Ford Follows Customers to Drive Profitable Growth; Reinvests in Trucks, Hybrids, Affordable EVs, Battery Storage; Takes EV-Related Charges

Key Terms

battery energy storage system technical

bess technical

lfp technical

universal ev platform technical

extended-range electric vehicle technical

prismatic cells technical

non-gaap financial

-

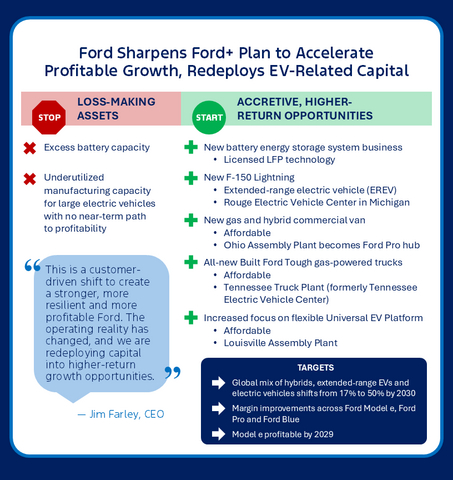

Offers broad choice with gas, hybrids and EVs: Ford to offer range of hybrids to complement efficient gas engines. Universal EV Platform will underpin multiple models. By 2030, about

50% of Ford’s global volume will be hybrids, extended-range EVs and electric vehicles, versus17% today -

Fills

U.S. plants with affordable new models: New “Built Ford Tough” pickups to be assembled at BlueOval City inTennessee , new gas and hybrid van to be produced at Ohio Assembly Plant; Ford to hire thousands of new employees in theU.S. in next few years - Launches battery energy storage business: Ford will leverage wholly owned plants in Ky. and Mich. and leading LFP technology to provide solutions for energy infrastructure and growing data center demand. Ford plans to begin shipping BESS systems in 2027 with 20 GWh of annual capacity

- Improves profitability: Actions will drive robust accretive returns and accelerate margin improvements across Ford Model e, Ford Pro and Ford Blue. Ford Model e now expected to reach profitability by 2029 with improvements beginning in 2026

-

Rationalizes

U.S. EV-related assets and product roadmap: Ford expects to record about$19.5 billion $5.5 billion -

Raises guidance: Company raises 2025 adjusted EBIT guidance to about

$7 billion $2 billion $3 billion

The company is shifting to higher-return opportunities, including leveraging its

This approach prioritizes affordability, choice and profits. Ford will expand powertrain choice – including a range of hybrids and extended-range electric propulsion – while focusing its pure electric vehicle development on its flexible Universal EV Platform for smaller, affordable models.

“This is a customer-driven shift to create a stronger, more resilient and more profitable Ford,” said Ford president and CEO Jim Farley. “The operating reality has changed, and we are redeploying capital into higher-return growth opportunities: Ford Pro, our market-leading trucks and vans, hybrids and high-margin opportunities like our new battery energy storage business.”

These actions provide a path to profitability in Model e by 2029, targeting annual improvements beginning in 2026. The actions will also improve profits in Ford Blue and Ford Pro over time with early signs of benefits in 2026. As a result, Ford expects to record about

To support these actions, Ford and its subsidiaries plan to hire thousands of people across America, reinforcing the company’s leadership as the top employer of

The evolved strategy is built on four key pillars.

Expanding Customer Choice with Gas, Hybrids and Low-Cost Electric Vehicle Platform

By 2030, Ford expects approximately

Ford will concentrate its North American electric vehicle development on its new, low-cost, flexible Universal EV Platform. This next-generation architecture is engineered to underpin a high-volume family of smaller, highly efficient and affordable electric vehicles designed to be accessible to millions of customers.

The first vehicle from the Universal EV Platform will be the fully connected midsize pickup truck assembled at Louisville Assembly Plant starting in 2027.

Ford plans to expand hybrids with a range of executions based on customer needs and duty cycle – economical, performance hybrids and hybrids with exportable power. Ford is enhancing its strategy for larger trucks and SUVs to better align with customer demand for capability, towing and range, which includes adding extended-range electric options to its lineup.

