FenixOro Signs Definitive Agreement for Porvenir Mine and Permitted Facility

Rhea-AI Summary

Positive

- Acquisition of producing mine with high-grade gold production (13 g/t)

- Fully permitted processing facility with expansion capability to 60 tonnes/day

- Additional 300 tonnes/day facility in final permitting stages

- Existing resource of 80,000 oz gold with expansion potential

- Immediate cash flow potential from existing operations

- Strategic land package expansion to 2,000 hectares

- Potential to bypass multi-year environmental approval process

Negative

- Significant share dilution through issuance of 55 million new shares

- Resource calculation is not 43-101 compliant

- Company currently under cease trade order

- Requires additional financing to complete development

- Multiple closing conditions could delay or prevent transaction completion

Significantly Expands Abriaqui Project Land Package

TORONTO, ON / ACCESS Newswire / May 22, 2025 / FenixOro Gold Corp (CSE:FENX)(OTC PINK:FDVXF)(Frankfurt:8FD) ("FenixOro" of "the Company") is pleased to announce that it has executed a definitive agreement to obtain the El Porvenir Mine and processing facility along with a significant contiguous land package and consolidate these assets (the "Assets") with its flagship Abriaqui gold project in Antioquia, Colombia (the "Transaction").

FenixOro CEO John Carlesso stated: "This transaction is transformational as it unifies adjacent properties to create a single project of scale and significance, combining exploration upside with existing production capabilities. This introduces both immediate and long term strategic value to the Company as the existing scalable, fully permitted production facility will allow FenixOro to take advantage of historic all-time-high gold prices within a relatively short period of time. Longer term, permitting for a new larger 300 tonnes per day processing facility is in final stages of approval. Once completed, this provides a turnkey, scalable processing solution for gold production on the combined Abriaqui project as a whole, circumventing what is typically a multi-year environmental application approval process. With this transaction we will be better positioned to execute on our corporate objective of proving out a "Buritica-style" deposit in both size and scale. The resulting project from this combination contains the entire package of mineralization of significance from north to south, and positions the Company with certainty for its development and long term, expanded production strategy. We strongly believe that this combination of unique, high grade, and highly prospective assets will deliver tremendous value for shareholders as we transition to executing on a production strategy that contributes cash flow towards our continuing development and growth objectives."

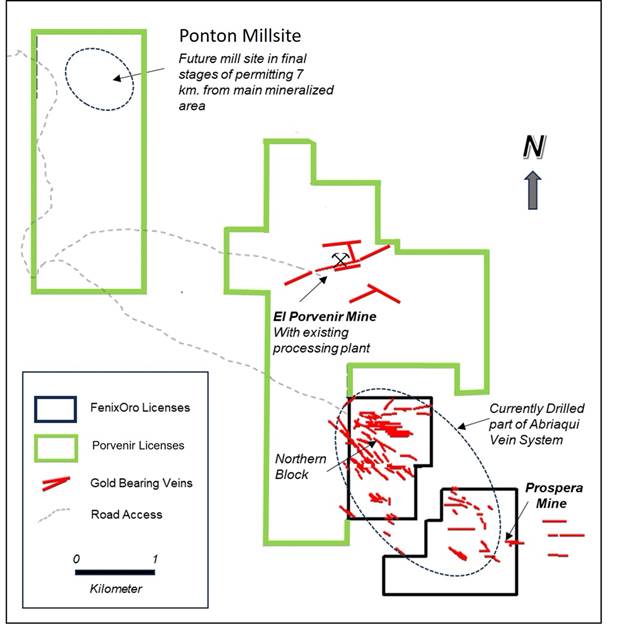

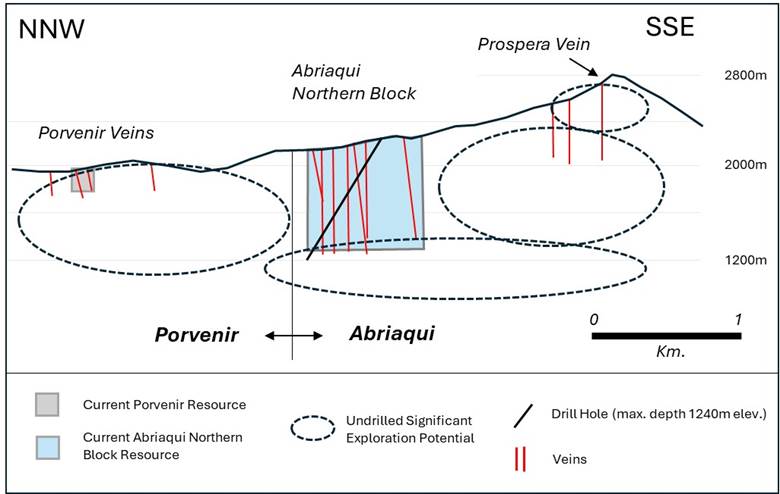

The El Porvenir Mine lies 3 kmto the northwest of the extension of the Abriaqui property boundary and is the largest historic producer in the district (see Figure 1). 1500 meters of lateral development have been completed along the vein which has been worked on four levels. High grade gold mineralization is open at depth and in both strike directions.Seven additional gold-bearing veins have been identified, some of which are the northwestward extensions of the prominent vein set which has been previously tested by FenixOro in prior drill programs. Geologically, the Porvenir veins are similar to those on which FenixOro has encountered potentially economic gold mineralization at drilled depths of more than 700 meters below surface. The Porvenir Mine has never been drilled, and to date mining levels have extended only to a depth of 280m below surface. The new package adds significantly to the resource potential of the combined properties both at depth at the northern and southern ends, and in the gap between the northernmost drill holes and the Porvenir mine (see Figure 2).

