EON Resources Inc. Reports Results for the Third Quarter of 2025

Rhea-AI Summary

EON Resources (NYSE American: EONR) reported record net income of $5.6 million for Q3 2025 and closed a $45.5 million funding package on September 9, 2025 that combined volumetric funding and a farmout.

Key outcomes: $37M of debt retired (including ~$20M senior debt and a $15M seller note), all preferred shares redeemed (redemption value $27M), shareholder equity up $22.7M, and a Farmout with Virtus to drill up to 90 horizontal wells (10–20 per year) with expected cumulative capex > $300M.

Positive

- Record net income of $5.6 million in Q3 2025

- Closed $45.5 million funding on September 9, 2025

- Retired approximately $37 million of debt

- Shareholder equity increased by $22.7 million

- Farmout commits to up to 90 horizontal wells with > $300M cumulative capex

- Eliminated a $700,000/month amortization payment on senior debt

Negative

- Recorded a $16 million reduction in GJF property value for ORRI conveyance

- Issued 1.5 million Class A shares in the transaction (share count increase)

- Remaining convertible notes of $5.4 million outstanding at quarter end

- SJF added approximately $475,000 to total lease operating expenses in Q3

- Q3 included $1.1 million of non-recurring G&A costs related to funding

News Market Reaction

On the day this news was published, EONR gained 9.73%, reflecting a notable positive market reaction. Argus tracked a peak move of +14.8% during that session. Argus tracked a trough of -7.2% from its starting point during tracking. Our momentum scanner triggered 12 alerts that day, indicating notable trading interest and price volatility. This price movement added approximately $2M to the company's valuation, bringing the market cap to $22M at that time.

Data tracked by StockTitan Argus on the day of publication.

Record Net Income of

HOUSTON, TEXAS / ACCESS Newswire / November 17, 2025 / EON Resources Inc. (NYSE American:EONR) ("EON" or the "Company") is an independent upstream energy company with 20,000 leasehold acres in the Permian Basin. The fields have a total of 750 producing and injection wells producing over 1,000 barrels of oil per day. Today, the Company reports revenue and earnings for the third quarter of 2025.

Key third quarter highlights:

On September 9, 2025,

Sources and Uses of the

$20.0 million was received from a private family office in consideration for the sale by the LHO of a15% perpetual overriding royalty interest ("ORRI") in existing leases and wells in the GJF.$20.5 million came from the private family office for the sale by LHO of a5% perpetual ORRI in production from the San Andres formation in horizontal wells to be drilled under the farmout program by Virtus.$5.0 million was received from Virtus in consideration for a farmout of the LHO's rights in new horizontal wells to be drilled in the San Andres formation in which Virtus will own a65% operated working interest subject to earning and retention conditions through drilling commitments. LHO will retain a35% non-operated working interest in such wells.EON paid

$20.5 million as cash consideration to the seller of the GJF whereby (i) LHO purchased a10% overriding royalty interest seller had retained in the GJF valued at$13.5 million , (ii) EON retired the$20 million seller note ($15 million principal balance plus accrued interest) for$7.0 million , and (iii) EON issued 1.5 million shares of Class A common stock in exchange for the return to treasury of the preferred units owed by seller with a redemption value of$27 million .Retired senior debt of EON of approximately

$19.3 million . The payoff of the senior debt eliminated a$700,000 per month amortization payment (principal and interest) and released all oil and gas properties of LHO as collateral for such debt.

"With the completion of the

The Company entered into a Farmout Agreement ("Farmout") with Virtus on September 9, 2025: Under the Farmout, Virtus acquired the right to develop LHO's San Andres formation within the Grayburg Jackson Field under certain conditions and horizontal drilling commitments. Important Farmout provisions follow:

Virtus paid LHO

$5.0 million for the acquisition of a65% working interest in the leasehold rights in the San Andres formation developed through horizontal drilling. LHO retains a35% non-operated working interest in the horizontal wells to be drilled by Virtus in the San Andres formation . LHO retains its100% operated working interest in existing vertical wells and in the remaining formations under lease.As many as 90 horizontal wells are expected to be drilled at a cost between

$3.5 million to$4.0 million per well. Cumulative capital investment by Virtus and LHO is expected to exceed$300 million over the life of the project.The annual horizontal drilling program is expected to range from 10 to 20 new horizontal wells per year with initial production rates of 300 to 500 barrels of oil per day ("BOPD").

