GMV Minerals Inc. Announces Updated PEA Results at Mexican Hat Gold Project in S.E. Arizona

Rhea-AI Summary

GMV Minerals (OTCQB:GMVMF) has announced positive results from an updated Preliminary Economic Assessment (PEA) for its Mexican Hat Gold Project in Arizona. The Base Case projects a pre-tax IRR of 66.1% and NPV of $390.2 million using a $2,500/oz gold price, with a 1.53-year payback period.

The project features a 10-year mine life with total production of 597,841 ounces, averaging 60,000 ounces annually. Initial capital expenditure is estimated at $89.9 million, with cash costs of $1,354 per ounce and all-in sustaining costs of $1,545 per ounce. The operation will process 10,000 tonnes per day through conventional heap leaching.

At current gold prices ($3,350/oz), the project demonstrates even stronger economics with a pre-tax IRR of 106.8% and NPV of $767 million.

Positive

- Strong pre-tax IRR of 66.1% and NPV of $390.2M in base case scenario

- Rapid payback period of 1.53 years (pre-tax)

- Low strip ratio of 2.05 and minimal pre-stripping required

- High metallurgical recoveries of 88% through heap leaching

- Significant upside potential at current gold prices with IRR of 106.8%

- Existing infrastructure including power and water access

Negative

- High all-in sustaining costs of $1,545 per ounce

- Resource base consists entirely of Inferred category, requiring additional drilling

- Relatively modest production scale at 60,000 ounces per year

- Initial capital requirement of $89.9M needed for development

News Market Reaction

On the day this news was published, GMVMF gained 11.40%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, BC / ACCESS Newswire / August 13, 2025 / GMV Minerals Inc. (the "Company" or "GMV") (TSXV:GMV)(OTCQB:GMVMF) is pleased to announce positive results from the updated Preliminary Economic Assessment ("PEA") study of the Mexican Hat Gold Project (the "Mexican Hat Project"), located in Cochise County, southeastern Arizona.

A National Instrument 43-101 -Standards of Disclosure for Mineral Projects ("NI 43-101") compliant technical report (the "Report") entitled "Updated NI 43-101 Technical Report Preliminary Economic Assessment, Mexican Hat Project" with an effective date of August 8, 2025 will be filed on SEDAR+ at www.sedarplus.ca under the Company's profile within 45 days of this news release. All amounts are stated in second quarter 2025 US dollars (US$).

The Mexican Hat hosts a shallow oxide gold resource with excellent metallurgy and high recoveries, supported by a low strip ratio and minimal pre-stripping. Infrastructure is in place and the Mexican Hat Project demonstrates a robust NPV and IRR. With fast leach kinetics and low reagent consumption, the Company believes the Mexican Hat Project offers exceptional potential economics.

Highlights:

The Base Case generates a pre-tax Internal Rate of Return ("IRR") of

66.1% (after-tax50.2% ) and a pre-tax net present value ("NPV") at a5% discount rate of US$390.2 million (after-tax US$268.3 million ) with a 1.53 year payback (1.82 year after-tax) of invested capital using a US$2,500 per ounce gold price.

Based on price sensitivity analysis at approximately the current price of US

$3,350 per ounce of gold, the project returns a pre-tax IRR of106.8% (after-tax82.5% ) and a pre-tax NPV at a5% discount rate of US$767 million (after-tax US$538.1 million ) with a payback period of 1.10 years (1.3 years after-tax).

Base Case mine life of 10 years with total production of 597,841 ounces, averaging approximately 60,000 ounces per year.

Crushed mineralized material will be conveyor stacked at a rate of approximately 10,000 tonnes/day on a conventional heap leach pad.

Capex: US

$89,997,000 (including US$15.4 million contingency).

Opex: US

$788 million LOM with Low LOM Strip Ratio of 2.05

Estimated cash cost of production is US

$1,354 per ounce with an all-in-sustaining cost of$1,545 per ounce inclusive of sustaining capital and additional overhead support.

Engineering design analysis indicates the potential to increase pit size and contained ounces with increased gold prices.

FINANCIAL INDICATORS

The following table summarizes the financial indicators for the Mexican Hat Project for both before and after taxes.

Financial Indicators Before Taxes | Values |

NPV cash flow (undiscounted) | US |

NPV @ | US |

IRR % | |

Payback (years) | 1.53 |

Financial Indicators After Taxes | Values |

NPV cash flow (undiscounted) | US |

NPV @ | US |

IRR % | |

Payback (years) | 1.82 |

GOLD PRICE SENSITIVITY TABLE (US$ MILLIONS)

The following table summarizes the pre-tax and post-tax economic results to gold price sensitivity.

