Gunnison Copper Reports Positive Results from Initial Mineral Sorting "High-Value-Add" Work Program at the Gunnison Copper Project in Southeast Arizona

Gunnison Copper (OTCQB: GCUMF) reported positive results from its mineral sorting test program at the Gunnison Copper Project in Arizona. The tests demonstrated a significant 75% reduction in acid consumption while maintaining copper recovery rates. Testing on Martin Formation samples, which comprises 44% of the resource base, showed that over 90% of internal acid-consuming waste was successfully removed using optical mineral sorting.

Key results include: 57% of the sample sorted to mineralized material with 0.62% total copper content, while 43% sorted to waste with minimal copper loss. The process could potentially remove about 40% of mined Martin Formation as waste, effectively doubling the process head grade and reducing operating costs. The company plans to incorporate these results into an updated preliminary economic assessment expected in Q1 2026.

Gunnison Copper (OTCQB: GCUMF) ha riportato risultati positivi dal suo programma di sorting mineralogico presso il Gunnison Copper Project in Arizona. I test hanno dimostrato una significativa riduzione del 75% nel consumo di acidi mantenendo i tassi di recupero del rame. I test sui campioni della formazione Martin, che costituisce il 44% della base risorsa, hanno mostrato che oltre il 90% dello scarto interno al consumo di acidi è stato rimosso con successo mediante sorting ottico dei minerali.

Risultati chiave includono: 57% del campione ordinato a materiale mineralizzato con 0,62% di rame totale, mentre 43% è stato ordinato come rifiuto con perdita di rame minima. Il processo potrebbe rimuovere circa 40% della Martin Formation come rifiuto, raddoppiando effettivamente la testa di processo e riducendo i costi operativi. L'azienda intende incorporare questi risultati in una valutazione economica preliminare aggiornata prevista nel Q1 2026.

Gunnison Copper (OTCQB: GCUMF) informó resultados positivos de su programa de clasificación mineral en el Proyecto Gunnison Copper en Arizona. Las pruebas mostraron una reducción significativa del 75% en el consumo de ácido manteniendo las tasas de recuperación de cobre. Las pruebas en muestras de la Formación Martin, que comprende el 44% de la base de recursos, mostraron que más del 90% de los residuos internos que consumen ácido se eliminaron con éxito mediante clasificación óptica de minerales.

Resultados clave incluyen: 57% de la muestra clasificada a material mineralizado con 0,62% de cobre total, mientras que 43% se clasificó como desecho con una pérdida mínima de cobre. El proceso podría eliminar aproximadamente un 40% de la Martin Formation como desecho, doblando prácticamente la cabecera del proceso y reduciendo los costos operativos. La compañía planea incorporar estos resultados en una evaluación económica preliminar actualizada prevista para el Q1 2026.

Gunnison Copper (OTCQB: GCUMF)는 애리조나 주의 Gunnison Copper Project에서 광물 분류 테스트 프로그램의 긍정적 결과를 발표했다. 테스트는 구리 회수율을 유지하면서 산 소비량을 75% 감소시키는 중요한 결과를 보여주었다. 44%를 차지하는 Martin Formation 샘플에 대한 시험은 자원 기저의 44%인데, 내부 산성 소모 폐기물의 90% 이상을 광학 광물 분류를 사용해 성공적으로 제거했다고 나타났다.

주요 결과로는: 57%의 샘플이 광물화 물질로 분류되었고 총 구리 함량 0.62%, 43%이 흠이 적은 손실로 폐기물로 분류되었다. 이 프로세스는 Martin Formation의 약 40%를 폐기물로 제거해 실제로 공정 머리 등급을 두 배로 올리고 운전 비용을 줄일 수 있다. 회사는 이 결과를 2026년 1분기에 예정된 업데이트된 예비 경제 평가에 반영할 계획이다.

Gunnison Copper (OTCQB: GCUMF) a publié des résultats positifs de son programme de tri minéral sur le projet Gunnison Copper en Arizona. Les tests ont démontré une réduction significative de 75% de la consommation d’acide tout en maintenant les taux de récupération du cuivre. Les tests sur des échantillons de la Formation Martin, qui représentent 44% de la base de ressources, ont montré que plus de 90% des déchets internes consommant de l’acide ont été efficacement retirés grâce au tri optique des minéraux.

Les résultats clés incluent : 57% de l’échantillon trié vers du matériau mineralisé avec 0,62% de cuivre total, tandis que 43% ont été triés comme déchet avec une perte de cuivre minimale. Le processus pourrait éliminer environ 40% de la Martin Formation en tant que déchet, doublant ainsi le grade en tête du processus et réduisant les coûts opérationnels. L’entreprise prévoit d’intégrer ces résultats dans une évaluation économique préliminaire mise à jour prévue pour le Q1 2026.

