U.S. Global Investors Announces Fiscal Year 2025 Results and Strategic International ETF Listings for GoGold in Mexico and Colombia

Rhea-AI Summary

U.S. Global Investors (NASDAQ: GROW) reported financial results for fiscal year 2025, posting a net loss of $334,000 ($0.03 per share), compared to net income of $1.3 million in FY2024. Operating revenues declined 23% to $8.5 million, while average assets under management (AUM) decreased to $1.4 billion from $1.9 billion.

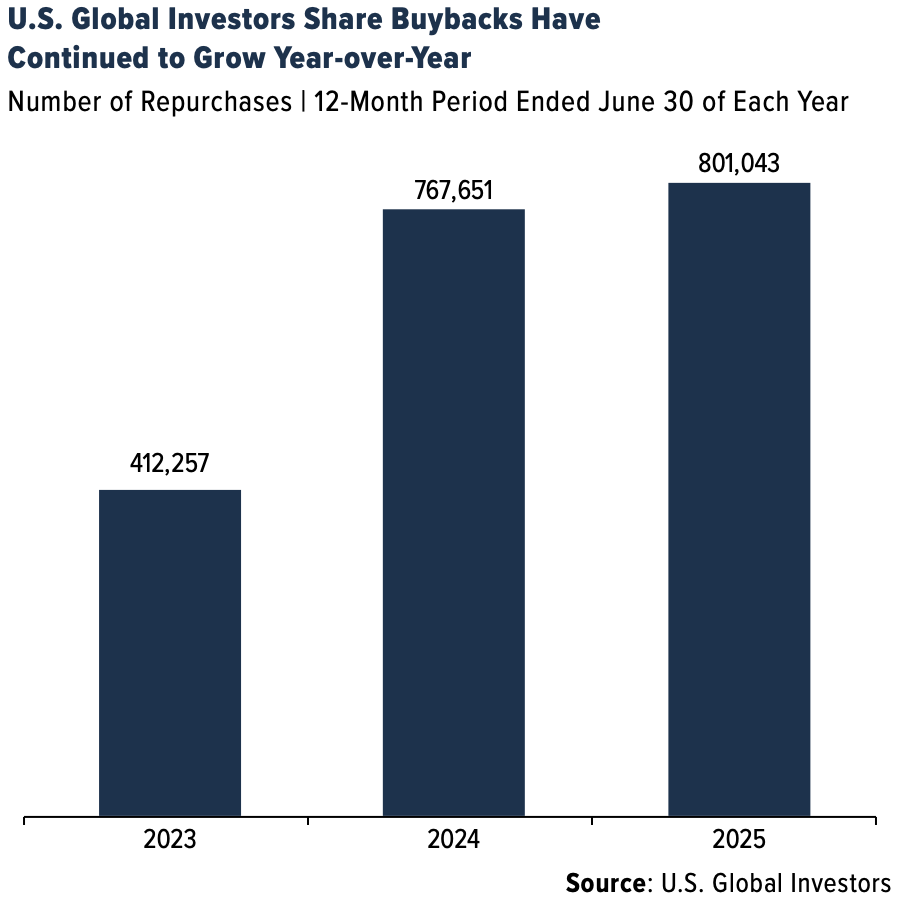

The company announced strategic international ETF expansions, with its SEA ETF listing on the Mexican Stock Exchange and GOAU ETF launching in Colombia. Despite challenging market conditions, GROW maintained shareholder value through a 9.1% shareholder yield and continued its monthly dividend program at $0.0075 per share. The company repurchased 801,043 shares and maintains strong liquidity with $24.6 million in cash and working capital of $37.2 million.

Positive

- Shareholder yield of 9.1%, more than double the 10-year Treasury bond yield

- Increased share repurchases by 4% year-over-year, buying back 801,043 shares

- Strong liquidity position with $24.6 million in cash and $37.2 million in working capital

- Strategic expansion with new ETF listings in Mexico (SEA) and Colombia (GOAU)

- Maintained consistent monthly dividend program since 2007

Negative

- Net loss of $334,000 compared to $1.3 million profit in previous year

- 23% decrease in operating revenues to $8.5 million

- Average AUM declined 26% to $1.4 billion from $1.9 billion

- Operating loss widened to $2.986 million from $480,000 previous year

News Market Reaction 1 Alert

On the day this news was published, GROW declined 2.44%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

SAN ANTONIO, Sept. 08, 2025 (GLOBE NEWSWIRE) -- U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a registered investment advisory firm1 with deep expertise in global markets and specialized sectors from gold mining to airlines, today announced a net loss of

Average assets under management (AUM) for the fiscal year ended June 30, 2025, were

The shareholder yield as of June 30, 2025, was

“Markets in fiscal 2025 were among the most difficult to navigate in recent memory. The prospect of sweeping tariffs created waves of uncertainty, with investors reacting sharply to every headline and policymakers’ statements. Concerns over growth, profitability and inflation weighed on sentiment,” says Frank Holmes, the Company CEO and Chief Investment Officer. “Yet amid the turbulence, we also witnessed a remarkable rebound in U.S. equities from the April lows, underscoring the resilience of the American economy and the opportunities that can emerge in times of disruption. At U.S. Global, we remain committed to helping investors navigate the volatility with disciplined strategies in specialized sectors, where we have decades of experience.”

Gold Continues to Make New Highs

The surge in gold prices has been driving profit margins for gold stocks, which have outperformed the S&P 500 so far this year through the end of August.

