Emperor Commences 10,000-15,000 Metre Drilling Program at the Duquesne West Gold Project

Rhea-AI Summary

Emperor Metals (OTCQB: EMAUF) has started a 10,000–15,000 metre diamond drilling program at the Duquesne West gold project for the 2025–2026 winter season.

The program is funded with approximately $11.1 million in working capital and builds on 2024 results that supported an initial resource estimate that more than doubled the historical figure (July 9, 2025).

Key objectives: expand the conceptual open-pit footprint, convert inferred ounces to indicated, extend mineralized zones ~1 km east toward the Nip Zone; initial assays are expected mid–late January 2026.

Positive

- 10,000–15,000 m planned drilling program

- $11.1M working capital to fund program

- Initial resource estimate more than doubled historical figure

Negative

- Material still contains significant inferred resources needing conversion

- Initial assay results not expected until mid–late January 2026

News Market Reaction

On the day this news was published, EMAUF declined 6.14%, reflecting a notable negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

EMAUF was down 1.02% while gold peers were mixed: CGLCF and RRDMF fell 3.83% and 2.9%, while GPTRF, JGLDF, and NSRPF gained between 0.66% and 2.34%, indicating stock-specific factors rather than a uniform sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 04 | Drill program start | Positive | -6.1% | Launch of 10,000–15,000 m winter drilling at Duquesne West. |

| Oct 30 | Resource clarification | Neutral | -8.6% | Correction of mineral resource figures and percentage increase wording. |

| Oct 30 | Conference update | Positive | -4.2% | Showcasing growth, updated resource, and 2025 drilling at conference. |

| Oct 28 | Drill mobilization | Positive | +7.7% | Drill rig mobilized after $11.1M financing to advance exploration. |

| Aug 27 | Technical report filing | Positive | -5.2% | Filing of technical report supporting maiden MRE for Duquesne West. |

News on Duquesne West has often been followed by negative next-day moves, with only the October 28 drilling mobilization showing a clearly positive reaction.

Over the past six months, Emperor Metals has focused on the Duquesne West Gold Project, progressing from a maiden Mineral Resource Estimate filed on Aug 27, 2025 through financing and drill mobilization. Subsequent updates on conference participation, resource clarification, and today’s 10,000–15,000 m drilling launch built on an Inferred resource of 1.46 Moz at 1.69 g/t Au. Despite these milestones, several prior announcements, including the technical report and resource clarification, saw negative 24h price reactions, highlighting a pattern of cautious market responses.

Market Pulse Summary

The stock moved -6.1% in the session following this news. A negative reaction despite operational progress would fit prior patterns where positive Duquesne West milestones, such as the technical report on Aug 27, 2025 and the conference update on Oct 30, 2025, were followed by -5.16% and -4.23% moves. The market may reassess near-term dilution of expectations around drilling outcomes and the wait for assays, even though the company reported $11.1 million in working capital and a sizeable 10,000–15,000 m program.

Key Terms

diamond drilling technical

working capital financial

artificial intelligence technical

assay results technical

replacement-style mineralization technical

AI-generated analysis. Not financial advice.

Edmonton, Alberta--(Newsfile Corp. - December 4, 2025) - Emperor Metals Inc. (CSE: AUOZ) (OTCQB: EMAUF) (FSE: 9NH) ("Emperor") is pleased to announce the start of its 10,000 - 15,000 metre diamond drilling program at its flagship Duquesne West Gold Project in Quebec for the 2025-2026 winter season.

V.P. Exploration John Labrecque commented: "We are excited to resume drilling at Duquesne West. Building on the strong results from 2024, our team has clearly defined the key targets for this next phase. With approximately

2025-2026 Winter Exploration Program

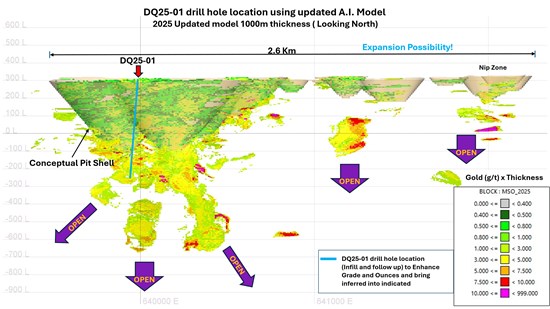

Leveraging insights from the 2024 results, our advanced AI (Artificial Intelligence) models will guide targeting efforts to improve and refine the economic parameters of the conceptual open-pit environment by following up on poorly understood areas ( e.g., DQ24-12: 21.7m of 35.2 g/t Au), focus on converting some of the ounces from inferred to indicated, and extending the footprint an additional 1 km east of the conceptual open pit toward the Nip Zone.

