Foremost Clean Energy Continues Exploration Success Reporting Positive Lithium Drill Results at its Jean Lake Gold-Lithium Property

Rhea-AI Summary

Foremost Clean Energy (NASDAQ: FMST) reported positive lithium assays from its 2025 Jean Lake drill program, with JL25-005B returning 1.64% Li2O over 5.0 m (incl. 2.8% over 2.1 m) and additional spodumene-bearing intervals. The company also cites near-surface gold intercepts from earlier holes, including 12.7 g/t Au over 2.1 m and 10.7 g/t Au over 5.6 m. Foremost completed historic core re-sampling (assays pending) and plans to integrate 2025 results into an updated geological model to guide future exploration at Jean Lake.

Positive

- JL25-005B: 1.64% Li2O over 5.0 m

- JL25-005B: 2.8% Li2O over 2.1 m (included)

- Earlier gold: 12.7 g/t Au over 2.1 m

- Earlier gold: 10.7 g/t Au over 5.6 m

- Completed historic core re-sampling program (assays pending)

Negative

- Assay results for 11 drill holes are still pending

- Reported intervals are downhole; true widths not yet determined

- Historical results lack NI 43-101 validation

News Market Reaction

On the day this news was published, FMSTW gained 3.07%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

FMST fell 5.73% with several metals peers also lower: LITM -7.85%, ELBM -4.74%, WWR -4.88%, while STSBD and MKVNF were flat, indicating broader basic materials pressure alongside company news.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 22 | Exploration budget | Positive | -1.2% | $9.0M 2026 exploration program across uranium and Jean Lake. |

| Dec 19 | AGM results | Neutral | -1.2% | Shareholders approved directors, auditor appointment and stock incentive plan. |

| Dec 18 | Shareholder letter | Positive | +0.8% | Year-end update on drilling, uranium discovery and capital, debt reduction. |

| Dec 8 | Drill program update | Positive | +5.1% | Completion of 15-hole Jean Lake program and core re-sampling start. |

| Dec 4 | Gravity survey plan | Positive | +7.7% | Announcement of Hatchet Lake ground gravity survey to refine drill targets. |

Recent operational and exploration updates have more often seen positive price alignment, though some constructive news, like the 2026 exploration budget, drew modest selling.

Over the past months, Foremost Clean Energy has consistently reported operational progress. On Dec 4, 2025, it announced a Hatchet Lake gravity survey, with shares up 7.74%. A 15-hole, 2,266 m Jean Lake program and core re-sampling update on Dec 8 coincided with a 5.12% rise. A year-end shareholder letter on Dec 18 highlighting >100% yearly share gains and key drill intercepts saw a 0.79% move. However, the $9.0M 2026 exploration program on Dec 22 was followed by a 1.2% decline, showing occasional divergence.

Market Pulse Summary

This announcement highlights high-grade lithium intervals from JL25-005B and strong historical gold intercepts at Jean Lake, alongside a firmer lithium price above $20,000 per ton. It continues a sequence of 2025 updates on drilling and targeting across Jean Lake and Hatchet Lake. Investors may track follow-up assays from the remaining 11 holes, integration of re-sampling data into the geological model, and how upcoming 2026 drilling programs are prioritized and financed relative to these results.

Key Terms

spodumene technical

pegmatite technical

li2o technical

chain of custody technical

sodium peroxide fusion technical

icp-aes technical

iso/iec 17025 technical

national instrument 43-101 regulatory

AI-generated analysis. Not financial advice.

