HIVE Delivers Record Q2 with 285% Revenue Growth as Bitcoin Production and BUZZ HPC Hit New Highs Powered by a 223% Year-Over-Year Increase in Operational Bitcoin Hashrate, Resulting in ~300% Growth in Bitcoin Mining Revenue, and BUZZ HPC Revenue up 175% Year-Over-Year

Rhea-AI Summary

HIVE (TSXV: HIVE / NASDAQ: HIVE) reported record Q2 FY2026 revenue of $87.3 million on November 17, 2025, up 285% YoY and 91% QoQ. Adjusted EBITDA was $31.5 million and GAAP net loss was $15.8 million due largely to $38.3 million of accelerated ASIC depreciation. Operational hashrate reached 16.2 EH/s at quarter end and 25 EH/s operational in November 2025; Bitcoin mined totaled 717 BTC in Q2. BUZZ HPC revenue was a record $5.2 million (+175% YoY). Cash and digital currencies totaled $47.0 million. Paraguay capacity reached 300 MW with a path to 400 MW.

Outlook: optionality to 35 EH/s by Q4 2026 and BUZZ HPC annualized run-rate target of ~$140 million by Q4 2026.

Positive

- Revenue $87.3M (+285% YoY)

- Adjusted EBITDA $31.5M

- Operational hashrate 16.2 EH/s at quarter end

- 25 EH/s operational in November 2025

- BUZZ HPC revenue $5.2M (+175% YoY)

- 300 MW Paraguay capacity completed in six months

- Cash and digital currencies $47.0M

Negative

- GAAP net loss $15.8M driven by accelerated depreciation

- Accelerated ASIC depreciation of $38.3M this quarter

- Direct mining costs $42.1M with ~88% energy component

- G&A increased to $7.8M vs $5.8M prior quarter

News Market Reaction

On the day this news was published, HIVE gained 7.55%, reflecting a notable positive market reaction. Our momentum scanner triggered 5 alerts that day, indicating moderate trading interest and price volatility. This price movement added approximately $61M to the company's valuation, bringing the market cap to $873M at that time.

Data tracked by StockTitan Argus on the day of publication.

San Antonio, Texas--(Newsfile Corp. - November 17, 2025) - HIVE Digital Technologies Ltd. (TSXV: HIVE) (NASDAQ: HIVE) (FSE: YO0) (referred to as the "Company" or "HIVE"), a global leader in sustainable data center infrastructure, today announced its financial results for the second quarter ended September 30, 2025, delivering record revenue of

This quarter marks the strongest dual-engine growth in HIVE's history, driven by the rapid scale-out of its Bitcoin mining fleet to 16.2 EH/s by period end September 30, 2025 (with 25 EH/s operational today) and accelerating demand for BUZZ HPC services.

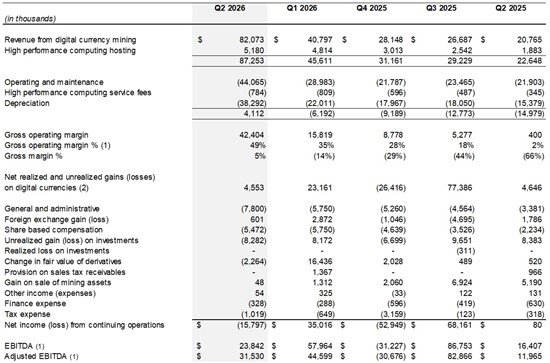

Q2 FY2026 Financial Highlights:

- Total Revenue:

$87.3 million , a285% increase from$28.7 million in Q2 FY2025, and a91% sequential increase. Gross operating margin was48.6% , up from34.7% in Q1 FY2026. See the calculation of direct costs and mining margin included below in this press release.

- Digital currency mining revenue:

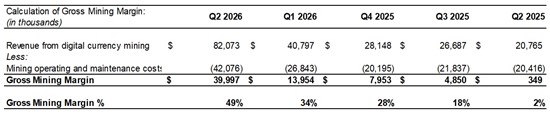

$82.1 million , up101.2% sequentially, reflecting an86.2% quarter-over-quarter increase in average hashrate to 16.2 EH/s and slightly higher Bitcoin prices. This mining revenue was achieved against direct costs of$42.1 million , of which approximately88% represents energy costs. See the calculation of direct costs included below in this press release.

- Bitcoin Production: 717 Bitcoin mined in Q2, up

76.6% sequentially despite a21.4% quarter-over-quarter increase in network difficulty.

- HPC Revenue: Record BUZZ HPC revenue of

$5.2 million , up175% year-over-year and7.6% quarter-over-quarter, achieved with direct costs of$2.0 million .

- G&A:

$7.8 million , up from$5.8 million in Q1 FY2026, primarily due to increased staffing supporting global expansion, including Paraguay and the BUZZ HPC division.

