G2 Goldfields Issues Corporate & Exploration Update

Rhea-AI Summary

G2 Goldfields (OTCQX: GUYGF / TSX: GTWO) provided a corporate and exploration update for the Oko Gold Project, Guyana, announcing a combined updated MRE and maiden PEA in November 2025 based on 666 diamond holes totaling 170,329m. The company reported visible gold in two recent border-zone holes and plans a 35,000m deep program plus multiple near‑mine drill programs (planned metres: 7,400m border, 35,000m deep, and additional target programs totaling several thousand metres).

G2 expects a G3 spin-out (one G3 share per two G2 shares) in December subject to approvals, and aims to scale to six rigs by December and eight rigs thereafter while advancing permits, environmental and geotechnical studies.

Positive

- Maiden PEA scheduled for November 2025

- Updated MRE based on 666 holes / 170,329m

- Visible gold in 2 maiden border-zone drill holes

- G3 spin-out at 1 G3 per 2 G2 shares planned

- Plan to reach 6 rigs by Dec 2025 (8 thereafter)

- OMZ indicated resource: 808,000 oz Au

Negative

- Assay results for recent visible-gold holes are pending

- G3 spin-out is subject to regulatory, court and shareholder approvals

- PEA and resource updates may change mine plan economics after release

- Permitting requires additional environmental and geotechnical studies

News Market Reaction

On the day this news was published, GUYGF declined 7.07%, reflecting a notable negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

- Highlights of the maiden Preliminary Economic Assessment based on new updated gold mineral resource to be released in November

- Anticipated completion of G3 Spin-Out in December

- Drilling underway with several rigs testing multiple new high priority targets

- Visible gold identified within two of five maiden drill holes in new border zone

TORONTO, Oct. 27, 2025 (GLOBE NEWSWIRE) -- G2 Goldfields Inc. (“G2” or the “Company”) (TSX: GTWO; OTCQX: GUYGF) is pleased to provide a corporate update on advancing the Oko Gold Project, Guyana, to production, with delivery of a combined updated Mineral Resource Estimate (“MRE”) and maiden Preliminary Economic Assessment (“PEA”) in November, as well as details on multiple exciting exploration activities currently underway focusing on new, near-mine resource growth opportunities and regional discovery potential.

Corporate Update

The Oko Project is a multi-million-ounce high grade gold project located immediately adjacent to the Oko West Project presently being developed by G Mining Ventures Corp. (“G Mining”). G2 will be publishing its maiden PEA on the Project next month which is based on data from 666 diamond drill holes totalling 170,329m with a drilling cut-off date of August 31, 2025. The study will examine the economic merits of a standalone mining operation encompassing multiple open pits as well as underground operations. In parallel, G2 is rapidly moving to further de-risk the Project by completing additional environmental and geotechnical studies in support of advancing permitting activities for the Project.

Additionally, the Company will complete a spin-out of G3 Goldfields Inc. (“G3”), a wholly owned subsidiary of the Company. G2 shareholders will receive one G3 share for every two G2 common shares held as of the effective date of the spin-out (refer to press release dated October 15, 2025). G3’s exploration property portfolio consists of three historical past-producing gold mines with an approximate 87,000-acre land package. A more fulsome update on G3 target areas and exploration programs will be provided in due course. The G3 spin-out will be subject to regulatory and court approvals, as well as approval by not less than two-thirds of the votes cast at the Company’s annual general and special meeting held on November 27, 2025.

