Forte Minerals Commences First-Ever Drilling at the Pucarini High-Sulfidation Gold Project, Puno, Peru

Rhea-AI Summary

Forte Minerals (OTCQB: FOMNF) has started its first-ever diamond drilling campaign at the 100% owned Pucarini High-Sulfidation Gold Project in Puno, Peru. The Phase I program is 5 holes totaling 1,750 metres to test a large-scale high-sulfidation epithermal gold system over a 3.6 km by 1.8 km alteration footprint. Core processing and sampling from drill hole #1 is underway and the company expects assay results in early Q1 2026. Forte also disclosed two strategic investors who each invested C$5.7 million, strengthening the treasury for Pucarini and the Alto Ruri gold project.

Positive

- 1,750 m inaugural drill program underway

- Assays expected in early Q1 2026

- Two strategic investors funded C$11.4M combined

Negative

- Conflicting assay timeline: December comment vs early Q1 2026 stated elsewhere

News Market Reaction

On the day this news was published, FOMNF gained 1.83%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers show mixed moves: VIPRF +12.84%, EQMEF +25.18%, while CTMCF -4.93% and SSVRF is flat. FOMNF’s modest +1.83% move appears more stock-specific than part of a uniform sector swing.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Nov 26 | Drilling commencement | Positive | +1.8% | First-ever 5-hole, 1,750m drill program and two C$5.7M investors. |

| Oct 14 | Leadership change | Positive | -5.4% | Appointment of new independent chairman and issuance of 2,750,000 options. |

| Sep 16 | Shareholder disposition | Negative | +5.5% | Large holder sold 1,428,000 shares, reducing stake from 9.59% to 7.42%. |

Recent news has often seen price moves that diverge from the apparent tone of the announcements, with governance and ownership changes drawing sharper reactions than operational progress.

This announcement continues a recent series of corporate and project developments. On Sep 16, 2025, a major shareholder reduced its stake, yet the stock rose. On Oct 14, 2025, a new non-executive chairman and option grants coincided with a price decline. Today’s Nov 26, 2025 news marks the first-ever drilling at Pucarini, a 1,750-metre, 5-hole program backed by two new strategic investors, each committing C$5.7 million.

Market Pulse Summary

This announcement marks the first-ever drilling at Pucarini, a 1,000-hectare project with a 1,750-metre, 5-hole Phase I program targeting a large high-sulphidation epithermal system. Two strategic investors, each committing C$5.7 million, bolster the treasury and support both Pucarini and Alto Ruri. Investors may watch upcoming assay results in early Q1 2026, progress on Alto Ruri permitting, and any further governance or ownership changes for additional signals.

Key Terms

high-sulphidation epithermal technical

epithermal gold technical

porphyry copper - molybdenum technical

magnetic susceptibility technical

chargeability technical

diamond drilling technical

qualified person regulatory

national instrument 43-101 regulatory

AI-generated analysis. Not financial advice.

- Five-hole 1,750m drill program underway

- Testing for potential large-scale high-sulphidation epithermal gold system

- Assay results expected early Q1 2026

VANCOUVER, British Columbia, Nov. 26, 2025 (GLOBE NEWSWIRE) -- Forte Minerals Corp. (“Forte” or the “Company”) (CSE: CUAU) (OTCQB: FOMNF) (Frankfurt: 2OA) is pleased to announce that diamond drilling has commenced at its