Key components of the 2025 season include:

Expand the Open Pit Footprint: Target additional discoveries within the host rock containing high-grade gold lenses, focusing on the conceptual open-pit model.

Increase the Thickness of the High-Grade Lenses: Incorporate previously unaccounted lower-grade gold from the margins of high-grade lenses and enhance their overall thickness.

Expand Mineralized Zones: Extend the lateral footprint of mineralized zones along strike and dip.

Discover New Zones: Explore potential new zones not yet included in the conceptual open-pit model, with a particular focus on eastward expansion.

Validate Historical Zones: Confirm existing high grade historical zones along plunge to determine extent of mineralization and bring inferred material into measured and indicted categories.

The 2024 program clearly demonstrated the project's strong potential, underpinning a new initial resource estimate that more than doubled the historical figure (see press release dated July 9, 2025) and identifying multiple priority targets for the current phase of work. This substantial increase in resources was achieved by evaluating and integrating both open-pit and underground mining scenarios.

Upcoming Catalysts

The current drill program is scheduled to continue through early spring 2026, with initial assay results anticipated between mid-late January 2026. Our first drillhole of 2025 is planned to reach a depth of 550 meters and will test several gold-bearing intercepts, reflecting the multiple mineralized lenses that characterize this deposit. These multiple lenses not only support the potential of our conceptual open-pit model but also indicate a robust and laterally extensive gold-mineralizing system, suggesting meaningful opportunities for future expansion within and outside the main conceptual open pit model (See Figure 1).

Emperor is currently drilling hole DQ25-01 and is encountering the hallmark replacement-style mineralization characteristic of the deposit (See Image 1). This style of mineralization commonly develops with substantial thickness, thereby reducing dilution in a mining scenario and further underscoring the enduring strength of the southern Abitibi and the advantages of exploring a region repeatedly proven to be richly endowed with economic mineralization.

Figure 1: Location of DQ25-01, initial drill target.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8461/276871_f1c40c8f649d58c2_001full.jpg

Image 1: Highlights a recent intercept from DQ25-01, exhibiting the hallmark features of replacement-style mineralization that accounts for a significant portion of the deposit's total tonnage.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8461/276871_emperor1.jpg

About the Duquesne West Gold Project

The Duquesne West Gold Property is located 32 km northwest of the city of Rouyn-Noranda and 10 km east of the town of Duparquet. The property lies within the historic Duparquet gold mining camp in the southern portion of the Abitibi Greenstone Belt in the Superior Province.

Under an Option Agreement, Emperor agreed to acquire a one hundred percent (

The Property hosts a recent inferred mineral resource (see press release dated July 9, 2025). The gold system remains open for resource identification and expansion.

A reinterpretation of the existing geological model was created using AI and Machine Learning. This model shows the opportunity for additional discovery of ounces by revealing gold trends unknown to previous workers and the potential to expand the resource along significant gold-endowed structural zones.

QP Disclosure

The technical content for the Duquesne West Project in this news release has been reviewed and approved by John Labrecque, P.Geol., a Qualified Person pursuant to CIM guidelines.

About Emperor Metals Inc.

Emperor Metals Inc. is an innovative Canadian mineral exploration company focused on developing high quality gold properties situated in the Canadian Shield. For more information, please refer to SEDAR+ (www.sedarplus.ca), under the Emperor's profile.

ON BEHALF OF THE BOARD OF DIRECTORS and CEO John Florek

s/ "John Labrecque"

John Labrecque, P.Geol,

Vice President Exploration,

Emperor Metals Inc.

Contact: John Florek, President/CEO

T: (807) 228-3531

The Canadian Securities Exchange has not approved nor disapproved the content of this press release.

Cautionary Note Regarding Forward-Looking Statements:

Certain statements made and information contained herein may constitute "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and United States securities legislation. These statements and information are based on facts currently available to Emperor and there is no assurance that the actual results will meet management's expectations. Forward-looking statements and information may be identified by such terms as "anticipates," "believes," "targets," "estimates," "plans," "expects," "may," "will," "could" or "would." Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and other matters. While Emperor considers its assumptions to be reasonable as of the date hereof, forward-looking statements and information are not guarantees of future performance and readers should not place undue importance on such statements as actual events and results may differ materially from those described herein. Emperor does not undertake to update any forward-looking statements or information except as may be required by applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276871