Near-Mine Resource Growth and Discovery Drilling Programs

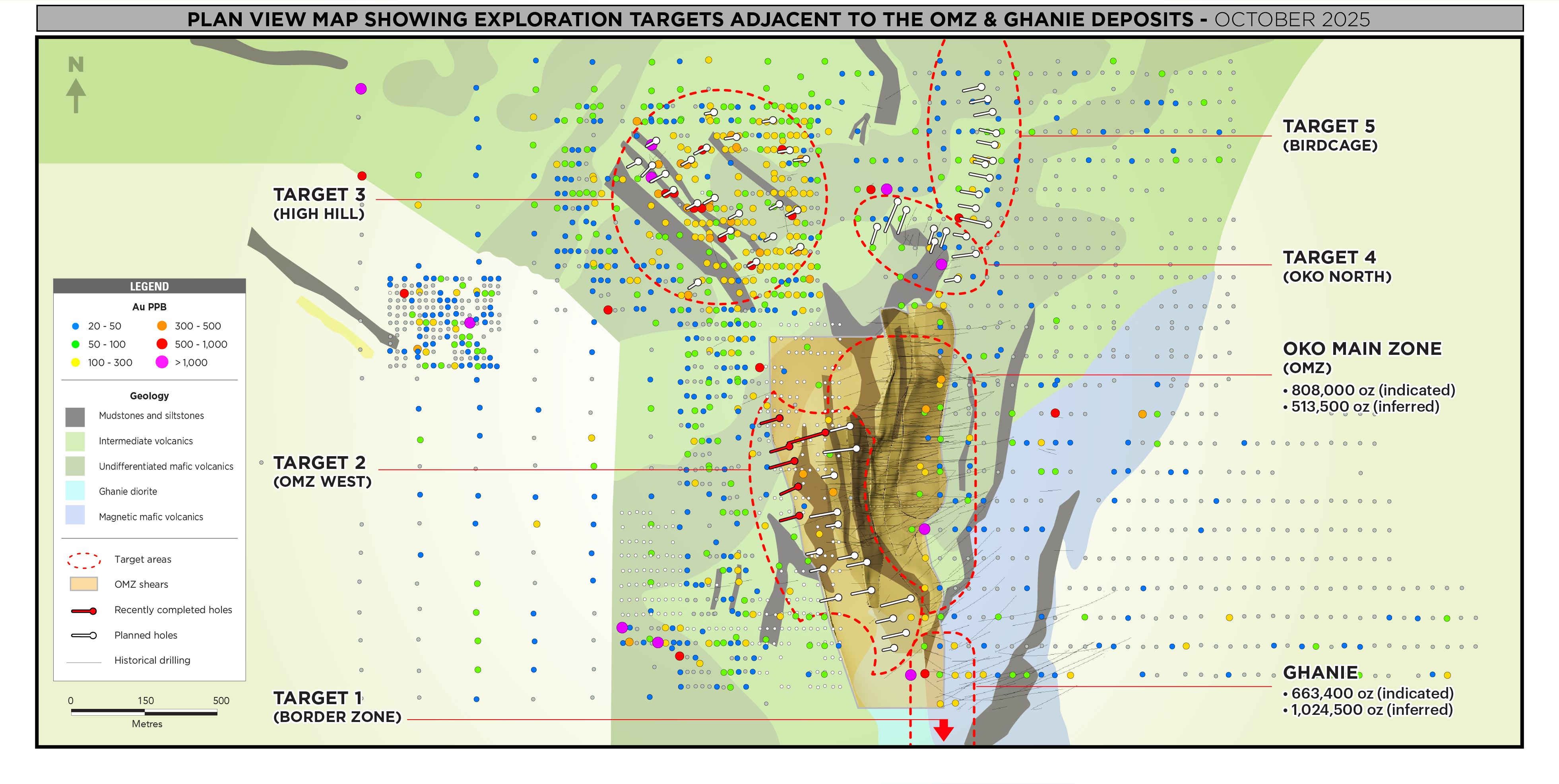

During the month of September, G2 undertook a complete review of all existing data on the properties as well as completed a drone assisted geophysical survey over the entire +105,000-acre G2 land package. New areas for drill targeting were developed based on interpretation of existing geophysical models, new mineralized areas discovered by artisanal mining, as well as recent new drill results released by G Mining on September 9, 2025 on the border shared with G2. As a result of this review, G2 has developed eight high priority, near-mine resource growth and discovery drill target areas, as shown in Figure 1.