VANCOUVER, British Columbia, Jan. 14, 2026 (GLOBE NEWSWIRE) -- Foremost Clean Energy Ltd. (NASDAQ: FMST) (CSE: FAT) ("Foremost" or the "Company"), is pleased to report positive lithium assay results from its 2025 drill program at the

HIGHLIGHTS:

JL25-005B

1.6% Li2O over 5.0 m from 52.0m, including 2.1m of2.8% Li2O1.5% Li2O over 4.8m from 62.6m, including 0.8m of2.3% Li2O

The release of lithium results from JL25-005B (see Table 1) comes amid a strengthening market backdrop with lithium carbonate prices seeing a strong rally, increasing to over

Jason Barnard, President and CEO of Foremost Clean Energy, commented: “These lithium results are an exciting step forward for Foremost and further demonstrate the potential of the Jean Lake Project. Intersecting

Recent independent research, such as Morgan Stanley’s December 2025 report, underscores a constructive outlook for core energy transition metals. The report highlights strong uranium price momentum driven by a structural supply deficit—with long-term price accretion as we head into our upcoming 2026 drill season.”

Barnard continues: “Our upcoming drill program at our anchor, the Hatchet Lake Uranium Property, is designed to follow up on our new discovery from last season. The urgency to discover and define new uranium resources has never been greater. A structural supply deficit and the pressing need for procurement for utilities to secure long-term supply have created a market where sustained exploration is not just an opportunity but is viewed as imperative for energy security. This directly aligns with our exploration strategy, which focuses on high-impact discoveries in the world’s premier uranium district, the Athabasca Basin. By actively exploring in this proven jurisdiction, we are executing our plans to fulfill this critical need. We believe this presents a compelling opportunity as we advance our prospective uranium portfolio, rooted in meaningful catalysts to build long-term shareholder value.”

1 https://tradingeconomics.com/commodity/lithium

Table 1 – Lithium Assay Results

| Hole ID | From (m) | To (m) | Interval (m) | Li2O1 | Notes |

| 46.6 | 48.5 | 1.9 | 0.44 | ||

| JL25-005B2 | 52.0 | 57.0 | 5.0 | 1.64 | Incl. |

| 62.6 | 67.4 | 4.8 | 1.46 | Incl. | |

| 73.8 | 78.4 | 4.6 | 0.62 | Incl. |

1 Uses cut-off grade of

2 JL25-005B was drilled with an azimuth of 212° a dip of -70 ° located at 452829 E, 6076336N (NAD83 Zone 14)

The Company has now completed its historic core re-sampling program (assays pending), the results of which will strengthen its geological model for both lithium and gold at Jean Lake. This follows the December 8, 2025, announcement that confirmed completion of the 2025 drill program and the start of the re-sampling initiative. Gold assay results from the initial four drill holes have defined a near-surface mineralized footprint that extends beyond the original discovery area. Notable results included hole JL25-001: 12.7 g/t Au over 2.1 metres (including 40.0 g/t Au over 0.6 metres) and hole JL25-002: 10.7 g/t Au over 5.6 metres (including 82.0 g/t Au over 0.7 metres) (see news release November 10, 2025). Assay results for the remaining 11 holes are still pending from the completed drill program.