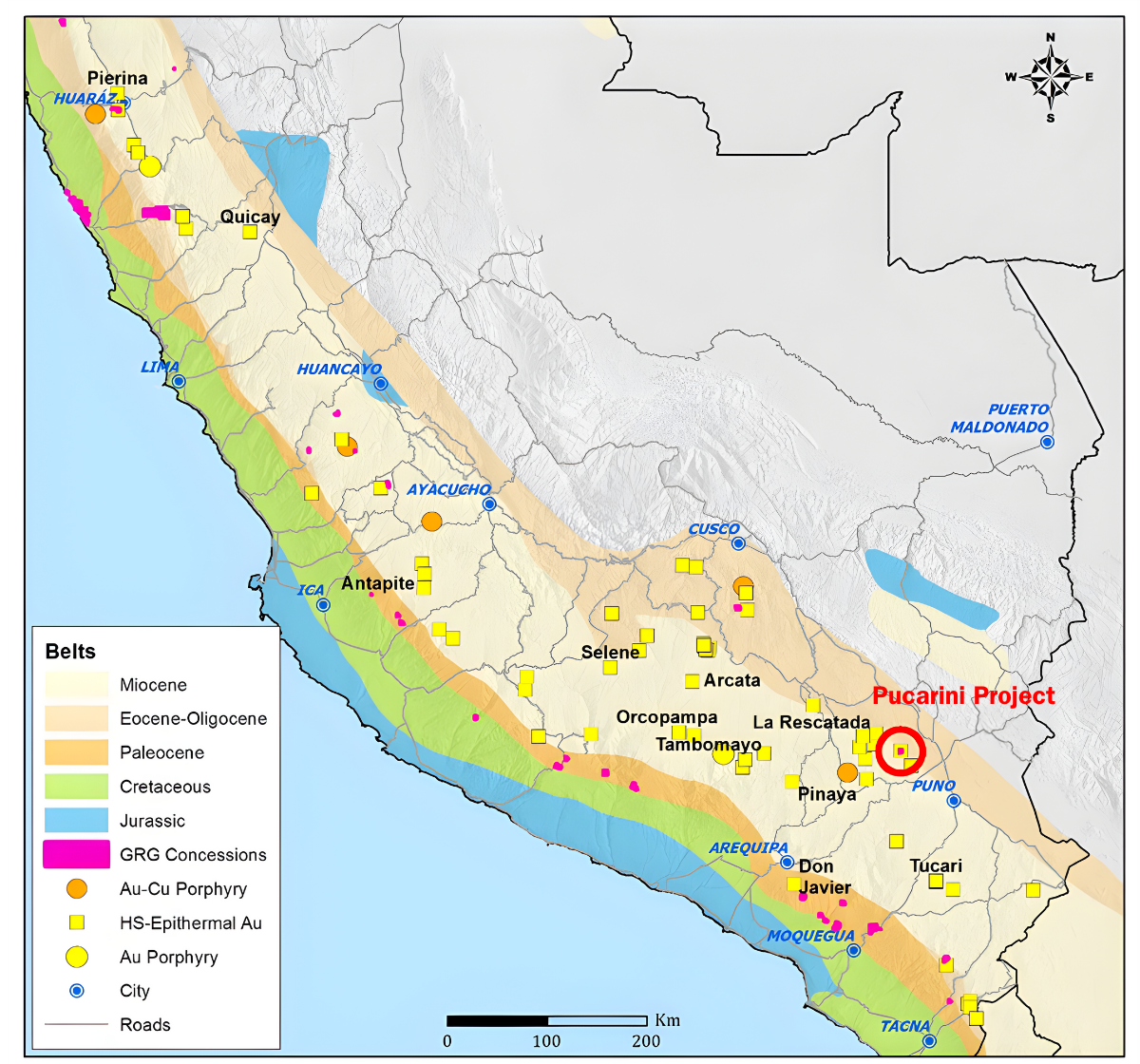

Pucarini is located within the Southern Peru Miocene Mineral Belt, which hosts numerous epithermal gold (“Au”) and porphyry copper - molybdenum (“Cu-Mo”) deposits. The Project exhibits a large-scale hydrothermal alteration footprint with high-sulphidation epithermal Au type mineralization, similar to those of neighbouring and regional deposits in the Puno region of Southern Peru.

Figure 1 - Key Mineral Belts of Southern Peru, INGEMMET, 2020.