Figure 1 – District Plan View of Targets

Target 1 – Border Zone (G2 Target)

The Border Zone target area focuses on extensions of recent high grade drilling intercepts by G Mining which are very close to G2’s southern property boundary. Intercepts released by G Mining in their September 9, 2025 press release include 14.0m @ 4.3g/t Au and 6.9m @ 16.1g/t Au. These high grade zones are expected to be associated with shear structures that are continuous into G2’s Ghanie deposit area. The Company has planned sixteen drill holes for 7,400m on this southern border zone (refer to Figure 2). G2 has successfully intersected visible gold in two drill holes completed thus far at depths within 220m from surface. These intercepts are interpreted to be part of the same mineralized structures as previously reported in G2 drill hole GDD-68A, which intercepted 11.0m @ 37.9g/t Au. Assays are pending.

Additionally, the Company has planned a 35,000m deep drilling program to explore the main mineralized trend at up depths of 1000m. This program is anticipated to provide significant extensions to the existing Ghanie gold resource. Impressive high grade intercepts, such as G2 hole GDD-194 which cut 51.4m @ 5.3g/t Au, provide positive indications for the discovery potential of additional high grade gold mineralization down plunge of existing high grade shoots.

Figure 2 – Border Zone

Target 2 – OMZ West: Shears 5 and 6 (G2 Targets)

The Oko Main Zone (“OMZ”) deposit consists of well-defined discrete shear zones that host high grade mineralization, generally within laminated quartz reefs. To date, there are six documented shear zones within the deposit which are sub-parallel to each other (refer to Figure 3). Shear zone 5 has previously delivered some of the highest-grade drill intercepts in the OMZ deposit, which has an average Indicated resource grade of 7.9 g/t Au. In the footwall to this structure, a 6th parallel shear zone was intercepted at depth close to the footwall contact of the same sedimentary package that hosts Shear zone 5. Significant drilling gaps exist in the areas where Shear 5 and 6 project to surface along the slope of a hill which has a cemented laterite duricrust layer that disrupts typical surface prospecting and sampling methods. An initial 2,200-m drill program consisting of mainly shallow diamond drill holes is designed to test the up-plunge projection of these shear zones.

