Foremost Clean Energy Announces 2,500 Metre Drill Program at its Jean Lake Gold-Lithium Property

Foremost Clean Energy (NASDAQ: FMST) has announced a strategic 2,500-metre diamond drill program at its 100% owned Jean Lake Gold-Lithium Property in Snow Lake, Manitoba. The program, comprising up to 20 holes, aims to capitalize on record gold prices of $3,680 USD per ounce and will run concurrently with ongoing uranium drilling at Murphy Lake South Property.

The company's previous drilling campaign in 2022-2023 yielded significant results, including 7.50 g/t Au over 7.66 metres (including 102.0 g/t Au over 0.48 metres) and 1.26% Li₂O over 3.35 metres. The new program, scheduled to commence in September 2025, focuses on expanding known high-grade gold and lithium mineralization identified in previous campaigns.

Foremost Clean Energy (NASDAQ: FMST) ha annunciato un programma di carotaggi a diamante di 2.500 metri presso la sua proprietà Jean Lake Gold-Lithium, interamente di proprietà, a Snow Lake, Manitoba. Il programma, che prevede fino a 20 fori, mira a sfruttare i record dei prezzi dell’oro di 3.680 USD per oncia e si svolgerà in parallelo alle trivellazioni di uranio in corso presso la proprietà Murphy Lake South.

La precedente campagna di trivellazione dell’azienda nel 2022-2023 ha prodotto risultati significativi, tra cui 7,50 g/t Au su 7,66 metri (inclusi 102,0 g/t Au su 0,48 metri) e 1,26% Li₂O su 3,35 metri. Il nuovo programma, previsto per iniziare a settembre 2025, si concentra sull’espansione della mineralizzazione di oro ad alta gradazione e di litio identificata nelle campagne precedenti.

Foremost Clean Energy (NASDAQ: FMST) ha anunciado un programa de perforación con diamante de 2.500 metros en la propiedad Jean Lake Gold-Lithium, 100% propiedad, en Snow Lake, Manitoba. El programa, que comprende hasta 20 agujeros, tiene como objetivo aprovechar los récords de precio del oro de 3.680 USD por onza y se ejecutará de forma concurrente con las perforaciones de uranio en curso en la propiedad Murphy Lake South.

La campaña anterior de perforación de la empresa en 2022-2023 arrojó resultados significativos, incluyendo 7,50 g/t Au sobre 7,66 metros (incluyendo 102,0 g/t Au sobre 0,48 metros) y 1,26% Li₂O sobre 3,35 metros. El nuevo programa, que está programado para comenzar en septiembre de 2025, se centra en ampliar la mineralización de oro de alto grado y litio ya identificada en campañas anteriores.

Foremost Clean Energy (NASDAQ: FMST)는 매니토바주 스노우 레이크의 Jean Lake 금-리튬 속성에 100% 소유의 전략적 2,500미터 다이아몬드 드릴 프로그램을 발표했습니다. 이 프로그램은 최대 20개의 시추를 포함하며 온스당 3,680 USD의 기록 금 가격을 활용하는 것을 목표로 하고 있으며 Murphy Lake South 속성에서 진행 중인 우라늄 드릴링과 동시 진행될 예정입니다.

회사가 2022-2023년에 수행한 이전 시추 캠페인은 7.50 g/t Au over 7.66 metres (포함하여 102.0 g/t Au over 0.48 metres) 및 1.26% Li₂O over 3.35 metres와 같은 중요한 결과를 낳았습니다. 새로운 프로그램은 2025년 9월에 시작될 예정이며 이전 캠페인에서 확인된 고등급 금 및 리튬 광물화의 확장을 목표로 합니다.

Foremost Clean Energy (NASDAQ: FMST) a annoncé un programme de forage à diamant stratégique de 2 500 mètres sur sa propriété Jean Lake Gold-Lithium, entièrement détenue, à Snow Lake, Manitoba. Le programme, comprenant jusqu'à 20 forages, vise à profiter de prix record de l’or à 3 680 USD l’once et se déroulera parallèlement au forage d’uranium en cours sur la propriété Murphy Lake South.

La campagne de forage précédente de l’entreprise en 2022-2023 a donné des résultats significatifs, dont 7,50 g/t Au sur 7,66 mètres (y compris 102,0 g/t Au sur 0,48 mètres) et 1,26% Li₂O sur 3,35 mètres. Le nouveau programme, prévu pour commencer en septembre 2025, se concentre sur l’expansion de la minéralisation d’or et de lithium de haut grade identifiée lors des campagnes précédentes.