Pre-Tax and Post-Tax Sensitivity to Gold Price

- | - | - | - | Base | + | + | + | + | |

US$/troy oz Gold | 1,000 | 1,375 | 1,750 | 2,125 | 2,500 | 2,875 | 3,350 | 3,625 | 4,000 |

IRR (Pre-Tax) | |||||||||

NPV @ | -274.7 | -108.5 | 57.7 | 224.0 | 390.2 | 556.4 | 767.0 | 888.9 | 1,055.1 |

IRR (Post-Tax) | |||||||||

NPV @ | -274.9 | -117.3 | 25.8 | 149.3 | 268.3 | 387.4 | 538.1 | 625.4 | 744.4 |

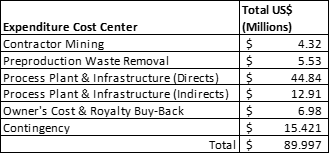

INITIAL CAPITAL EXPENDITURES (US$ MILLIONS)

Initial capital expenditures are estimated at US

OPERATING COSTS

The mine operating costs were calculated to average

Mine Operating Cost Center | Unit Cost (US$/t mined) |

Owner Mining Personnel | |

Owner Supplies & Misc. | 0.03 |

Contractor Mining | 3.35 |

Total Cost (Rounded) |

The life-of-mine operating costs were calculated to average US

Operating Cost | Cost per Tonne of Crushed Material Processed (US$/t) |

Mining | |

Processing | |

G&A | |

Total Site Operating Cost |

MINERAL RESOURCES

An updated Mineral Resource Estimate prepared by DRW Geological Consultants Ltd., with an effective date of August 8, 2025, was used in the PEA. Details of the Mineral Resource Estimate can be found in the Report to be filed on SEDAR+ within 45 days of this release.

Category | Cut-off (g/t Au) | Grade (Au, g/t) | Tonnes | Gold Oz | Strip Ratio |

Inferred | 0.20 | 0.58 | 36,733,000 | 688,000 | 2.36 |

The Mineral Resource Estimate has been constrained to a preliminary optimized pit shell, using the following parameters: SG = 2.57 gm/cc based on testwork, mining costs =

$3.00 /tonne, mining recovery =98% , mining dilution =2% , process cost =$5.00 per tonne, G&A =$1.05 per tonne, gold price =$2,500 per troy ounce, throughput at 10,000 tpd., discount rate =5% . A cost of$0.03 was added per bench to the mining cost below the existing level surface.A top cut of 32 gpt gold is applied to all zones except Zone 6 which has a top cut of 50 gpt gold.

Mineral Resources have been calculated using the Inverse Distance Squared method.

Mineral Resources constrained to optimized pit shells are not Mineral Reserves and do not have demonstrated economic viability.

Conforms to NI 43-101, Companion Policy 43-101CP, and the CIM Definition Standards for Mineral Resources and Mineral Reserves. Inferred Resources have been estimated from geological evidence and limited sampling and must be treated with a lower level of confidence than Measured and Indicated Resources.

All numbers are rounded. Overall numbers may not be exact due to rounding.

There are no known legal, political, environmental, or other risks that could materially affect the potential development of the mineral resources.

MINE PLAN

The mine plan is conceived as a conventional open pit tuck and shovel/loader operation. There are two independent pits which are developed with five-phase or pushback designs. Pit shells were designed using 6.0-meter benches with a catch bench installed every 18 meters. A bench face angle of 66° was used, resulting in an inner-ramp angle of 45° when catch benches were included. An

The mine and crushing will be operated by contractors with oversight by GMV mine management. The mine plan produces a nominal tonnage to the crushing and heap leach of 3,500 Ktonnes per year (10,000 tpd) from a total material movement of 93.8 Ktonnes for the life of mine (26,106 tpd LOM average).

The PEA is preliminary in nature; it includes inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized. There is no Mineral Reserve at the Mexican Hat Project at this time. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Over the course of the mine life, 38.6 Mtonnes of Mineralized Resource is planned for processing out of a total material movement of 117.8 Mtonnes.

INFRASTRUCTURE & PROCESS PLANT

The Mexican Hat Project is located in the southeastern part of the State of Arizona, approximately 72 miles east-southeast of Tucson, and can be accessed from the Old Ghost Town Road., a gravel road extending south of the Town of Pearce or north from Gleeson Road.

Groundwater will be used as the source of water for mining operations. No permitting restrictions or quantity issues are anticipated.

A 69 kV powerline to site will be supplied by Sulphur Springs Valley Electric Cooperative from their power plant located 30 km north of the project site.

The crushing plant will be operated by a contractor to produce a crushed product for heap leaching with a 25 mm top size. Pregnant solution from the heap leach will be processed in a conventional adsorption desorption recovery (ADR) plant. The process plant will produce doré gold bars.

TECHNICAL REPORT AND QUALIFIED PERSONS

The Report entitled Updated Preliminary Economic Assessment, Mexican Hat Project", with an effective date of August 8, 2025 and which was prepared by the following Qualified Persons (as defined under NI 43-101), all of whom are independent of the Company, will be filed by the Company within 45 days of this release on www.sedarplus.com:

Mr. Brian Olson, Q.P., Samuel Engineering, Inc. (Metallurgical Test Work and Recovery, Process Plant and Process Operating Costs)

Mr. Steven Pozder, P.E., Samuel Engineering, Inc. (Project Economics and Infrastructure)

Dr. Dave Webb, Ph.D., P.Eng., P.Geo., DRW Geological Consultants Ltd. (Mineral Resource Estimate, Property Description and Location, Accessibility, Climate, Local Resource, Infrastructure and Physiography, History, Geological Setting and Mineralization, Deposit Types, Exploration, Drilling, Sample Preparation, Analysis and Security, Data Verification).