Figure 3 – Target 2

Figure 4 – Target 2

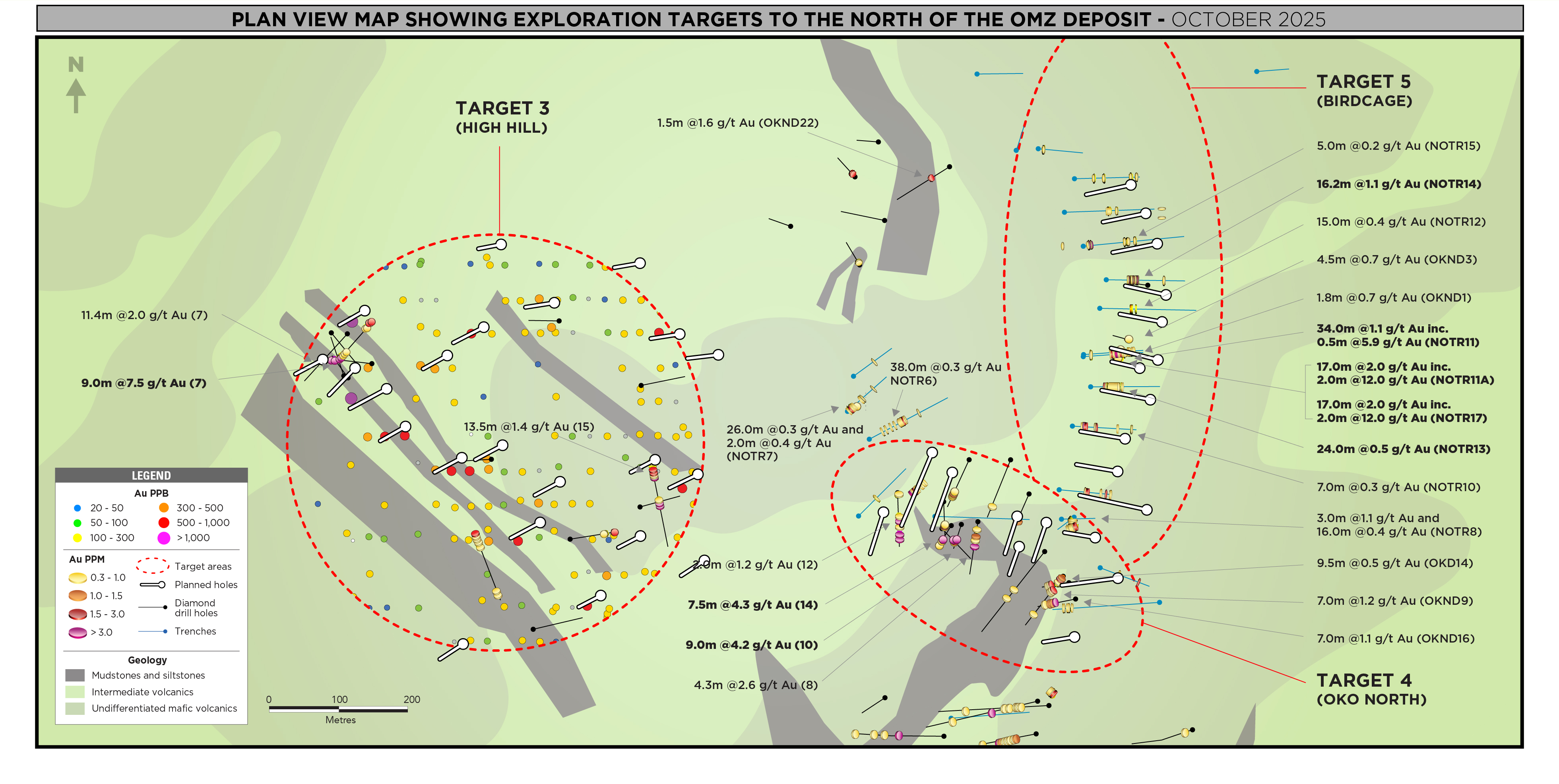

Target 3 – High Hill (G2 Target)

The High Hill area was initially highlighted by a 2019 soil sampling program, which had two soil samples above 1 g/t Au within lateritic soils. The initial diamond drilling follow-up intercepted a friable zone of quartz within saprolite at 122m depth within hole OKNWD-4 that was associated with a shear zone that assayed 11.4m @ 2.0 g/t Au. A subsequent drill hole OKND-7 successfully intersected the zone which assayed 9.0m @ 7.5 g/t Au. New ground geophysical data led to an interpretation of a NW trending structure being the likely host structure for the mineralization. This was subsequently confirmed with an infill soil sampling program that highlighted a 600m-long anomalous zone of +100 ppb Au in soils, including multiple samples above +500 ppb Au. One interpretation of this anomalous zone suggests it may be the northern continuation of some of the mineralized shears in the nearby OMZ deposit. An initial 1,060m drill program is designed to further evaluate this target.

An adjacent zone potentially represents the northern continuation of the mineralized OMZ deposit shear structures. It is highlighted by a 580m-long anomalous zone of +100ppb Au in soil anomaly. The zone trends in a northerly direction parallel to and directly along trend of the shears of the OMZ deposit. It will be initially drill tested with a 650m diamond drilling program.

Figure 5 – Close-Up Plan View of Near-Mine Resource Growth Targets

Target 4 – Oko North (G2 Target)

This zone occurs immediately to the north of the OMZ deposit which has estimated Indicated mineral resources of 808,000 oz Au and Inferred mineral resources of 513,500 oz Au. The OMZ host rocks have been locally rotated to a north-westerly strike direction and hosts shear hosted gold mineralization for a currently defined strike length of 300m. Drill intercepts within this shear zone to date include 7.5m @ 4.3 g/t Au in hole OKND-14 and 9m @ 4.2 g/t Au in hole OKD-10, complementary to the occurrence of visible gold within OMZ-style laminated quartz reefs in multiple drill holes. The high-grade mineralization within this zone remains open at depth and along strike to the NW in plunging zones, and an 800m diamond drill program has been designed to follow up on this target.

Figure 6 – Plan View of Targets North of Oko Main Zone

Target 5 – Birdcage (G2 Target)

This potential northern continuation of shear zone 1 from the OMZ deposit was projected and initially highlighted by a soil sampling anomaly. This anomalous zone was followed up with a series of systematically executed trenches spaced approximately 50m apart for a distance of over 800m strike length. The shear zone was consistently intercepted in these trenches and returned a highlight interval of 34.0m @ 1.1g/t Au, including 5.0m @ 5.9g/t Au in trench NOTR-11. Only three drill holes were conducted in this target area to follow up the trench intercepts to date, with a highlight of 4.5m @ 0.7g/t Au in OKND-3. A 1,700m drill program consisting of shallow diamond drill holes is planned to test the known strike extent of the shear structure.