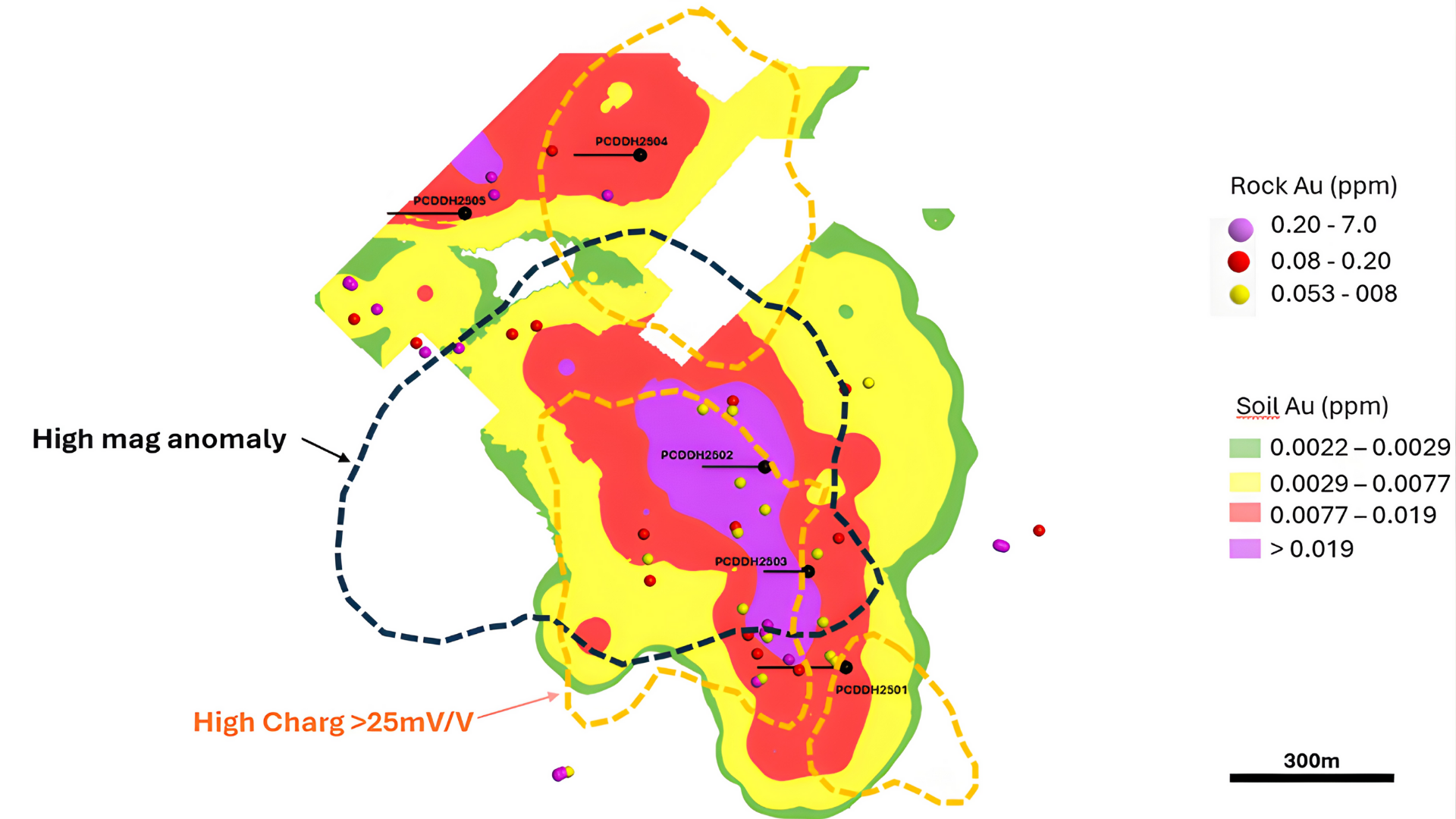

Figure 2 – Pucarini Au Geochemistry - IP Chargeability-Resistivity 3D Model - Ground Magnetic Susceptibility 3D Model and Proposed Drilling

Over the past several years, Forte has carried out detailed mapping, geochemistry, multispectral mineralogical analysis, and ground geophysics, while also building strong, long-term relationships with local communities. The Company secured its DIA drilling permit in August 2023 (refer to news release – September 29, 2023) and entered into a renewed one-year Community Agreement on March 1, 2025, ensuring local support for the 2025–2026 exploration drilling program.