Foremost Clean Energy (NASDAQ: FMST) a annoncé un programme de forage à diamant stratégique de 2 500 mètres sur sa propriété Jean Lake Gold-Lithium, entièrement détenue, à Snow Lake, Manitoba. Le programme, comprenant jusqu'à 20 forages, vise à profiter de prix record de l’or à 3 680 USD l’once et se déroulera parallèlement au forage d’uranium en cours sur la propriété Murphy Lake South.

La campagne de forage précédente de l’entreprise en 2022-2023 a donné des résultats significatifs, dont 7,50 g/t Au sur 7,66 mètres (y compris 102,0 g/t Au sur 0,48 mètres) et 1,26% Li₂O sur 3,35 mètres. Le nouveau programme, prévu pour commencer en septembre 2025, se concentre sur l’expansion de la minéralisation d’or et de lithium de haut grade identifiée lors des campagnes précédentes.

Foremost Clean Energy (NASDAQ: FMST) أعلنت عن برنامج حفر ثلاثي أبعاد بعمق 2,500 متر في ممتلكاتها Jean Lake Gold-Lithium المملوكة بنسبة 100% في Snow Lake، مانيتوبا. يضم البرنامج ما يصل إلى 20 بئراً، بهدف الاستفادة من أسعار الذهب القياسية البالغة 3,680 دولار أمريكي للأونصة وسيتم بالتوازي مع حفر اليورانيوم الجاري في ممتلك Murphy Lake South.

وقد حققت حملة الحفر السابقة للشركة في 2022-2023 نتائج ملحوظة، بما في ذلك 7.50 g/t Au على 7.66 أمتار (بما في ذلك 102.0 g/t Au على 0.48 أمتار) و 1.26% Li₂O على 3.35 أمتار. البرنامج الجديد، المقرر أن يبدأ في سبتمبر 2025، يركز على توسيع معدنية الذهب والليثيوم عالية الجودة المعروفة من الحملات السابقة.

Foremost Clean Energy (NASDAQ: FMST) 已宣布在其100%自有的 Jean Lake 金-鋰礦區(位於曼尼托巴省 Snow Lake)進行一項 2500米鑽探計劃。該計劃包括最多20口井,旨在利用金價創紀錄的 3,680美元/盎司,並將與 Murphy Lake South 礦區正在進行的铀鉆探同時進行。

公司在 2022-2023 年的先前鉆探活動取得顯著結果,包括 7.50 g/t Au 超過 7.66 米(其中包括 102.0 g/t Au 超過 0.48 米)和 1.26% Li₂O 超過 3.35 米。新計劃預定於 2025 年 9 月開始,重點在於擴展先前計劃中已識別的高品位金和鋰礦化。

- Record high gold prices of $3,680 USD per ounce provide favorable market conditions

- Previous drilling yielded high-grade results: 7.50 g/t Au over 7.66m including 102.0 g/t Au over 0.48m

- Company owns 100% interest in Jean Lake property as of July 2025

- Concurrent drilling programs at two properties maximize operational efficiency

- Property located in proven gold jurisdiction that produced over 1 million ounces

- Historical results have not been verified according to National Instrument 43-101 standards

Insights

Foremost leverages high gold prices with new drilling at Jean Lake while maintaining uranium focus, showcasing strategic dual-commodity approach.

Foremost's announced 2,500-metre drill program at Jean Lake represents a strategic expansion of their asset development pipeline, intelligently capitalizing on gold's record price environment ($3,680 USD/oz) while maintaining their core uranium focus. The parallel execution with ongoing uranium drilling at Murphy Lake demonstrates operational efficiency and resource allocation optimization.

The previous drilling campaign yielded impressive high-grade gold intercepts, notably 7.5 g/t Au over 7.66m (including an exceptional 102 g/t Au over 0.48m), indicating potential for a significant gold system. These grades substantially exceed typical economic thresholds for underground gold mining operations, which often operate profitably at 5-6 g/t.

The property's dual-commodity potential with lithium mineralization (1.26% Li₂O over 3.35m from surface) provides additional optionality. Lithium demand continues to be driven by electric vehicle battery production, creating a secondary value proposition beyond gold.

The Jean Lake property's location in the established Flin Flon-Snow Lake greenstone belt—where Hudbay's operations have produced over 1 million gold ounces—significantly de-risks the geological setting. The 100% ownership position (fully earned as of July 2025) eliminates future option payments and provides maximum economic exposure to exploration success.

Foremost's multi-asset strategy targeting both precious metals and energy transition minerals positions them across two high-demand sectors, potentially reducing overall portfolio volatility while maintaining substantial upside exposure to each commodity cycle.

