Electric Metals Announces Mutual Termination of Altair Resources Option and Acquisition Agreement, Strategic Partnership Opportunities on Nevada Silver Assets, and Board DSU Grants

Electric Metals (OTCQB:EMUSF) announced three key developments: First, the mutual termination of its option and acquisition agreement with Altair Resources for the Nevada silver assets, effective July 25, 2025, with no termination fees. Second, the company is actively seeking new strategic partners for its Nevada precious metal assets, including the Corcoran Canyon Silver-Gold Project (containing 33.5M silver-equivalent ounces) and the Belmont Silver Project.

The Corcoran resource estimate from 2021 used metal prices of $21.09/oz silver and $1,657/oz gold, while current prices are significantly higher at $38.18/oz (+81%) and $3,343.50/oz (+101%) respectively, indicating substantial upside potential. Additionally, the company granted 3,939,740 Deferred Share Units (DSUs) to non-executive board members, vesting over one year and redeemable upon director departure.

Electric Metals (OTCQB:EMUSF) ha annunciato tre sviluppi chiave: primo, la risoluzione consensuale del suo accordo di opzione e acquisizione con Altair Resources per gli asset argentei del Nevada, con effetto dal 25 luglio 2025, senza penali di risoluzione. Secondo, la società sta attivamente cercando nuovi partner strategici per i suoi asset di metalli preziosi in Nevada, tra cui il Progetto Argento-Oro Corcoran Canyon (contenente 33,5 milioni di once equivalenti in argento) e il Progetto Argento Belmont.

La stima delle risorse di Corcoran del 2021 utilizzava prezzi dei metalli di 21,09 $/oz per l'argento e 1.657 $/oz per l'oro, mentre i prezzi attuali sono significativamente più alti, rispettivamente 38,18 $/oz (+81%) e 3.343,50 $/oz (+101%), indicando un potenziale di crescita sostanziale. Inoltre, la società ha concesso 3.939.740 Unità Azionarie Differite (DSU) ai membri non esecutivi del consiglio, con maturazione in un anno e riscattabili al momento della loro uscita dal consiglio.

Electric Metals (OTCQB:EMUSF) anunció tres desarrollos clave: primero, la terminación mutua de su acuerdo de opción y adquisición con Altair Resources para los activos de plata en Nevada, efectivo a partir del 25 de julio de 2025, sin cargos por terminación. Segundo, la empresa está buscando activamente nuevos socios estratégicos para sus activos de metales preciosos en Nevada, incluyendo el Proyecto Plata-Oro Corcoran Canyon (que contiene 33.5 millones de onzas equivalentes de plata) y el Proyecto Plata Belmont.

La estimación de recursos de Corcoran de 2021 utilizó precios de metales de $21.09/oz para plata y $1,657/oz para oro, mientras que los precios actuales son significativamente más altos, con $38.18/oz (+81%) y $3,343.50/oz (+101%) respectivamente, lo que indica un potencial considerable de crecimiento. Además, la compañía otorgó 3,939,740 Unidades de Acciones Diferidas (DSUs) a los miembros no ejecutivos de la junta, que se consolidan en un año y son canjeables al salir del director.

Electric Metals (OTCQB:EMUSF)는 세 가지 주요 발전 사항을 발표했습니다: 첫째, 2025년 7월 25일부로 Altair Resources와의 네바다 은 자산에 대한 옵션 및 인수 계약을 상호 해지하며, 해지 수수료는 없습니다. 둘째, 회사는 Corcoran Canyon 은-금 프로젝트(은 환산 3,350만 온스 포함)와 Belmont 은 프로젝트를 포함한 네바다 귀금속 자산에 대해 새로운 전략적 파트너를 적극적으로 모색하고 있습니다.

2021년 Corcoran 자원 추정치는 은 가격 $21.09/온스, 금 가격 $1,657/온스를 기준으로 했으나, 현재 가격은 각각 $38.18/온스 (+81%)와 $3,343.50/온스 (+101%)로 크게 상승해 상당한 상승 잠재력을 보여줍니다. 또한, 회사는 비집행 이사회 멤버들에게 1년간 베스팅되며 이사 퇴임 시 상환 가능한 3,939,740개의 이연 주식 단위(DSUs)를 부여했습니다.