Inaugural Drill Program

The Phase I program consists of:

- 5 diamond drill holes

- 1,750 metres total (~350 m per hole)

- Testing a potential large-scale high-sulfidation epithermal gold system.

The drill targets were prioritized based on coincident gold geochemistry, high-sulfidation alteration zones, and high resistivity geophysical anomalies, creating a potential cohesive exploration model.

Figure 3 – Pucarini Au in Rock and Soil Geochemistry - Ground High Magnetic Susceptibility and Proposed Drill Hole Locations (1,750 m Proposed)

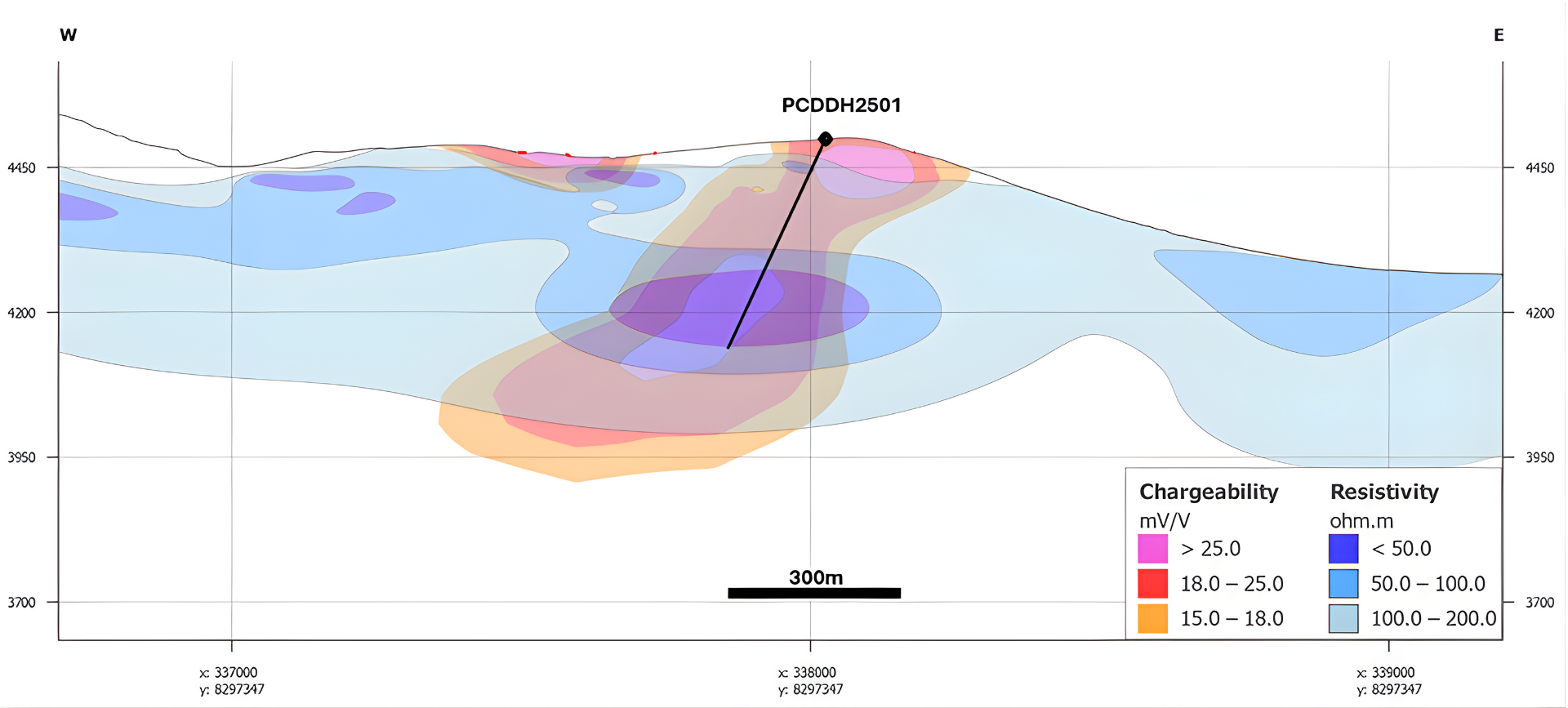

Figure 4 – Pucarini Diamond Drill Hole #1 in Cross section – Shallow IP High Chargeability/High Resistivity Anomaly with Deeper IP High Chargeability/Low Resistivity Anomaly.

Figure 5 – Pucarini Diamond Drill Hole #2 in Cross section - IP High Chargeability/ Low Resistivity Anomalies Coincident with a High Magnetic Susceptibility Anomaly