The Program is Designed to Capitalize on Record Gold Prices to Expand on Previous High-Grade Gold Discovery Concurrent with Ongoing Athabasca Uranium Drilling on its Murphy Lake Property

VANCOUVER, British Columbia, Sept. 16, 2025 (GLOBE NEWSWIRE) -- Foremost Clean Energy Ltd. (NASDAQ: FMST) (CSE: FAT) ("Foremost" or the "Company"), is pleased to announce up to 20-hole 2,500 metre diamond drill program will commence this month at its

Foremost’s President and CEO, Jason Barnard comments: "With gold achieving historic highs by surpassing

Our multi-asset model is designed for exactly this scenario. While uranium continues to anchor our long-term vision in the face of transformative global demand, these parallel drill programs provide exceptional, capital-efficient leverage. We are not diverting focus; we are amplifying it. We are going to commence actively drilling on not one, but two highly prospective properties. With Jean Lake now fully owned and requiring minimal sustaining capital, it provides Foremost with significant optionality and value for our shareholders, aligning with our steadfast commitment to nuclear fuels and other critical energy minerals.”

The Jean Lake property is situated within the prolific Flin Flon-Snow Lake greenstone belt, a geological terrain renowned for its significant gold endowment and emerging lithium potential. The previous program successfully intersected gold mineralization in eight drill holes, with intercepts extending from surface to a depth of 110 metres. Notable results include an intercept of 7.5 g/t Au over 7.66 metres, which contains a spectacular high-grade zone of 102 g/t Au over 0.48 metres, located approximately 65 metres below surface. (See news release June 06, 2023).

Key Highlights

- Drill program will commence later this month concurrently with the Company’s ongoing Murphy Lake Uranium Drill Program in Saskatchewan

- Company optioned the Jean Lake property in July, 2021 and earned

100% interest announced on July 16, 2025 - Located in proven gold jurisdiction in Snow Lake, Manitoba which includes Hudbay Minerals’ core operating area, which has produced more than 1 million+ ounces of gold at its Lalor Mine1

- Previous drilling includes high-grade gold & lithium intercepts including 7.50 g/t Au over 7.66m (including 102.0 g/t Au over 0.48 metres) in drill hole FM23-8 and

1.26% Li₂O over 3.35m in drill hole FM23-04A

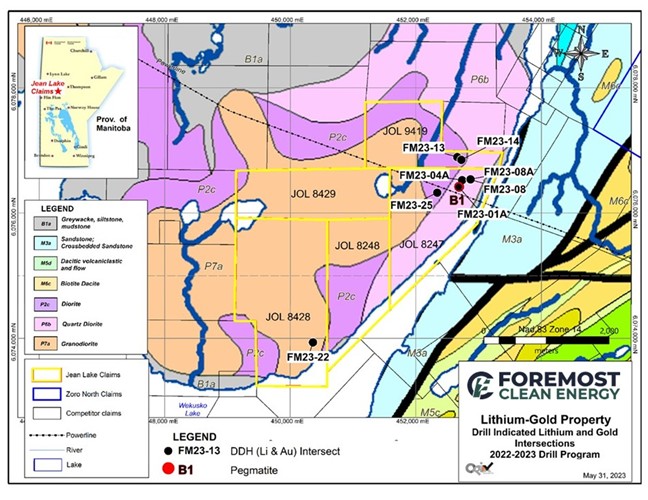

Foremost’s 2022/2023 Drill Campaign

The Company completed a 3,002 meter initial diamond drill program, designed to drill test targets based on integrated prospecting, UAV-borne magnetic survey results, MMI soil geochemical surveys and outcrop rock chip analyses (Foremost news release June 6, 2023). The program intersected numerous gold mineralized intervals at vertical depths up to 110 m below surface as well lithium at the B1 spodumene bearing pegmatite. The locations of drill holes that intersected gold mineralized intervals are illustrated in Figure 1, in addition to the B1 drill hole location. Details of the lithium and gold intersections are provided in Table 1 below.

