Electric Metals Files NI 43-101 Preliminary Economic Assessment for the North Star Manganese Project on SEDAR+

Rhea-AI Summary

Electric Metals (OTCQB:EMUSF) filed an NI 43-101 Preliminary Economic Assessment for the North Star Manganese Project with an effective date of Aug 15, 2025 and issue date Sep 30, 2025.

Key metrics: after-tax NPV(10%) US$1.39B, IRR 43.5%, and initial CapEx US$474.8M. The project combines an underground mine in Emily, Minnesota and a U.S. high-purity manganese sulfate monohydrate (HPMSM) plant. Indicated and Inferred resources underpin the mine plan. Metallurgical test work supports battery-grade HPMSM. Planned next steps include pre-feasibility, flowsheet optimization, drilling, siting, permitting, and environmental studies.

Positive

- After-tax NPV(10%) of US$1.39B

- Internal rate of return of 43.5%

- Metallurgical test work supports battery-grade HPMSM

Negative

- Initial capital requirement of US$474.8M

- Mine plan relies on Indicated and Inferred resources

- Further drilling, optimization, and permitting required before PFS

News Market Reaction

On the day this news was published, EMUSF declined 1.53%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Results Underscore Robust Economics and a U.S. Manganese Ore to HPMSM Pathway

TORONTO, ON, ON / ACCESS Newswire / October 6, 2025 / Electric Metals (USA) Limited ("EML" or the "Company") (TSXV:EML)(OTCQB:EMUSF) announces it has filed on SEDAR+ the National Instrument 43-101 Preliminary Economic Assessment ("PEA") for its North Star Manganese Project (NSMP), a

PEA At-a-Glance: After-tax NPV(

The full NI 43-101 PEA is available under Electric Metals (USA) Limited on SEDAR+. This filing follows the Company's news release dated August 26, 2025, which summarized the PEA results. The filed NI 43-101 Technical Report provides the underlying assumptions, parameters, and risks that form the basis of the PEA and should be read in conjunction with that earlier disclosure.

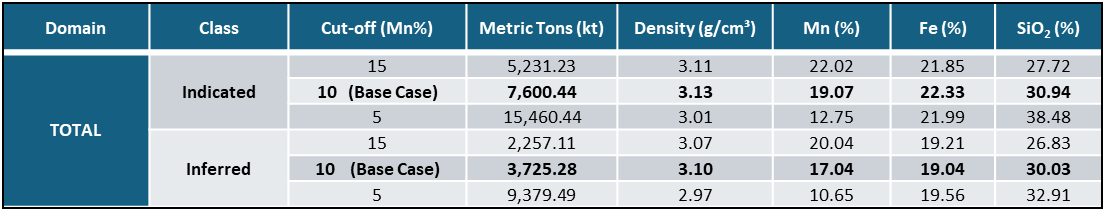

The Indicated and Inferred Mineral Resources used in the PEA operational and financial models are presented in Table 1.

Table 1: NSM Emily Classified Mineral Resource Estimate

Top 10 Takeaways from the PEA

PEA filed on SEDAR+ (milestone achieved).

NSMP integrates an underground mine at Emily, Minnesota with a U.S. HPMSM chemical plant (site under evaluation).

Strong after-tax economics. NPV(

10% ) US$1.39B and IRR43.5% at base assumptions.Initial capital scoped to enable underground development, surface infrastructure, and HPMSM production, including contingencies.

Life-of-Mine operating expenditures itemized across mining, processing, transportation, and G&A to support HPMSM economics.

Indicated and Inferred Resources underpin the mine plan; further work is defined to de-risk and potentially grow the mineral inventory.

Underhand cut-and-fill mining method selected for geometry and selectivity.

Metallurgical test work supports battery-grade HPMSM; a pre-feasibility study optimization will finalize the flowsheet and unit costs.

NPV and IRR remain robust across the entire range of Mn prices, capital expenditures, and operating expenditures.

Futurework program includes drilling, metallurgy/flowsheet optimization, siting/logistics, and environmental/hydrologic studies toward Pre-Feasibility.