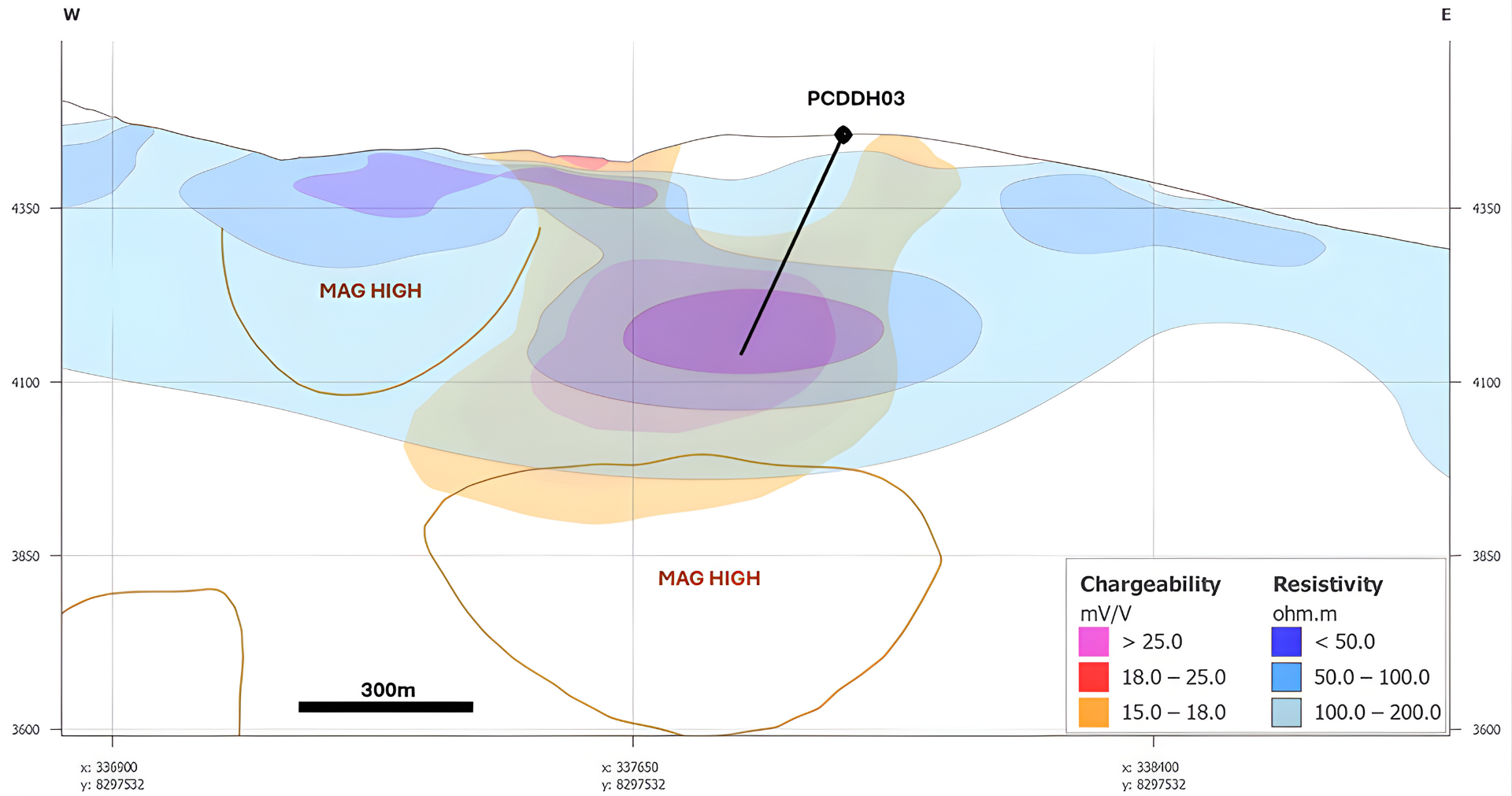

Figure 6 – Pucarini Diamond Drill Hole #3 in Cross section - IP High Chargeability/ Low Resistivity Anomaly and Deeper High Magnetic Susceptibility Anomaly

The 1,000-hectare

Forte has identified a cohesive Au geochemical anomaly in rocks and soils that spans 1,200 m by 600m, supported by a large 1,500 m by 600 m high chargeability anomaly. This is also coincident with a deep-rooted high magnetic susceptibility anomaly that potentially outlines a Au-Cu-Mo porphyry system at depth. Lower levels of anomalous Cu and Mo geochemistry in rocks and soils dominate the main target zone lending more conviction to a potential deeper porphyry target. Together, these datasets outline a robust, untested high-sulphidation epithermal Au target overprinting a potential porphyry Au-Cu-Mo target at greater depth.

With drilling now underway, the Company is positioned to unlock the first subsurface information ever collected from this extensive system. Core processing and sampling from the first drill hole is now underway, and the Company anticipates delivering first assay results to the market in early Q1 2026.

Figure 7 - Pucarini Project high sulfidation epithermal alteration with anomalous Au in surface rock geochemistry

For more details on the geology, targeting methodology, and exploration model at Pucarini, please visit the project page: https://forteminerals.com/projects/pucarini/

Forte’s President & CEO Statement, Patrick Elliott commented:

“The start of drilling at Pucarini is a major milestone for Forte. After years of geological groundwork, permitting progress, and meaningful collaboration with local communities, we are finally able to test what we believe is one of the most compelling untested high-sulfidation gold exploration targets in southern Peru.

The scale of the alteration system, the strength of the geophysics, and the consistency of the gold anomaly make this a highly attractive first-pass discovery opportunity. With drilling underway, we look forward to sharing initial results with the market in December.”

Strengthened Balance Sheet and Strategic Alignment

Over the past four months, Forte has welcomed two new strategic investors, each investing C

Alto Ruri Gold Project (15 km from Barrick’s Pierina Mine)

While drilling progresses at Pucarini, Forte remains committed to advancing its second Au project, Alto Ruri, located approximately 15 km from the past-producing Pierina Mine, one of Barrick’s former cornerstone operations. Alto Ruri hosts shallow historical drilling, high-resistivity geophysical anomalies, and district-scale epithermal signatures, underscoring its potential for a near-surface Au discovery (refer to the news release dated March 4th, 2024).

With the support of two new strategic investors with deep operational experience in Peru, advancing environmental permitting at Alto Ruri is a key priority as the Company prepares the project for future drilling.