Highlights include:

GOLD

- In drill hole FM23-8: 7.50 g/t Au over 7.66 metres from 94.35 - 102.01 m (including 102.0 g/t Au over 0.48 metres from 94.77 - 95.25 m)

- In drill hole FM23-04A: 11.27 g/t Au over 2.75 metres from 73.75 - 76.50 m (including 91.8 g/t Au over 0.32 metres from 74.74 - 75.06 m)

- In drill hole FM23-01A: 2.46 g/t Au over 3.70 metres from 41.30 - 45.00m

LITHIUM

1.26% Li2O over 3.35 metres from surface in drill hole FM23-01A

Figure 1. Lithium and Gold Intersections Drill Holes

Table 1 - 2022 – 2023 Program Lithium and Gold Intersections in Drill Holes

| Hole ID | Easting | Northing | Strike | Dip | Depth | Intercept in Metres |

| FM23-01A | 452688 | 6076420 | 205 | -66 | 62m | |

| FM23-01A | 452688 | 6076420 | 205 | -66 | 62m | 2.46 g/t Au over 3.70m from 41.30m-45m |

| FM23-04A | 452743 | 6076529 | 90 | -45 | 80m | 11.27 g/t Au over 2.75m from 73.75m-76.5m including 91.8 g/t Au over 0.32m from 74.74 - 75.06m |

| FM23-08 | 452877 | 6076534 | 245 | -45 | 134m | 1.44 g/t Au for 0.32m from 11.33m-11.65m and 7.50 g/t Au for 7.66m from 94.35m-102.01m including 29.95 g/t Au for 1.77m from 94.35m-96.12m and 1.28 g/t Au for 0.3m from 107.6m-107.9m |

| FM23-08A | 452878 | 6076543 | 110 | -45 | 173m | 1.51 g/t Au for 0.52m from 95.18m-95.7m |

| FM23-13 | 452667 | 6076898 | 270 | -45 | 125m | 0.94 g/t Au for 1.23m from 121.30m-122.53m |

| FM23-14 | 452732 | 6076854 | 270 | -45 | 158m | 1.23 g/t Au for 2.85m from 151.24m-154.09m |

| FM23-22 | 450367 | 6073940 | 314 | -45 | 125 | 3.04 g/t Au for 0.68m from 102.92m-103.6m |

| FM23-25 | 452347 | 6076330 | 120 | -45 | 114m | 2.07 g/t Au for 3.49m from 25.3m-28.79m including 6.86 g/t Au for 0.54m from 25.30m-25.84m and 1.27 g/t Au for 2.4m from 69.6m-72m |

Foremost’s 2025 Jean Lake Diamond Drill Program

The company anticipates the drill program to commence before the end September 2025, with the goal to expand both the lithium and gold mineralized systems. Drill target locations are currently being finalized by Foremost’s technical team.

Qualified Person

The technical content of this news release has been reviewed and approved by Cameron MacKay, P. Geo., Vice President of Exploration for Foremost Clean Energy Ltd., and a Qualified Person under National Instrument 43-101.

A qualified person has not performed sufficient work or data verification to validate the historical results in accordance with National Instrument 43-101. Although the historical results may not be reliable, the Company nevertheless believes that they provide an indication of the property’s potential and are relevant for any future exploration program.

About Foremost

Foremost Clean Energy Ltd. (NASDAQ: FMST) (CSE: FAT) (WKN: A3DCC8) is a rapidly growing North American uranium and lithium exploration company. The Company holds an option to earn up to a

Foremost also has a portfolio of lithium projects at varying stages of development, which are located across 55,000+ acres in Manitoba and Quebec. For further information, please visit the Company’s website at www.foremostcleanenergy.com.

Contact and Information

Company

Jason Barnard, President and CEO

+1 (604) 330-8067

info@foremostcleanenergy.com

Follow us or contact us on social media:

X: @fmstcleanenergy

LinkedIn: https://www.linkedin.com/company/foremostcleanenergy

Facebook: https://www.facebook.com/ForemostCleanEnergy

Forward-Looking Statements

Except for the statements of historical fact contained herein, the information presented in this news release and oral statements made from time to time by representatives of the Company are or may constitute “forward-looking statements” as such term is used in applicable United States and Canadian laws and including, without limitation, within the meaning of the Private Securities Litigation Reform Act of 1995, for which the Company claims the protection of the safe harbor for forward-looking statements. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any other statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect,” “is expected,” “anticipates” or “does not anticipate,” “plans,” “estimates” or “intends,” or stating that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved) are not statements of historical fact and should be viewed as forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, continuity of agreements with third parties and satisfaction of the conditions to the option agreement with Denison, risks and uncertainties associated with the environment, delays in obtaining governmental approvals, permits or financing. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. Forward-looking information is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company’s ability to control or predict. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this news release can be found in the Company’s filings with the Securities and Exchange Commission. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities. and information. Please refer to the Company’s most recent filings under its profile at on Sedar+ at www.sedarplus.ca and on Edgar at www.sec.gov for further information respecting the risks affecting the Company and its business.

The CSE has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy hereof.