The El Porvenir Mine is fully permitted for exploitation and has a processing facility on site with the capability to expand to 60 tonnes per day. Current production is reported to average 13 g/t Gold. The land package also includes a 525 hectare mining title to the northwest that includes a 35 hectare parcel which is in the final stages of permitting for a new 300 tonne per day processing facility. Permits are expected in calendar 2025. A current resource calculation commissioned for main vein at El Porvenir, based on channel sampling on multiple mine levels (non-43-101 compliant), totals 80,000 oz of gold in all categories. Drilling on strike and at depth is expected to increase this number and a drill program has been designed to be implemented in the short term. Detailed mining sequences have been mapped and budgeted for the exploitation of the known ore body.

This strategic combination adds valuable near-term production capabilities and cash flow, and expands the size of the project area to almost 2000 hectares. Upon completion of the Transaction, the Company's Abriaqui project will now encompass all relevant mineralized areas from the historic Prospera Mine in the southeast (100 continuous meters along strike of 39.2 g/t Gold, 254 g/t Silver,

The Company is seeking financing and will provide further updates while it works to complete the necessary filings to resume the trading of its common shares on the Canadian Stock Exchange (CSE) and the OTC in the United States.

The Assets are currently held through certain private Colombian holding companies by a group of individuals who are arm's length to the Company (the "Colombian Parties"). The transaction is expected to close in two phases. Closing of the first phase will result in the Company issuing to the Colombian Parties approximately 39 million common shares, in exchange for receiving a

Closing of the transaction is subject to a number of conditions, including but not limited to:

confirmatory due diligence satisfactory to each party;

confirmation of certain permitting with respect to the Assets;

completion of a technical report in compliance with NI 43-101 on the El Porvernir Mine;

lifting of the cease trade order issued in respect of the Company's common shares;

government approvals in Colombia; and

the approval of the CSE.

Closing of the second phase is conditional on the closing of the first phase, and the entering into of an operating agreement between the parties concerning the development of the Assets and associated budgeting.

About FenixOro

FenixOro Gold Corp is a Canadian company focused on acquiring and exploring gold projects with world class exploration potential in the most prolific gold producing regions of Colombia. FenixOro's flagship property, the Abriaqui project, is the closest project to Zijin-Continental Gold's Buritica project. It is located 15 km to the west in Antioquia State at the northern end of the Mid-Cauca gold belt, a geological trend which has seen multiple large gold discoveries in the past 10 years including Buritica and Anglo Gold's Nuevo Chaquiro and La Colosa.

FenixOro's VP of Exploration, Stuart Moller, led the discovery team at Buritica for Continental Gold from 2007-2011. A Phase 2 drilling program has been completed at Abriaqui resulting in a significant discovery of a high grade, "Buritica style" gold deposit.

Technical Information

Stuart Moller, Vice President Exploration and Director of the Company and a Qualified Person for the purposes of NI 43-101 (P.Geo, British Colombia), has prepared or supervised the preparation of the technical information contained in this press release. Mr. Moller has more than 40 years of experience in exploration for precious and other metals including fifteen years in Colombia and is a Fellow of the Society of Exploration Geologists.

Cautionary Statement on Forward-Looking Information

This news release contains certain "forward-looking information" within the meaning of applicable Canadian securities legislation and may also contain statements that may constitute "forward-looking statements". Such forward-looking information and forward-looking statements are not representative of historical facts or information or current condition, but instead represent only the Company's beliefs regarding future events, plans or objectives, many of which, by their nature, are inherently uncertain and outside of FenixOro's control. The forward-looking information and forward-looking statements contained herein include, but are not limited to, information concerning any potential financing, the Assets, the closing of the Transaction, and the anticipated benefits to the Company of consolidating the Assets. Although FenixOro believes that the assumptions and factors used in preparing, and the expectations contained in, the forward-looking information and statements are reasonable, undue reliance should not be placed on such information and statements, and no assurance or guarantee can be given that such forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information and statements. In particular, there can be no guarantee that the Transaction will be completed, that anticipated permitting will be received,that any financing will be completed, and there is no guarantee that Abriaqui or the Porvenir Mine will produce viable quantities of minerals, or that the Company will pursue Abriaqui or that any mineral deposits will be found. The forward-looking information and forward-looking statements contained in this news release are made as of the date of this press release, and FenixOro does not undertake to update any forward-looking information and/or forward-looking statements that are contained or referenced herein, except in accordance with applicable securities laws.

Neither the Canadian Securities Exchange nor its Market Regulator (as defined in the policies of the Canadian Securities Exchange) accept responsibility for the adequacy or accuracy of this release.

For further information, please contact:

FenixOro Gold Corp

John Carlesso, CEO

Email: jcarlesso@FenixOro.com

Telephone: 1-833-FENXORO

FIGURE 1 NEW PROPERTY BOUNDARIES

FIGURE 2 CONSOLIDATED PROJECT POTENTIAL

SOURCE: FenixOro Gold Corp.

View the original press release on ACCESS Newswire