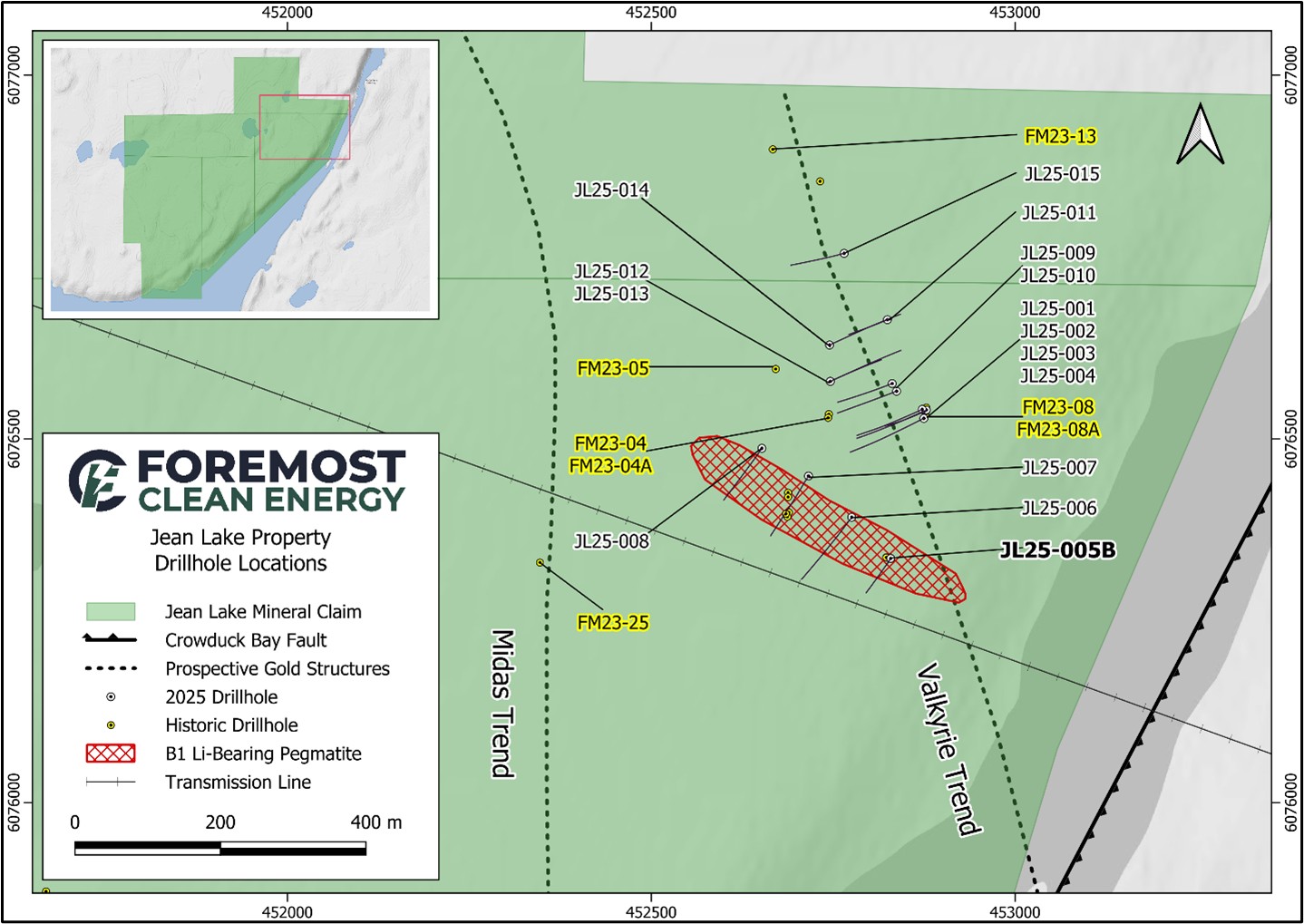

Figure 1. Jean Lake 2025 Drillholes and 2023 Resampled Drillhole Locations

Looking ahead, Foremost plans to integrate the 2025 drill results and the historic re-sampling data into an updated geological and structural model to guide future exploration at Jean Lake. A total of six high-priority 2023 drillholes along the Valkyrie Trend were selected for re-sampling in 2025 (Figure 1). These include hole FM23-08, which previously returned 102 g/t Au over 0.5 m, within 7.50 g/t Au over 7.66 m (see news release June 06, 2023). In addition, one drillhole from the Midas Trend, FM23-25, is being re-sampled (Figure 1). Historical highlights from FM23-25 include 6.86 g/t Au over 0.54 m, within 2.07 g/t Au over 3.49 m (see news release June 06, 2023).

Sampling, Analytical Methods and QA/QC

Drill core samples were collected from pegmatite dykes intersected during the drilling program. All samples consisted of NQ-sized diamond drill core. Sampling intervals were selected based on geological logging, with continuous sampling through pegmatite intervals and adjacent wall rock. Sample lengths typically ranged from 0.5 m to 1.0 m, depending on lithological boundaries and internal zoning within the pegmatite.