Gunnison Copper (OTCQB: GCUMF) hat positive Ergebnisse aus seinem Mineral-Sortierprogramm bei dem Gunnison Copper-Projekt in Arizona gemeldet. Die Tests zeigten eine signifikante 75%-Reduktion des Säureverbrauchs, während die Kupfer-Ausbeute beibehalten wurde. Tests an Proben der Martin-Formation, die 44% der Ressourcenbasis ausmachen, zeigten, dass über 90% des internen säureverbrauchenden Abfalls erfolgreich durch optisches Mineral-Sorting entfernt wurden.

Schlüssel-Ergebnisse umfassen: 57% der Probe wurde zu mineralisiertem Material sortiert mit 0,62% gesamter Kupfergehalt, während 43% zu Abfall sortiert wurden mit minimalem Kupferverlust. Der Prozess könnte etwa 40% der Martin Formation als Abfall entfernen, was effektiv den Prozess-Head-Grade verdoppeln und Betriebskosten senken würde. Das Unternehmen beabsichtigt, diese Ergebnisse in eine aktualisierte vorläufige wirtschaftliche Bewertung aufzunehmen, die voraussichtlich im Q1 2026 veröffentlicht wird.

Gunnison Copper (OTCQB: GCUMF) أبلغ عن نتائج إيجابية من برنامج فرز المعادن في مشروع Gunnison Copper في أريزونا. أظهرت الاختبارات انخفاضاً كبيراً بمقدار 75% في استهلاك الحمض مع الحفاظ على معدلات استرداد النحاس. أظهرت الاختبارات على عينات تشكيل Martin، التي تشكل 44% من قاعدة الموارد، أن أكثر من 90% من النفايات التي تستهلك الحمض داخلياً قد أُزيلت بنجاح باستخدام فرز المعادن البصري.

تشمل النتائج الرئيسية: 57% من العينة المصنَّفة إلى مادة معدنية بوجود 0.62% من النحاس الكلي، بينما تم تصنيف 43% كنفايات مع فقدان نحاس ضئيل. قد يزيل هذا النظام نحو 40% من Martin Formation كنفايات، ما يضاعف فعلياً درجة رأس العملية ويقلل من تكاليف التشغيل. تخطط الشركة لدمج هذه النتائج في تقييم اقتصادي أولي محدث من المتوقع أن يكون في الربع الأول من 2026.

Gunnison Copper (OTCQB: GCUMF) 报告了在亚利桑那州 Gunnison Copper 项目中矿物分级测试计划的积极结果。测试表明在维持铜回收率的同时,酸消耗显著下降了75%。对 Martin Formation(约占资源基数的 44%)的样品测试显示,使用光学矿物分选法可成功去除内部酸耗废物的 90% 以上。

关键结果包括:57%的样品被分选为矿化材料,铜总含量为 0.62%,而 43%被分选为废物,铜损失极低。该工艺有望将约 40% 的 Martin Formation 作为废物去除,实质上使工艺前端品位翻倍并降低运营成本。公司计划将这些结果纳入更新后的初步经济评估,预计在 2026 年第一季度发布。

- Achieved 75% reduction in acid consumption, a key operating cost driver

- Successfully removed over 90% of internal acid-consuming waste

- Less than 1% copper loss during sorting process, maintaining strong recovery rates

- Potential to double process head grade through waste removal

- Results indicate significant operating cost reduction potential

- Further testing required to confirm initial results

- Updated economic assessment not available until Q1 2026

Sorting Tests Reduced Acid Consumption, a Key Operating Cost Driver, on the Highest Acid Consuming Mineralized Material by Approximately

Phoenix, Arizona--(Newsfile Corp. - September 15, 2025) - Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) ("Gunnison" or the "Company") is pleased to announce encouraging results from its initial mineralized material sorting test program at the flagship Gunnison Copper Project in southeast Arizona, one of the largest and most advanced copper development projects in the United States.

"These initial results are extremely encouraging, showing the potential to significantly reduce acid consumption while maintaining copper recovery," stated Roland Goodgame, Gunnison's SVP of Business Development. "This type of high-value-add program can materially improve the Project's already robust economics and feed directly into our upcoming update to our preliminary economic assessment and planned pre-feasibility study. These results support Gunnison's vision of producing cost-effective, sustainable, and

Initial Mineralized Material Sorting Results:

- Sample: A half-ton sample consisting of 2" to 6" pieces of PQ drill core from the Martin Formation, collected as part of Gunnison's recently completed metallurgical drilling program. The Martin Formation is the highest acid consuming rock type in the deposit and makes up ~

44% of the resource base. The sample was comprised of ~54% mineralized material and ~46% internal waste, consistent with the overall Martin Formation. - Waste Reduction: Over

90% of the internal acid-consuming waste was successfully removed from the mineralized material using optical mineral sorting equipment at a commercial scale. - Acid Consumption Reduction: Due to the removal of the high-acid-consuming waste, the sorted material is expected to require up to 4x lower acid consumption.