Electric Metals (OTCQB:EMUSF) a annoncé trois développements clés : premièrement, la résiliation mutuelle de son accord d’option et d’acquisition avec Altair Resources concernant les actifs argentifères du Nevada, effective au 25 juillet 2025, sans frais de résiliation. Deuxièmement, la société recherche activement de nouveaux partenaires stratégiques pour ses actifs en métaux précieux du Nevada, y compris le projet argent-or Corcoran Canyon (contenant 33,5 millions d’onces équivalentes argent) et le projet argent Belmont.

L’estimation des ressources de Corcoran de 2021 utilisait des prix des métaux de 21,09 $/oz pour l’argent et 1 657 $/oz pour l’or, alors que les prix actuels sont bien plus élevés, à 38,18 $/oz (+81%) et 3 343,50 $/oz (+101%) respectivement, indiquant un potentiel de hausse important. De plus, la société a attribué 3 939 740 unités d’actions différées (DSU) aux membres non exécutifs du conseil d’administration, acquises sur une période d’un an et rachetables lors du départ des administrateurs.

Electric Metals (OTCQB:EMUSF) gab drei wichtige Entwicklungen bekannt: Erstens die einvernehmliche Beendigung des Options- und Erwerbsvertrags mit Altair Resources für die Silber-Assets in Nevada, wirksam ab dem 25. Juli 2025, ohne Kündigungsgebühren. Zweitens sucht das Unternehmen aktiv nach neuen strategischen Partnern für seine Edelmetall-Assets in Nevada, darunter das Corcoran Canyon Silber-Gold-Projekt (mit 33,5 Mio. Silberäquivalent-Unzen) und das Belmont Silber-Projekt.

Die Ressourcenschätzung von Corcoran aus dem Jahr 2021 basierte auf Metallpreisen von 21,09 $/oz Silber und 1.657 $/oz Gold, während die aktuellen Preise mit 38,18 $/oz (+81%) bzw. 3.343,50 $/oz (+101%) deutlich höher liegen, was erhebliches Aufwärtspotenzial signalisiert. Darüber hinaus gewährte das Unternehmen 3.939.740 Deferred Share Units (DSUs) an nicht geschäftsführende Vorstandsmitglieder, die über ein Jahr vesten und bei Ausscheiden der Direktoren einlösbar sind.

- Significant upside potential with current silver prices 81% higher and gold prices 101% higher than 2021 resource estimate assumptions

- Corcoran Project hosts substantial 33.5M silver-equivalent ounces resource that remains open in all directions

- Strategic location in highly endowed Au-Ag district with 24 Moz gold and 89+ Moz silver

- Clean termination of Altair agreement with no financial penalties

- Loss of previously announced partnership with Altair Resources for Nevada assets

- Company needs to find new strategic partners for its Nevada precious metal assets

- Shift in focus away from Nevada assets to Emily Manganese Deposit in Minnesota

TORONTO, ON / ACCESS Newswire / July 28, 2025 / Electric Metals (USA) Limited ("EML" or the "Company") (TSXV:EML)(OTCQB:EMUSF) announces the mutual termination of the previously announced option and acquisition agreement (the "Agreement") with Altair Resources Inc. ("Altair"), the Company's intention to pursue strategic partnership opportunities on its Nevada silver assets, and the grant of 3,939,740 Deferred Share Units ("DSUs") to members of its Board of Directors.