Mr. Thomas L. Dyer, P.E., RESPEC LLC. (Mine Design, Production Schedule, Capital and Operating Costs)

Mr. Francisco J. Barrios, P.E., BBA Consultants International LP (Pad Design and Loading)

Ms. Dawn Garcia, CPG, PG, Stantec Consulting Services Inc. (Environmental)

All Qualified Persons have contributed to their corresponding sections in Interpretation, and Recommendations. The Qualified Persons have reviewed and approved the scientific, technical, and economic information obtained in this news release.

For a description of the data verification process and limitations, underlying assumptions and the results of surveys and quality assurance program regarding exploration information, please refer to the Company's existing NI 43-101 Technical Report filed on SEDAR+ entitled "Preliminary Economic Assessment, Mexican Hat Project" with an effective date of October 20, 2020.

Ian Klassen, President & CEO remarked that "The robust PEA confirms our contention that the project's strong economic potential de-risks the development pathway, providing a solid foundation for advancement. The results validate the open-pit, heap-leach concept, demonstrate excellent metallurgy and recoveries, and outline a simple mining and processing strategy. With high margins, rapid payback, and straightforward engineering, the PEA positions the project well for the future, where detailed design, capital optimization, and permitting can advance with confidence."

2025-2026 Forward Looking Plan

The Mexican Hat Project PEA economics justify continued investment in project development. The forward-looking plan for Mexican Hat includes work required to advance the project through Feasibility Study and into the permitting process.

These tasks include:

Approx. 7000 meters of in-fill drilling to increase confidence in the current geological understanding and mineral resource estimation to sufficient level to support mineral reserve development

Metallurgical column, hardness, and grinding tests to further optimize and improve heap leach gold recovery, and to provide information for feasibility design work

Performing a trade-off study for self-mining and crushing versus contract mining and crushing

Geotechnical drilling and analysis to optimize pit slope design parameters

Conduct base-line water sampling, and update of hydrologic, cultural, and environmental studies for permitting

About GMV Minerals Inc.

GMV Minerals Inc. is a publicly traded exploration company focused on developing precious metal assets in Arizona. GMV, through its

PEA Information and Cautionary Note Regarding Inferred Mineral Resources

The mine plan evaluated in the PEA is preliminary in nature and includes Inferred Mineral Resources, as defined by NI 43-101 that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be converted to Mineral Reserves. Additional drilling and technical studies will need to be completed in order to fully assess its viability. There is no certainty that a production decision will be made to develop the Mexican Hat Project or that the economic results described in the PEA will be realized. Mine design and mining schedules, metallurgical flow sheets and process plant designs will require additional detailed work and economic analysis and internal studies to ensure satisfactory operational conditions and decisions regarding future targeted production.

Cautionary Note to U.S. Investors

The United States Securities and Exchange Commission permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this report, such as "measured," "indicated," "inferred," and "resources," that the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC.

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain "forward-looking information" under applicable Canadian securities legislation. Forward-looking information include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking information may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Forward-looking information contained in this news release include, but are not limited to, statements or information with respect to: the results of the PEA, including the IRR and NPV, life of mine and production, capital and operating expenditures, cost estimates; permitting restrictions, and the mine plan, including infrastructure requirements and future plans; the filing of the PEA, including timing thereof, mineral resources; and future gold prices. Since forward-looking information are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties as described in the Company's filings with Canadian securities regulators. Assumptions upon which forward-looking information contained in this news release is based, without limitation, include: results of future exploration; gold prices; accuracy of the results of the PEA, including key assumptions and methods used to determine mineral resources and the results of the PEA; the ability to obtain required permits and approvals; the ability to execute future plans; exchange rates; ability to obtain funding; and changes in regulatory or community environment; Risks, and uncertainties include: results of further exploration; risks related to mineral tenure, permits and approvals; risks related to the execution of future plans; changes in gold price and exchange rates; risks related to obtaining financing; foreign country risks; regulatory risks and liabilities; and those risks and uncertainties as further described in the Company's filings with Canadian securities regulators which can be found on SEDAR+ at www.sedarplus.ca under the Company's profile. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Dr. D.R. Webb, Ph.D., P.Geo., P.Eng. is the Q.P. responsible for this release within the meaning of NI 43-101 and has reviewed the technical content of this release and has approved its content.

ON BEHALF OF THE BOARD OF DIRECTORS

Ian Klassen, President

For further information please contact:

GMV Minerals Inc.

Ian Klassen

Tel: (604) 899-0106

Email: info@gmvminerals.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: GMV Minerals, Inc.

View the original press release on ACCESS Newswire