- Copper Recovery: Less than

1% of total copper was lost to waste, ensuring strong copper recovery and protecting revenue. - Testing Location: Initial sorting tests were conducted at Steinert's facilities in Kentucky in August 2025.

Table 1: Results of mineral sorting test work on the Martin Formation from the Gunnison Open Pit resource.

| Category | Total Copper %* | Acid Soluble Copper % | Sample Weight (lbs) | % of Materials in Samples |

| All materials (Martin core) | 0.35 | 0.30 | 1,028 | |

| Sorted to mineralization | 0.62 | 0.54 | 591 | |

| Sorted to waste | 0.03 | 0.01 | 437 |

*Copper grades estimated from assays on hand-sized samples from recently drilled core

Should further test work remain consistent with the initial testing results, it suggests approximately

Next Steps:

- Optimization testing on different size fractions of the Martin formation

- Mineral Sorting samples will be crushed at Base Metallurgical Labs in Tucson.

- Crushed materials will then be returned to Steinert for further mineral sorting tests to determine further liberation and sizing characteristics.

- Following the mineralization being separated from internal waste, column leach testing will be conducted on sorted products.

- Some samples may be sent to Germany for testing using Steinert's advanced M Sorters.

- Incorporating results into updated PEA expected in the first quarter of 2026.

About Mineralized Material Sorting:

Copper oxide exists on visually distinct blue-green and red-brown zones that are ideally suited to optical mineralized material sorting. Preliminary testing was

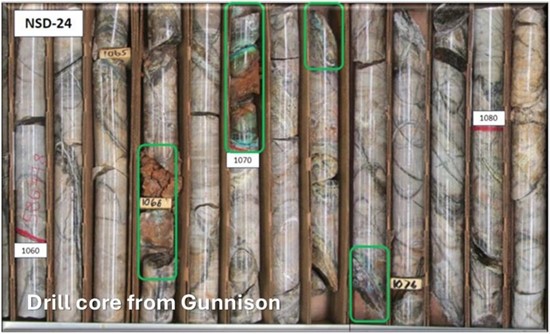

Figure 1 - Drill core showing Martin formation mineralization at the Gunnison Open Pit project. The green boxes show mineralized portions of the rock that test work has shown can be optically sorted from the remaining internal waste.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2744/266394_gunnisonimg1.jpg

ABOUT GUNNISON COPPER

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt.

Its flagship asset, the Gunnison Copper Project, has a Measured and Indicated Mineral Resource containing over 831.6 million tons with a total copper grade of

The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

In addition, Gunnison's Johnson Camp Asset, which is now in production, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

Other significant deposits controlled by Gunnison in the district, with potential to be economic satellite feeder deposits for Gunnison Project infrastructure, include Strong and Harris, South Star, and eight other deposits.

For additional information on the Gunnison Project, including the PEA and mineral resource estimate, please refer to the Company's technical report entitled "Gunnison Project NI 43-101 Technical Report Preliminary Economic Assessment" dated effective November 1, 2024 and available on SEDAR+ at www.sedarplus.ca.

Roland Goodgame, Senior Vice President Business Development of the Company is a Qualified Person as defined by NI 43-101. Dr. Goodgame has reviewed and is responsible for the technical information contained in this news release.

Dr. Goodgame has verified the data disclosed in this news release, including the assay and test data underlying the information or opinions contained in this news release. Dr. Goodgame verified the data disclosed in this news release by reviewing imported and sorted assay data; checking the performance of blank samples and certified reference materials; and reviewing grade calculation formulas. Dr. Goodgame detected no significant QA/QC issues during review of the data and is not aware of any sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to in this news release.

For more information on Gunnison, please visit our website at www.GunnisonCopper.com.

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

Melissa Mackie

T: 647.533.4536

E: info@GunnisonCopper.com

www.GunnisonCopper.com

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" concerning anticipated developments and events that may occur in the future. Forward-looking information contained in this news release includes, but is not limited to, statements with respect to: (i) the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; (ii) the continued funding of the stage 2 work program by Nuton; (iii) the details and expected results of the stage two work program; (iv) timelines for future production and production capacity from the Company's mineral projects; (v)that the test results can materially improve the project's already robust economics; (vi) plans for an update to the preliminary economic assessment and planned pre-feasibility study; (vii) that these results support Gunnison's vision of producing cost-effective, sustainable, and

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects" or "does not expect", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, Nuton will continue to fund the stage 2 work program, the availability of financing to continue as a going concern and implement the Company's operational plans, the estimation of mineral resources, the realization of resource estimates, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks related to the Company not obtaining adequate financing to continue operations, Nuton failing to continue to fund the stage 2 work program, the breach of debt covenants, risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks related to the delay in approval of work plans, variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions on the Company's business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/266394