“We continue to recommend a

Record Defense Spending Constructive for AI WAR ETF

Launched in December 2024, the U.S. Global Technology and Aerospace & Defense ETF (NYSE: WAR) has already established itself as a timely offering. The actively managed fund is designed to capture one of the most significant defense and technology transformations in decades, where artificial intelligence (AI), semiconductors and cybersecurity are as critical as traditional aerospace hardware.

Mr. Holmes states: “The world is rearming, and it’s doing so with a focus on AI, software and advanced technology. Global defense spending reached a record

SEA Launched in Mexico, GOAU in Colombia

The Company is pleased to announce that its shipping ETF, the U.S. Global Sea to Sky Cargo ETF (NYSE: SEA), is now listed on Bolsa Mexicana de Valores (BMV), also known as the Mexican Stock Exchange. SEA became the third U.S. Global ETF to be made available to investors in Mexico, joining the U.S. Global Jets ETF (NYSE: JETS) and U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU).

Launched in January 2022, SEA seeks to provide investors with diversified access to the global shipping and air freight industries. Its index, the U.S. Global Sea to Sky Cargo Index (SEAX), uses a Smart Beta 2.0 strategy to help determine the most efficient marine shipping, air freight and port and harbor companies in the world.

“More than

SEA’s Mexico listing followed the launch of GOAU in Colombia in May 2025. With this new listing, Colombian investors will gain access to the GoGold ETF, which offers exposure to companies engaged in the production of gold and other precious metals, either through active mining or passive royalty and streaming agreements.

Share Repurchases and Monthly Dividends

During the fiscal year ended June 30, 2025, the Company repurchased a total of 801,043 of its own shares at a net cost of approximately

As of June 30, 2025, the Board of Directors has authorized a monthly dividend of

Healthy Liquidity and Capital Resources

As of June 30, 2025, the Company had net working capital of approximately

Tune In to the Earnings Webcast

The Company has scheduled a webcast for 7:30 a.m. Central time on September 9, 2025, to discuss the Company’s key financial results for the fiscal year. Frank Holmes will be accompanied on the webcast by Lisa Callicotte, chief financial officer, and Holly Schoenfeldt, marketing and public relations manager. Click here to register for the earnings webcast or visit www.usfunds.com for more information.

Selected Financial Data (unaudited): (dollars in thousands, except per share data)

| 12 months ended | ||||||

| 6/30/2025 | 6/30/2024 | |||||

| Operating Revenues | $ | 8,452 | $ | 10,984 | ||

| Operating Expenses | 11,438 | 11,464 | ||||

| Operating Income (Loss) | (2,986 | ) | (480 | ) | ||

| Total Other Income | 2,724 | 2,395 | ||||

| Income (Loss) Before Income Taxes | (262 | ) | 1,915 | |||

| Income Tax Expense | 72 | 582 | ||||

| Net Income (Loss) | $ | (334 | ) | $ | 1,333 | |

| Net Income (Loss) Per Share (Basic and Diluted) | $ | (0.03 | ) | $ | 0.09 | |

| Avg. Common Shares Outstanding (Basic) | 13,343,506 | 14,182,300 | ||||

| Avg. Common Shares Outstanding (Diluted) | 13,344,627 | 14,182,353 | ||||

| Avg. Assets Under Management (Billions) | $ | 1.4 | $ | 1.9 | ||

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 50 years when it began as an investment club. Today, U.S. Global Investors, Inc. (www.usfunds.com) is a registered investment adviser that focuses on niche markets around the world. Headquartered in San Antonio, Texas, the Company provides investment management and other services to U.S. Global Investors Funds and U.S. Global ETFs.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors may include certain “forward-looking statements,” including statements relating to revenues, expenses and expectations regarding market conditions. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “opportunity,” “seeks,” “anticipates” or other comparable words. Such statements involve certain risks and uncertainties and should be read with corporate filings and other important information on the Company’s website, www.usfunds.com, or the Securities and Exchange Commission’s website at www.sec.gov.

These filings, such as the Company’s annual report and Form 10-Q, should be read in conjunction with the other cautionary statements that are included in this release. Future events could differ materially from those anticipated in such statements and there can be no assurance that such statements will prove accurate and actual results may vary. The Company undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS here, GOAU here and for SEA here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds.

The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, such as China and/or Taiwan, a regional ETFs returns and share price may be more volatile than those of a less concentrated portfolio.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS, GOAU, WAR and SEA.

________________

1 Registration does not imply a certain level of skill or training.

2 The Company calculates shareholder yield by adding the percentage of change in shares outstanding, the dividend yield and debt reduction, if any, for the 12 months ending June 30, 2025.

3 Liang, Xiao; Nan Tian; Diego Lopes da Silva; Lorenzo Scarazzato; Zubaida Karim; and Jade Guiberteau Ricard. Trends in World Military Expenditure, 2024. Stockholm International Peace Research Institute, April 2025. https://www.sipri.org/sites/default/files/2025-04/2504_fs_milex_2024.pdf

4 NATO. Defence Expenditures and NATO’s

5 Review of Maritime Transport 2024. UN Trade and Development, Oct. 22, 2024. https://unctad.org/publication/review-maritime-transport-2024.

Contact:

Holly Schoenfeldt

Director of Marketing

210.308.1268

hschoenfeldt@usfunds.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f203a632-46e1-4a9c-8f90-12c370423fe6