Over the life of the horizontal drilling program, gross oil production is expected to exceed 20,000 BOPD with

35% , or 7,000 BOPD from the San Andres formation, net to LHO's35% working interest.The first three wells are anticipated to be completed by mid-year 2026. The costs associated with the drilling and completion of the first three wells are solely the responsibility of Virtus. LHO retains a

35% working interest in these first three wells.The Economic Summary Projection of the anticipated development plan prepared by Virtus estimates more than ninety-five million dollars of reserve value based on net present value discounted at ten percent ("NPV-10") net to LHO's retained ownership interest.

More information on the funding and farmout can be found in the

Operational accomplishments during the third quarter:

Grayburg-Jackson Field had stabilized production and maintained lease operating expenses at reduced levels that have been maintained across 2025.

By the end of the quarter, over 2 miles of water injector flowlines had been installed on the GJF. Testing and fine-tuning are being performed as needed where the flowlines are expected to be completed in Q4.

The South Justis Field results started after acquisition by LHO at end of the second quarter, and thus the third quarter reflects the first full quarter of results for SJF.

Financial highlights for the quarter ended September 30, 2025 :

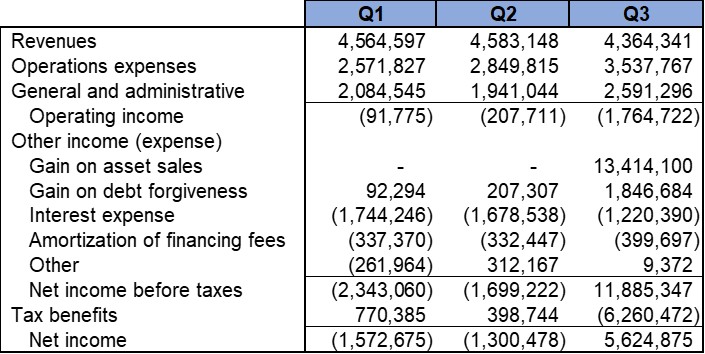

Income statement : Below is a condensed version of the income statement that is included in the 10-Q filing, followed by discussions on certain results and changes from prior quarters.

Revenues were Consistent: The revenues for the quarter remained consistent with prior quarters as production and prices had only minor fluctuations.

Lease Operating Expenses ("LOE") were Consistent: The LOE for the GJF remained consistent at reduced levels across 2025 compared to 2024 LOE levels. The South Justis Field ("SJF") LOE costs commenced in Q3 of 2025 after acquisition of the SJF adding approximately

$475 K to the total LOE.General and Administrative ("G&A") Costs had Decline in Recurring Costs: The recurring G&A costs continue to trend downward quarter over the quarter. The Q3-2025 G&A costs included approximately

$1.1 million of non-recurring costs attributable to the September 9, 2025 funding.Interest Expense was Reduced: As expected, interest expense dropped by approximately

$500 K for the third quarter compared to the prior quarters due to the retirement of the senior debt and the seller note.Gain of

$13.4 million on Asset Sale from the Funding: There was a one-time GAAP gain of$13.4 million as a result of the funding and Farmout agreements.Gain

$1.8 million from Forgiveness of Debt: There was$1.8 million in total gains from the reduction of the senior debt at pay-off and settlement of underwriting fees.

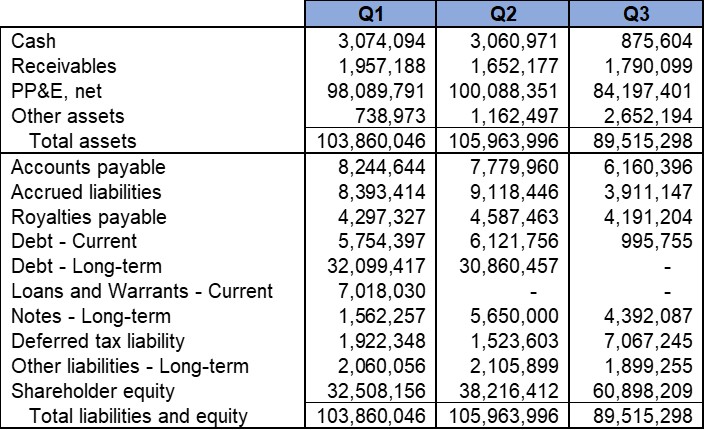

Balance Sheet: Below is a condensed version of the balance sheet that is included in the 10-Q filing, followed by discussions on certain results and changes from prior quarters.