- Gross Operating Margins3:

$42.4 million (49% ). See the Calculation of gross operating margins included below in this press release.

- Net Income: GAAP net loss of

$15.8 million , driven by accelerated two-year depreciation of ASICs used in the Paraguay expansion ($38.3 million depreciation for the quarter) and non-cash losses related to equity investments and derivative revaluations.

- Adjusted EBITDA1:

$31.5 million .

- Balance Sheet: Ended the quarter with

$47.0 million in cash and digital currencies.

OPERATIONAL MILESTONES

Rapid Infrastructure Expansion

- Completed 300 MW of new capacity in Paraguay within six months.

- Recently achieved 25 EH/s operational hashrate in November 2025.

- Generated

$132.9 million in revenue during the six months ending September 30, 2025.

Positioning for AI and HPC Growth

- Advanced conversion of the 70 MW Grand Falls campus in New Brunswick into a Tier III+ liquid-cooled data center, allowing for hyperscale colocation. For AI Cloud this provides the potential capacity for approximately 25,000 next-gen GPUs at <PUE 1.3 based on GPU reference architecture.

- Continued upgrades at the 7.2 MW Toronto facility to allow for operation of 2,000 next-generation AI compute GPUs for the BUZZ AI Cloud business.

- Accelerated Tier III+ retrofit progress in Boden, Sweden, enabling faster and more cost-effective HPC deployment, to allow for operation of 2,000 next-generation AI compute GPUs for BUZZ AI Cloud business

Future Capacity & Growth Outlook

- With its recently announced additional 100 MW expansion in Yguazú, HIVE now has 300 MW operational in Paraguay and a path to 400 MW secured via a power purchase agreement.

- Global hydro-powered data center footprint now reaches 540 MW.

- Optionality to scale to 35 EH/s by Q4 2026 with next-generation ASICs.

- Targeting BUZZ HPC annualized run-rate revenue of ~

$140 million by Q4 2026, at ~80% gross margins.

Management Insights

Frank Holmes, HIVE's Executive Chairman, stated, "This was a defining quarter for HIVE. We delivered record revenue in both our digital currency mining and BUZZ HPC segments. Despite Bitcoin hashprice being up only about

Aydin Kilic, President & CEO, stated", Our teams executed flawlessly. With a sequential

Darcy Daubaras, HIVE's CFO, stated, "We are very pleased with our financial performance this quarter. Revenue increased

Conference Call Information

HIVE will hold its fiscal Q2 2026 earnings call on Monday, November 17 at 8:00 AM EST. To participate in this event, please log on or dial in approximately 5 minutes before the call.

Date: November 17, 2025

Time: 8:00 AM EST

Webcast: Registration link here

Dial-in: Provided after registration

Financial Statements and MD&A

The Company's Consolidated Financial Statements and Management's Discussion and Analysis (MD&A) thereon for the three months ended September 30, 2025 will be accessible on SEDAR+ at www.sedarplus.ca under HIVE's profile and on the Company's website at www.HIVEdigitaltechnologies.com.

¹ Non-GAAP measure. Adjusted EBITDA (net income or loss from operations, as reported in profit and loss, before finance income and expense, tax and depreciation and amortization) adjusted for by removing other non-cash items, including share-based compensation, non-cash effect of the revaluation of digital currencies and one-time transactions. Gross mining profit, gross mining margin, Adjusted EBITDA, Direct Cost per BTC and Total Cash Cost per BTC are non-GAAP financial measures or ratios and should be read in conjunction with, and should not be viewed as alternatives to or replacements of measures of operating results and liquidity presented in accordance with GAAP. Readers are referred to the reconciliations of non-IFRS measures included in the Company's MD&A in the Company's Quarterly Report for the Quarter ended September 30, 2025.

² Net realized and unrealized gains (losses) on digital currencies is calculated as the change in fair value (gain or loss) on the coin inventory, and the gain (loss) on the sale of digital currencies which is the net difference between the proceeds and the carrying value of the digital currency.

³ The following represents the Revenue and related costs that comprise the gross mining margin. We include connectivity, security, data center maintenance, and electrical equipment maintenance. Electrical costs may vary quarter over quarter.

4 Assumes current Bitcoin price of

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5335/274757_hive11172025tbl1.jpg

*Average revenue per BTC is for mining operations only and excludes HPC operations.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5335/274757_hive11172025tbl2.jpg

⁴ References to annualized revenue and run-rate revenue are considered future-oriented financial information. Readers should be cautioned that this information is used by the Company only for the purpose of evaluating the merit of this line of its business operations and may not be appropriate for other purposes.