Target 6 – RED Zone (G3 Target)

The RED Zone target was initially identified by three parallel +100 ppb Au in soil anomalies that corresponded to mapped shear structures with limited outcrop in lateritic terrain. Due to the presence of laterite duricrust at surface, a drilling program was designed as a follow-up program. Six holes over 842m were completed in the initial program, all of which intercepted sheared zones on the margin of carbonaceous mudstones interbedded with argillaceous siltstones and mafic volcanics. The highlight intercept was RED-1 which intercepted 47.5m @ 0.5 g/t Au from 29.5m depth. This zone is associated with visible gold showings in cm scaled grey quartz veins interpreted as extensional veins adjacent to the principal shear structure. To date, the main shear zone has been defined for over 300m and remains open to the NE and SW. It is interpreted to be a parallel shear structure which is analogous to the structure hosting the New Oko Discovery that is 5.7km to the SW. An additional drill program is being planned to follow-up on this zone.

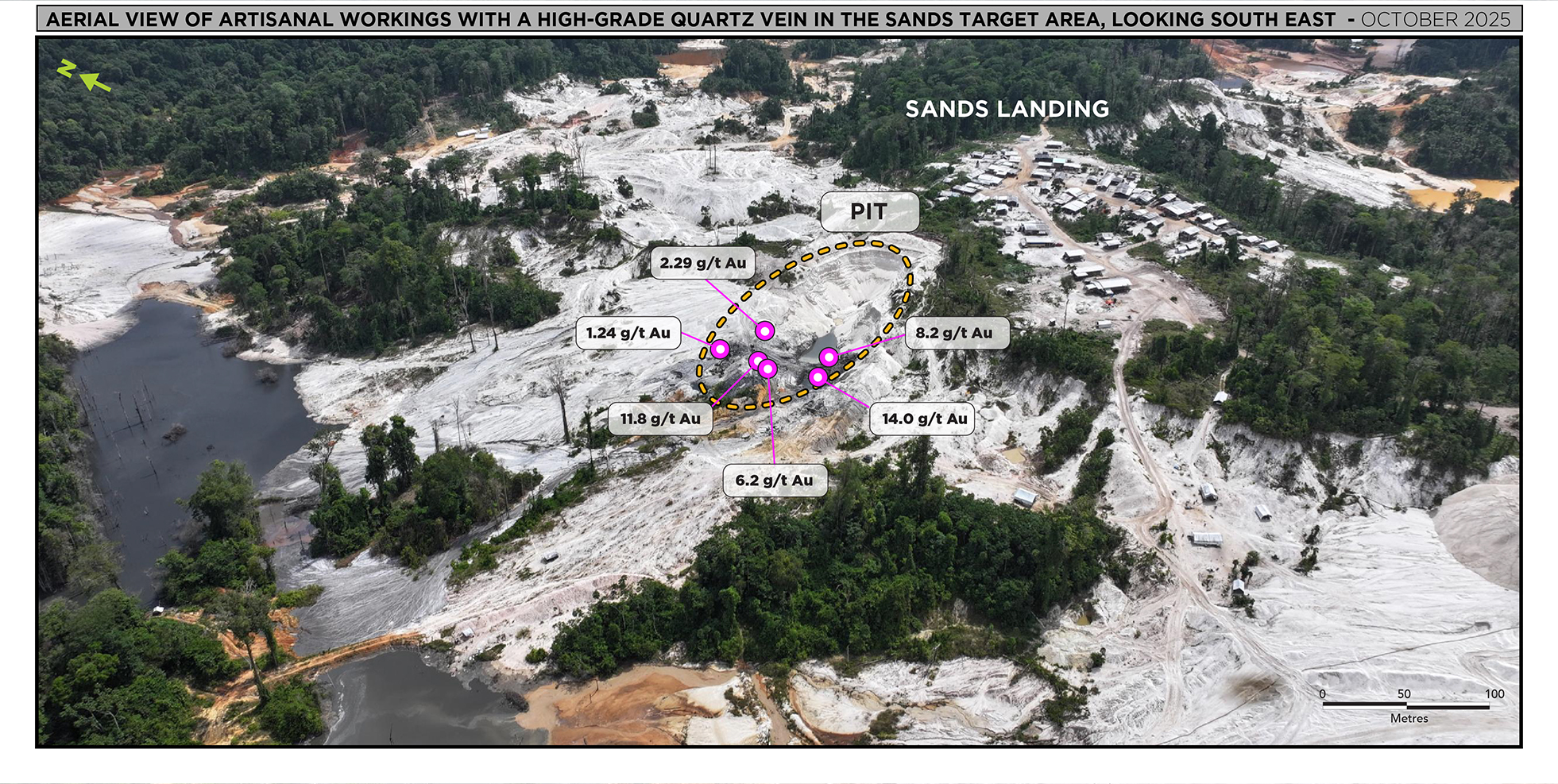

Target 7 – Sands (G2 Target)

An artisanal mining pit has exposed a quartz vein beneath 25m vertical of white sand cover. This quartz reef is typical OMZ-style grey smoky looking quartz hosted in dark grey carbonaceous mudstones. The quartz veins have ribbon-textured stylolites and the occurrence of multiple fine grains of visible gold. Grab samples of floats returned multiple encouraging values including 6.2 g/t, 8.2 g/t, 11.8 g/t, and 14.0 g/t Au. The pit is approximately 90m in length at the base and approximately 1.3km to the NW of the Oko NW deposit. The hosting shear structure was mapped in an E-W striking direction, and steeply dipping to the N. The width of the shear zone or quartz vein could not be determined due to the presence of the sand cover at surface. Notably, multiple +100 ppb Au in soil anomalies occur east along strike of this zone, and multiple +500 ppb Au in soil anomalies occur between this showing and the NW Oko deposit. An initial diamond drill program of 800m is planned to follow up on this target in the sands pit area, coincident with infill soil sampling on the anomalous showings in adjacent areas to the E and SE of the pit.