As part of this plan, Ford’s next-generation F-150 Lightning will shift to an extended-range electric vehicle (EREV) architecture and be assembled at the Rouge Electric Vehicle Center in

“The F-150 Lightning is a groundbreaking product that demonstrated an electric pickup can still be a great F-Series,” said Doug Field, Ford’s chief EV, digital and design officer. “Our next-generation Lightning EREV is every bit as revolutionary. It keeps everything customers love –

The company no longer intends to produce a previously planned new electric commercial van for

These moves complement the company’s plan to launch five new affordable vehicles by the end of the decade, four of which will be assembled in the

Recently, Ford announced a series of changes to its business in

Expanding Ford’s Truck and Van Leadership with New

This strategy reinforces Ford’s commitment to American manufacturing by repurposing its facilities in

- Tennessee Truck Plant: On the BlueOval City campus, the Tennessee Electric Vehicle Center is renamed Tennessee Truck Plant. The facility will produce all-new Built Ford Tough truck models with production starting in 2029. These new affordable gas-powered trucks will broaden Ford’s truck family and extend its market leadership, replacing the previously planned next-generation electric truck.

- Ohio Assembly Plant: The plant will become a central hub for Ford Pro, assembling the new gas- and hybrid-powered commercial van starting in 2029, alongside Super Duty chassis cabs, strengthening Ford’s commercial vehicle dominance.

Launching a Battery Energy Storage System Business

Ford is launching a new business – including sales and service – to capture the large demand for battery energy storage from data centers and infrastructure to support the electric grid. Ford plans to repurpose existing

The

Leveraging more than a century of manufacturing expertise and licensed advanced battery technology, Ford plans to bring initial capacity online within 18 months, positioning the company to capture share in the growing

Last week, Ford, SK On, SK Battery America and BlueOval SK entered into a joint venture disposition agreement. Under this mutual agreement, a Ford subsidiary will independently own and operate the

Separately, Ford will utilize BlueOval Battery Park Michigan in

Building a Stronger, More Sustainable Future

Today’s actions are consistent with Ford’s goal of becoming carbon neutral across its vehicles, manufacturing facilities and supply chain no later than 2050.

The company will continue its environmental leadership with investments in cleaner manufacturing, sustainable supply chains and breakthrough technologies that reduce emissions across its entire ecosystem.

Updated 2025 Guidance

Company raises 2025 adjusted EBIT guidance to about

Ford plans to report its fourth-quarter and full-year 2025 financial results Tuesday, Feb. 10.

About Ford Motor Company

Ford Motor Company (NYSE: F) is a global company based in

Adjusted EBIT and adjusted free cash flow are non-GAAP financial measures. When Ford provides guidance for adjusted EBIT and adjusted free cash flow, the company does not provide guidance for net income or net cash provided by/(used in) operating activities, the respective most comparable GAAP measures, because they include items that are difficult to predict with reasonable certainty. See pages 75-76 of Ford's Annual Report on Form 10-K for the year ended December 31, 2024, for the definitions of adjusted EBIT and adjusted free cash flow.

Cautionary Note on Forward-Looking Statements

Statements included or incorporated by reference herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation:

- Ford’s long-term success depends on delivering the Ford+ plan, including improving cost and competitiveness;

- Ford’s vehicles could be affected by defects that result in recall campaigns, increased warranty costs, or delays in new model launches, and the time it takes to improve the quality of our vehicles and services and reduce the costs associated therewith could continue to have an adverse effect on our business;

- Ford is highly dependent on its suppliers to deliver components in accordance with Ford’s production schedule and specifications, and a shortage of or inability to timely acquire key components or raw materials can disrupt Ford’s production of vehicles;

- Ford’s production, as well as Ford’s suppliers’ production, and/or the ability to deliver products to consumers could be disrupted by labor issues, public health issues, natural or man-made disasters, adverse effects of climate change, financial distress, production difficulties, capacity limitations, or other factors;

- Ford may not realize the anticipated benefits of existing or pending strategic alliances, joint ventures, acquisitions, divestitures, or business strategies or the benefits may take longer than expected to materialize;