At-the-Market Offering

The Company also announces that on October 1, 2025, it completed its at-the-market offering commenced in October 2024 and continued in May 2025 (the "October 2024 ATM Equity Program"). On October 1, 2025 (being the terminal period of the October 2024 ATM Equity Program), the Company issued 522,778 common shares (the "October 2024 ATM Shares") for gross proceeds of C

About HIVE Digital Technologies Ltd.

Founded in 2017, HIVE Digital Technologies Ltd. builds and operates sustainable blockchain and AI infrastructure powered by renewable hydroelectric energy. With a global footprint across Canada, Sweden, and Paraguay offering scalable AI and cloud compute services, HIVE is committed to operational excellence, green energy leadership, and creating long-term value for its shareholders and host communities.

For more information, visit hivedigitaltech.com, or connect with us on:

X: https://x.com/HIVEDigitalTech

YouTube: https://www.youtube.com/@HIVEDigitalTech

Instagram: https://www.instagram.com/hivedigitaltechnologies/

LinkedIn: https://linkedin.com/company/hiveblockchain

On Behalf of HIVE Digital Technologies Ltd.

"Frank Holmes"

Executive Chairman

For further information, please contact:

Nathan Fast, Director of Marketing and Branding

Frank Holmes, Executive Chairman

Aydin Kilic, President & CEO

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Information

Except for the statements of historical fact, this news release contains "forward-looking information" within the meaning of the applicable Canadian and United States securities legislation and regulations that is based on expectations, estimates and projections as at the date of this news release. "Forward-looking information" in this news release includes but is not limited to: the acquisition of the new sites in Paraguay and Toronto and their potential, the timing of it becoming operational; business goals and objectives of the Company, including its target hashrate milestones and the costs to achieve the milestones; the results of operations for the three and six months ended September 30, 2025; the expected costs of maintaining and growing its operations; financial information related to annualized run rate; the acquisition, deployment and optimization of the mining fleet and equipment; the continued viability of its existing Bitcoin mining operations; the receipt of government consents; and other forward-looking information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward looking information include, but are not limited to: the inability to complete the construction of the Paraguay acquisition on an economic and timely basis and achieve the desired operational performance; the ongoing support and cooperation of local authorities and the Government of Paraguay; the volatility of the digital currency market; the Company's ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory as required, or at all; a material decline in digital currency prices may have a significant negative impact on the Company's operations; the regulatory environment for cryptocurrency in Canada, the United States and the countries where our mining facilities are located; economic dependence on regulated terms of service and electricity rates; the speculative and competitive nature of the technology sector; dependency on continued growth in blockchain and cryptocurrency usage; lawsuits and other legal proceedings and challenges; government regulations; the global economic climate; dilution; future capital needs and uncertainty of additional financing, including the Company's ability to utilize the Company's ATM Program and the prices at which the Company may sell Common Shares in the ATM Program, as well as capital market conditions in general; risks relating to the strategy of maintaining and increasing Bitcoin holdings and the impact of depreciating Bitcoin prices on working capital; the competitive nature of the industry; currency exchange risks; the need for the Company to manage its planned growth and expansion; the need for continued technology change; the ability to maintain reliable and economical sources of power to run its cryptocurrency mining assets; the impact of energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; network security risks; the ability of the Company to maintain properly working systems; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; share dilution resulting from the ATM Program and from other equity issuances; the construction and operation of facilities may not occur as currently planned, or at all; expansion may not materialize as currently anticipated, or at all; the digital currency market; the ability to successfully mine digital currency; revenue may not increase as currently anticipated, or at all; it may not be possible to profitably liquidate the current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on operations; an increase in network difficulty may have a significant negative impact on operations; the volatility of digital currency prices; the anticipated growth and sustainability of electricity for the purposes of cryptocurrency mining in the applicable jurisdictions; the inability to maintain reliable and economical sources of power for the Company to operate cryptocurrency mining assets; the risks of an increase in the Company's electricity costs, cost of natural gas, changes in currency exchange rates, energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates and the adverse impact on the Company's profitability; the ability to complete current and future financings, any regulations or laws that will prevent the Company from operating its business; historical prices of digital currencies and the ability to mine digital currencies that will be consistent with historical prices; an inability to predict and counteract the effects of pandemics on the business of the Company, including but not limited to the effects of pandemics on the price of digital currencies, capital market conditions, restriction on labour and international travel and supply chains; and, the adoption or expansion of any regulation or law that will prevent the Company from operating its business, or make it more costly to do so; and other related risks as more fully set out in the Company's disclosure documents under the Company's filings at www.sec.gov/EDGAR and www.sedarplus.ca.

The forward-looking information in this news release reflects the Company's current expectations, assumptions, and/or beliefs based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company's objectives, goals or future plans, the timing thereof and related matters. The Company has also assumed that no significant events occur outside of the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance, and accordingly, undue reliance should not be put on such information due to its inherent uncertainty. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, other than as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/274757