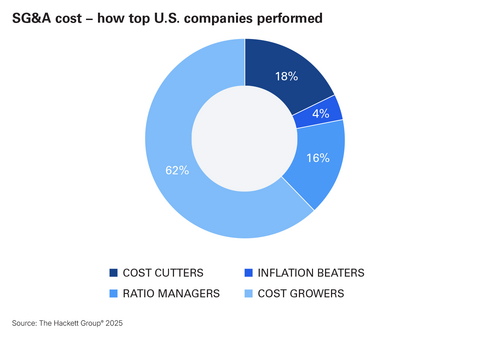

The Hackett Group® Finds SG&A Costs at a Five-Year High as 62% of US Companies Struggle to Control Spending Amid Slowing Revenue Growth

Key Terms

sg&a financial

Median SG&A cost ratio rose to

In the US SG&A Cost Study, The Hackett Group® compared the FY23 and FY24 financial performance of the 1,000 largest nonfinancial services companies in

The study – based on an analysis of the 1,000 largest

“Organizations face mounting pressure as revenue growth cools and complexity increases, but the data shows that traditional cost-cutting approaches are not enough,” said Murray Shevlin, principal, Benchmarking at The Hackett Group®. “Sustainable SG&A improvement requires companies to move beyond tactical measures and embrace a more strategic operating model – one powered by process excellence, digital enablement and next-generation AI capabilities.”

Digital World Class® leaders set a new benchmark

For a typical

Digital World Class® technology organizations also allocate significantly more investment toward advanced technologies, devoting

Agentic enterprise strategies emerge as the path forward

The report outlines a clear set of actions for companies seeking to reverse SG&A cost trends and build long-term resilience:

- Embrace an agentic enterprise model, redesigning work so AI can assist, augment, and autonomously act with human oversight.

- Establish a robust AI center of excellence (COE) to govern the end-to-end life cycle of AI initiatives.

- Remove process and system complexity – the top barrier to AI optimization cited by executives.

- Invest in data foundations and analytics, enabling higher-quality insights and automation at scale.

- Strengthen partnerships with technology providers and third-party services to enhance operational efficiency.

“We’re seeing a clear pattern: companies that lean into Gen AI and agentic principles are pulling ahead,” said Kyle McNabb, principal and Gen AI Executive Advisory program leader at The Hackett Group®. “The next wave of SG&A performance will be defined by organizations that reimagine work, build strong AI governance, and use data-driven intelligence to streamline decision-making and unlock new levels of efficiency.”

The US SG&A Cost Study and Scorecard analyzes the publicly available financial statements of the 1,000 largest public companies headquartered in

About The Hackett Group®

The Hackett Group, Inc. (NASDAQ: HCKT) is a Gen AI strategic consulting and executive advisory firm that enables Digital World Class® performance. Using Hackett AI XPLR™ and ZBrain™ – our ideation through implementation platforms – our experienced professionals help organizations realize the power of Gen AI and achieve quantifiable, breakthrough results, allowing us to be key architects of their Gen AI journey.

Our expertise is grounded in unparalleled best practices insights from benchmarking the world’s leading businesses – including

Trademarks

The Hackett Group®, quadrant logo, and Digital World Class® are the registered marks of The Hackett Group®.

Cautionary Statement Regarding “Forward-Looking” Statements

This release contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933 as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Statements including without limitation, words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” or other similar phrases or variations of such words or similar expressions indicating, present or future anticipated or expected occurrences or outcomes are intended to identify such forward-looking statements. Forward-looking statements are not statements of historical fact and involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements to be materially different from the results, performance or achievements expressed or implied by the forward-looking statements. Factors that may impact such forward-looking statements include without limitation, the ability of The Hackett Group® to effectively market its digital transformation, our ability to transition our capabilities to support generative artificial intelligence (AI)-related consulting services and solutions and other consulting services, our ability to effectively integrate acquisitions into our operations, our ability to manage joint ventures and successfully cooperate with our joint venture partners, competition from other consulting and technology companies that may have or develop in the future, similar offerings, the commercial viability of The Hackett Group® and its services as well as other risk detailed in The Hackett Group’s reports filed with the United States Securities and Exchange Commission. The Hackett Group® does not undertake any duty to update this release or any forward-looking statements contained herein.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251209972589/en/

Source: The Hackett Group, Inc.