current project area.

DRA Global completed a Feasibility Study for Dugbe in June 2022, and more recently, Pasofino announced that they have engaged MineScope Services to complete a gap analysis and trade-off studies to update the 2022 Feasibility Study. 'Phase One' of this process has now been completed, and improvement workstreams have been outlined for the next 12 months, leading to the planned release of an updated study next year.

The proposed greenfield project is a multi-pit mine, utilising truck-shovel open pit mining methods with a single processing plant. The 2022 Dugbe Feasibility Study proposed a 5 Mtpa mill throughput with a 14-year mine life, producing ~162,000 ounces of gold per annum, averaging ~200,000 ounces of gold per annum over the first ten years of full production. All project infrastructure to be constructed is included in the study, as well as upgrades at the nearby port facility at Greenville, and the 75km access route. The royalty area also contains a number of encouraging exploration prospects, including the very promising Sackor and Bukon Jedeh areas.

Figure 3 - Elemental Altus royalty coverage over the Dugbe Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8358/264731_2895771f54ab7a52_003full.jpg

Frederick Bell

CEO

Corporate & Media Inquiries:

Tel: +1 604 646 4527

info@elementalaltus.com

www.elementalaltus.com

TSXV: ELE | OTCQX: ELEMF | ISIN: CA28619K1093 | CUSIP: 28619K109

About Elemental Altus Royalties Corp.

Elemental Altus is an income generating precious metals royalty company with 10 producing royalties and a diversified portfolio of pre-production and discovery stage assets. The Company is focused on acquiring uncapped royalties and streams over producing, or near-producing, mines operated by established counterparties. The vision of Elemental Altus is to build a global gold royalty company, offering investors superior exposure to gold with reduced risk and a strong growth profile.

Neither the TSX-V nor its Regulation Service Provider (as that term is defined in the policies of the TSX-V.) accepts responsibility for the adequacy or accuracy of this press release.

Qualified Person

Richard Evans, FAusIMM, is Senior Vice President Technical for Elemental Altus, and a qualified person under National Instrument 43-101 - Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical disclosure contained in this press release.

Notes

Genesis Minerals Limited ASX release titled "Genesis eyes further growth in production and cashflow with the acquisition of Laverton Gold Project", dated May 25, 2025, at https://genesisminerals.com.au/

Brightstar Resources Limited ASX release titled "Compelling Scoping Study for Jasper Hills Gold Project", dated March 25, 2024, at https://brightstarresources.com.au/

Brightstar Resources Limited ASX release titled "Menzies & Laverton Gold Projects Feasibility Study Outlines

$461m Free Cash Flow", dated June 30, 2025, at https://brightstarresources.com.au/Dugbe Gold Project NI 43-101 Technical Report - Feasibility Study, effective June 13, 2022, and dated July 28, 2022, at https://www.pasofinogold.com/

Elemental Altus notes that for historical deposits, the tonnages and grades stated were not prepared or disclosed consistent or compliant with NI 43-101 or an acceptable foreign code. No qualified person has completed sufficient work to classify the estimate as current mineral resources or mineral reserves.

Cautionary note regarding forward-looking statements

This news release contains "forward-looking information" within the meaning of applicable Canadian securities laws and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995, (together, "forward-looking statements"), concerning the business, operations and financial performance and condition of the Company. Forward-looking statements include, but are not limited to, statements with respect to the future price of gold; the timing of and completion of the royalty acquisitions; perceived merit of properties and exploration results; the estimation of mineral reserves and mineral resources; the realization of Mineral Reserve estimates; work programs, capital expenditures, timelines, strategic plans; the potential rapid advancement of mining leases into Genesis' mine plan; the Company's growth prospects; the Company's estimated 2025 revenues; and the timing and amount of estimated future production. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as "plans," "expects" or "does not expect," "is expected," "budget," "scheduled," "estimates," "forecasts," "intends," "anticipates" or "does not anticipate," "believes," "projects" or variations of such words and phrases or state that certain actions, events or results "may," "could," "would," "might" or "will be taken," "occur" or "be achieved." Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made, and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements, including, but not limited to, volatility in the price of gold, discrepancies between anticipated and actual production by companies in our portfolio, risks inherent in the mining industry to which the companies in our portfolio are subject, regulatory restrictions, activities by governmental authorities (including changes in taxation), currency fluctuations, the accuracy of the mineral reserves, resources and recoveries set out in the technical data published by the companies in our portfolio, the unavailability of financing, and other factors. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company cautions readers not to place undue reliance on forward-looking statements, as forward-looking statements involve significant risks and uncertainties. Forward-looking statements should not be read as guarantees of future performance or results and will not necessarily be accurate indications of whether or not the times at or by which such performance or results will be achieved. The Company does not undertake to update any forward-looking statements except in accordance with applicable Canadian securities laws. Readers are directed to the Company's Annual Information Form dated August 18, 2025, filed under the Company's profile on SEDAR+ (www.sedarplus.ca) for a complete list of applicable risk factors. Investors are advised that National Instrument 43-101 Standards for disclosure for Mineral Projects ("NI 43-101") of the Canadian Securities Administrators requires that each category of Mineral Reserves and Mineral Resources be reported separately. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/264731