The GJF Property Value was Reduced due to the ORRIs Conveyance: The GJF recorded property value was reduced by approximately

$16 million as an offset to the VMA funding by the ORRIs conveyed.Debt was Reduced by Approximately

$37 million : With the funding on September 9, 2025,$20 million of senior debt and the$15 million seller note were retired leaving only$5.4 million of convertible notes remaining. The current portion of debt was reduced from$6.1 million in Q2 to$1.0 million at end of Q3.Shareholder Equity Increased by a Net

$22.7 million : With the retirement of the seller preferred shares, all non-controlling interest was eliminated. The combined impact of the funding, elimination of preferred shares and gains from the funding transactions increased total equity by approximately$22.7 million .

About EON Resources Inc.

EON is an independent upstream energy company focused on maximizing total returns to its shareholders through the development of onshore oil and natural gas properties in a diversified portfolio of long-life producing oil and natural gas properties and other energy holdings. EON's approach is to build through acquisition and through selective development of its properties. Class A Common Stock of EON trades on the NYSE American Stock Exchange under the symbol of "EONR" and the Company's public warrants trade under the symbol of "EONRWS". For more information on the Company, please visit the EON website.

About the Grayburg-Jackson Field Property

Our Grayburg-Jackson Field ("GJF") is located on the Northwest Shelf of the Permian Basin in Eddy County, New Mexico. The GJF comprises of 13,700 contiguous leasehold acres where the leasehold rights include the Seven Rivers, Queen, Grayburg and San Andres intervals that range from as shallow as 1,500 feet to 4,000 feet in depth. The December 2024 reserve report from our third-party engineer, Haas and Cobb Petroleum Consultants, LLC, estimates proven reserves of approximately 14.0 million barrels of oil and 2.8 billion cubic feet of natural gas. The mapped original-oil-in-place ("OOIP") is approximately 956 million barrels of oil. The Company has two production programs. The first is the existing waterflood recovery primarily in the Seven Rivers formation via the 550 wells already in place. The second is via a Farmout agreement in the San Andres formation where the recovery will primarily be under the horizontal drilling program whereby the Company expects to participate in drilling up to 90 new wells over the coming years. More information on the property can be located on the Grayburg-Jackson Field page of our website.

About the South Justis Field Property

The South Justis Field ("SJF") is a carbonate reservoir similar to the rest of the Permian, and is located in Lea County, New Mexico approximately 100 miles from the GJF. The SJF is comprised of 5,360 contiguous acres containing 208 total producing and injection wells with well spacing of 50 acres. The producing formations include the Glorietta, Blinebry, Tubb, Drinkard and Fusselman intervals that range from 5,000 feet to 7,000 feet in depth. The original-oil-in-place ("OOIP") is approximately 207 million barrels of oil. More information on the property can be located on the South Justis Field page of our website.

Forward-Looking Statements

This press release includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties that could cause actual results to differ materially from what is expected. Words such as "expects," "believes," "anticipates," "intends," "estimates," "seeks," "may," "might," "plan," "possible," "should" and variations and similar words and expressions are intended to identify such forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Such forward-looking statements relate to future events or future results, based on currently available information and reflect the Company's management's current beliefs. A number of factors could cause actual events or results to differ materially from the events and results discussed in the forward-looking statements. Important factors - including the availability of funds, the results of financing efforts and the risks relating to our business - that could cause actual results to differ materially from the Company's expectations are disclosed in the Company's documents filed from time to time on EDGAR (see www.edgar-online.com) and with the Securities and Exchange Commission (see www.sec.gov). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Except as expressly required by applicable securities law, the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Investor Relations

Michael J. Porter, President

PORTER, LEVAY & ROSE, INC.

mike@plrinvest.com

SOURCE: EON Resources Inc.

View the original press release on ACCESS Newswire