All drill core was cut longitudinally using a diamond saw, with one half retained on site for reference and future verification and the remaining half submitted for geochemical analysis. Samples were securely packaged, labelled, and shipped under chain of custody to SGS Canada Inc.’s geochemistry laboratory in Burnaby, British Columbia, for sample preparation and primary analysis.

At SGS, samples were dried at 105°C, crushed to

All analytical work was carried out at SGS laboratories operating under ISO/IEC 17025-accredited quality management systems. SGS laboratories employ method-specific internal quality control protocols that include the routine insertion of preparation blanks, certified reference materials, duplicates, and pulp replicates. These controls are monitored through SGS’s Laboratory Information Management System, which automatically flags results that fall outside predefined accuracy or precision thresholds and initiates reanalysis when required.

In addition to laboratory QA/QC procedures, Foremost Clean Energy implemented an independent quality assurance program that included the regular insertion of certified lithium reference materials, blank samples, and field duplicates into the sample stream. These control samples were used to independently assess analytical accuracy, precision, and potential contamination during sample preparation and analysis. Results from QA/QC samples were reviewed upon receipt of analytical data and were found to be within acceptable limits for lithium exploration purposes.

All reported sample intervals represent downhole lengths. True widths of mineralized intervals have not yet been determined.

Qualified Person

The technical content of this news release has been reviewed and approved by Cameron MacKay, P. Geo., Vice President of Exploration for Foremost Clean Energy Ltd., and a Qualified Person under National Instrument 43-101.

A qualified person has not performed sufficient work or data verification to validate the historical results in accordance with National Instrument 43-101. Although the historical results may not be reliable, the Company nevertheless believes that they provide an indication of the property’s potential and are relevant for any future exploration program.

About Foremost

Foremost Clean Energy Ltd. (NASDAQ: FMST) (CSE: FAT) (WKN: A3DCC8) is a North American uranium and lithium exploration company strategically positioned to support the accelerating demand for reliable, carbon-free energy. As artificial intelligence, data centers, and electrification drive unprecedented growth in global power consumption, the expanding need for reliable nuclear baseload power creates a direct and critical imperative for the sustained exploration required to secure its uranium feedstock.

The Company holds an option from Denison to earn up to

Foremost also has a portfolio of lithium projects at varying stages of development, which are located across 55,000+ acres in Manitoba and Quebec providing exposure to other critical materials underpinning electrification and energy storage.

For further information, please visit the Company’s website at www.foremostcleanenergy.com.

Contact and Information

Company

Jason Barnard, President and CEO

+1 (604) 330-8067

info@foremostcleanenergy.com

Follow us or contact us on social media:

X: @fmstcleanenergy

LinkedIn: https://www.linkedin.com/company/foremostcleanenergy

Facebook: https://www.facebook.com/ForemostCleanEnergy

Forward-Looking Statements

Except for the statements of historical fact contained herein, the information presented in this news release and oral statements made from time to time by representatives of the Company are or may constitute “forward-looking statements” as such term is used in applicable United States and Canadian laws and including, without limitation, within the meaning of the Private Securities Litigation Reform Act of 1995, for which the Company claims the protection of the safe harbor for forward-looking statements. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any other statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect,” “is expected,” “anticipates” or “does not anticipate,” “plans,” “estimates” or “intends,” or stating that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved) are not statements of historical fact and should be viewed as forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, continuity of agreements with third parties and satisfaction of the conditions to the option agreement with Denison, risks and uncertainties associated with the environment, delays in obtaining governmental approvals, permits or financing. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. Forward-looking information is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company’s ability to control or predict. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this news release can be found in the Company’s filings with the Securities and Exchange Commission. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities. and information. Please refer to the Company’s most recent filings under its profile at on Sedar+ at www.sedarplus.ca and on Edgar at www.sec.gov for further information respecting the risks affecting the Company and its business.

The CSE has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy hereof.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a2adda11-d95e-4077-9826-a684816cd103