Golden Valley Bancshares Reports First Quarter 2025 Results (Unaudited); Announces Dividends & Stock Repurchase Plan

Rhea-AI Summary

Golden Valley Bancshares (OTC PINK:GVYB) has reported strong Q1 2025 results, announcing special and annual cash dividends along with a new stock repurchase plan. The company declared a special dividend of $1.00 per share and an annual dividend of $0.40 per share, both payable in May 2025.

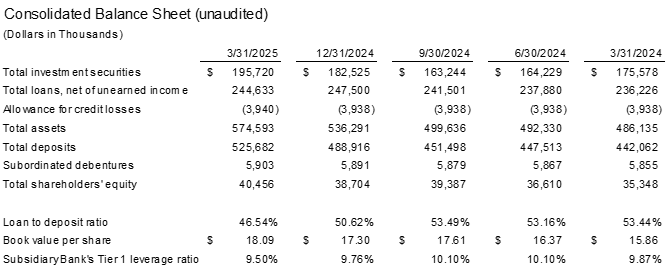

Key financial highlights for Q1 2025 vs Q1 2024 include:

- Assets up 18.2% to $574.6 million

- Deposits increased 18.9% to $525.7 million

- Loans grew 3.6% to $244.6 million

- Equity rose 14.5% to $40.5 million

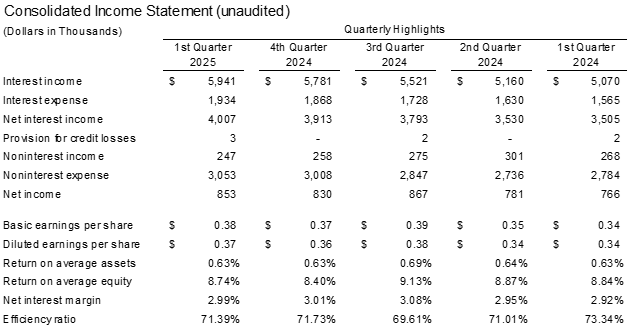

The company reported Q1 2025 net profit of $853,000, up from $766,000 in Q1 2024. Interest income increased to $5.94 million, while interest expense rose to $1.93 million. The Board approved a $1 million stock repurchase program effective May 1, 2025 through December 31, 2025. Asset quality remains exceptional with no loans over 30 days past due.

Positive

- Net profit increased to $853,000 in Q1 2025 from $766,000 in Q1 2024

- Assets reached all-time high, growing 18.2% to $574.6 million

- Deposits hit record levels, increasing 18.9% to $525.7 million

- Zero loans over 30 days past due, no charge-offs in over a decade

- Announced special dividend of $1.00 and annual dividend of $0.40 per share

- Authorized $1 million stock repurchase program

Negative

- Interest expense increased to $1.93 million due to elevated rates

- Experiencing stagnant loan market with modest 3.6% loan growth

- Shift in deposit mix from non-interest bearing to interest-bearing accounts

News Market Reaction

On the day this news was published, GVYB gained 0.59%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

CHICO, CA / ACCESS Newswire / April 10, 2025 / Golden Valley Bancshares (OTC PINK:GVYB), with its wholly owned subsidiary, Golden Valley Bank headquartered in Chico, California today reported first quarter 2025 financial results, cash dividends and stock repurchase plan.

Golden Valley Bancshares announced today that the Board of Directors declared a special cash dividend on Golden Valley Bancshares common stock of

On March 11, 2025, the Board of Directors authorized a new stock repurchase plan for up to

First quarter 2025 financial highlights compared to the first quarter of 2024 include:

Assets increased

$88.5 million or18.2% to$574.6 million Loans increased

$8.4 million or3.6% to$244.6 million Deposits increased

$83.6 million or18.9% $525.7 million Equity increased

$5.1 million or14.5% to$40.5 million

The company ended the quarter with all-time highs in both assets and deposits. The exceptional deposit growth experienced in 2024 continued throughout the first three months of 2025 as deposits increased

While enduring a stagnant loan market, the Company was able to grow the loan portfolio by

Asset quality continued to be exceptional with no loans over 30 days past due at quarter end. It's been over a decade since the Bank had a charge off in our loan portfolio. Chief Credit Officer, Quinn Velasquez stated "The Bank is lending to qualified businesses and individuals as a result of our deep knowledge and understanding of our local markets."

The continued momentum created by our strong asset growth positions us well to make significant strides in each of our markets - Chico, Redding and Oroville - in 2025.

Net profit for the quarter ending March 31, 2025, totaled

Interest income increased to

The Bank continues to be a well-capitalized bank and far exceeds minimum regulatory requirements. For additional financial information, please visit the Investors Relations page at goldenvalley.bank/Investor-Relations.

Golden Valley Bancshares, a bank holding company with its wholly owned subsidiary, Golden Valley Bank is a locally owned and operated commercial bank serving the needs of individuals and businesses in northern California. The Bank has full service offices in Chico, Redding and Oroville, California. For more information regarding the bank please call at (530) 894-1000 or visit goldenvalley.bank.

Contact:

Mark Francis

President & CEO

530-894-4920

mfrancis@goldenvalley.bank

Forward-Looking Statements

Statements concerning future performance, developments or events, expectations for growth and income forecasts, and any other guidance on future periods, constitute forward-looking statements that are subject to a number of risks and uncertainties. Actual results are pre-fiscal year-end audit and may differ materially from stated expectations. Specific factors include, but are not limited to, loan production, balance sheet management, expanded net interest margin, the ability to control costs and expenses, interest rate changes, technological factors (including external fraud and cybersecurity threats), natural disasters, pandemics such as COVID-19 and financial policies of the United States government and general economic conditions. Golden Valley Bancshares disclaims any obligation to update any such factors.

SOURCE: Golden Valley Bancshares

View the original press release on ACCESS Newswire