Mutual Termination of Altair Agreement

The Company and Altair have mutually agreed to terminate the Agreement, originally announced on November 22, 2023, which contemplated Altair earning up to

Strategic Partnership Opportunities - Nevada Silver Assets

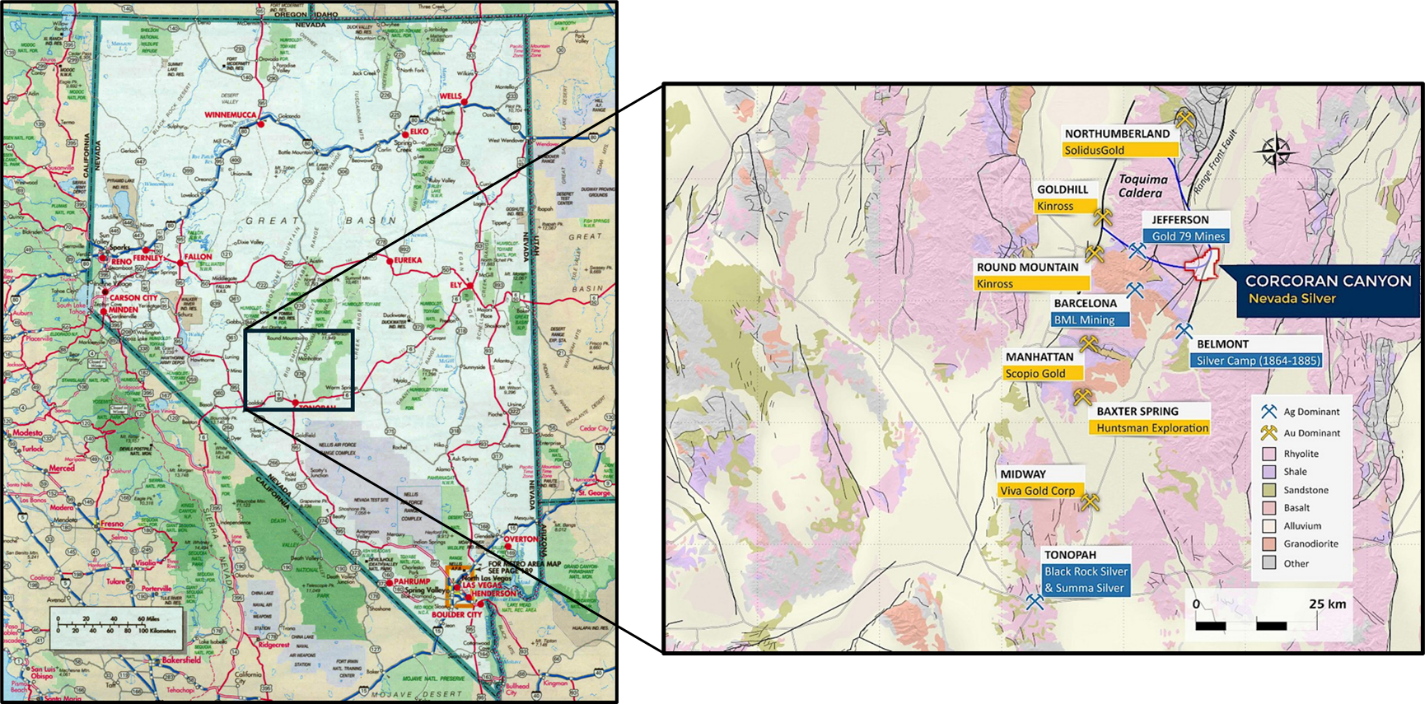

Following the termination of the Agreement, the Company is actively seeking partners to earn-in or acquire its Nevada-based precious metal assets: the Corcoran Canyon Silver - Gold Project, the Belmont Silver Project and the Belmont North Gold-Silver Project. These projects are located north of Tonopah and east of Round Mountain in Nye County, within the Toquima caldera complex-one of the most highly endowed Au-Ag districts in the U.S. This 30 km-wide zone of nested calderas includes five ore deposits hosting 24 Moz gold and 89+ Moz silver.