- Ford may not realize the anticipated benefits of restructuring actions and such actions may cause Ford to incur significant charges, disrupt our operations, or harm our reputation;

- Failure to develop and deploy secure digital services that appeal to customers and grow our subscription rates could have a negative impact on Ford’s business;

- Ford’s ability to maintain a competitive cost structure could be affected by labor or other constraints;

- Ford’s ability to attract, develop, grow, support, and reward talent is critical to its success and competitiveness;

- Operational information systems, security systems, vehicles, and services could be affected by cybersecurity incidents, ransomware attacks, and other disruptions and impact Ford, Ford Credit, their suppliers, and dealers;

- To facilitate access to the raw materials and other components necessary for the production of electric vehicles, Ford has entered into and may, in the future, enter into multi-year commitments to raw material and other suppliers that subject Ford to risks associated with lower future demand for such items as well as costs that fluctuate and are difficult to accurately forecast;

- With a global footprint and supply chain, Ford’s results and operations could be adversely affected by economic or geopolitical developments, including protectionist trade policies such as tariffs, or other events;

- Ford’s new and existing products and digital, software, and physical services are subject to market acceptance and face significant competition from existing and new entrants in the automotive and digital and software services industries, and Ford’s reputation may be harmed based on positions it takes or if it is unable to achieve the initiatives it has announced;

- Ford may face increased price competition for its products and services, including pricing pressure resulting from industry excess capacity, currency fluctuations, competitive actions, or economic or other factors, particularly for electric vehicles;

- Inflationary pressure and fluctuations in commodity and energy prices, foreign currency exchange rates, interest rates, and market value of Ford or Ford Credit’s investments, including marketable securities, can have a significant effect on results;

-

Ford’s results are dependent on sales of larger, more profitable vehicles, particularly in

the United States ; - Industry sales volume can be volatile and could decline if there is a financial crisis, recession, public health emergency, or significant geopolitical event;

- The impact of government incentives on Ford’s business could be significant, and Ford’s receipt of government incentives could be subject to reduction, termination, or clawback;

- Ford and Ford Credit’s access to debt, securitization, or derivative markets around the world at competitive rates or in sufficient amounts could be affected by credit rating downgrades, market volatility, market disruption, regulatory requirements, asset portfolios, or other factors;

- Ford Credit could experience higher-than-expected credit losses, lower-than-anticipated residual values, or higher-than-expected return volumes for leased vehicles;

- Economic and demographic experience for pension and OPEB plans (e.g., discount rates or investment returns) could be worse than Ford has assumed;

- Pension and other post retirement liabilities could adversely affect Ford’s liquidity and financial condition;

- Ford and Ford Credit could experience unusual or significant litigation, governmental investigations, or adverse publicity arising out of alleged defects in products, services, perceived environmental impacts, or otherwise;

- Ford may need to substantially modify its product plans and facilities to comply with safety, emissions, fuel economy, autonomous driving technology, environmental, and other regulations;

- Ford and Ford Credit could be affected by the continued development of more stringent privacy, data use, data protection, data access, and artificial intelligence laws and regulations as well as consumers’ heightened expectations to safeguard their personal information; and

- Ford Credit could be subject to new or increased credit regulations, consumer protection regulations, or other regulations.

We cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking statements speak only as of the date of their initial issuance, and we do not undertake, and expressly disclaim to the extent permitted by law, any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events, or otherwise. For additional discussion, see “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024, as updated by our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

For news releases, related materials and high-resolution photos and video, visit www.media.ford.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251215095165/en/

Media

Inquiries

David Tovar

1.773.682.7954

dtovar9@ford.com

Equity Investment Community

Lynn Antipas Tyson

1.203.616.5689

ltyson4@ford.com

Fixed Income Investment Community

Sean

1.313.248.1587

smoor192@ford.com

Shareholder

Inquiries

1.800.555.5259 or

1.313.845.8540

stockinf@ford.com

Battery Energy Storage

Sales Inquires

Joanna Kalis

energy@ford.com

Source: Ford Motor Company