Qualified Person and NI 43-101 Disclosure

Richard Osmond, P.Geo., an Independent Director, is the Company’s Qualified Person (“Qualified Person”) as defined by National Instrument 43-101. He has reviewed and approved the technical information contained in this news release.

The information contained in this press release can also be viewed in the NI 43-101 Technical Report on the Pucarini Property, filed on SEDAR+ in November 2021.

About Forte Minerals

Forte Minerals Corp. is a well-funded exploration company with a strong portfolio of high-quality copper and gold assets in Peru. Through a strategic partnership with GlobeTrotters Resources Perú S.A.C., the Company gains access to a rich pipeline of historically drilled, high-impact targets across premier Andean mineral belts. The Company is committed to responsible resource development that generates long-term value for shareholders, communities, and partners.

On behalf of Forte Minerals Corp.

(signed) “Patrick Elliott”

Patrick Elliott, MSc, MBA, PGeo

President & Chief Executive Officer

Forte Minerals Corp.

T: (604) 983-8847

| Investor Inquiries | Media Contact |

| Kevin Guichon, IR & Capital Markets | Anna Dalaire, VP Corporate Development |

| E: kguichon@forteminerals.com | E: adalaire@forteminerals.com |

| C: (604) 612-9976 | T: (604) 983-8847 |

| info@forteminerals.com | |

| www.forteminerals.com | |

Follow Us On Social Media: LinkedIn | Instagram | X | Meta | The Drill Down; Newsletter

Certain statements included in this press release constitute forward-looking information or statements (collectively, “forward-looking statements”), including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “may”, “should” and similar expressions to the extent they relate to the Company or its management. The forward-looking statements are not historical facts but reflect current expectations regarding future results or events. This press release contains forward looking statements relating to the intended use of proceeds of the Strategic Placement. These forward-looking statements and information reflect management's current beliefs and are based on assumptions made by and information currently available to the Company with respect to the matter described in this press release. Forward-looking statements involve risks and uncertainties, which are based on current expectations as of the date of this release and subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Additional information about these assumptions and risks and uncertainties is contained under "Risk Factors and Uncertainties" in the Company’s latest management’s discussion and analysis, which is available under the Company’s SEDAR+ profile at www.sedarplus.ca, and in other filings that the Company has made and may make with applicable securities authorities in the future.

Forward-looking statements are not a guarantee of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Factors that could cause the actual results to differ materially from those in forward-looking statements include the continued availability of capital and financing, and general economic, market or business conditions. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those implied by such statements. Although such statements are based on management's reasonable assumptions, there can be no assurance that the statements will prove to be accurate or that management’s expectations or estimates of future developments, circumstances or results will materialize. The Company assumes no responsibility to update or revise forward-looking information or statements to reflect new events or circumstances unless required by law. Readers should not place undue reliance on the Company’s forward-looking statements.

Neither the Canadian Securities Exchange (the “CSE”) nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Images accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/52e7d639-603f-4d4a-b7de-3dd04fa2bc2d

https://www.globenewswire.com/NewsRoom/AttachmentNg/edea04da-ac6b-4f7a-a72b-60babaf95040

https://www.globenewswire.com/NewsRoom/AttachmentNg/d31dd674-76a5-4a7b-a6e1-96aa007d99be

https://www.globenewswire.com/NewsRoom/AttachmentNg/68ed58ee-1d7f-465c-974b-4842b64a4e93

https://www.globenewswire.com/NewsRoom/AttachmentNg/386f7ccf-a5c2-4890-8484-c2159ea9b24a

https://www.globenewswire.com/NewsRoom/AttachmentNg/36a4fcbb-8a28-43ee-ae62-ca35dbb5b2b2

https://www.globenewswire.com/NewsRoom/AttachmentNg/769d6ed9-ceb9-4402-846e-a017e0362e8c

https://www.globenewswire.com/NewsRoom/AttachmentNg/c372199d-8780-49ea-9dfc-43d0c6018805