Corcoran Canyon and Belmont Silver Projects Location Map

Corcoran Canyon Silver-Gold Project

Corcoran hosts near-surface mineralization that remains open in all directions and carries an NI 43-101 Mineral Resource Estimate of 33.5 million silver-equivalent ounces (effective August 12, 2021), prepared by Mr. Gregory Z. Mosher, P.Geo., M.Sc. and Mr. David S. Smith, P.Geo., M.S. The estimate assumes an open-pit cut-off grade of 15 g/t Ag-Eq and underground cut-off of 100 g/t Ag-Eq, calculated with recoveries of

For context, as of July 25, 2025, the London PM Fix price for silver was US

Belmont Silver Project and Belmont North Gold-Silver Project

Located 15 km south of Corcoran, Belmont was among the earliest and richest silver mining camps in the Tonopah district, historically averaging 25 oz/t (775 g/t) Ag. Despite negligible exploration since the 1880s, USGS sampling has confirmed grades up to

"Both the Corcoran Canyon and Belmont Projects represent attractive targets for silver and gold discovery and expansion in an excellent location in central Nevada. We are actively evaluating opportunities to enhance work on these projects and monetize the Nevada assets for the benefit of our shareholders," said Brian Savage, CEO, EML. "At the same time, our primary focus remains on advancing our high-grade Emily Manganese Deposit in Minnesota, with the results of the Emily Manganese PEA to be announced soon."

Parties interested in partnership or acquisition discussions are invited to contact the Company for further information.

Grant of Deferred Share Units

The Company granted an aggregate of 3,939,740 Deferred Share Units (DSUs) to non-executive members of its Board of Directors on July 24, 2025, under the Company's Omnibus Equity Incentive Plan that Shareholders approved on June 26, 2024. The Board sets DSU vesting terms, subject to TSXV rules that require a one-year minimum vesting period while the Company is TSXV-listed, with limited exceptions (e.g., death or a Change of Control). DSUs are redeemable for common shares upon a director's departure, aligning interests with those of shareholders. The DSUs are being issued in lieu of cash-based Board fees.

About Electric Metals (USA) Limited

Electric Metals (USA) Limited (TSXV: EML) (OTCQB: EMUSF) is a US-based mineral development company with manganese and silver projects geared to supporting the transition to clean energy. The Company's principal asset is the Emily Manganese Project in Minnesota, the highest-grade manganese deposit in North America, which has been the subject of considerable technical studies, including National Instrument 43-101 Technical Reports - Resource Estimates. The Company's mission in Minnesota is to become a domestic US producer of high-value, high-purity manganese metal and chemical products to supply the North American electric vehicle battery, technology and industrial markets. With manganese playing a critical and prominent role in lithium-ion battery formulations, and with no current domestic supply or active mines for manganese in North America, the development of the Emily Manganese Project represents a significant opportunity for America, the State of Minnesota and for the Company's shareholders.

For further information, please contact:

Electric Metals (USA) Limited

Brian Savage

CEO & Director

(303) 656-9197

Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words "believes," "may," "plans," "will," "anticipates," "intends," "could", "estimates", "expects", "forecasts","projects" and similar expressions, and the negative of such expressions.

Such statements in this news release include, without limitation: the ability of the Company to complete the Offering; the size, terms and timing of the Offering; participation in the Offering by insiders of the Company; the timing and receipt of TSXV and other approvals required in connection with the Offering; the intended use of proceeds of the Offering; the Company's mission to become a domestic US producer of high-value, high-purity manganese metal and chemical products to supply the North American electric vehicle battery, technology and industrial markets; that manganese will continue to play a critical and prominent role in lithium-ion battery formulations; that with no current domestic supply or active mines for manganese in North America, the development of the Emily Manganese Project represents a significant opportunity for America, Minnesota and for the Company's shareholders; and planned or potential developments in ongoing work by Electric Metals.

These statements address future events and conditions and so involve inherent risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such risks include, but are not limited to, the failure to obtain all necessary stock exchange and regulatory approvals; investor interest in participating in the Offering; and risks related to the exploration and other plans of the Company. Forward-looking information is based on the reasonable assumptions,estimates, analysis and opinions of management made in light of its experience and perception of trends, updated conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances at the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information.Accordingly, readers should not place undue reliance on forward-looking information.

All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events, or developments,except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE:

View the original press release on ACCESS Newswire