Figure 7 – Sands Photograph

Although very little data from this area is currently available, it represents a highly intriguing drill target, and resources are currently being committed to the district for a maiden drill program focussing on discovering high grade veins.

Target 8 – Aremu West (G3 Target)

This zone occurs on the western margin of the Aremu batholith and a poly-deformed package of volcanic and sedimentary greenstone supracrustal rocks. The zone is directly south along the same structural trend that hosts the “Quartzstone” mineral occurrence and a potential source area of the prolific alluvial artisanal mining fields that extends for several kilometers along the Aremu River and many of its tributaries. An initial soil sampling campaign in 2024 highlighted two zones of gold-in-soil anomalies defined by +50 ppb Au. The eastern zone has a strike length of 2.5km while the western zone has a strike length of 1.6km. Field mapping has confirmed that the eastern zone is associated with a continuous shear structure that sits on the margin with the Aremu batholith. This shear structure has been mapped out for over 5km in length and also hosts large +1m sized quartz reefs to the southern end, which were observed as boulder floats in the field. The western anomalous zone is associated with a shear zone on the contact between an elongated felsic intrusive stock and undifferentiated mafic volcanics. A trenching program is being planned to follow up on these zones.

Patrick Sheridan, Executive Chairman, commented, “Clearly, there remains very considerable exploration upside on this +105,000-acre land package. We will be systematically adding drilling capacity to reach six rigs operating by December, and we intend to have eight rigs operating in the New Year. In tandem, we fully expect the PEA to demonstrate the potential for a very robust standalone operation and thus, we will be advancing the Project to a production decision as fast as possible, while continuing to add ounces, through both further extensional drilling to existing zones and new, near-mine untested areas.”