Brian Savage, CEO, commented: "Filing the PEA is a major milestone for Electric Metals' North Star Manganese Project. With strong economics and North America's highest-grade manganese resource, we're positioned to deliver U.S.-sourced, HPMSM for the electrification of everything-and to support defense, steel/alloy, technology, and industrial markets. Next, we move directly into pre-feasibility, flowsheet optimization for battery-grade HPMSM, and permitting and siting for both the mine and the U.S. chemical plant."

Qualified Persons

The PEA was prepared by Forte Dynamics, Inc. The following independent Qualified Persons (NI 43-101) are responsible for the report and have reviewed and approved the scientific and technical content of this news release:

Donald E. Hulse, P.E., SME-RM - Mining/Resource Estimation

Deepak Malhotra, Ph.D., SME-RM - Metallurgy

Gordon Sobering, P.E., SME-RM - Mining Engineering

Ronald A. Steiner, Ph.D., CPG-AIPG - Geology

Douglas F. Hambley, P.E., P.Eng., SME-RM - Mining/Geotechnical

About Electric Metals (USA) Limited

Electric Metals (USA) Limited (TSXV:EML)(OTCQB:EMUSF) is a U.S.-based critical minerals company advancing manganese and silver projects that support the clean energy transition. The Company's principal asset is the Emily manganese deposit in Minnesota, the highest-grade manganese deposit in North America. The North Star Manganese Project has been the subject of extensive technical work, including a Preliminary Economic Assessment prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Electric Metals' mission is to establish a fully domestic U.S. supply of high-purity manganese chemical and metal products for the North American electric vehicle battery, technology, and industrial markets. With manganese playing an increasingly important role in lithium-ion battery formulations, and with no current domestic production in North America, the development of the North Star Manganese Project represents a strategic opportunity for the United States, the State of Minnesota, and the Company's shareholders.

For further information, please contact:

Electric Metals (USA) Limited

Brian Savage

CEO & Director

(303) 656-9197

Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words "believes," "may," "plans," "will," "anticipates," "intends," "could", "estimates", "expects", "forecasts", "projects" and similar expressions, and the negative of such expressions.

Such statements in this news release include, without limitation: the Company's mission to become a domestic U.S. producer of high-value, high-purity manganese products for the North American electric vehicle battery, technology and industrial markets; that manganese will continue to play a critical role in lithium-ion battery formulations; that with no current domestic supply or active mines for manganese in North America, the development of the North Star Manganese Project represents a significant opportunity for America, Minnesota and for the Company's shareholders; and planned or potential developments in ongoing work by Electric Metals.

Forward-looking information also includes statements with respect to the results of the Preliminary Economic Assessment ("PEA"), including but not limited to estimates of NPV, IRR, capital and operating costs, mine life, production, recovery rates, timelines, and pricing assumptions. The reader is cautioned that the PEA is preliminary in nature, includes Inferred Mineral Resources, and is subject to a high degree of uncertainty. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Inferred Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized.

These statements address future events and conditions and involve inherent risks, uncertainties and other factors that could cause actual events or results to differ materially from those estimated or anticipated. Such risks include, but are not limited to: failure to obtain all necessary stock exchange, regulatory, environmental and governmental approvals; risks relating to the accuracy of resource estimates; the speculative nature of Inferred Resources; risks relating to metallurgical test work, recoveries and process design; delays in or failure to advance to more detailed studies, including a Feasibility Study; the ability to secure project financing on reasonable terms; risks relating to construction, cost overruns and schedule delays; risks associated with securing offtake agreements; risks relating to the availability and cost of infrastructure, reagents, power, labor and transportation; fluctuations in commodity prices and exchange rates; potential changes to U.S. government policy or support for domestic critical mineral development; general market conditions and investor appetite; and risks associated with exploration, development and mining activities.

Forward-looking information is based on the reasonable assumptions, estimates, analysis, and opinions of management made in light of its experience and perception of trends, updated conditions, and expected developments, and other factors that management believes are relevant and reasonable in the circumstances as of the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results to differ from what is anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially. Accordingly, readers should not place undue reliance on forward-looking information.

All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events, or developments, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Electric Metals (USA) Limited

View the original press release on ACCESS Newswire