QA/QC

Drill core is logged and sampled in a secure core storage facility located on the OKO Project site, Guyana. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to MSALABS Guyana, in Georgetown, Guyana, which is an accredited mineral analysis laboratory, for analysis. Samples from sections of core with obvious gold mineralization are analysed for total gold using an industry-standard 500g metallic screen fire assay (MSALABS method MSC 550). All other samples are analysed for gold using standard Fire Assay-AA with atomic absorption finish (MSALABS method; FAS-121). Samples returning over 10.0 g/t gold are analysed utilizing standard fire assay gravimetric methods (MSALABS method; FAS-425). Certified gold reference standards, blanks, and field duplicates are routinely inserted into the sample stream, as part of G2 Goldfield’s quality control/quality assurance program (QAQC). No QA/QC issues were noted with the results reported herein.

About G2 Goldfields Inc.

G2 Goldfields finds and develops gold deposits in Guyana. The founders and principals of the Company have been directly responsible for the discovery of more than 10 million ounces of gold in the prolific and underexplored Guiana Shield. G2 continues this legacy of exploration excellence and success.

In March 2025, G2 announced an Updated Mineral Resource Estimate (“MRE”) for the Oko property in Guyana [see press release dated March 10, 2025]. Highlights of the Updated MRE include:

Total combined open pit and underground Resource for the Oko Main Zone (OMZ):

- 513,500 oz. Au – Inferred contained within 3,473,000 tonnes @ 4.60 g/t Au

- 808,000 oz. Au – Indicated contained within 3,147,000 tonnes @ 7.98 g/t Au

Total combined open pit and underground Resource for the Ghanie Zone:

- 1,024,500 oz. Au – Inferred contained within 12,062,000 tonnes @ 2.64 g/t Au

- 663,400 oz. Au – Indicated contained within 10,288,000 tonnes @ 2.01 g/t Au

Total open pit Resource for the Oko NW Zone:

- 97,200 oz. Au – Inferred contained within 4,976,000 tonnes @ 0.61 g/t Au

The MRE was prepared by Micon International Limited with an effective date of March 1, 2025. The Oko district has been a prolific alluvial goldfield since its initial discovery in the 1870s, and modern exploration techniques continue to reveal the considerable potential of the district.

All scientific and technical information in this news release has been reviewed and approved by Dan Noone (CEO of G2 Goldfields Inc.), a “qualified person” within the meaning of National Instrument 43-101. Mr. Noone (B.Sc. Geology, MBA) is a Fellow of the Australian Institute of Geoscientists.

Additional information about the Company is available on SEDAR+ (www.sedarplus.ca) and the Company's website (www.g2goldfields.com).

On behalf of the Board of G2 Goldfields Inc.

“Daniel Noone”

CEO & Director

For Further Information

Jacqueline Wagenaar, VP Investor Relations

Direct: +1.416.628.5904 x.1150

Email: j.wagenaar@g2goldfields.com

Forward-Looking Statements

This news release contains certain forward-looking statements, including, but not limited to, statements about the mineralization and mineral resource estimates in respect of the Company’s properties, an updated MRE and PEA for a multi-open pit and underground operation and the anticipated timing thereof, the spin-out of G3 and the anticipated timing and composition thereof, signs of visible gold identified within two of five maiden drill holes in new border zone, multiple gold targets being explored along a prominent mineralized trend across the entire G2 land package and the anticipated planned drill programs and meters thereof and expected continuation and extension of mineralized shears and gold resources. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “schedule”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof. Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements, including the risk factors set out in the annual information form of the Company for the year ended August 25, 2025. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. The Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/2447b1d6-5d96-41f2-bb10-8723002176c7

https://www.globenewswire.com/NewsRoom/AttachmentNg/fcc0da14-7276-4a89-bbe6-da47d211096d

https://www.globenewswire.com/NewsRoom/AttachmentNg/4d5367d5-e87d-4022-8073-81ab2ca1fbe7

https://www.globenewswire.com/NewsRoom/AttachmentNg/1acc9110-d2ee-45c6-97db-8399cce3477f

https://www.globenewswire.com/NewsRoom/AttachmentNg/48876abc-089d-474b-9183-11ea9ad906e9

https://www.globenewswire.com/NewsRoom/AttachmentNg/3a26af7e-8def-4eb6-b18b-d6602c9ff1fa

https://www.globenewswire.com/NewsRoom/AttachmentNg/daa4a429-ec16-4d70-98f9-894187617a63